Introduction

Cisco Systems, Inc. (NASDAQ:CSCO) will report Q1 ’24 earnings on the 15th of November after the bell. I will give my comments on what’s expected of the company, my thoughts on the company’s longevity and what are the company’s biggest concerns in the long term. As I mentioned in my previous article, even with conservative assumptions, CSCO is a great buy at these price levels, therefore I initiated a small position before the report because, in my opinion, the company will perform well. Therefore, CSCO maintains its buy rating.

What happened since the last coverage

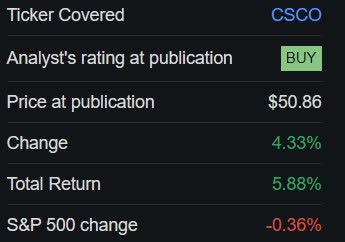

CSCO is up around 6% with dividends since my last article, while the S&P 500 is basically flat. In the first article, I argued that the company may not have much in terms of catalysts for revenues and that the AI hype may not help it in the end, and the company’s average revenue growth will revert to its historical figures. I also said that it doesn’t matter if the company isn’t seeing much in terms of growth because the company’s margins are outstanding in my opinion, and as long as it can chug along at these levels, the company will reward its shareholders in the long run.

CSCO performance since last coverage (Seeking Alpha)

Outlook

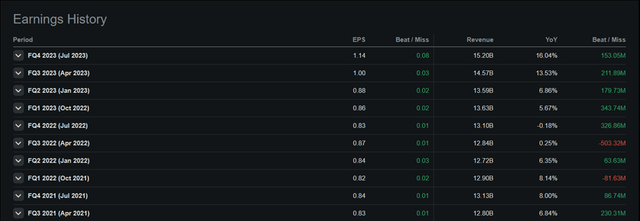

The company for the next quarter expects to see sales to be between $14.5B and $14.7B, while adjusted earnings to be $1.03 at the midpoint. Both numbers are slightly above analysts’ estimates of $14.57B and $0.99 a share. As I mentioned previously in my article, the company’s 10% sales increase for FY23 will not be sustained and the management sees around 1% increase from FY23 to around $57.6B in sales.

Ever since Q4 earnings, the company trended down, which can be a mixture of the weak guidance and the overall market sentiment that kept the S&P 500 flat over the period. In terms of earnings beats, the company has been beating expectations in eight out of the last 10 quarters in sales and a perfect score on EPS. So, I wouldn’t be surprised if the company beats analysts’ estimates once again, as I believe the management is purposefully lowballing its future performance.

Earnings Beat (Seeking Alpha)

In terms of margins, I believe there will be a continual improvement in gross and operating margins, although very small, as the company continues layoffs, with the next batch coming from Silicon Valley, where the company is going to lay off 350 employees. This initiative was announced about a year ago when management said it would lay off around 5% of the company’s workforce, which would amount to around 4,000 employees. The company has almost finished this restructuring and it’s expected to complete in Q1 ’24. Employees in Silicon Valley do tend to get paid more than the national average, so I would expect some improvements in margins.

The merger and past worries

Arguably the biggest news that came out since I covered the company is the acquisition of Splunk Inc. (SPLK) for a whopping $28B. The company expects the deal to close by the end of the third quarter of 2024, which is possible, however, it’s not unheard of to see some delays. The management also expects the deal to be “gross margin accretive and cash flow positive.”

The merger has received mixed reactions. I think it’s a good way of increasing the company’s revenue growth, which has been growing at an abysmal 2% CAGR over the last decade. The two companies will help enterprises to be more secure amidst the new AI revolution. On the other hand, many analysts have very little faith in CSCO’s ability to integrate the acquired companies smoothly. That’s a big concern for me too. On paper, it looks like a great move to enhance its portfolio, however, if we look at the past acquisitions that didn’t go as planned, we may need to add a bit of a discount.

CSCO’s acquisition of Linksys comes to mind where the company basically “neglected Linksys” and was releasing subpar products where the competitors were making much higher quality products, so Linksys fell on hard times.

Another acquisition came to mind when the company bought Pure Digital in 2009, only to sell it two years later as the popular flip camera was losing its footing. This one made no sense in the first place, as the company had nothing to do with consumer electronics, and it’s a good thing it stopped.

The acquisitions of NDS Group and Open DNS for $5B and $635m, respectively, are the more recent failures to synergize with the company and eventually led to these companies being sold in 2019. So, there have been some failures to integrate companies into its ecosystem. Fortunately, most of them were small in comparison to the most recent acquisition of Splunk, however, it’s something to think about when it comes to the future implementation of SPLK since it would be a costly mistake if it doesn’t pan out.

Valuation

Since it’s been quite a bit of time since the last coverage, I went ahead and updated my valuation model to reflect the new interest rate environment where the 10-year Treasury yields went from 3.75% to 4.7% as of writing this update (Nov. 6).

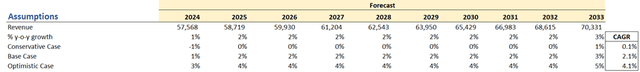

For revenue expectations, I went with quite conservative numbers, as I don’t believe the company will be able to grow at a much faster pace than it did in the past. I kept the same CAGR just to be on the conservative end of estimates, which will provide me with an extra margin of safety. Below are my assumptions for the three scenarios.

Revenue Assumptions (Author)

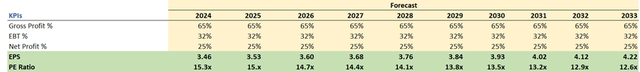

In terms of margins and EPS, I also decided to keep it conservative for that extra cushion and went slightly below analysts’ estimates.

Margins and EPS Assumptions (Author)

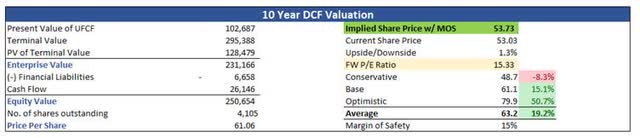

For the DCF valuation, I used the company’s weighted average cost of capital as my discount rate (8.7%) and 2.5% terminal growth rate.

On top of these estimates, I also added another 15% margin of safety for that “sleep well at night” feeling. With that said, the company’s intrinsic value is around $54 a share, which means the company is trading at basically fair value.

Intrinsic Value of CSCO (Author)

Closing Comments

It looks like the company is trading at its fair value and nothing has changed since my last coverage of the company in terms of its performance. If the company can implement the large acquisition successfully, CSCO will be able to grow at higher revenue levels, which would change its fair valuation dramatically. I have no problem starting a position before the earnings come out, so I started a small position this morning (Nov. 6), and if it drops on the earnings day, I will be glad I only started a small position. If the long thesis remains intact, why would I be mad about being able to buy the company at even lower prices than what I bought already?

I still believe that the slow and steady approach of the company is going to reward shareholders handsomely in the future, and if it can beat my conservative estimates going forward, I would expect a nice performance in the end.

Read the full article here

Leave a Reply