Value stocks represent a key part of any high quality diversified portfolio. This is particularly true in a high interest rate environment, such as we find ourself in now. Value stocks tend to outperform in high interest rate environments due to the fact that they often return significant cash in the near term compared to growth companies which will return cash later in time.

Finding stocks that trade at low valuations is relatively easy given that there are many companies with weak prospects trading at dirt cheap valuations. However, many of those companies are value traps due to significant near term challenges.

By most conventional metrics The Cigna Group (NYSE:CI), is a very cheap stock. While the stock trades cheap to its peers for a reason, I believe the stock is too cheap to ignore and represents a buy at current levels.

Company Overview

CI is a leading managed healthcare and insurance company. The company operates in two segments: Evernorth Health Services and Cigna Healthcare. The Evernorth Health segment, which includes Pharmacy Benefit Services, Specialty Pharmacy, and Care Services generates ~56% of Adjusted EBITDA. The Cigna Healthcare segment which includes U.S. Commercial, U.S. Government, and International Health generates the remaining ~44% of Adjusted EBITDA.

Cigna Investor Presentation

Strong Historical Financial Performance

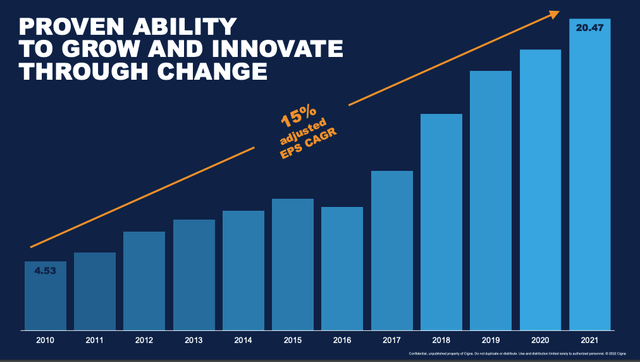

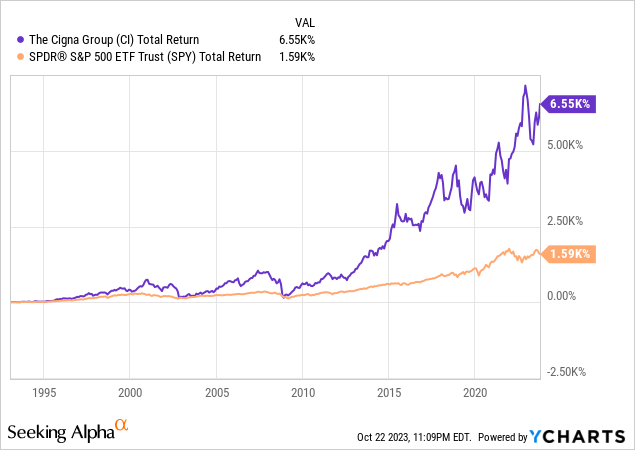

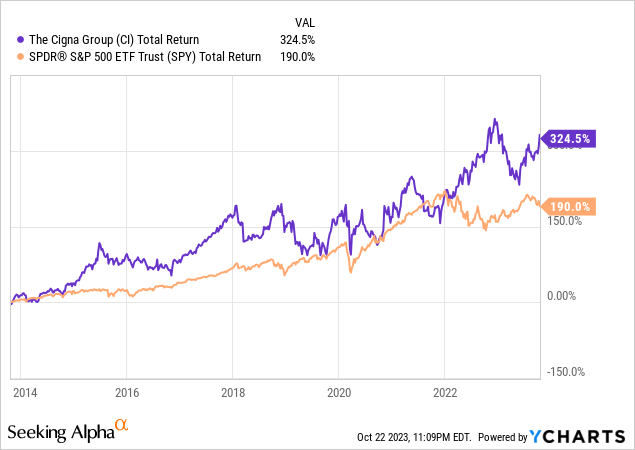

As shown by the chart below, CI was able to grow its earnings at ~15% CAGR from 2010 through 2021 and grew earnings by 13.7% in 2022. Strong financial performance has allowed CI to massively outperform the S&P 500 since going public and to significantly outperform the S&P 500 over the past 10 years.

Cigna Investor Presentation

Growth Opportunities

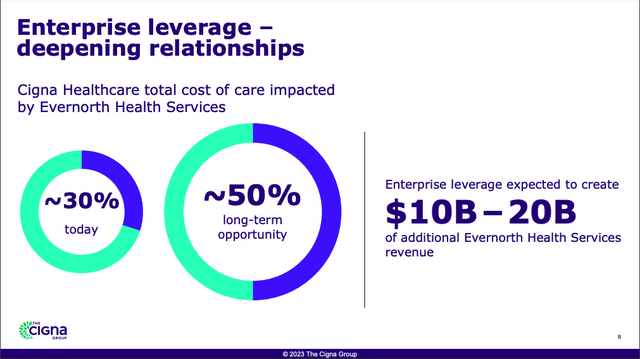

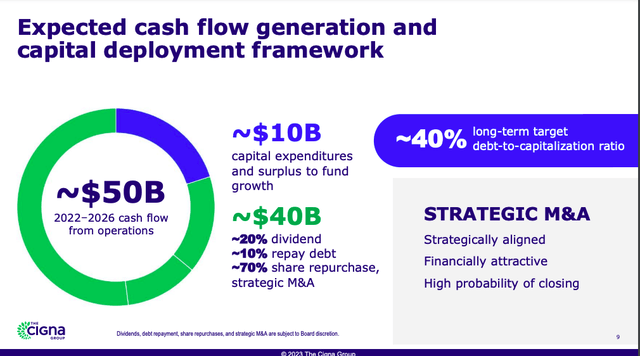

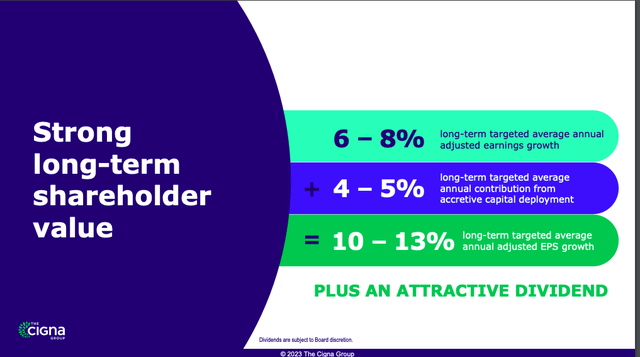

While CI is poised to benefit from the overall growth the healthcare insurance market, the company also has a potential growth opportunity in the form of expanding the proportion of Cigna Healthcare services costs that are impacted by Evernorth Health Services. In addition to organic growth and growth from further integration of the Evernorth Health Services business, CI also continues to see potential for strategic M&A as a growth driver. As a result of these opportunities, CI believes it can drive long-term earnings per share growth of between 10% and 13%. Consensus analyst estimates currently project similar growth rates over the next few years and I am inclined to agree with that.

Cigna Investor Relations

Cigna Investor Relations

Cigna Investor Presentation

Seeking Alpha

Relative Valuation

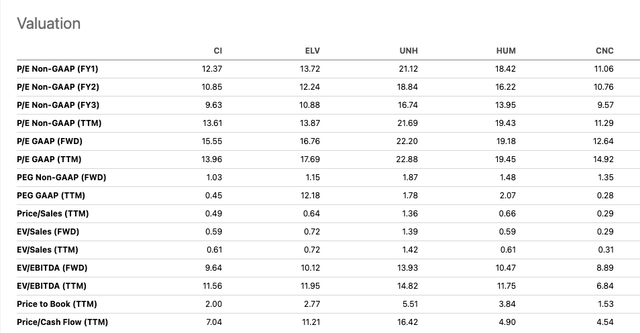

CI currently trades at 10.8x forward earnings compared to 17.9x forward earnings for the S&P 500. CI trades at a forward PEG ratio of just 1.03. Comparably, assuming the consensus 12% earnings growth rate, the S&P 500 trades at a forward PEG of 1.49. Thus, CI is trading very cheap relative to the S&P 500 in my view.

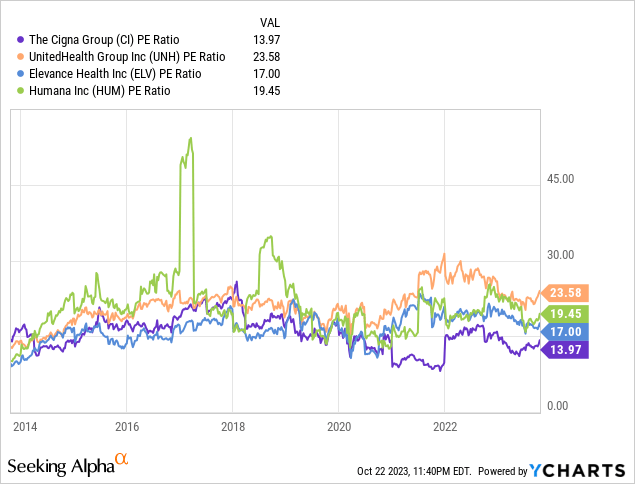

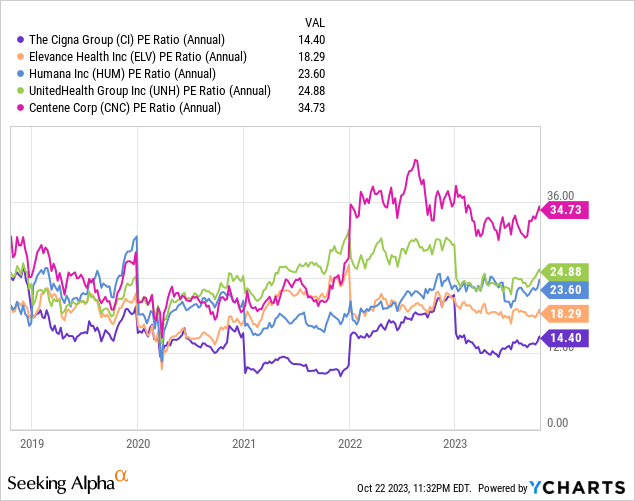

Additionally, as shown by the table below, CI currently trades at among the lowest valuations of its peer group based on most conventional metrics. In particular, CI trades at a forward PEG of 1.03 compared to ELV at 1.15, UNH at 1.87, HUM at 1.48 and CNC at 1.35. This is not a new phenomenon as CI has tended to trade at the lower end of the industry value range more recently. However, it is interesting to note that prior to CI’s $67 billion acquisition of Express Scripts in December 2018 the company traded more in line with peers. Thus, I believe a significant part of the value disconnect which has emerged has been related to CI’s larger dependence on the pharmacy benefit manager business.

Seeking Alpha

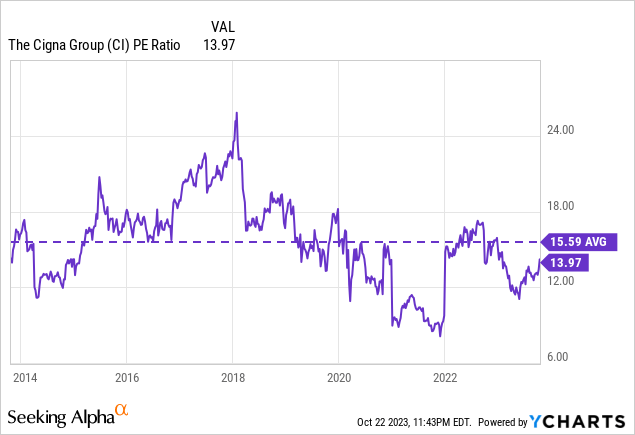

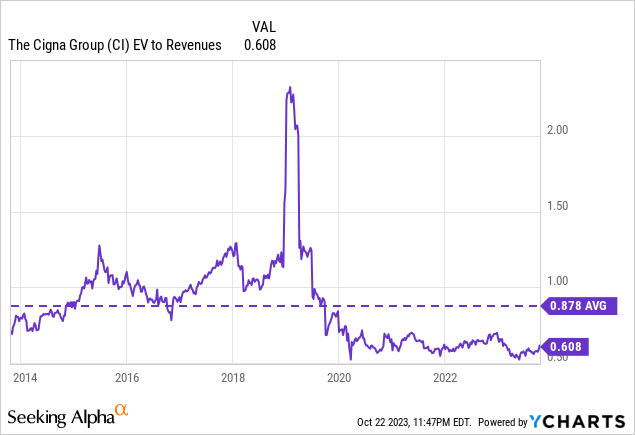

Historical Valuation

In addition to trading cheap vs the S&P 500 and peers, CI is currently trading cheap relative to its own historical average valuation.

Understanding The Valuation Discount to Peers

In my view, the reason that CI trades at a significant discount to peers comes down to two reasons. Firstly, CI is more exposed to the pharmacy benefit management business with pharmacy revenues making up nearly 70% of revenues. Comparably, ELV derives only 25% of its revenue from its pharmacy benefit heavy business known as Carelon. UNH derives ~ 30% of revenues from its pharmacy benefit manager Optum Rx. Recently, the pharmacy benefit business has grown out of favor with Wall Street following news that CVS lost a major mandate in California. I am skeptical that the pharmacy benefit business will be easily disrupted as entrenched health care businesses have proved challenging to disrupt in the past with a prime example being the failure of a Haven, health care venture previously launched by Amazon, J.P. Morgan, and Berkshire Hathaway.

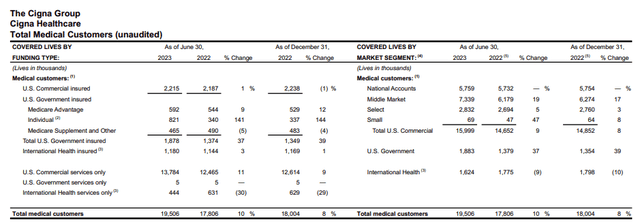

Another reason why CI trades at a valuation discount relative to peers is that it is focused primarily on the U.S. Commercial services only business and has a relatively small presence in the rapidly growing and profitable government insured business. As shown by the table below, U.S. Commercial services only customers make up ~70% of CI’s total medical customers. While the services only business has some advantages such requiring limited amounts of capital, it also tends to be more competitive and offer lower profit margins compared to risk based insurance offerings. Additionally, the commercial insurance business tends to be more cyclical than the government insurance business in nature due to impacts related to changes in employment.

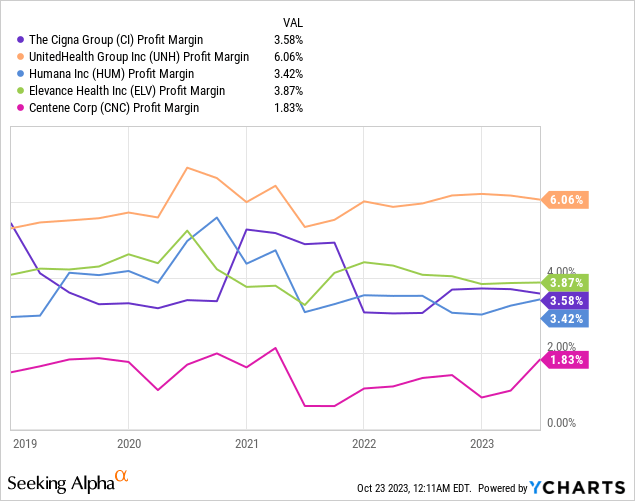

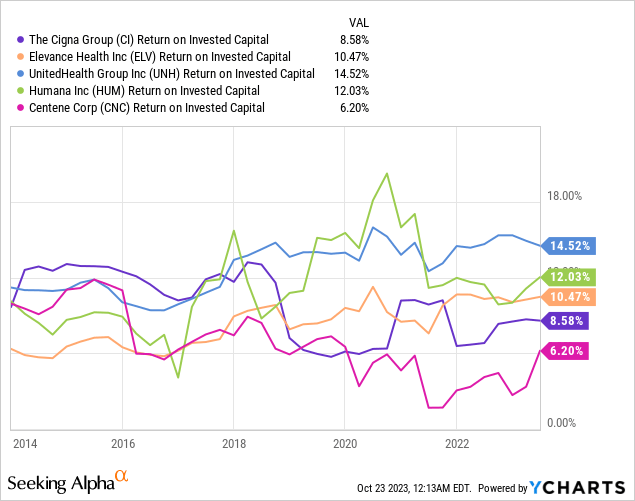

Despite these challenges, CI has been able to maintain net margins close to its peer group with UNH being the outlier primarily due to advantages regarding its scale. Based on return on invested capital, CI has modestly underperformed UNH, HUM, and ELV.

Cigna Q2 2023 Financial Supplement

Risks To Consider

The biggest risk that CI faces is some sort of government reform that disrupts the wonderful business that CI currently enjoys. Healthcare reform can take many different forms but arguably the most significant change would be a nationalization of the health insurance system. While this risk of radical change is always there in the future, this risk is very low right now given the current political climate. A higher probability, though less catastrophic risk for CI, would be government reform that leads to increased levels of competition and allows smaller players to compete with the likes of CI, UNH, HUM, and ELV. Another important risk to consider regarding CI is the potential for the disruption of the pharmacy benefit management business. However, there has been little follow through after the announcement that CVS lost a major contract with Blue Cross Blue Shield of California to Amazon and Mark Cuban Cost Plug Drug Company.

Conclusion

The investment setup around CI is currently characterized by low valuations relative to growth expectations. CI trades at a forward PEG of just 1.03 which is highly attractive relative to the S&P 500 forward PEG of 1.49. Furthermore, CI’s forward PEG of 1.03 also compares favorably to its peers which trade at PEGs ranging from 1.15 to 1.87. While it is true that CI’s business mix is somewhat less favorable than peers, CI does benefit from the ability to substantially increase the portion of Cigna Healthcare services impacted by its Evernorth Health Services segment. For these reasons, I believe the stock is an attractive value investment at current levels and I am initiating coverage with a buy rating.

Read the full article here

Leave a Reply