Chesapeake Energy (NASDAQ:CHK) management is finally beginning to show some operational improvements. But management is a long way from reporting to shareholders much of the supporting information that is typically available to shareholders elsewhere. The investment may well succeed at this point as this is a time of natural gas pricing weakness. But that does not mean there will not be money left on the table. Full disclosure and transparency is a vital check on management that shareholders need to ensure maximum returns.

Additionally, management may have made a strategic mistake in selling the Eagle Ford assets while retaining the Haynesville acreage. The Eagle Ford is known as a low breakeven basin while the Haynesville is known as the swing natural gas producer. While the Haynesville activity is being cut back, oil prices are strengthening which is increasing the profitability of the Eagle Ford.

Second Quarter Report

The second quarter press release does have positive things in it. But investors are referred to the 10-Q that was filed or the slide presentation.

Murphy Oil (MUR) for example has 13 pages of detail to help the investor understand the business. Compare that to the one-page earnings announcement of Chesapeake Energy. Included in those pages are some decent details by project which Chesapeake Energy now has a slide for in the current presentation. But much of the supporting detail is not there.

Even competitor Antero Resources (AR) and EQT Corporation (EQT) provide much more supporting detail for results than is the case with this company.

All of these companies will file a 10-Q just as Chesapeake Energy does. It is just that they provide so much more insight into their business.

Eagle Ford Sale

Management noted that they sold the Eagle Ford while retaining and adding to the dry gas acreage. This really should have been explained in detail to shareholders.

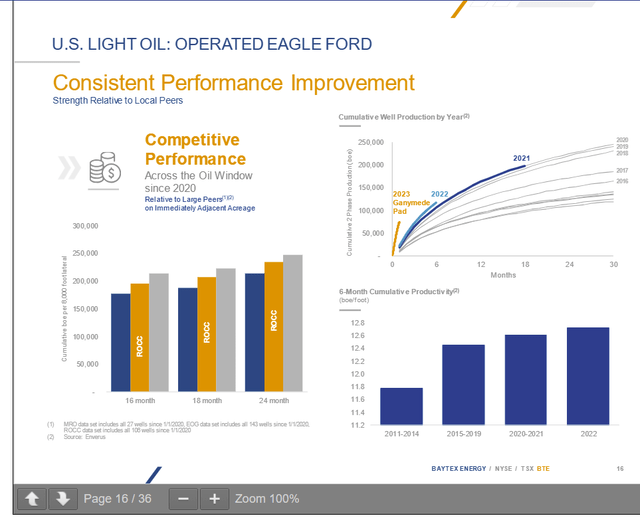

Baytex Energy Eagle Ford Acreage Performance (Baytex Energy Corporate Presentation September 2023)

Much of the Baytex Energy (BTE) acreage that is not operated by Baytex is operated by Marathon Oil (MRO). Marathon has one of the best basin reputations around. The wells payback very fast in the current environment (shown on an earlier slide) and management has long noted that the Eagle Ford wells breakeven in the low WTI$30 range.

Since oil prices are currently rising while natural gas prices are weak, it would appear that management should have held on to this acreage (and if necessary, obtain a creditable operator to run the acreage for them). In fact, management likely could have added rigs to drill for still more profits.

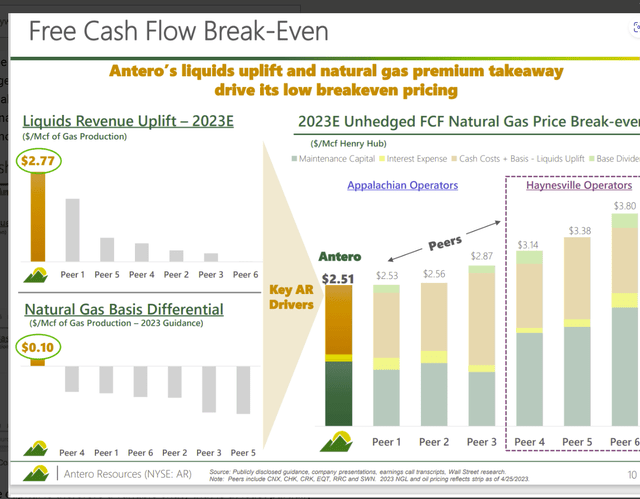

Antero Resources Basin Presentation Of Relative Natural Gas Breakeven Points (Antero Resources Corporate Presentation May 2023)

Meanwhile, management has focused on a basin with a relatively high breakeven point. This acreage should eventually benefit from all the export capacity being built nearby (relatively speaking). However, high cost usually means activity in this basin is affected first. Without any high value liquids being produced, the bet by management is that selling prices will rise enough to get this acreage out of the “swing producer” category in the future.

In the meantime:

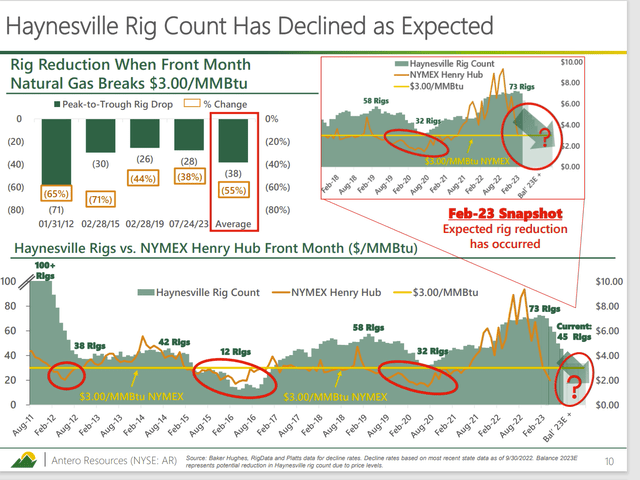

Antero Resources History Of Haynesville Activity (Antero Resources Second Quarter 2023, Earnings Conference Call Slides)

Clearly, this slide confirms why Chesapeake management mentioned they are cutting back on operating rigs in the Haynesville. The profitability is just not there to justify more than minimal activity levels. The current result of the Haynesville-Eagle Ford strategy appears to be to have sold the basin where commodity prices (and hence profits) are increasing while emphasizing a “swing basin” where activity is decreasing due to low natural gas commodity prices.

Eventually, once supplies get low enough, there will be a pricing recovery. Chesapeake Energy appears to have the financial strength to wait this out. Right now, the strategy does not appear to be correct.

Pricing

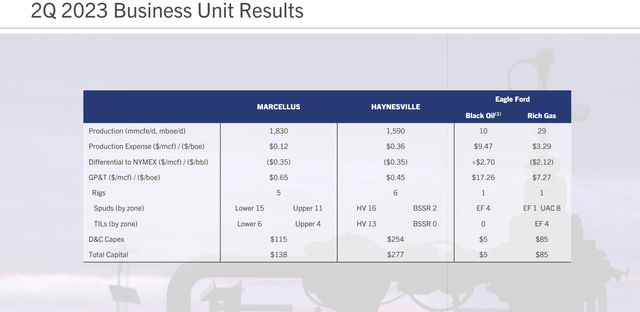

Management gave the following pricing relationships:

Chesapeake Energy Pricing Results Second Quarter 2023 (Chesapeake Energy Earnings Call Presentation Second Quarter 2023)

As shown above, Antero Resources reports a small premium to the benchmark pricing as is typical for them. Antero Resources has long planned to get its production to stronger markets than the Marcellus basin.

Chesapeake management, on the other hand has yet to come up with a way to avoid the discounts shown other than with a hedging program. When that is combined with the relatively high cost of the Haynesville basin, management needs the very strong balance sheet that it now has just to survive. Average cash flow throughout the business cycle does not look really good.

Now admittedly that could change as the North American export capacity increases. But that is far from a sure thing until it actually happens.

Cost

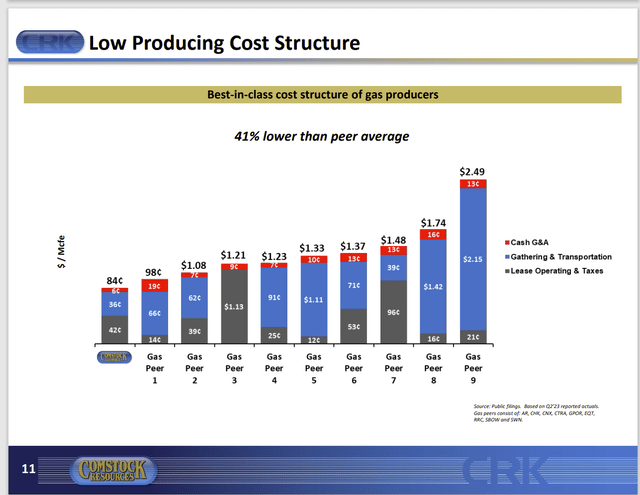

In the meantime, another competitor maintains the low-cost title in the Haynesville.

Comstock Resources Cost Comparison Of Natural Gas Producers (Comstock Resources Corporate Presentation September 2023)

If this comparison is reliable, it means that not only is Chesapeake Energy in a high-cost basin, but it is also not a low-cost producer in a high-cost basin. That is a terrible competitive position to be in. Comstock Resources (CRK) management is claiming that they are the low-cost producer in the chart shown before.

If a company just has to be a high-cost producer (for whatever reason), then it is far better to be a high-cost producer in a low-cost basin like the Eagle Ford. At least the Eagle Ford oil production often gets a premium oil price which allows for some competitive wiggle room. I am not at all sure that there is any wiggle room here at all.

Key Ideas

Chesapeake Energy management is selling the Eagle Ford acreage that many in the industry would desire. That acreage would have been a good diversification from all the natural gas business cycle tendencies. Many companies I follow have moved to at least some liquids. This company appears to be going in the opposite direction of much of the industry.

But more to the point, Antero Resources management points out the big advantage they have of superior natural gas prices. This is before management has long expected liquids pricing to strengthen from current levels. Oil prices have already begun to meet that expectation.

In the first quarter, Antero Resources management sold all the hedges on the expectation of better commodity prices. That should be good news for a dry gas producer like Chesapeake.

Meanwhile, Comstock Resources management considers that company to have the lowest costs in the Haynesville basin. But the Haynesville has “swing production” status. That means when prices weaken, this is the basin that responds the most to lower natural gas prices. It also confirms the relatively high-cost status of the basin among dry gas producers.

Chesapeake Energy management does not discuss any of this. Nor do they provide much detail in the earnings announcement or the corporate presentation. Management does have some operational accomplishments in the latest presentation. But they need to explain their strategy to shareholders in detail in light of recent events. Management also needs to explain how they intend to improve the company’s competitive position in the future.

Read the full article here

Leave a Reply