Here we go again. Mr. Market just went off the deep end with the common stock of Chart Industries (NYSE:GTLS) one more time. Despite the fact that it’s business as usual and this is a small company dealing with relatively large projects, the variation from market expectations resulted in a stock price rout.

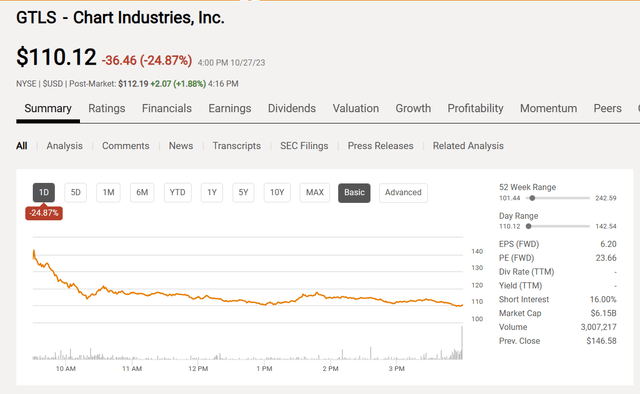

Chart Industries Common Stock Price One Day Action And Key Valuation Measures (Seeking Alpha Website October 27, 2023)

That chart shown above is the equivalent of giving up hope and moving on. This is despite the fact that a relatively small company dealing with relatively large projects is going to have quarters like this.

Such variations do not mean anything is wrong or that climbing growth and profits will be reversing anytime soon. But you sure would not know that from the reaction today.

Management Explanation

Here are the official reasons from the Third Quarter Conference Call (with slides to follow):

“We are updating our full year adjusted EBITDA guidance to reflect the lower revenue in 2023, which has now moved into 2024 due to supply chain and customer delivery timing.”

Management has noted that they don’t lose sales. Even during times like 2020 and 2008 when the market pushed the stock down about 90% or so from its highs, business continued along, and the stock eventually reverted back to better valuations. In fact, growth in the stock price resumed.

Here’s a little more detail on that first comment during the conference call from Jill Evanko, CEO:

“Third quarter 2023 sales of $897.9 million grew about 10% when compared to the third quarter of 2022 and included record sales for CTS and Specialty Products. During the third quarter, we saw revenue push out to future periods related to customer project design and schedule changes, supply chain delayed deliveries impacting percent of completion revenue recognition and timing within our RSL book and chip business. While a smaller impact, we also prioritized certain customer schedules within our facilities that created timing changes between projects and backlog. Third quarter revenue would have been above $1 billion absent these timing impacts.

Based on current order and market trends, we are confident in realizing this revenue, which is still in our backlog, during the fourth quarter in 2024. As a reminder, historically, order cancellation rates have been significantly below 1%, and since the Howden acquisition, we have only had 0.19% of backlog canceled.”

The key to all of this is you have a relatively small company successfully bidding and competing with other businesses for some very large projects. Those large projects basically do not change once they are approved and definitely do not get cancelled (as a rule).

The problem the market has is it made for a negative third-quarter comparison with “no analysis needed” as it was automatically bad for a “high-flier.” But there’s a huge difference between sales moving between quarters and an actual start to a sales issue in the future.

Therefore, the current period of worry will likely be resolved even given the extreme nature of the plunge. To say that the price reaction was excessive does not do justice to what happened on Oct. 27. That plunge is about as irrational as it gets.

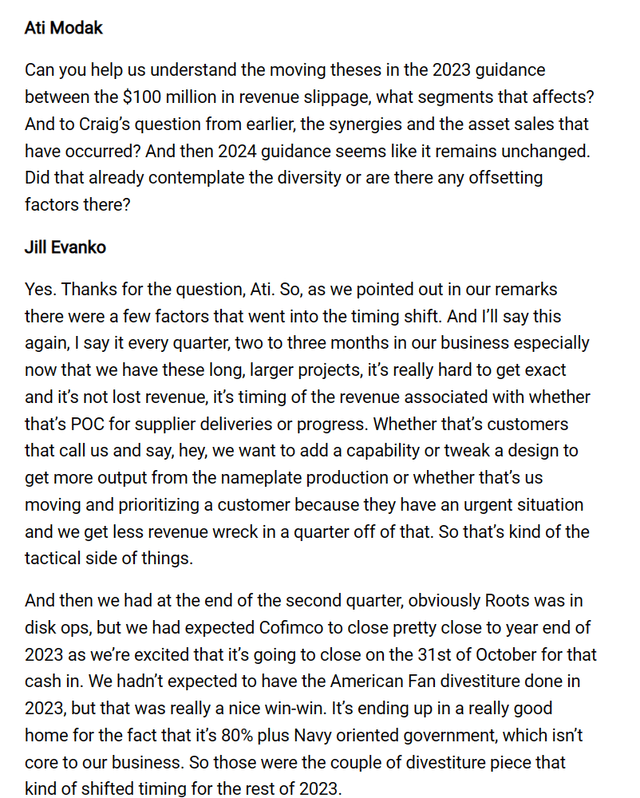

Then came a question from the conference call that could imply a lack of confidence in the guidance because “things changed”:

Jill Evanko, CEO, Chart Industries, Answering Question On the Negative Comparison For Sales (Chart Industries Third Quarter 2023, Earnings Conference Call)

When sales move between quarters due to big project logistics, there can be a negative sales comparison which I will show later that is going to be made up in the future. As I have noted many times, this company does not lose backlogs, but sales and margins can gyrate wildly on large orders and it does not imply a major continuing problem.

Probably the key to posting these is to understand the disbelief that business will continue as it has in the past led to the big market sell-off. The market can “stay irrational longer than you can stay solvent” applies.

Therefore, the article is an attempt to cover what may happen short term in an irrational fashion “longer than you can stay solvent” but nearly always realizes that the overreaction is way overdone in an extreme seldom seen.

The Market Issue

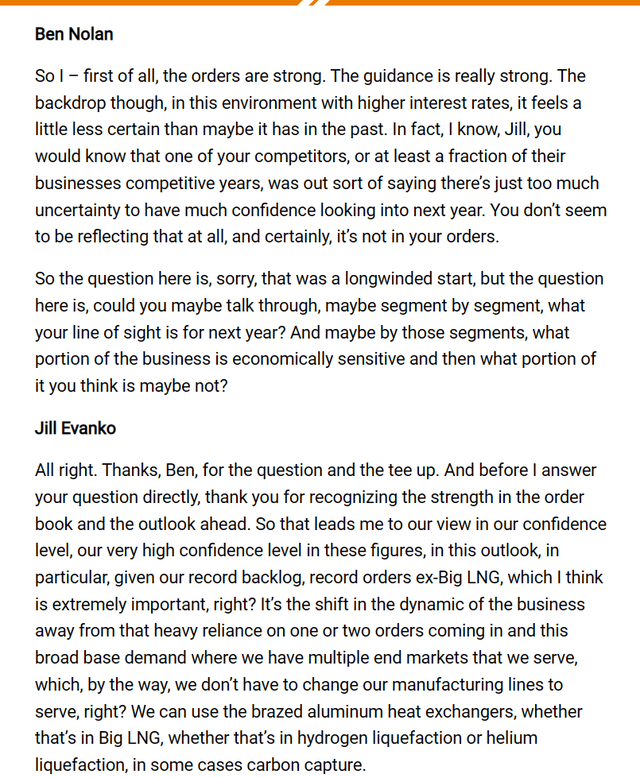

Despite management’s explanation, the exchange from the conference call shows where the market disbelief is coming from:

Why The Market Does Not Believe Chart Industry Management (Chart Industries Third Quarter 2023, Earnings Conference Call)

This is the beginning of a very detailed answer. Frankly, Mr. Market is in a mood that he could care less about the answer. As far as the market is concerned, the answer is pure baloney despite the fact that Mr. Market has been wrong about this time and time again.

As I showed in my article back in 2020, even the pandemic did not influence backlog losses which are comfortably below 0.5% (and actually remain close to zero). There are articles after that showing that the firm business remained firm and the company ran right through that year with no problems at all (almost as if the pandemic never existed).

But that’s the advantage of large projects that generally continue to matter in current economic conditions. This company also has a lot of government-backed business because the products are used in the renewables market as well as the rapidly growing hydrogen market. This business also is recession resistant.

The orders being filled for the fourth quarter have been largely fixed, and as usual the chances of cancellation are close to zero. But more importantly, Jill Evanko, CEO, mentioned that 65% of 2024 is now in the backlog and lessor amounts of future years. There will be a lot of small orders to fill in the rest of the year.

The key is that the backlog is long and therefore the first two quarters of 2024 already are known to management with little room for some “odds and ends.” There’s probably not much left for the third and fourth quarters to change given we’re about to head into November. So, this management has an unusually clear “line-of-sight” to the profitability of the next fiscal year that’s very uncommon in any industry.

The market gets all worried that large projects do not get approved. But that usually catches up during any cyclical business recovery. Since the economy is going “full blast” even that is not an issue.

The Business

Unlike the lack of faith demonstrated by the questions management answered that displayed a lack of faith in management explanations, the business appears to be in fine shape.

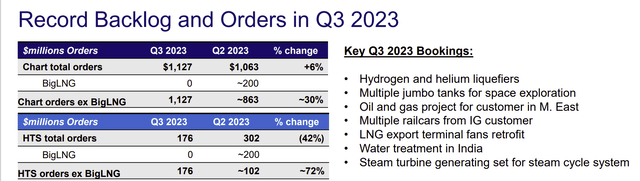

Chart Industries Summary Of Backlog Status Third Quarter 2023 (Chart Industries Third Quarter 2023, Earnings Conference Call Slides)

This stock normally trades on orders progress to a significant extent. The problem is that last year there was a big LNG order (and those orders are notoriously lumpy). So, the order rate progress was somewhat hidden by that big order which was broken out above.

On the other hand, the volatility of orders is reduced as intended by the acquisition program. A steadier order rate due to a lot of products that are not so lumpy is going to ease market nerves going forward.

This company always has been a fast grower with attractive markets. But the stock has been unusually volatile throughout its history. Long term it’s clear that the management strategy is alleviating the order volatility issue.

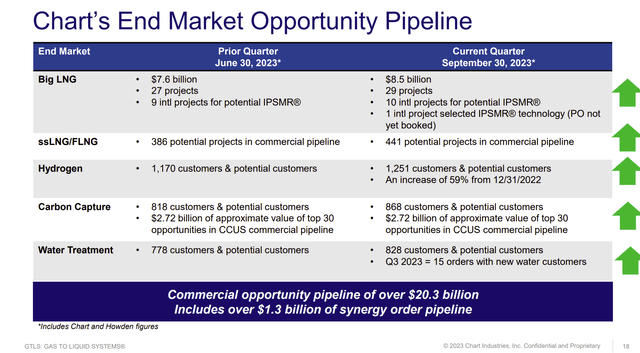

Chart Industries Order Opportunities (Third Quarter View) (Chart Industries Third Quarter 2023, Earnings Conference Call Slides)

The presence in the rapidly growing Hydrogen and Carbon Capture markets is one of the reasons that this stock usually is not very cheap. That and the rapid growth are reasons the stock is likely to return to former highs and then some as the growth continues.

Leverage Progress

Management talks about this and sales synergy at the same time. The only way the market sees sales synergy is through a growing backlog. But that influence is “out the window” for this quarter due to the lack of a big LNG order (which is not that unusual).

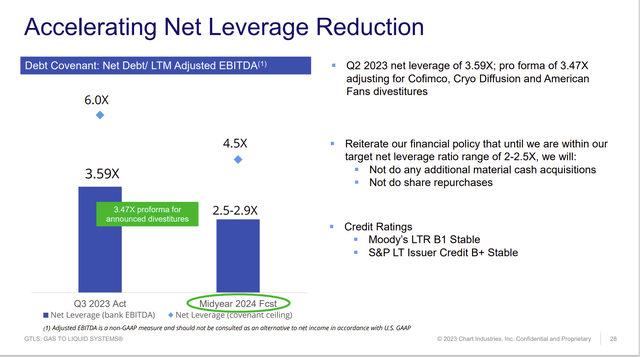

Chart Industries Reiterates Leverage Guidance And Beats Current Leverage Goals (Chart Industries Third Quarter 2023, Earnings Conference Call Slides)

Management never included the subsidiary sales in its guidance. Therefore, the roughly $500 million paydown from those sales has resulted in an acceleration of the deleveraging process ahead of guidance. In fact, management is now ahead of the permitted level of leverage for next year at the current time.

But Mr. Market is stubborn enough to not give management credit for this until leverage is back within market-acceptable range. Also aiding this cause is the projected increase in EBITDA for the next fiscal year. So, management is strategically increasing the business while paying down debt to get that debt ratio into an acceptable range.

This is where the negative sales comparison worries the market.

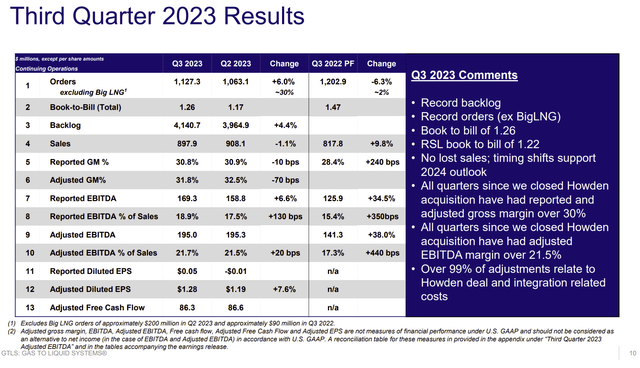

Chart Industries Third Quarter Results Comparison (Chart Industries Third Quarter 2023, Earnings Conference Call Slides)

There are a lot of positives on that slide (like the improved EBITDA margins since Howden was acquired). But the only thing Mr. Market cares about besides leverage right now is the sales comparison to the previous quarter. Historically, each sales quarter is supposed to be larger than the last when you begin with a historically light first quarter. So, the above comparison appears to trump any and all progress elsewhere despite the fact that those sales (causing the comparison) are only delayed and not gone. This is a sign of a bear market.

Going Forward

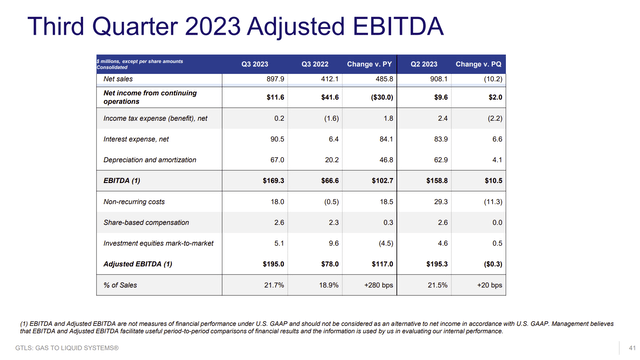

There is an old saying that you cannot spend EBITDA and it definitely has merit. However, this company often converts EBITDA into cash flow once all the acquisition-related costs are gone. There was an additional adjustment to net income for divestitures. So let’s start with EBITDA.

Chart Industries Third Quarter EBITDA Comparison (Chart Industries Third Quarter 2023, Earnings Conference Call Slides)

Even though on the GAAP income statement, the quarter in the last fiscal year, as management alluded to, was more profitable on a GAAP basis, you now have a far larger company with a likely different earnings pattern than was the case before.

Not only that but with a big acquisition and some divestments, the quarterly reports are almost in “cannot analyze” territory as they’re hopelessly complicated. The above slide does help somewhat. But it will take time for earnings to clear up.

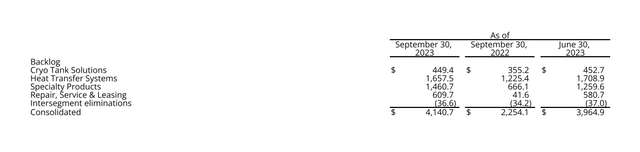

Chart Industries Third Quarter 2023, Backlog Detail Comparison (Chart Industries Third Quarter 2023, Earnings Press Release)

In the meantime, the backlog shows healthy growth over the previous quarter of the last fiscal year. That’s very likely to continue. Given the effects of large orders, a close comparison or two of order rates is nothing to worry about. This market currently thinks otherwise. But it will likely come around to a more reasonable stance in the future.

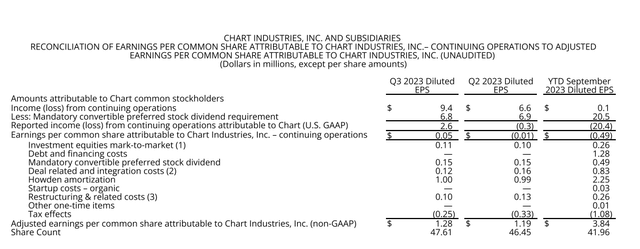

Chart Industries Earnings Per Share Without Nonrecurring Items (Chart Industries Third Quarter 2023, Earnings Press Release)

Actual income per share is overcoming the burden of the preferred stock dividend. That’s actually fast progress. But there’s a whole lot of other things that need to be part of the reconciliation until the acquisition issues fade. A confused market will say “no.” That appears to be the case right now.

The Howden amortization is a non-cash charge. The fact that management usually recovers amortization when they sell divisions and more (oftentimes) usually justifies the substantial intangible assets on the book. This time around, there are some discontinued business costs which does not happen often (but are likely to happen sooner or later even with the best run companies).

The year-to-date guidance has been adjusted for divestitures that closed ahead of time as well as sales moving into the next fiscal year. With any high flier, just a little movement like that can have big stock consequences. Next year, the guidance has been maintained so far. That’s likely to be very firm because 65% of the 2024 business already is in the order book for fiscal year 2024. There’s probably more now.

Overall, it appears the market reaction was far out of line with reality. That has happened often with this stock and it is likely to continue in the future. Therefore, the volatility is likely to continue. This stock is only for those with strong stomachs that can take these wide volatile stock price swings. Everyone else can look elsewhere.

This stock remains a speculative strong buy based upon a very solid long-term growth record. But only for those that can withstand a very bumpy ride.

Read the full article here

Leave a Reply