ChargePoint Inc.’s (NYSE:CHPT) quest to electrify the world, one charging station at a time, is experiencing a rather turbulent pit stop. The electric vehicle charging infrastructure company recently reported Q2 FY 2024 earnings, and the results disappointed investors. A widening gap between expectations and reality drove the company’s shares 11% lower on September 7, and the near-term outlook remains bleak despite the company still narrating an interesting story. Although I have previously been bullish on the company’s prospects based on my belief that ChargePoint was well-positioned to convert this attractive story into quantifiable financial results, the poor execution and continued industry pressures have forced me to downgrade my rating on ChargePoint. I believe there will be more pain before the company recovers, if at all.

The Disappointing Financial Performance

ChargePoint reported a disappointing second-quarter loss of $125.3 million, or 35 cents per share. This poor performance contrasts sharply with the prior year’s performance when the company lost $92.7 million, or 28 cents per share. Analyst projections portrayed a significantly brighter picture: a net loss of only 13 cents per share on revenue of $153.2 million, according to FactSet.

The disappointing deterioration of ChargePoint’s profitability can be attributed to several factors. The once-promising electrification dream has been overshadowed by the daunting realities of supply chain disruptions, a challenge that has plagued industries all around the world. Additionally, rising interest rates have piled on further financial pressure, adding to the headwinds the company faces. The once-thriving EV charging leader lost its momentum just months after its debut, as it began its ambitious expansion plan that strained its balance sheet.

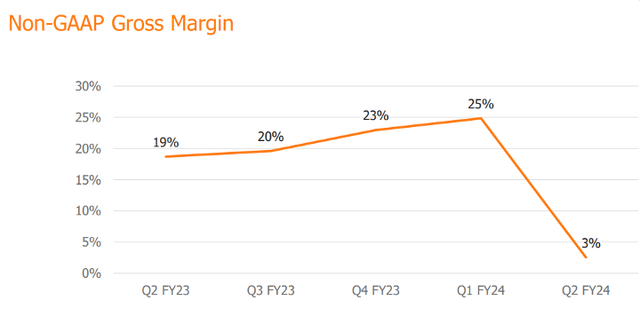

While ChargePoint’s recent financial performance has spooked investors, one aspect of the report stands out: the company’s notable revenue increase. ChargePoint reported $150 million in revenue in the second quarter, a 39% increase over the previous year’s second quarter. Diving deeper into the numbers, it’s evident that the company’s core revenue streams are on the rise. Revenue from networked charging systems reached $114.6 million in the second quarter, up 36%, while subscription revenue reached 30 million, up 48% from the same quarter the previous year. However, these positive revenue figures were met with a significant drop in gross margins. In the second quarter, ChargePoint’s GAAP gross margin plummeted to a mere 1%, down from 17% in the previous year’s second quarter. The non-GAAP gross margin followed a similar trajectory, dwindling to 3% from a more robust 19% in Q2 FY 2023.

Exhibit 1: Non-GAAP gross margin

Earnings presentation

The management cited a $28 million inventory impairment charge as the main reason for the significant margin contraction. This charge was deemed necessary to address legacy supply chain costs and excess supply issues related to a specific DC product. Despite the financial turbulence, the company aims to achieve positive EBITDA and operating cash flow by the end of the calendar year 2024.

The Attractive Story Remains Intact

As a growth investor, I am attracted to companies that narrate interesting stories. Of course, it’s not just about the story – a company should be able to back the story up with numbers too. Unfortunately, ChargePoint has not been able to do this yet. Its story, however, remains valid and attractive.

While the majority of ChargePoint’s revenue comes from the sale of charging stations to a wide range of clients, including businesses and households, the company’s strategic expansion into software and subscription fees demonstrates its commitment to long-term growth. Subscription revenue, with its potential for consistent and recurring income, is a viable option for strengthening the company’s financial base. This forward-looking approach has driven ChargePoint to allocate resources strategically, prioritizing the establishment of a robust early customer base to pave the way for long-term subscription-based revenue. Consequently, the company has invested significantly in its DC charging network, boasting over 20,000 ports. These forward-looking investments are commendable as they allow ChargePoint to remain competitive in an evolving industry.

ChargePoint’s reach extends well beyond North America, where the company is a recognized leader in all-purpose charging. Operating across various verticals and integrated into everyday life, the company’s services span 16 European markets, offering support in nine languages and forging strategic partnerships with energy retailers and leasing solution providers. The company’s continued progress in Europe is part of its story that I find attractive. For context, revenue in Europe increased 78% YoY in Q2, and the company reached an expansive roaming network of 500,000 ports for drivers in addition to the installations.

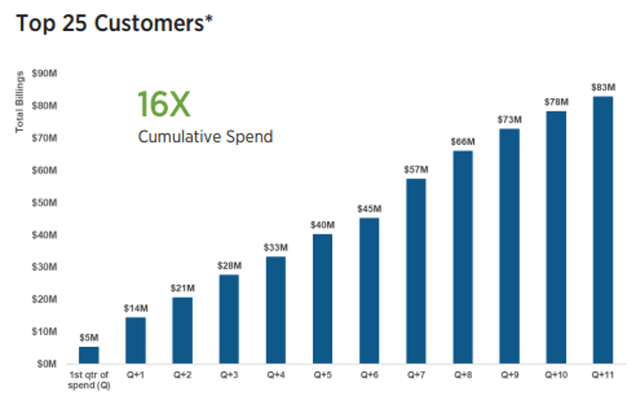

Further, integration into consumer platforms such as Apple Pay and Google Pay, partnerships with fleet management solutions including GEOTAB, and collaborations with automotive giants such as Audi and Mercedes-Benz position ChargePoint as a key player in the evolving EV ecosystem. Notably, 76% of Fortune 50 companies have chosen ChargePoint as their preferred EV-charging solution provider. This recognition is more than just continued software and warranty subscriptions; it also represents a surge in hardware acquisitions that mirrors the rising trend of EV adoption, as evidenced by the top 25 customers increasing their cumulative spending by 16-fold from Q1 FY 2017 to Q4 FY 2023.

Exhibit 2: Spending by the top 25 customers

Company presentation

With the global EV adoption story still in its early stages, ChargePoint seems to have a long runway to grow as an established charging solutions provider. However, the company faces several challenges, which need to be monitored closely.

The Mounting Challenges

Several challenges are looming on the horizon for ChargePoint.

First, Tesla, Inc.’s (TSLA) recent decision to open up its DC Supercharger network to other automakers threatens to alter the competitive landscape in the EV charging industry. Tesla aims to deploy at least 7,500 chargers for all EVs by the end of 2024, with a significant portion-3,500 of them-sporting 250 kW capabilities along highway routes, all accessible via the Tesla app or website. While ChargePoint’s management sees this development as a potential remedy for range anxiety and a boost to EV adoption, it also casts a shadow of uncertainty over ChargePoint’s growth trajectory. ChargePoint offers both Level 2 and DC fast charging stations, but its DC fast charging network is much smaller than Tesla’s. By allowing non-Tesla EVs to access Superchargers, Tesla is increasing the availability and convenience of fast charging for millions of drivers, while also creating a new revenue stream for itself. ChargePoint may face increased competition from Tesla, especially in areas where Superchargers are more abundant and faster than ChargePoint stations. However, there is a silver lining for ChargePoint as well. ChargePoint can benefit from Tesla’s move, as it could attract more Tesla drivers to its network by offering Level 2 charging options at workplaces, homes, and destinations. The company could also leverage its existing partnerships with automakers, retailers, and utilities to expand its network and offer more value-added services to its customers. Despite these opportunities, I am wary of Tesla’s attempts to disrupt the EV charging sector.

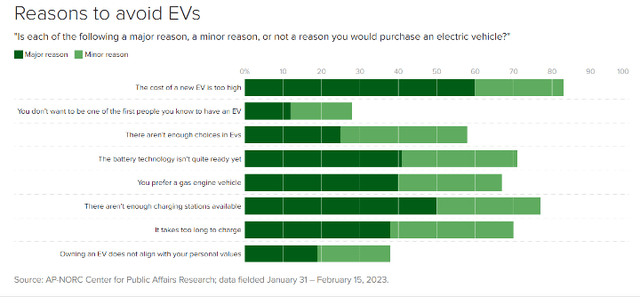

Another challenge is the waning momentum behind EV adoption. According to recent Cox Automotive data, EVs are expected to account for less than 8% of total new vehicle sales in 2023. While sales of plug-in vehicles have grown rapidly in recent years, the pace is slowing, with a nearly 50% growth rate in the first half of the year compared to 65% in 2022 and 71% in the same period in 2021. The slower pace may be attributed to several factors such as pricing barriers, waning government incentives in key markets, and consumer acceptance challenges. In June, the supply of EVs on dealer lots reached 92 days, significantly higher than the 51 days of inventory for all models. Notably, only 31% of dealers see EVs as the future, contrasting with the 53% of car buyers who share this perspective. High prices continue to deter American car buyers despite incentives and rebates designed to encourage adoption, with 43% of potential buyers citing cost as a significant barrier.

Exhibit 3: Reasons to avoid EVs

CBS News

Although EVs will certainly account for a much larger share of vehicles on the road by 2030, the next couple of years may bring to light new challenges as the EV sector adapts to an inflationary environment.

Takeaway

As investors grapple with uncertainties surrounding the future of pure-play EV charging companies, ChargePoint finds itself navigating several challenges. The company’s continued failure to convert its growing scale into a meaningful expansion in margins or profitability is concerning, especially given the intensifying competition in the EV charging sector. With earnings revisions trending lower, I do not expect a change in CHPT’s fortunes in the foreseeable future. A deceleration of revenue growth in the next few quarters – which is a very likely scenario going by the company’s guidance – limits the upside potential from here. The company still has the necessary ingredients to emerge as a true winner of the EV revolution, but I believe things will get ugly before they turn for the better – which is dependent on the company’s ability to navigate competitive threats successfully.

Read the full article here

Leave a Reply