Investment thesis

Cerence Inc. (NASDAQ:CRNC) is a company that offers generative AI features for automotive original equipment manufacturers [OEMs]. The company invests heavily in innovation and its 54% global production vehicle penetration looks impressive and indicates high-quality offerings for me. At the same time, this penetration level also suggests that there is still a big room for revenue expansion. The last four quarters were challenging for the company due to the challenging environment, but consensus estimates suggest that financial performance will improve significantly in the upcoming quarter. I am highly convinced that the company will benefit from favorable secular trends in the automotive industry. The valuation looks very attractive with about 25% upside potential. All in all, I assign the stock a “Buy” rating.

Company information

Cerence offers AI-powered virtual assistants for the mobility and transportation market. The company has an extensive portfolio of large automotive customers, including giants like BMW, Daimler, Ford, General Motors, Volkswagen, and Toyota.

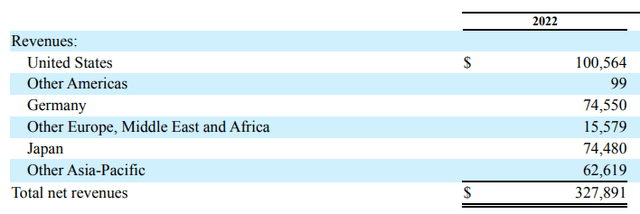

The company’s fiscal year ends on September 30 with a sole operating segment. According to the latest 10-K report, the company generates about 70% of its revenues outside the U.S.

Cerence’s latest 10-K report

Financials

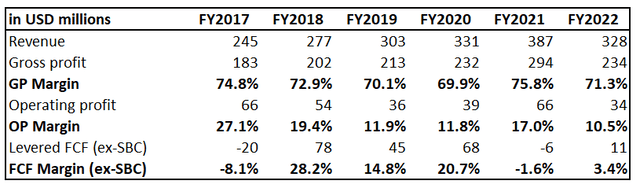

The company debuted as a separate public entity in 2019, therefore, we have a relatively short earnings history. From the past six fiscal years, we see that the company demonstrated solid revenue growth up to FY 2021. Still, there was a notable YoY drop in FY 2022 due to the challenging macro environment, which included the economic slowdown, lockdowns in Mainland China, and chip shortage. All these factors look temporary and not secular to me. The revenue CAGR between FY 2017 and FY 2022 might look low at 6%, but if we consider growth between FY 2017 and FY 2021, revenue compounded at 12% annually.

Author’s calculations

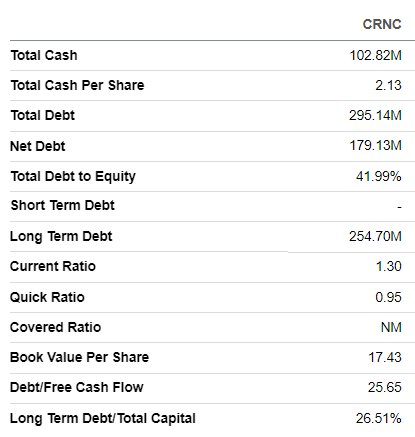

The business demonstrates a strong above 70% gross margin, meaning Cerence has wide opportunities to reinvest in innovation and marketing. Indeed, the company reinvests about a third of its sales in R&D, which is massive and a solid positive sign to me. Commitment to innovation means the management is focused on building long-term value for shareholders. The free cash flow margin [FCF] has been volatile but mostly positive and wide. Cerence does not pay dividends but repurchases its own shares. Generating a positive FCF margin means the company is able to maintain a healthy balance sheet with low leverage and strong liquidity metrics.

Seeking Alpha

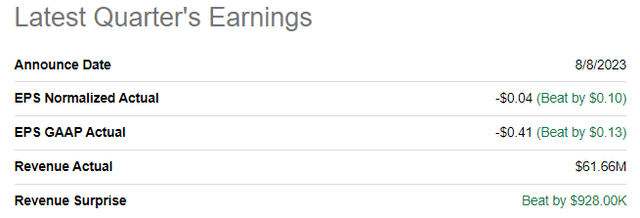

The latest quarterly earnings were released on August 8, when the company topped consensus estimates. Business is still experiencing severe headwinds, so revenue demonstrated a 30% YoY decrease. The adjusted EPS followed the top line and became negative at -$0.04 compared to $0.43 a year ago.

Seeking Alpha

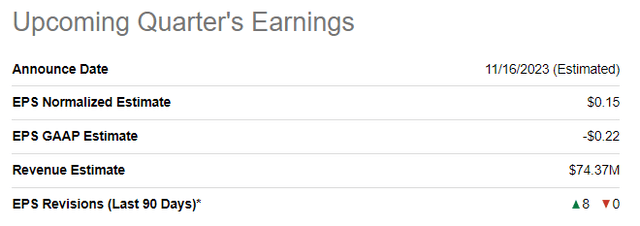

The upcoming quarter’s earnings are scheduled to be released on November 16. The positive sign is that consensus expects revenue to rebound and demonstrate a 28% YoY growth. The adjusted EPS is expected to turn positive again at $0.15.

Seeking Alpha

As the upcoming quarter’s earnings estimates suggest, the bumpy road is in the rearview mirror. Revenue is expected to return to its growth path in the fiscal Q4. To me, headwinds are apparently temporary and not secular. The AI-backed assistant for the automotive industry is a useful feature that makes driving easier and safer. That said, the value of Cerence’s offerings is obvious for OEMs. It is also important to underline that with the increased penetration of EVs, the competition in the automotive industry has become very intense, especially when we talk about high-tech features. Therefore, all automakers are competing to offer the best technologies for customers, and smart assistant is a must in our era of generative AI, which already commenced. According to the latest earnings presentation, the company’s global production vehicle penetration is at 54%. For me this penetration figure looks positive, meaning that the company has a solid market positioning and is well-recognized by OEMs, but there is still vast room for penetration improvement. To conclude, I believe that secular trends are very positive for Cerence and the company’s substantial penetration level means OEMs trust in CRNC’s offerings and consider them reliable.

Valuation

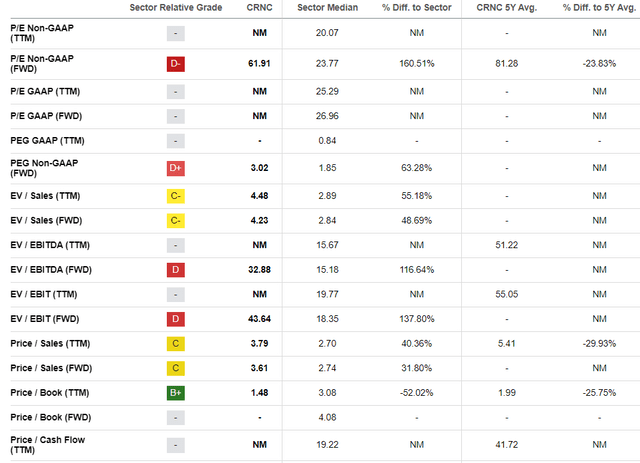

The stock is outperforming the broader U.S. market in 2023 with a 35% year-to-date rally. Seeking Alpha Quant assigns the stock an average “C+” valuation grade, indicating that the stock is fairly valued from the perspective of the multiples. The company’s valuation ratios are substantially higher than the sector median but are currently lower than historical averages.

Seeking Alpha Quant

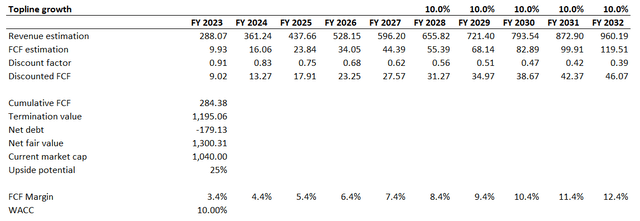

To get more evidence about the valuation, I have to simulate the discounted cash flow [DCF] model. I use a 10% WACC for discounting. I have revenue consensus estimates available up to FY 2027 and project a modest 10% revenue CAGR for the years beyond. For my DCF model’s base year, I use an FY 2022 FCF margin and expect it to expand by one percentage point yearly. Assumptions are very conservative, in my opinion.

Author’s calculations

According to my DCF simulation, the business’s fair value is $1.3 billion. That said, the stock is about 25% undervalued. To me, this looks like a very attractive valuation.

Risks to consider

Investors of CRNC face significant risks of the company’s underperformance compared to consensus estimates. The major part of the company’s market capitalization depends on future revenue growth and the ability to convert this revenue growth into an expanded FCF margin. If the company struggles to drive consistent growth, it will lead to investors’ disappointment and a massive stock sell-off. We have seen it in 2022 when the stock price crashed more than four times from $80 to below $20. While this year’s weak financial performance is already priced in, the stock’s past performance suggests that the stock price can decline rapidly if the company fails to meet aggressive growth expectations.

The company’s earnings are very vulnerable to the broader economic health. Cerence’s revenue declined about 15% in FY 2022 and has demonstrated revenue decline in Q1-Q3 of the fiscal 2023. The company’s offerings are not diversified enough to protect the business from unfavorable swings in the broader environment. That said, it is highly likely that the company’s financial performance will be significantly adversely affected during economic turmoils. The management invests heavily in improving existing products and services, but I see little evidence that the portfolio of offerings is expanding notably. The company is vulnerable to swings in economic cycles and misses the opportunity to cross-sell and up-sell.

Bottom line

To conclude, Cerence is a high-quality business. It has experienced tough times over the past four quarters, but the management was able to handle macro headwinds successfully. There is much more optimism regarding the upcoming quarter because revenue is expected to return to its double-digit growth path. Shifts in the automotive industry look favorable for Cerence, and the company’s substantial investments in innovation and notable penetration give me a high conviction that the company is well-positioned to absorb industry tailwinds. Moreover, the valuation looks very attractive and outweighs the risks and uncertainties. Therefore, I assign the stock a “Buy” rating.

Read the full article here

Leave a Reply