Introduction

Centrus Energy Corp. (NYSE:LEU) is a supplier of enriched uranium for nuclear fuel and services in nuclear power energy in the United States. Nuclear energy is a well-grounded source of carbon-free energy, which makes it a valuable asset for the energy transition process. The total revenue of Centrus comes from two segments: LEU and Technical Solutions. The LEU segment provides most of the company’s revenue by selling enriched uranium for nuclear fuel to customers, which are mostly utility companies. The Technical Solutions segment offers advanced engineering, design, and manufacturing services. In this thorough article, I analyze the market and financial outlooks for Centrus Energy and conclude that the stock has a profitable future.

Centrus market outlook

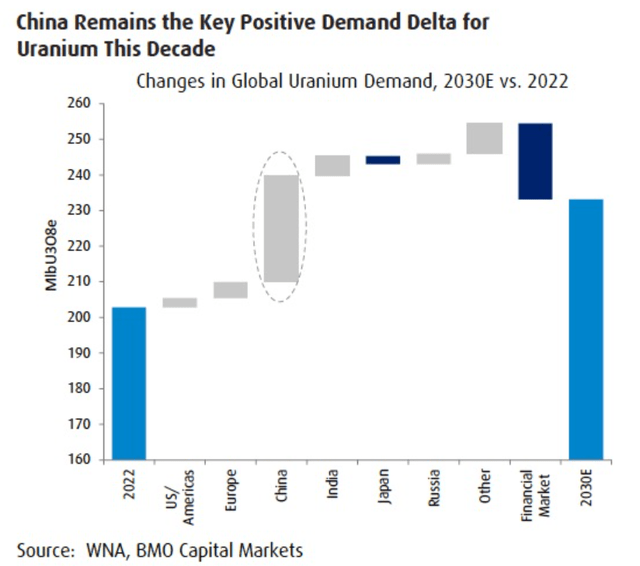

Why is Centrus a profitable shot? The World Nuclear Association (WNA) predicts that the demand for uranium is likely to surge to circa 130,000 tonnes by 2040, which is 98% higher than an estimate of 65,650 tonnes in 2023. The upper forecast for this surge is 184,300 tonnes, and the lowest forecast is 87,000 tonnes by 2040, showing that a rise in demand for uranium is predictable in the following years. It is worth noting that the capacity to generate electricity from nuclear plants is expected to accelerate by approximately 75% to 686 gigawatts by 2040. In doing so, LEU is a key component in the production of nuclear fuel for reactors that generate electricity, and Centrus Company supplies LEU and its components through the U.S. and international utilities for use in nuclear reactors. Note that China carries the highest uranium demand in this decade to replace coal, which provides the majority of the country’s energy needs (see Figure 1). Overall, 4.1% CAGR demand growth expected by 2040 brings a high future demand for the uranium market.

Figure 1 –

Mining.com

As Figure 2 illustrates, uranium prices surged during the prior three quarters and reached $74 per pound recently, which has been the highest level since 2008. As I mentioned earlier, this surge is due to an accelerating demand and low inventories, thereby threats to supply. Large economies around the world have embarked on boosting their investments in nuclear power due to the volatile fossil fuel prices and decarbonization goals. In this regard, China plans to add 32 nuclear reactors by the end of the decade; also, Japan has restarted nuclear projects and plans. On the supply side, inventories in Europe dropped by 21% since 2018.

Figure 2 –

Trading Economics

Centrus business outlook

Centrus Energy has a plan to provide a secure and reliable source of HALEU to meet the needs of industry demand. It is worth knowing that the company secured the final approval from the Nuclear Regulatory Commission to begin receiving and loading uranium into their cascade. As the management explained:

“We are now finishing some final testing activities and expect to begin production and meet our contractual obligation to make 20 kilograms of high-assay, low-enriched uranium, or HALEU, by the end of this year. This will be the first U.S. owned U.S. technology enrichment plant to begin production in 70 years.”

In support of their production costs, the Department of Energy will not only cover the production expenses but also give an incentive fee in exchange for the output of the cascade. As a result, the U.S. government is their first customer, and it is predicted there will be more worldwide customers; after all, it is a very strong fuel: 3 tablespoons of it are enough to generate a person’s electricity needs for their lifetime. Due to the urgent need for HALEU, the Department of Energy has a plan to purchase up to 145,000 kilograms of HALEU during the next ten years.

Centrus financial outlook

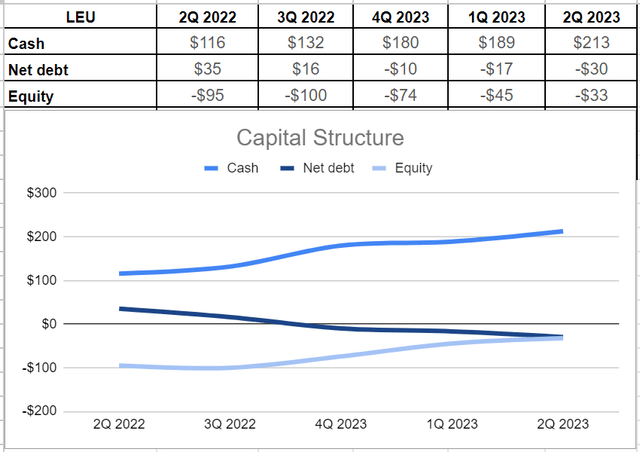

Analyzing the company’s financial statements indicates that Centrus has been able to provide a good performance during the recent quarter. The company generated $12.7 million of net income and $98.4 million of revenue by the end of Q2 2023. It is worth mentioning that recent increases in uranium prices due to global supply constraints had a crucial impact on the company’s revenue. In other words, $39.5 million was directly from uranium sales. Furthermore, Centrus provides good levels of inventory; the management has already maintained the value of their order book at approximately $1 billion by 2030. Centrus Energy had negative levels of equity during the last year, and its equity sat at $(33) million at the end of the recent quarter. However, worth noting that the company has offered negative net debt. In minutiae, Centrus had approximately $183 million of total debt; aligned with a well-improved cash level of $213 million, which was 83% higher year over year than the second quarter of 2022, led to a negative amount of $(30) of net debt (see Figure 3).

Figure 3 – LEU’s capital structure (in millions)

Author

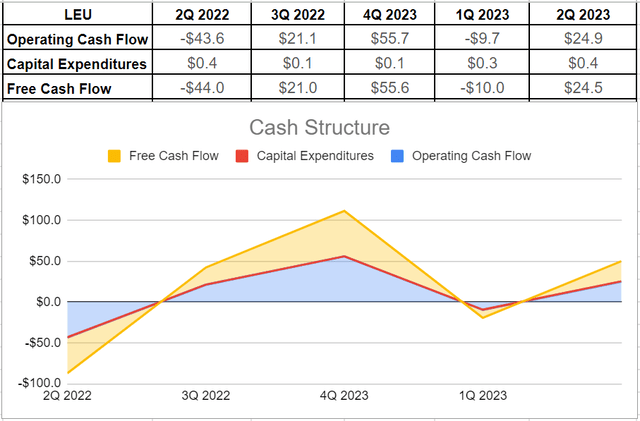

Furthermore, the company’s cash structure is healthy as the company could generate $25 million of operating cash in the second quarter in comparison with the operating cash outflow of circa $10 million at the end of the first quarter of 2023. As a result, more than $24 million of free cash flow was generated at the end of the recent quarter. Therefore, as Centrus Energy does not pay dividends and has a strong debt condition, its cash structure is healthy and paves the way for future profits (see Figure 4).

Figure 4 – Centrus cash structure (in millions)

Author

Centrus Energy’s performance vs. its peers

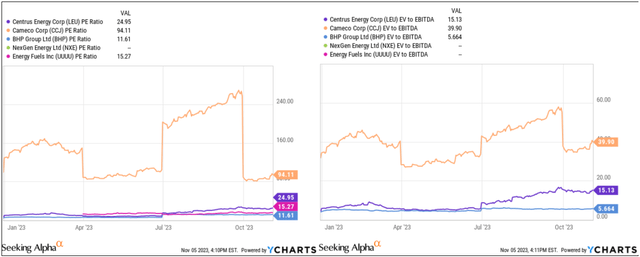

Centrus Energy operates in the coal and consumable fuels. Therefore, there may be no direct peer to its operations. However, I have compared its PE ratio and EV-to-EBITDA ratio with some other large uranium producers to bring more insights into the company’s performance. As Figure 5 demonstrates, Centrus Energy’s PE ratio is around 25x, which is far lower than Cameco Corp’s (CCJ) 94x. On the other hand, the company is pricier than other uranium producers like Energy Fuels (UUUU) and BHP Group (BHP), with PE ratios of 15x and 11x, respectively. Furthermore, Centrus Energy’s EV-to-EBITDA sits at 15x, which is far lower than Cameco’s circa 40x, while being higher than BHP’s ratio of 5.6x. As a result, Centrus Energy stock is cheaper than Cameco while being more expensive than BHP (see Figure 5).

Figure 5 – LEU’s valuation ratios vs. its peers

YCharts

Conclusion

Centrus Energy is performing in an industry with a bright future. Uranium demand is increasing due to the utility demand and energy transmission targets. On the other hand, supply chain constraints bring obstacles to the supply of uranium. As a result, the price of uranium jumped during the last three quarters and reached $74 per pound, which is the highest level since 2008. Centrus Energy’s negative net debt level and its $1 billion order book by 2030 make the company’s liquidity safe. When all was said and done, Centrus Energy’s valuation metrics show that the company undervalued.

Thank you for your time, and as always, I appreciate your insights.

Read the full article here

Leave a Reply