Introduction

Founded in October 2020, Centessa Pharmaceuticals (NASDAQ:CNTA) is a clinical-stage firm committed to creating transformative medicines. Utilizing an “asset-centric” approach, the company acquired 11 pre-revenue biotech firms in January 2021 and went public in June 2021. It has since restructured its management and subsidiaries, focusing on a diverse pipeline that spans early to late-stage developments in high-value, underserved medical areas. The company aims for regulatory approval to disrupt existing treatment paradigms and tap into multi-billion dollar markets.

The following article analyzes Centessa’s financial position, drug pipeline, and investment potential. It highlights the company’s liquidity, diversified pipeline, and promising drug candidate ORX750 for Narcolepsy Type 1.

Q2 Earnings Report

Looking at Centessa’s most recent earnings report, the company had $303.6M in cash and equivalents as of June 2023, bolstered by $15M from ATM sales in August. They project this will fund operations into 2026. R&D expenses decreased to $33.7M, compared to $53.7M in Q2 2022. G&A expenses were slightly down at $13.3M. Net loss narrowed to $24.9M, aided by a $24.1M tax benefit.

Cash Runway & Liquidity

Turning to Centessa’s balance sheet, the company has current assets of $145.2M in cash and cash equivalents and $158.4M in short-term investments, totaling $303.6M in liquid assets. From the Consolidated Statements of Cash Flows, the net cash used in operating activities over the last six months is $91.9M, translating to a monthly cash burn rate of approximately $15.3M. With this rate, the estimated cash runway is about 19.8 months. It’s important to note that these figures are based on past data and should not be solely relied upon for predicting future performance.

Centessa appears to be in a fairly liquid position, but its high rate of cash burn may necessitate additional financing. The company has long-term debt of $73.3M, indicating some leverage but not an overwhelming burden relative to its assets. Based on these factors, it seems plausible that the company could secure additional financing, although the favorable terms of such financing would be contingent on future operational milestones and market conditions. These are my personal observations, and other analysts might interpret the data differently.

Capital Structure, Growth, & Momentum

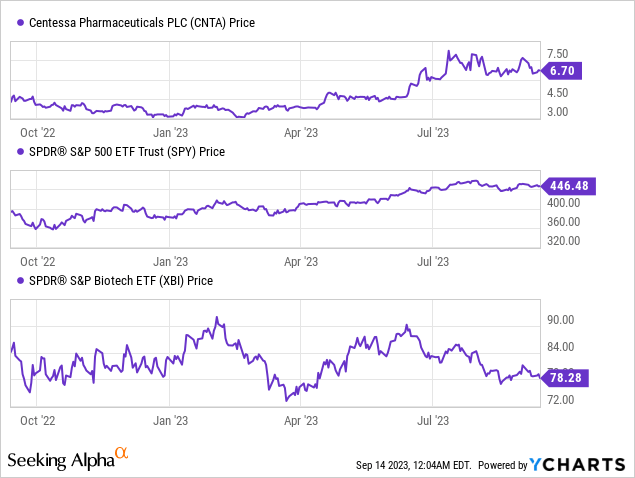

According to Seeking Alpha data, Centessa has a moderate debt-to-market cap ratio, offset by a significant cash cushion for financial stability. The firm’s enterprise value is $433.87M. Currently in the clinical stage, revenue generation appears a few years off. Recent stock trends show robust momentum, notably outperforming the S&P 500 over various periods.

With a varied pipeline and a targeted strategy, Centessa offers growth potential, contingent on overcoming clinical and regulatory challenges.

Centessa Targets High-Value Medical Niches

Centessa’s pipeline targets high-value medical niches with innovative approaches.

-

SerpinPC for Hemophilia: A subcutaneously administered candidate in Phase 2a trials, it aims to reduce bleeds with a novel mechanism and has secured FDA Fast Track and Orphan Drug designations.

-

LB101 and LB206 in Oncology: Utilizing LockBody technology, these candidates offer targeted tumor treatments while limiting systemic toxicity. LB101 is in Phase 1/2a trials, while LB206 shows preclinical promise.

-

ORX750 for Sleep Disorders: This orally-administered OX2R agonist is in preclinical development and targets Narcolepsy Type 1 (NT1), with potential for broader applications in sleep disorders.

Each candidate aims to provide a differentiated solution in their respective markets. For a deeper look into how Centessa plans to impact the sleep disorder market, let’s delve into the particulars of ORX750.

Centessa’s ORX750 Targets Orexin for Lasting Wakefulness

ORX750 is carving out its own niche in the field of narcolepsy treatments. With important data to be showcased at the forthcoming World Sleep Congress, this orally available OX2R selective agonist aims to address the root cause of NT1 by focusing on orexin neurotransmission.

Points of Differentiation:

-

Mechanism of Action: Unlike Belsomra, Dayvigo, and Quviviq, which mainly work by inducing sleep, ORX750 stimulates wakefulness by targeting the orexin receptor. The drug was formulated using a design rooted in high-definition protein crystallography, alongside a stabilized OX2R receptor protein.

-

Potency and Selectivity: ORX750 has displayed astonishing selectivity over human OX1R, 9,800-fold in vitro tests, and demonstrated full agonist capabilities at human OX2R with an EC50 of 0.11 nM, compared to orexin A’s EC50 of 0.035 nM.

-

In vivo Efficacy: Results from PiezoSleep assays and EEG/EMG/video assessments indicate ORX750 significantly elevates wakefulness, decreases cataplexy episodes, and extends the time before sleep and cataplexy events in Atax mice, an accepted model for human NT1.

-

Safety Metrics: While TAK-994, another orexin receptor agonist, showed impressive efficacy in improving wakefulness and reducing cataplexy, it fell short due to hepatotoxic side effects. ORX750’s safety profile will therefore be a crucial focus, potentially differentiating it from TAK-994.

-

Efficacy and Safety Balance: The upcoming data presentation at the World Sleep Congress is eagerly awaited, as it’s expected to offer comprehensive insights into both the efficacy and safety of ORX750. Given the potency and efficacy that TAK-994 displayed, ORX750 stands to benefit from comparable effectiveness, provided it demonstrates a favorable safety profile.

ORX750 is poised to potentially revolutionize NT1 treatment by directly addressing the underlying deficiency in orexin. For both investors and clinicians, the data to be revealed at the World Sleep Congress should provide invaluable insights into this promising candidate’s efficacy and safety.

My Analysis & Recommendation

In concluding my dive into Centessa Pharmaceuticals, several key points stand out. First, the company’s diversified pipeline, facilitated by its asset-centric model, offers multiple avenues for potential success. This diversification serves as a risk-mitigating strategy, ensuring the company has multiple “shots on goal.”

Financially, Centessa is relatively well-positioned. With $303.6M in liquid assets, the company has a financial buffer that could last until 2026. Although future financing may be required due to a high cash burn rate, a moderate long-term debt of $73.3M makes the prospect of securing additional funds plausible.

Of particular interest is ORX750, a preclinical candidate targeting NT1. Its unique mechanism and promising preclinical data make it an asset worth watching. However, it’s crucial to note that the drug is in its nascent stages. Investors should look forward to the World Sleep Congress for more comprehensive data that could validate ORX750’s promise.

While the drug’s safety profile remains a subject of upcoming data, the need for such a profile that addresses previously observed shortcomings in alternatives like TAK-994 cannot be overstated. In a field fraught with setbacks, the ability to demonstrate both efficacy and safety will be crucial.

Given Centessa’s financial health and diversified drug portfolio, I’m inclined to recommend a speculative “Buy.” ORX750 adds an intriguing and hidden layer of potential, but remember, the biotech sector is inherently volatile. Investors should continue to monitor upcoming clinical trials and data presentations, including the World Sleep Congress, as part of their due diligence.

In essence, keep Centessa on your radar as it may offer a blend of risk and reward that savvy biotech investors find appealing.

Risks to Thesis

While I’ve recommended a “Buy” for Centessa Pharmaceuticals, several risks could potentially undermine this stance:

-

Clinical Failure: Despite promising early results, any candidate like ORX750 could fail in later clinical stages.

-

Regulatory Hurdles: Fast Track and Orphan Drug designations don’t guarantee FDA approval.

-

Cash Burn: Even with over $300M in liquid assets, their high cash burn rate could require dilutive financing.

-

Competition: Other firms may produce more effective or safer drugs for targeted medical areas.

-

Management Execution: The company is young, and managing a diversified portfolio of 11 firms poses an operational risk.

-

Valuation: With no current revenue and a clinical-stage pipeline, market cap may be over-optimistic.

-

Economic Conditions: Broader economic downturns can affect biotech funding and market sentiment.

Read the full article here

Leave a Reply