Thesis

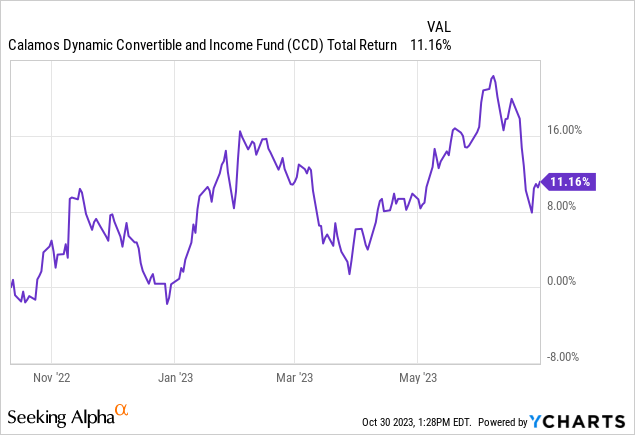

Today’s environment is very tricky. We believe we are in a multi-year bear market that is going to end up in tears, however rallies can be furious and long. We had one from October 2022 to July 2023 when CCD was up substantially:

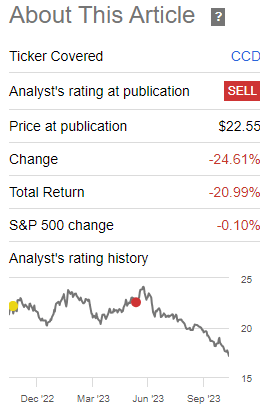

Calamos Dynamic Convertible and Income Fund (NASDAQ:CCD) is a high beta equity CEF that we have covered before here with a Sell rating. It is down substantially since then:

Author Sell Rating (Author)

The CEF is down -24% on a price basis and -20% on a total return basis since our Sell rating. Retail investors need to be very careful in today’s market with high beta CEFs. These instruments are not only volatile from a NAV perspective, but they get additional volatility via their premium fluctuations based on market risk-on or risk-off environments. In our past article we had pointed out that the CEF was trading at a historic high premium to NAV without a good reason outside the risk-on feature of the overall market.

CCD focuses on convertible debt, thus the main driver is equity prices, but a large secondary driver is represented by rates. There is an inverse relationship between rates and bond prices, thus as rates kept increasing bond fair values have gotten impacted.

With the overall stock market in a significant correction in the past month (the S&P 500 is down almost -10%), an ongoing peaking in rates and a disappearance in the CEF’s premium to NAV, we are no longer comfortable with a Sell rating, feeling the down move we anticipated has exhausted its path, and are moving to a Hold (Neutral) stance on the name.

High premium to NAV no more

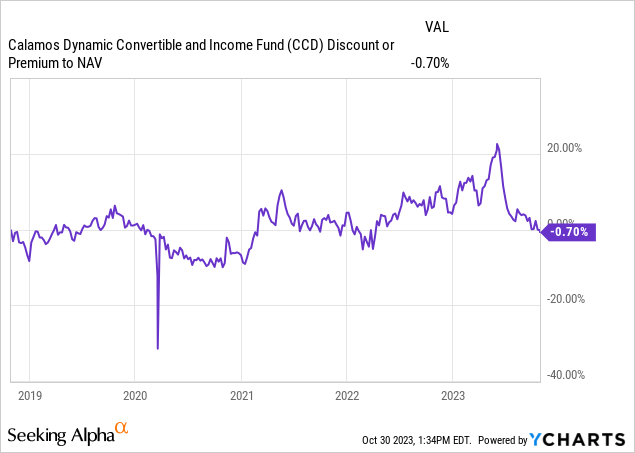

When we wrote our last piece we identified a massive red flag for the name via its high premium to NAV, which had reached a historic high level:

On the back of the overall market risk-off conditions the premium to NAV has compressed significantly, with CCD now trading fairly flat to net asset value. This is a proper state of affairs in our mind, since convertible funds need a low rates environment in order to command a high premium.

A CEF structure should only trade at a high premium to NAV when its primary risk factor is in a structural bull market, and the CEF via its structure (usually leverage) offers investors an advantage versus plain vanilla ETFs. We have seen this feature prominently in the 2020/2021 low rates bull market, when CEFs from a plethora of asset classes moved to premiums to NAV.

Correlation to the wider risk markets

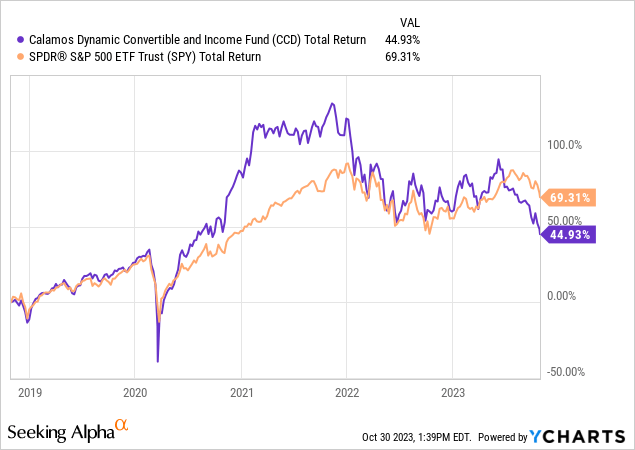

Convertible bond funds thrive in a low rate environment:

As observed from the above total return graph, CCD had an almost 1:1 correlation with the SPY until the zero rates post-Covid recovery, when it decoupled due to its leverage. As per its definition:

A convertible bond is a fixed-income corporate debt security that yields interest payments, but can be converted into a predetermined number of common stock or equity shares. The conversion from the bond to stock can be done at certain times during the bond’s life and is usually at the discretion of the bondholder. As a hybrid security, the price of a convertible bond is especially sensitive to changes in interest rates, the price of the underlying stock, and the issuer’s credit rating.

In a zero rates bull market the security usually has a very high delta because the underlying stock usually moves above the strike price of the conversion, thus making market participants trade the bond as actual equity. When you add leverage on top as CCD has (currently at 39%), you get a boosted positive return.

Analytics

AUM: $0.45 billion.

Sharpe Ratio: -0.05 (3Y).

Std. Deviation: 19.4 (3Y).

Yield: 13.6%. (30-day SEC yield)

Premium/Discount to NAV: -0.7%.

Z-Stat: -1.6.

Leverage Ratio: 39%

Composition: Convertible Securities

Distribution

The fund still has an eye popping distribution yield, but please note CCD employs a managed distribution plan:

The goal of the managed distribution policy is to provide investors a predictable, though not assured, level of cash flow, which can either serve as a stable income stream or, through reinvestment, may contribute significantly to long-term total return. We understand the importance that investors place on the stability of dividends and their ability to contribute to long-term total return, which is why we have instituted a managed distribution policy for the Fund. Under the policy, monthly distributions paid may include net investment income, net realized short-term capital gains, net realized long-term capital gains and, if necessary, return of capital.

Source: Semi-Annual Report

In today’s environment the CEF needs to crystallize capital gains (if any) in order to fully support its dividend yield. That is not the case presently.

What is next for CCD?

With the premium to NAV finally dis-inflated, CCD is going to exhibit a higher correlation with the overall market going forward. If we get a strong year-end rally as some market participants are asserting, CCD will follow suit. The trajectory for this name is no longer downwards, and it holds the potential to outperform the SPY on the back of a vicious year-end risk-on sentiment.

Overall however we are not big fans of converts in today’s high yield environment. We feel that convertible bonds will be structurally hampered until rates come down. CCD will be an ideal vehicle down the line, when a true structural bull market does develop and flourish.

Conclusion

CCD is a convertibles closed end fund. The vehicle represents a high beta take on equity risk markets, and performs best in a low rates environment. We covered this name before in May, with a Sell rating. The CEF is down -24% since, on a price basis. We are reviewing the name now given the drawdown in the S&P 500 and what we feel is another interim bottom in a structural bear.

The CEF’s premium to NAV is finally back to being flat to NAV, a level which we feel is appropriate in today’s interest rate environment. The contraction in the premium has been responsible for most of the CEF’s decline, and we no longer feel a Sell rating is appropriate at today’s levels, especially in light of a potential year-end rally in risk markets. We are therefore upgrading the rating for CCD to Hold (Neutral).

Read the full article here

Leave a Reply