Investment thesis

My last bullish call regarding the Caterpillar (NYSE:CAT) stock worked exceptionally well. The stock delivered a 15.5% total return since then, while the broader U.S. market declined more than 1%. Today, I would like to reiterate my bullish thesis for Caterpillar. The company continues demonstrating strong financial performance in the current uncertain environment, which is a solid bullish sign to me. Caterpillar’s management demonstrates a firm commitment to profitability improvement and the recent dividend hike indicates its confidence in the company’s bright prospects. The valuation is still very attractive. All in all, I assign the stock a “Buy” rating once again.

Recent developments

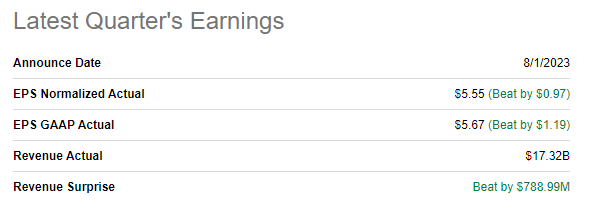

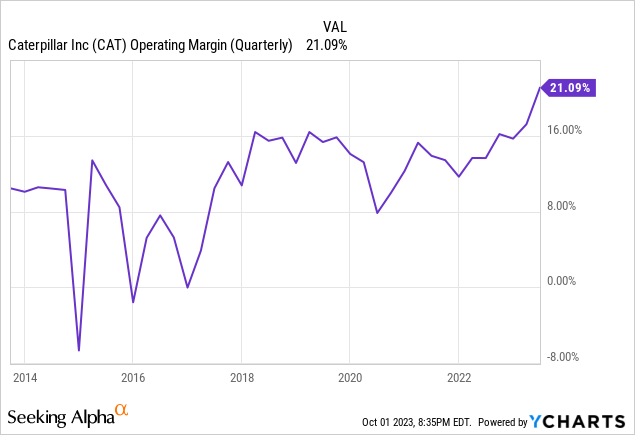

The latest quarterly earnings were released on August 1, when the company topped consensus estimates. Quarterly revenue demonstrated stellar growth momentum with a 21.6% YoY growth. The adjusted EPS followed the top line and expanded substantially from $3.18 to $5.55. Profitability metrics expansion has been nothing but stellar. The gross margin widened from 25.8% to 32.1%, and the operating margin improved from 14.2% to 21.1%.

Seeking Alpha

Caterpillar demonstrated strong revenue growth momentum across all three primary segments: Construction Industries, Resource Industries, and Energy & Transportation. The company benefited from both improved pricing and higher sales volumes. I like Caterpillar’s ability to demonstrate strong pricing power amid the uncertain environment. Another bullish sign is that the management demonstrates a strong commitment to cost control, with the quarterly operating margin being at its highest over the last decade.

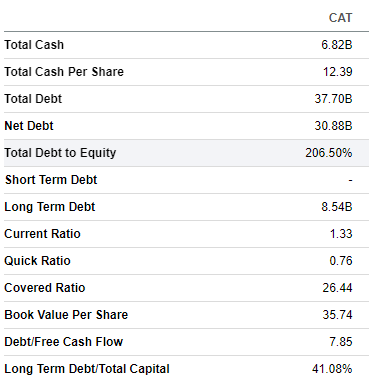

Improved profitability allowed the company to boost its free cash flow [FCF] to $3.8 billion. Such a solid FCF improvement means the company continues strengthening its fortress balance sheet. The company had $6.8 billion in cash as of the latest reporting date, which makes it well-positioned to fuel further growth and invest in innovation. Liquidity metrics are also in excellent shape. The company is a dividend aristocrat and well-known for its commitment to increasing dividends. The recent 8% hike indicates the management’s strong confidence in the company’s bright near-term prospects. Apart from its stellar dividend track record, Caterpillar is also well-known for its generous stock buyback programs.

Seeking Alpha

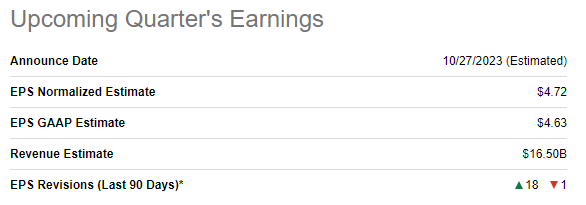

The upcoming quarter’s earnings are scheduled for release on October 27. Quarterly revenue is expected by consensus at $16.5 billion. There is a notable sequential drop, but historically, Q3 has been softer than Q2, so it is not a problem. What is important is that YoY growth is expected to be solid at 10%. The profitability is also expected to expand notably again, with the adjusted EPS forecasted to widen YoY from $3.95 to $4.72.

Seeking Alpha

The current environment of high commodity prices favors the company’s topline growth since approximately 60% of the total revenue is generated by the Resource Industries and Energy & Transportation segments. Amid high commodity prices, these segments’ customers are expanding their capital investment programs, pushing the demand for heavy machinery. Caterpillar’s strong brand allows the company to exercise solid pricing power and enjoy the current cycle from the demand side and the favorable pricing side. The near-term outlook looks bright for commodity producers, especially the oil and gas industry. Crude oil price is surging even amid the current environment of vast economic uncertainty and high inflation. This is due to substantial underinvestment in exploration and production during almost a decade of low commodity prices, which currently weighs on the supply side. The economic isolation of the commodities-rich Russian economy due to the war also pressed on the global supply of commodities.

Valuation update

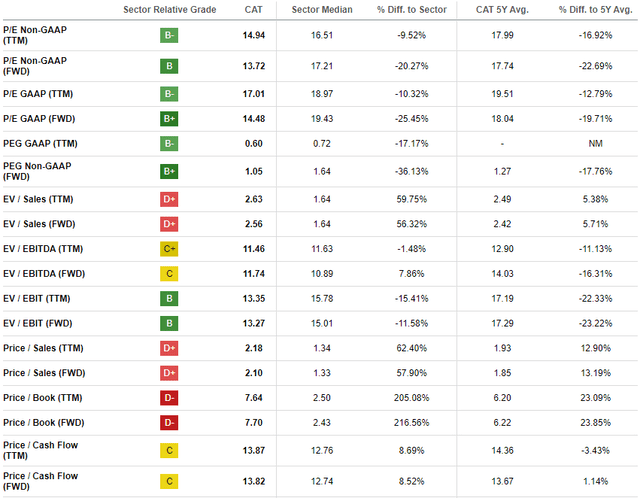

The stock rallied about 14% year-to-date, outperforming the broader U.S. market. Seeking Alpha Quant assigns the stock an average “C-” valuation grade. The outcomes of the multiples analysis are mixed since CAT’s current valuation ratios compare differently to the sector median and the company’s historical averages. That said, the analysis of valuation ratios does not give sufficient conviction.

Seeking Alpha

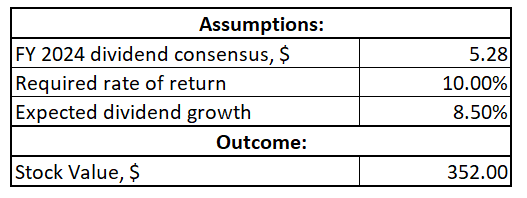

I want to proceed with the dividend discount model [DDM]. Caterpillar is a dividend aristocrat, and I consider this approach to be the best fit to get a reliable estimation of the stock’s fair value. To address the environment of increasing interest rates, I upgraded my WACC for DDM from 9% to 10%. Consensus dividend estimates forecast FY 2024 payout at $5.28. I also update the dividend growth rate and use a rounded-down 10-year CAGR of 8.5%.

Author’s calculations

According to the DDM, the stock’s fair value is $352. This indicates approximately 30% upside potential for CAT, meaning the stock is very attractively valued.

Risks update

There is still a substantial level of uncertainty regarding how far central banks of the developed world will go in their monetary policy tightening. Interest rates are at multidecade highs in the U.S., Canada, and Western Europe. Rates are still increasing, and during his last press conference, Jerome Powell left the door open for another hike this year. There is a high probability that if the Fed makes another interest rate hike, other developed world’s central banks will do the same. The world’s major economies can possibly cause a global recession by keeping tight monetary policy for longer. This will ultimately hit spending by both households and businesses, and the demand for commodities will be softened. Lower demand will undermine commodity prices, which will force resource companies to downsize their capital expansion plans. With lower capital spending, there will be less demand for Caterpillar’s products and services. On the other hand, a possible recession is just another phase of the economic cycle, which the recovery and growth stages will follow. I mean that there will likely be generous infrastructure spending in the developed world once commodity prices moderate. This is also highly likely to be a solid catalyst for Caterpillar, given the company’s strong brand reputation.

Bottom line

All in all, Caterpillar’s stock is still a “Buy”. The company’s revenue demonstrates stellar growth momentum, and the management is firmly committed to absorbing as much of this momentum as possible with its focus on profitability metrics improvement. The balance sheet is a fortress, which makes the company well-positioned to invest in innovation and continue improving its operating efficiency. The latest dividend hike is a solid bullish sign as well. Last but not least, my valuation analysis suggests that the stock is still very attractively valued with about 30% upside potential.

Read the full article here

Leave a Reply