Investment action

Based on my current outlook and analysis of Casey’s General Stores (NASDAQ:CASY), I recommend a hold rating. I expect the normalization of cents per gallon [CPG] and fuel gallon to be weak in the near term as consumers opt for cheaper alternatives. While the other segments, like inside-store SSS, remain strong, the fact that gasoline is now a bigger mix of the business will likely pressure the overall business financials as CPG reverts.

Basic Information

CASY operates a straight-forward business; they operate convenience stores [C-stores], similar to 7-11. Within the stores, they offer snacks, ready-to-eat products, beverages, tobacco products, and other non-food items. Most importantly, they sell gasoline too. CASY is a US-focused business, and as of 1FQ24, CASY has a total of 2,536 company-owned stores.

Review

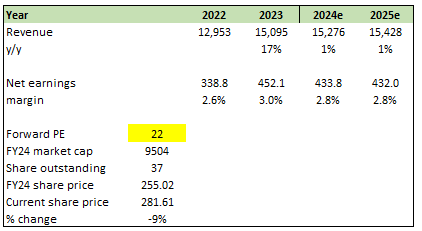

Historically, CASY has always been a mid-single-digit topline grower (FY11 to FY20 revenue CAGR of ~6%). However, revenue has surged tremendously in FY22 by ~49% due to the surge in gasoline revenue contribution due to the high gas price (driven by the Russia-Ukraine war). For context, in the first 3 quarters of FY21, gasoline revenue was meddling around $1 to $1.1 billion in revenue, but is now at $2.4 billion. As a result, net profit has surged to a historical high as well.

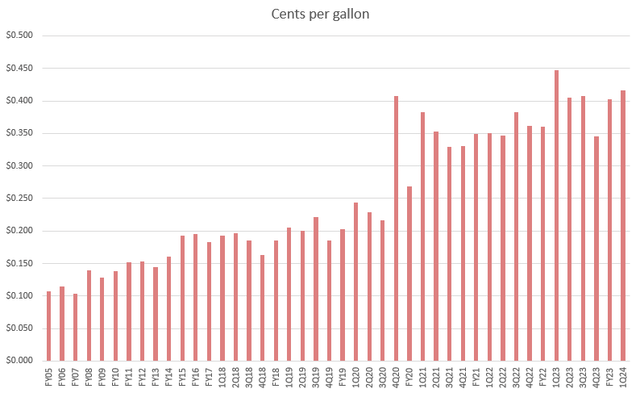

EPS increased by 11% to $4.52 in the most recent quarter for CASY, thanks to higher fuel margins and better cost management. Impressively, fuel margins of 41.6 CPG in FQ1 represent the 16th consecutive quarter that fuel margins were above 30 CPG. I expect this to continue to be a growth driver in the near term, as management noted the trend has persisted into August, when fuel margins trended in the high-30’s CPG range. I think the negative narrative here is that CPG is way too high when compared to historical levels, and frankly, it has indeed outdone my expectations by starting at this level for so long. The question is whether it will revert back to the 20s or remain in the 30s. My bet is that the new normal will be in the 30s. Given the myriad factors that are driving the oil price movement, my way of assessing it is to look at it from the cost of doing business or daily activities perspective, using interest rates and inflation as a benchmark. We have lived in the world of zero interest rates for so long that most people have forgotten that the average 10-year US rate is actually mid-single digits if we remove the recessionary years (highlighted in gray). Assuming we are back to normal, the cost of using oil should be more expensive as well in order to compensate. That said, I acknowledge the fact that the current mid-30s are not sustainable, and CASY will eventually see a reversion.

Macrotrends

CASY

Apart from the profit margins in the fuel sector, there was also a noteworthy 0.4% year-on-year growth in same-store fuel sales volumes, surpassing industry trends in the regions where Casey’s operates, as stated by management during the call. This indicates that Casey’s is gaining a larger market share. However, it’s worth noting that fuel volumes may face some challenges in the short term due to the recent sharp increase in crude oil prices. I believe the market has already factored this in, especially since management previously mentioned that fuel volumes in August were slightly below the midpoint of its FY24 projections. In my view, the volume is likely to remain under pressure as lower-income consumers are experiencing increased financial stress and are shifting towards fuels with higher ethanol blend.

Fuel ethanol’s price discount to gasoline was one factor that led to the higher summer blend rate. U.S. Energy Information Administration

Elsewhere, same-store sales [SSS] increased by an impressive 5.4% in the past year, with significant contributions coming from the grocery and general merchandise, prepared food, and dispensed beverage categories. Due to the current economic climate, I anticipate this trend to continue as customers flock to Casey’s 350 private-label products. Looking ahead, I expect 2Q24 inside SSS to remain healthy as traffic trend continued to 2Q, albeit at moderating levels vs. 1Q24 as it faces a tough 2Q23 comps.

Overall, I think the 1Q24 result was a strong one. However, given the tough comps last year, my concern is that growth on a headline basis might not be as attractive as in FY22/23 anymore. Note that FY23 grew 17% on top of FY22’s 49% growth, so the revenue base is a lot higher today.

Lastly, I also like to touch a little on the growing demand for EV. My view is that it is going to be negative for CASY in the near-to-medium-term as there is likely to be lesser demand for fuel. However, in the long-term, I do see a possible positive scenario playing out that CASY could provide value for EV users by repositioning their fuel stations to hybrid, or possibly full battery chargers. However, the latter case is likely to be far out into the future that would not be priced into today’s valuation.

Valuation

The fact is, CASY is going to see a reversion in revenue eventually, especially in the gasoline business. Suppose CPG reverts to the low-30s (assume 31 CPG in this case) in FY25, and that number of fuel gallons grows at a very slow rate of 1% to reflect the expensive fuel cost. FY25 fuel gallons would be 2.9 billion. This would equate to $907 million in gross profit for the fuel business, which is a 15% decline from CASY’s LTM fuel business gross profit ($907 million/1.063 billion).

Author’s work

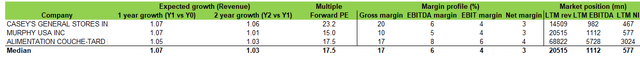

With that in mind, I am modeling a flattish 1% growth over the next 2 years with the expectation that FY24 will see moderating growth as it faces the tough FY23 comps and that FY25 will see pressure from the normalization of CPG, albeit seeing some support from other segments (e.g., inside stores, SSS). CASY currently trades at 22x forward earnings, which is in line with its historical premium vs. peers like Murphy and Couche-Tard, and I expect this multiple to hold for the near term.

Author’s work

Final thoughts

I recommend a hold rating for CASY stock based on my analysis. While the company has seen robust growth, particularly in its fuel business, thanks to high fuel margins and cost management, I anticipate a reversion in fuel profitability, which may impact the overall financials. Historically, CASY has shown steady growth, but the recent surge in gasoline revenue due to high gas prices has driven exceptional results. However, the question remains whether these margins will revert to historical levels.

Read the full article here

Leave a Reply