Positive Momentum Following Key Events

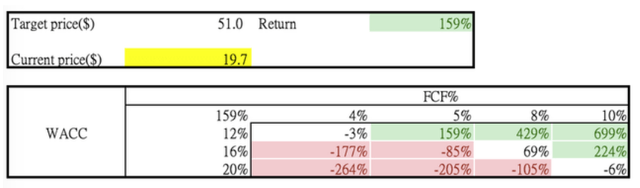

Carvana’s (NYSE:CVNA) stock had been trading in a range-bound pattern since we issued our target price of approximately $50, back when the stock was trading at $25. We noted further progress was needed to boost shares in our last piece after Q2 earnings. The stock jumped 13% on September 13 following Carvana’s comments at the Morgan Stanley conference that highlighted potential catalysts. Furthermore, the company presented an update on its Q3 projections and operational enhancements on August 9 at the J.P. Morgan conference. We believe this information holds value for investors and would like to communicate our insights with them.

Addressing Investor Concerns on Long-Term Profitability

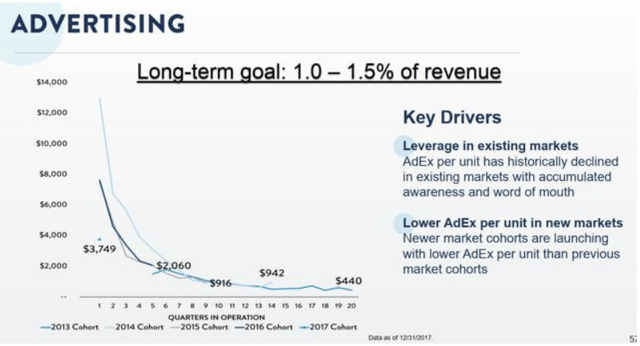

During the call, the company stated that it would break down fixed and variable costs in its Q3 earnings report to address potential investor concerns about long-term profitability. In the past, as the company has grown in scale, they have still struggled to achieve profitability. Even in 2021 when the stay-at-home economy boosted e-commerce, the company reported an operating loss of $104 million. Long-time investors, who follow us, understand this is not an issue, as the company is expanding into new markets and has only 1% aggregate market share currently. The analogy is like running a restaurant – you would not expect it to break even when just opening, especially with investments in additional logistics and dispatch systems for future growth. The profitability at 0.5%, 1%, and 3% penetration will be dramatically different as illustrated below. Providing cohort profitability helps investors understand the business model. Breaking down fixed and variable costs also aids in understanding at what penetration level local markets will be profitable.

CVNA

Strategies Driving Improved Unit Economics

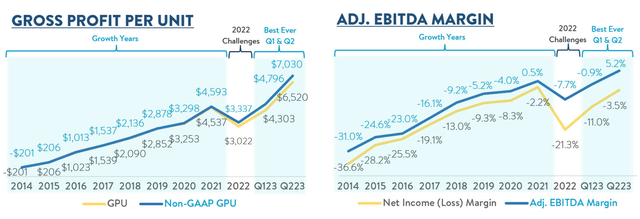

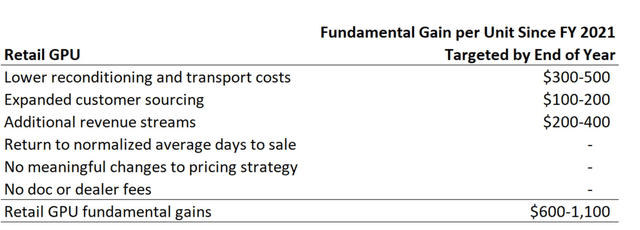

The company has taken many steps since COVID-19 to improve profitability. One topic mentioned on the earnings call is that while unit sales declined due to high-interest rates and used car prices, their team worked to enhance unit economics. The profitability of units at a smaller scale now exceeds pre-COVID levels, even with lower overall unit sales.

CVNA

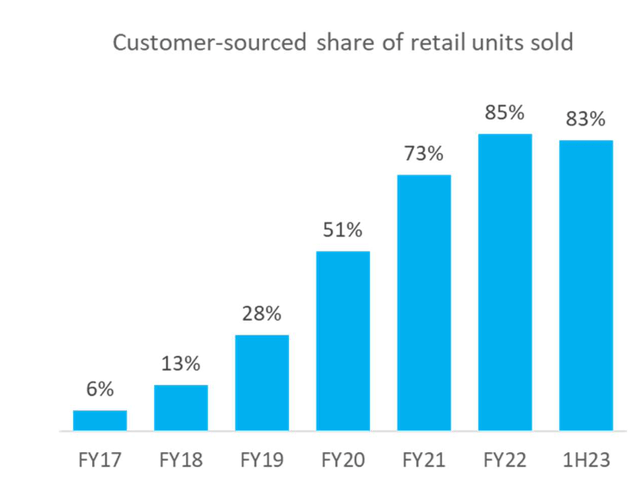

Some of the initiatives that have improved unit economics include building up the wholesale marketplace to increase gross profit per unit on wholesale sales, charging higher shipping fees for long-distance delivery, and increasing the customer-sourced share of retail units sold. These efforts have led to better profitability per unit sold.

CVNA

Building Customer Trust and Loyalty

The company’s custom er-sourced share increased to 83%, far higher than pre-COVID levels. This increase in customer relationships builds engagement and trust with customers over the long term. The high percentage of customer-sourced units sold demonstrates strong customer loyalty and repeat business.

CVNA

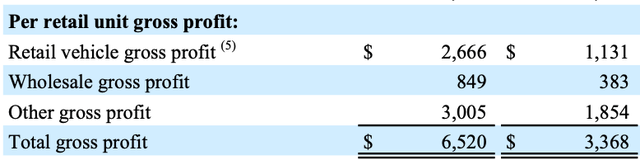

We believe customer trust is key to Carvana’s success, as they provide transparent pricing online rather than just convenience of delivery. This trust gives Carvana more opportunity to profit from loan financing. The charts below show Carvana’s loan financing margin per unit was as high as $3,005, even higher than its gross profit per car sold. Because Carvana has built customer trust through pricing transparency, it can generate significant profits from financing loans in addition to car sales. Their loan financing income demonstrates the value of cultivating loyal customers who trust Carvana for financing services.

CVNA

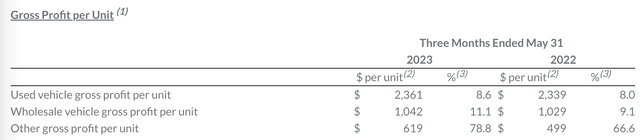

Carvana’s used vehicle gross profit per unit reached $2.6k, surpassing CarMax (KMX) at $2.3k. This suggests Carvana’s online used car sales model enables higher profitability compared to traditional brick-and-mortar dealerships.

KMX

Trust-Building Enhances Cross-Selling in Loan Financing

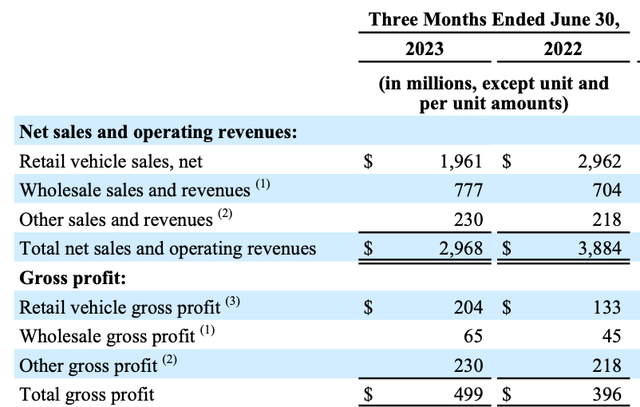

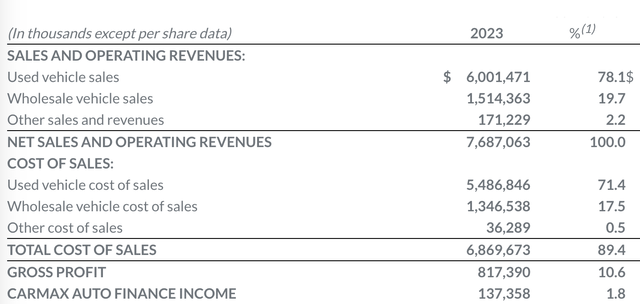

In addition, Carvana’s loan financing accounts for 46% of its gross profit or 7.8% of total revenue in the below chart. This is much higher than CarMax, where auto finance income is only 1.8% of total revenue, or 14% combined with gross profit (as they are displayed separately in financial statements). This indicates Carvana can generate more loan profits than CarMax, suggesting higher customer satisfaction. Although Carvana’s loan rates are higher than CarMax, Carvana gives customers the option to choose their own financing. The fact that many customers select Carvana financing demonstrates they find value in Carvana’s loan offerings. Carvana’s ability to profit on financing, despite higher rates, shows their business model cultivates loyal customers who trust them for financing services.

CVNA

KMX

Adjusting Shipping Strategies for Sustainability

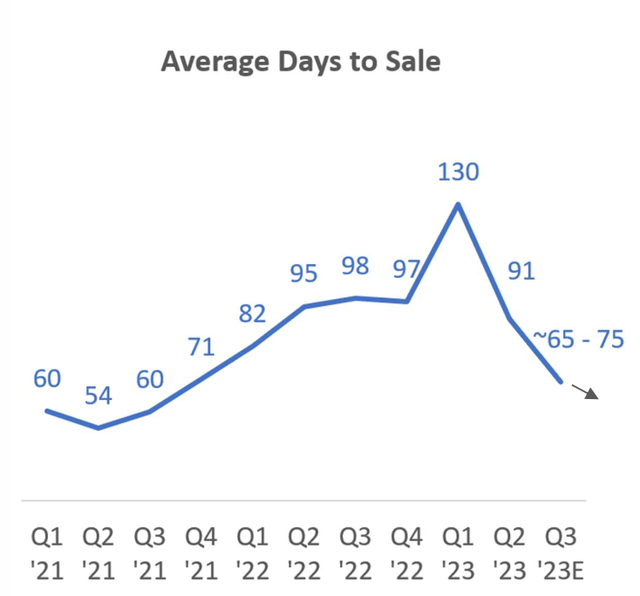

Carvana has changed its strategy to charge more for long-distance shipping. This makes sense as longer distances cost more and customers complained about shipping delays. By charging more and properly compensating the delivery fleet, Carvana can address these issues. Although this localizes the model, most customers would choose local inventory anyway, reducing the addressable market. However, this is a more sustainable approach long term. Carvana can still serve customers willing to pay a premium for scarce inventory shipped cross-country, while price-sensitive buyers will use local inventory. These initiatives have reduced average days to sale to the mid-60s.

CVNA

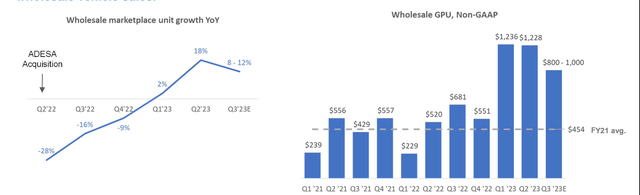

Wholesale Marketplace Growth

The wholesale marketplace has been gaining traction since the acquisition of ADESA. As we previously noted, investors should expect synergies from the ADESA acquisition. Carvana has shown progress, doubling wholesale GPU from pre-pandemic levels.

CVNA

Valuation Improved by Enhanced Cost Transparency

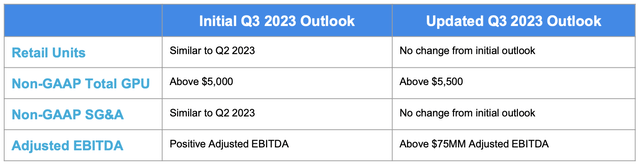

Despite GPU increasing to $5,500 and adjusted EBITDA guidance rising to $75M, this is still a sequential decrease from Q2. Thus, financials may not drive upside in Q3.

CVNA

The key factor is the fixed vs. variable cost breakdown, as this affects long-term margin assumptions. Our model assumes a 5% free cash flow margin, so long-term margins greatly impact valuation. We will monitor this metric closely in the Q3 report.

LEL

Diminishing Bankruptcy Risks

With only $50M capex in H1 2023 and $443M in operating cash flow, bankruptcy risks are fading as Carvana returns to positive free cash flow.

Conclusion: Maintaining a Positive Outlook

Bankruptcy chances are lower with the return of free cash flow. Although Carvana only sells used cars, its platform potential is high as it builds customer trust. We will monitor Q3 progress but maintain our Buy rating.

Read the full article here

Leave a Reply