Investment Thesis

Carter’s Inc.’s (NYSE:CRI) low forward multiple had me intrigued, so I decided to look into its financials to see if it is warranted. What I found was a mixed back of metrics and lackluster growth with deteriorating margins, which tells me that the low multiple, for now, is justified, and I assign a hold rating until these improve.

Briefly on the company

Carter’s is a retailer of childrenswear in the US and Internationally through brands like OshKosh, Skip Hop, and Child of Mine. The company has wholesale locations and e-commerce online stores.

Financials

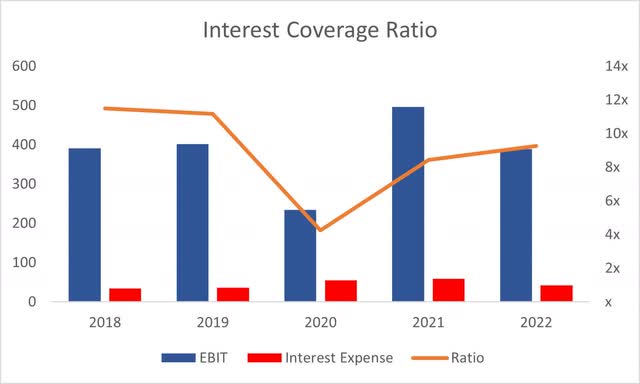

As of Q2 ’23, the company had around $175m in cash and equivalents against ~$497m in long-term debt. It’s worth pointing out that the debt burden has reduced since FY22 by around $120m, which is a positive sign. So, how bad is this debt for the company? I’m all for companies taking on debt for various strategic reasons as long as it is manageable. The historical interest coverage ratio has been more than acceptable, going as high as 11 and as low as 4. This means that EBIT was able to cover annual interest expense 4 to 11 times over. For reference, many analysts believe 2x is a healthy ratio, whereas I look for at least 5x for additional safety as I like to be more on the conservative end. I feel 2x is a little too tight.

As of Q2 ’23, the company was at around 5x coverage, which is just at that minimum of mine, however, since I don’t take quarterly reports too seriously as I would like to see the bigger picture, the company still has 2 quarters of performance to improve on the ratio, and I think it will. Nevertheless, it is safe to say the company is at no risk of insolvency.

Coverage Ratio (Author)

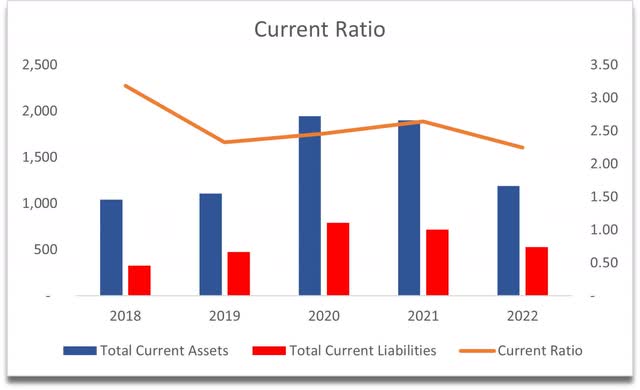

The company’s working capital ratio is around where I want it to be when it comes to efficiency. Maybe slightly on the inefficient end. What I call an efficient current ratio is anywhere in the range of 1.5-2.0. This range tells me that the company has enough liquidity to pay off short-term obligations and still has liquidity left over for strategic growth initiatives, and it also tells me that the company isn’t hoarding cash or is holding too much inventory. The company’s current ratio as of Q2 improved to 2.0 from 2.25, and I say improved because, in my opinion, it became more efficient due to the company’s ability to lower its inventory levels and use its cash. Safe to say, that the company has no liquidity issues.

Current Ratio (Author)

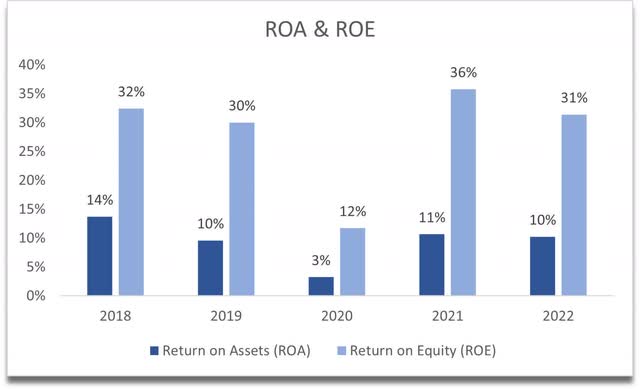

In terms of efficiency and profitability, CRI’s ROA and ROE have been very strong historically. These have recovered quite well from the pandemic lows and have averaged around the historical numbers. These are also well above my minimum of 5% for ROA and 10% for ROE. This tells us that the management is very adept at utilizing the company’s assets and shareholder capital efficiently, thus creating value in the process.

ROA and ROE (Author)

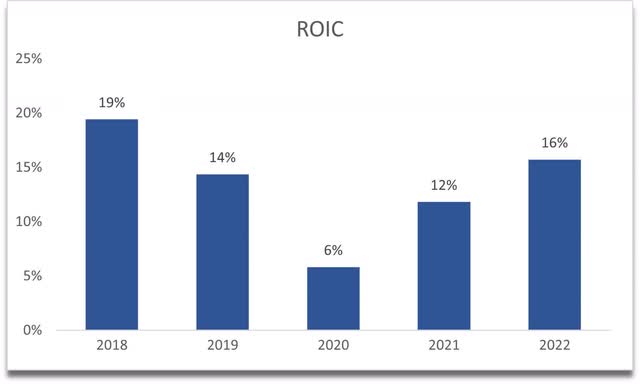

We can see a similar story unfolding in the company’s return on invested capital, or ROIC. It is well above the pandemic lows and above the minimum of 10% that I am looking to get from an investment. This tells us that the company has a competitive advantage and a decent moat, which I would be willing to pay a slight premium for.

ROIC (Author)

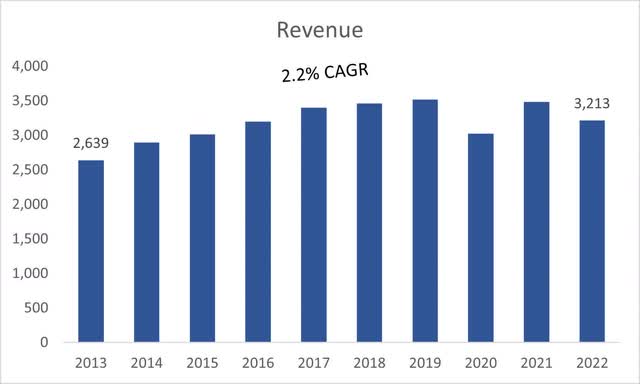

What I am quite disappointed in and probably a good reason the company’s trading at such low multiples, is the company’s lackluster revenue growth. Over the last decade, the company managed to keep up with the US long-term inflation goal of around 2%, which is quite underwhelming. I have no reason to suspect the company’s going to grow at a quicker pace than its historical.

Revenue Growth (Author)

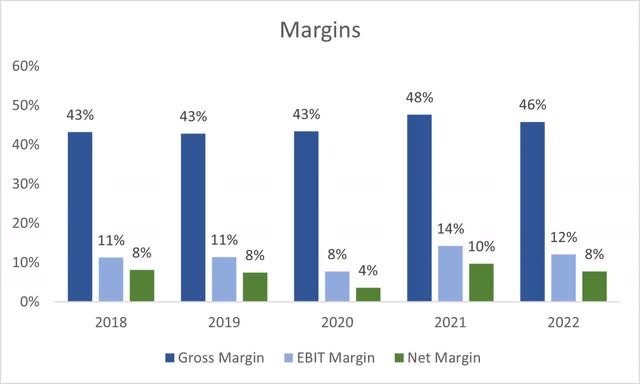

In terms of margins, these have been steady over the years, with slight deterioration in FY22, and unfortunately, six months ended July 1st ’23, the margins have not improved and also got a little worse, however, as I said earlier, I will take the quarterly reports with a grain of salt because they do tend to fluctuate more q/q.

Margins (Author)

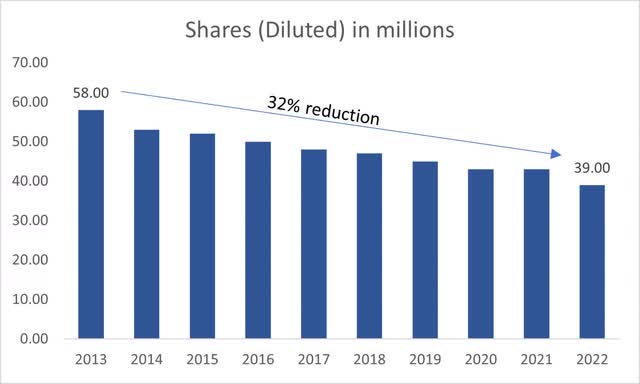

The company has been reducing its shares outstanding quite considerably over the last while, which is going to improve its EPS and create value for shareholders. I’m all up for companies buying back their shares, however, only if there are no better ways of creating value for shareholders and if the shares are considered cheap. If not, then I feel like it’s not the best use of the company’s money.

Shares outstanding (Author)

Overall, the company seems to be running quite smoothly, but rather unexciting in terms of revenue prospects and what seems like continuing margin deterioration. The company does have a decent competitive edge and a moat, which is a plus, and the management seems to be able to use the company’s assets efficiently. So, let’s see what I would be willing to pay for a lack of growth in revenues.

Valuation

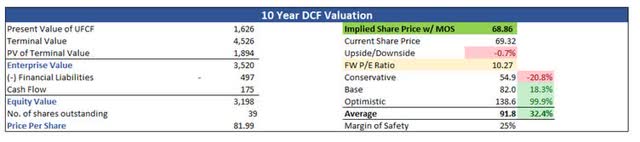

As I said, there’s no reason for me to believe the company would be able to achieve a higher revenue growth than its historical average. For my base case, I went with around 2.2% CAGR for the next decade, which is its historical average. For the optimistic case, I went with a 4% CAGR, while for the conservative case, the company will see 0 growth to give me a range of possible outcomes.

In terms of margins, for the base case, I decided to keep them as they were at the end of FY22, mainly because these are looking to deteriorate further, which doesn’t give me confidence that the company is going to become much more efficient and profitable over time. For the optimistic case, I went with around 400bps improvements from the base case over the next decade, while for the conservative case, I went with around 200bps worse than the base case over the same period.

On top of these estimates, I decided to add a 25% margin of safety, mainly because the company’s lack of growth and margin deterioration is keeping the company relatively low valued, and for me to take on such the company’s lack of growth, I require some additional safety. With that said, CRI’s intrinsic value is around $69 a share, which tells me that the company is trading at its fair value currently.

Intrinsic Value (Author)

Closing Comments

I am assigning a hold rating for now, due to a couple of unknowns. Firstly, it’s the company’s lackluster revenue growth that may be playing a big role in the company’s relatively low multiple because investors are looking for an exciting company that has growth potential and Carter’s seems to have stalled. The second reason I give it a hold rating is the uncertainty in the company’s profitability and efficiency. The margins so far seem to be continuing their deterioration. If this trend continues, I can see the share price dropping further until the company turns it around and introduces some decent cost-cutting initiatives to gain back the efficiency it once had.

I will look at the company’s next 2 quarters for a better picture of margins and revisit if I see that the margin situation is improving or at least showing some signs of improvement.

Read the full article here

Leave a Reply