At A Glance

Navigating the duality of CareDx’s (NASDAQ:CDNA) recent performance requires clinical and financial astuteness, a topic I’ve previously analyzed in depth. Since that analysis, the company has faced a sharp YoY revenue decline to $70.3 million, further complicated by changes in Medicare billing intricacies that have notably affected its testing services segment. In addition, the imminent expiration of the AlloMap patent in March 2024 casts its own shadow on future revenue. Financially, a strong balance sheet and diversified revenue streams offer downside protection, but they don’t fully negate the company’s high cash burn rate and Medicare dependency. Notably, substantial institutional holdings by entities like ARK Investment and BlackRock serve as key market sentiment indicators. Thus, the ensuing quarters for CareDx appear poised for volatility, warranting renewed, careful evaluation of the firm’s clinical strategies and financial resilience.

Q2 Earnings

To begin my analysis, looking at CareDx’s most recent earnings report for the quarter ended June 30, 2023, the company posted total revenue of $70.3M, a decrease from $80.6M YoY. Key revenue drivers were testing services at $53.4M and patient and digital solutions at $9.0M. Operating expenses amounted to $97.9M, outpacing revenues and resulting in a net loss of $24.9M for the quarter. Notably, there was a minor dilution in share count, from 53.6M shares as of December 31, 2022, to 54.0M shares as of June 30, 2023.

Financial Health

Turning to CareDx’s balance sheet, the company holds $87.8M in cash and cash equivalents and $194.9M in marketable securities, totaling $282.7M in liquid assets. The current ratio, calculated as total current assets of $360.8M divided by total current liabilities of $74.5M, stands at 4.84. Comparatively, the company has a healthy balance, given its total liabilities of $109.6M. Regarding cash burn, net cash used in operating activities over the past six months was $48.7M, translating to a monthly cash burn of approximately $8.1M. Therefore, the estimated cash runway is around 35 months. A brief caution: these values and estimates are based on past data and may not be applicable to future performance.

Based on these figures, and considering the realization of decreased YoY revenues, the probability of CareDx needing to secure additional financing within the next 12 months appears moderate. These are my personal observations, and other analysts might interpret the data differently.

Equity Analysis

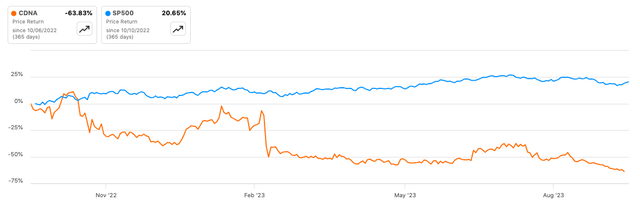

According to Seeking Alpha data, CareDx’s $349.39M market cap amid declining YoY revenue projects market skepticism. Analysts predict revenue contraction in FY 2023 and 2024, albeit with an uptick in FY 2025. The negative momentum in stock performance, lagging significantly behind SPY across timeframes, bolsters this outlook. Short interest is 7.83%, not alarmingly high but significant enough to indicate investor caution.

Seeking Alpha

The ownership structure leans heavily toward institutions, holding 92.31% of outstanding shares, with ARK Investment and BlackRock as notable names. New institutional positions amount to 1,733,354 shares while sold-out positions are at 383,998, indicating a slightly positive tilt. Insider activity strongly leans towards buying.

CareDx’s HeartCare Beats, But Revenue Skips a Beat

In the wake of CareDx’s Q2 2023 earnings report, investors find themselves navigating a complex landscape. On one hand, the company has carved out a unique competitive advantage with its industry-first MolDX approvals for HeartCare and AlloSure Lung, specifically targeting Medicare patients. This is a strategic move that could bode well for future revenue streams, especially given the critical role Medicare reimbursements play in the company’s financials.

However, it’s not all smooth sailing. The company reported a YoY revenue decline to $70.3 million, a downturn attributed mainly to Medicare Billing Article revisions. This decline is a red flag that warrants close monitoring, particularly in light of the complexities and risks associated with Medicare billing.

The testing services segment also saw a 20% decline, standing at $53.4 million. While this could be a direct result of policy changes, it’s a trend that should be scrutinized. On the flip side, CareDx has shown resilience by achieving growth in its non-testing services. Revenues for Patient and Digital Solutions and Products stood at $9.0 million and $7.9 million, respectively. This diversification could serve as a hedge against the billing complexities and reimbursement risks that have been a thorn in the company’s side.

Operational efficiency seems to be a focus for CareDx, as evidenced by an 80% adoption rate for new Test Requisition Forms (TRFs), achieved two quarters ahead of schedule. While this may seem like a minor point, such efficiencies could mitigate some of the billing complexities that have been a persistent challenge.

However, the company reported a 17% YoY decline in test results for its key products, AlloMap and AlloSure. This decline is concerning, especially considering that the AlloMap patent is set to expire in March 2024. The combination of declining test volumes and upcoming patent expiration could pose a significant risk to revenue.

On the financial front, CareDx seems to be on solid ground. The company collected over $20 million in incremental cash, driven by strong cash collections. This robust financial position could offer a cushion against some of the risks the company faces. Moreover, with a strong balance sheet boasting $283 million in cash and no debt, CareDx appears reasonably equipped to navigate regulatory and economic uncertainties.

My Analysis & Recommendation

In sum, CareDx finds itself at a precarious juncture. Its strong cash position and diversification strategies offer a bulwark against the systemic issues plaguing the testing services segment. Yet, investors cannot overlook the critical revenue declines and the looming expiration of the AlloMap patent. The company’s resilience in non-testing services has been commendable, but it needs to translate this to its core offerings. In light of its high institutional ownership, investors should closely monitor any shifts in holdings by key institutions like ARK Investment and BlackRock, as that could serve as a harbinger for stock performance.

Looking ahead, the next few quarters will be pivotal for CareDx. Investors should watch for any changes in Medicare policy that might affect billing – a core risk factors in its business model. Additionally, observe how the company maneuvers its product pipeline and partnerships to compensate for its declining test volumes. Given the substantial monthly cash burn and operating inefficiencies, scrutiny of operating leverage will be warranted. Although the company’s cash runway appears adequate for now, a failure to turn around could necessitate capital-raising measures, potentially diluting share value.

For those seeking antifragility in their portfolio, the uncertainties surrounding CareDx present a double-edged sword. While the company’s diversified revenue streams and robust cash position offer some downside protection, its reliance on Medicare billing and declining core business segments create significant fragility.

My recommendation is to maintain a “Sell” position. Despite its liquidity and balance sheet strength, the fundamental issues – revenue decline, billing complexities, and the pending patent expiration – make a compelling case against near-term optimism. Until CareDx demonstrates a meaningful turnaround, particularly in its core segments, a rerating of the stock appears unjustified.

Risks to Thesis

While my primary recommendation is to maintain a “Sell” position on CareDx, there are several considerations that could potentially contradict this view:

-

Overlooked Pipeline: The company’s advancements in MolDX approvals for HeartCare and AlloSure Lung might yield higher than anticipated revenues, particularly if Medicare policy shifts favorably.

-

Diversification Success: My analysis may underestimate the resilience provided by growth in non-testing services. A sharper rise in these segments could offset declines in testing services.

-

Institutional Investment: A high percentage of institutional ownership could act as a price floor. Notable players like ARK Investment and BlackRock may inject capital or exert influence that could positively impact stock valuation.

-

Cash Reserves: With a strong cash runway of around 35 months, the company has the time and resources to rectify current issues, which might mitigate the need for dilutive financing.

-

Operational Efficiency: The 80% adoption rate for new TRFs could be an early sign of addressing billing complexities, potentially reducing overhead and increasing margins.

Read the full article here

Leave a Reply