Introduction

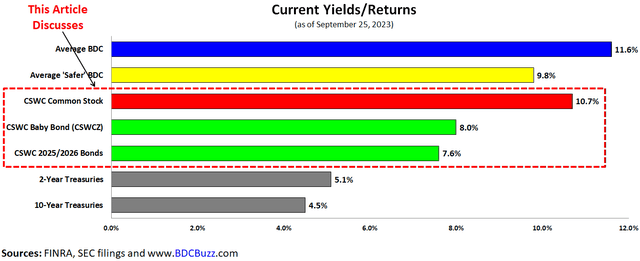

This is part of a series of articles discussing how to build a balanced retirement portfolio using business development company (“BDC”) common stocks currently yielding almost 12% and their safer notes – baby bonds/preferred shares with yield-to-maturities ranging from 6.5% to 9.0%. Please see the list of article links below for the previous portions of this series.

This article discusses Capital Southwest (NASDAQ:CSWC) which is an internally-managed BDC with a current dividend yield of 10.7% (including supplemental dividends, discussed later), its investment-grade notes (Moody’s Baa3, Fitch BBB-, CUSIPs: 140501AB3 and 140501AC1), and Baby Bond (CSWCZ) with yield-to-maturities of almost 8%.

We are very pleased to have received an investment grade rating from Fitch Ratings during the quarter. We now have investment grade ratings from both Moody’s and Fitch, which we believe is further market corroboration of our strong investment track record, first lien focused investment strategy, and prudent balance sheet management.”

FINRA, SEC Filings, & BDC Buzz

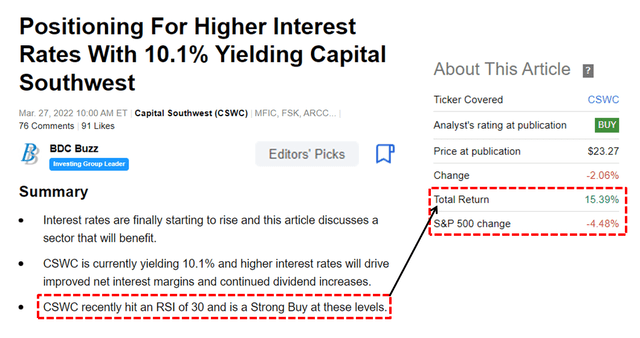

Also, this article is a follow-up to “Positioning For Higher Interest Rates With 10.1% Yielding CSWC” which suggested that readers should at least start a position and the stock has outperformed the S&P 500 by 20%:

Seeking Alpha

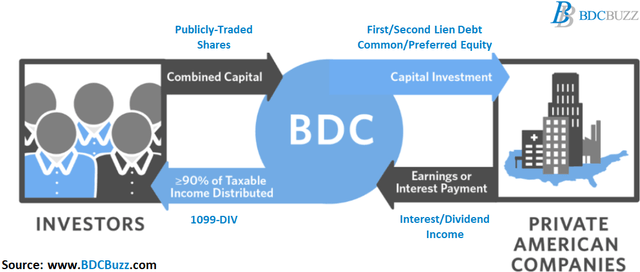

Business development companies invest shareholder capital in privately-owned, small- and medium-sized U.S. companies generating income from secured loans and capital gains from equity positions, much like venture capital or private equity funds.

BDC Buzz

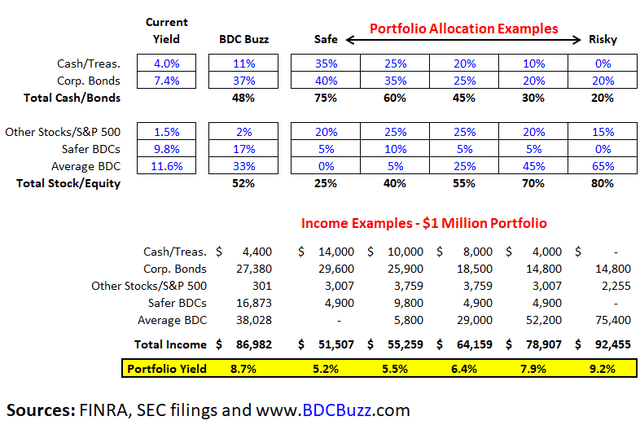

Many readers ask where BDC stocks and bonds fit into their overall portfolio. Your portfolio allocations depend on a few factors, including your age, overall risk appetite, investment time frame, and need to access capital. BDCs are for longer-term investors so please allow an investment time frame of at least three years. The following table uses the oversimplified asset classes of cash, Treasuries, corporate bonds/notes, other stocks (general market equities), and higher-yield investments (including BDCs) along with some examples of allocations and my personal portfolio (not exact) with portfolio yields ranging from 5.2% to 9.2%:

FINRA, SEC Filings, & BDC Buzz

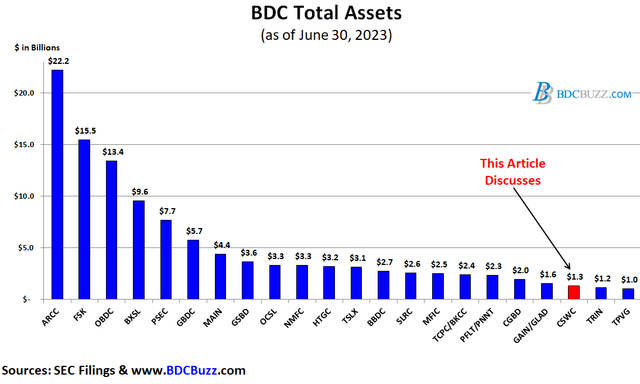

The BDCs in the chart below account for around 90% of the total assets and market capitalization for the sector. Over three months, we discussed the portfolio credit quality and/or dividend coverage for most of them, including Ares Capital (ARCC), Blue Owl Capital (OBDC), Blackstone Secured Lending Fund (BXSL), Prospect Capital (PSEC), Golub Capital BDC (GBDC), Main Street Capital (MAIN), Goldman Sachs BDC (GSBD), Oaktree Specialty Lending (OCSL), New Mountain Finance (NMFC), Hercules Capital (HTGC), Sixth Street Specialty Lending (TSLX), PennantPark Floating Rate Capital (PFLT), PennantPark Investment (PNNT), BlackRock TCP Capital (TCPC), Gladstone Investment (GAIN), Gladstone Capital (GLAD), Monroe Capital (MRCC), Trinity Capital (TRIN), and TriplePoint Venture Growth (TPVG) in the following articles:

SEC Filings & BDC Buzz

CSWC

CSWC Dividend Update and Coverage Ratios

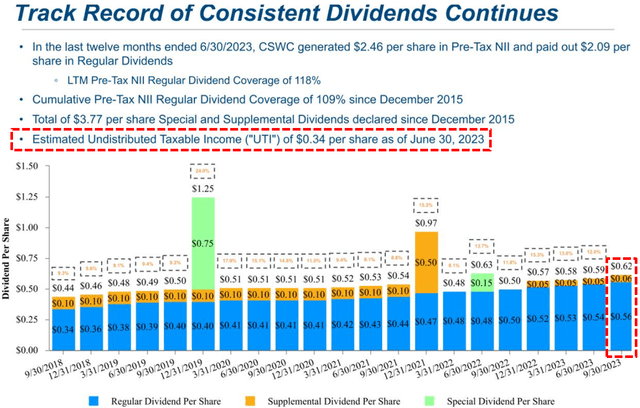

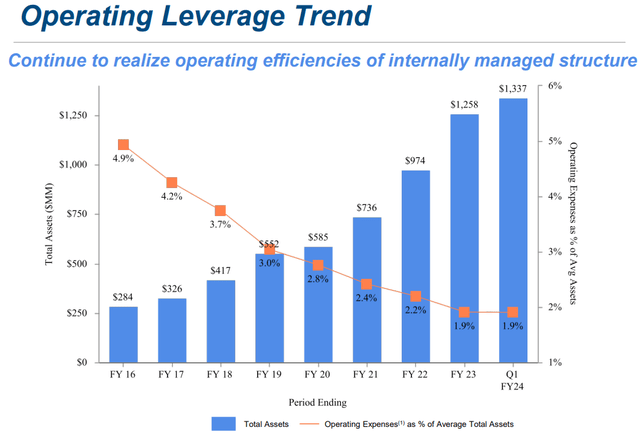

As discussed in previous articles, CSWC has better-than-average dividend coverage BDC, with the potential for increased regular quarterly dividends and/or additional supplemental dividends mostly due to the ability to leverage its internally managed cost structure and history of realized capital gains.

CSWC

As expected in my previous best-case projections, increased its regular quarterly dividend from $0.54 to $0.56 per share, plus another supplemental dividend of $0.06 per share for Q3 2023.

In consideration of the performance of our portfolio, improvements in our operating leverage, and rising market interest rates, the Board of Directors has declared an increase in our regular quarterly dividend to $0.56 per share for the September 30, 2023 quarter. In addition, given the excess earnings being generated by our floating rate debt portfolio, our Board of Directors has also declared a supplemental dividend of $0.06 per share for the September 30, 2023 quarter, resulting in total dividends for the September 30, 2023 quarter of $0.62 per share. While future dividend declarations are at the discretion of our Board of Directors, it is our intent to continue to distribute quarterly supplemental dividends for the foreseeable future while base rates remain materially above long-term historical averages and we have a meaningful UTI balance.”

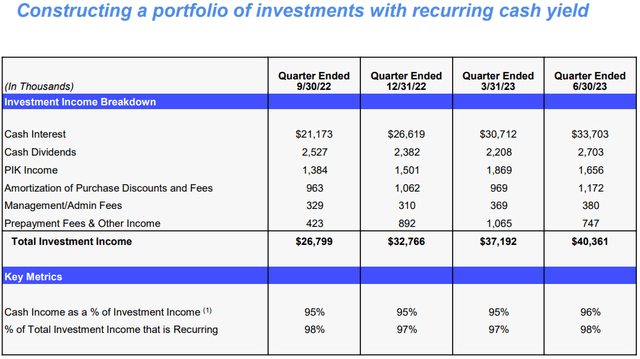

For calendar Q2 2023, CSWC beat its best-case projections mostly due to higher-than-expected dividend income and continued higher portfolio yield (increased from 12.1% to 12.6%). The amount of PIK income decreased from 5.0% to 4.1% of total income and 98% of total income was recurring for the quarter and partially responsible for the continued dividend increases.

CSWC

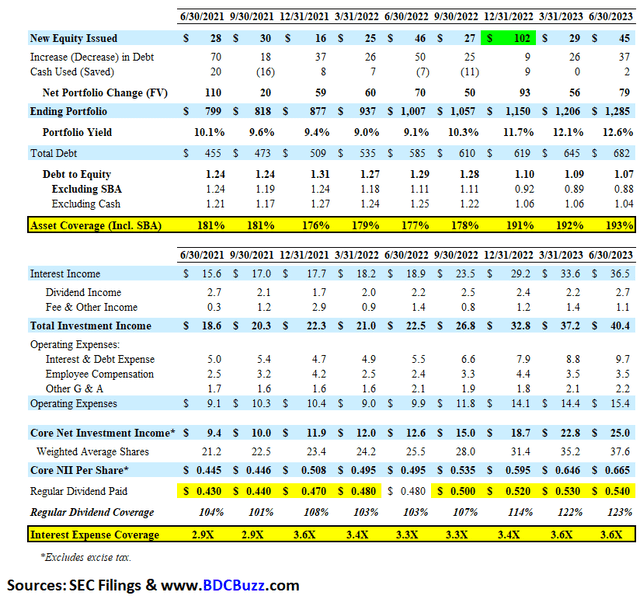

The “Interest Expense Coverage” ratio is used to see how well a company can pay the interest on outstanding debt. Also called the times-interest-earned ratio, this ratio is used by creditors and prospective lenders to assess the risk of lending capital to a firm. A higher coverage ratio is better, although the ideal ratio may vary by industry. When a company’s interest coverage ratio is only 1.5 times or lower, its ability to meet interest expenses may be questionable.

The “Asset Coverage Ratio” is a financial metric that measures how well a company can repay its debts by selling or liquidating its assets. The higher the asset coverage ratio, the more times a company can cover its debt. Therefore, a company with a high asset coverage ratio is considered less risky than a company with a low asset coverage ratio. BDCs are required to maintain minimum asset coverage of 150% providing strong protection to bondholders, which is one of the reasons that no publicly-traded BDC has ever filed for bankruptcy nor defaulted on bondholders in the history of the sector.

The following table shows the historical coverage ratios for CSWC which are higher than the ratios for other BDCs (please see previous articles linked above).

SEC Filings & BDC Buzz

During Q2 2023, CSWC sold 2.5 million shares through its Equity ATM (at-the-market) Program, maintaining a debt-to-equity ratio of 1.04 (net of cash). As of June 30, 2023, the company has $260 million available under the Equity ATM Program. However, shareholders will soon be voting to increase the amount of shares:

The upcoming Special Meeting of Shareholders (the “Special Meeting”) to be held virtually on October 11, 2023. Shareholders will soon be receiving a formal notice of the Special Meeting and a proxy statement outlining the proposals being considered for a shareholder vote. These matters are of utmost importance and relate to a proposed amendment to the Company’s Charter to increase the number of authorized shares of common stock from 40,000,000 to 75,000,000 shares. The additional authorized shares of common stock will allow the Company to continue its strong track record of growing the asset base by pursuing attractive investment opportunities consistent with the Company’s investment strategy. If the Company were unable to access the equity capital markets by issuing additional common shares, the Company’s ability to grow the balance sheet could be adversely affected. It is important that all shares be represented at the Special Meeting. The Company has hired a proxy solicitor who may be contacting shareholders prior to the Special Meeting to assist in the voting process. Every vote is very important to the Company, regardless of the number of shares held.”

CSWC

I’ve been asked how they should vote, and of course, I point out CSWC’s careful and diligent approach to building the portfolio backed by a strong balance sheet. As shown previously, CSWC has raised an average of $40 million per quarter over the last two years all of which has been accretive to NAV and earnings, especially after taking into account that CSWC is one of a handful of BDCs with an internal cost structure:

CSWC

For many of the higher-quality BDCs, I try to keep in contact with management to get clarifications and keep subscribers up to date. Bowen Diehl (CSWC president and CEO) mentioned the following:

The additional shares will be thoughtfully issued over the next several years to fund a portion of our new deal activity, sold primarily through our ATM program. As you know, that is key to growing the asset base while maintaining a conservative posture on leverage (which is core to our mgmt. philosophy). All shares issued above NAV too… we have never asked for approval to issue shares below NAV, as many BDCs have (as a fellow shareholder, I have no interest in that!). Our active use of our ATM program, over the past several years, has utilized most all of our authorized shares, hence, the need to replenish the pool for future issuances.

Over 90% of the shares that voted at the previous meeting voted “yay” to the proposal to increase the authorized shares. However, only 70% of the outstanding shares voted. As a Texas Corporation, CSWC needs 67% of all shares to vote yay which is why the company has an upcoming Special Meeting.

CSWC is a higher-quality BDC with an excellent history of carefully deploying shareholder capital but needs the increased share authorization to continue to leverage its internally managed cost structure which is one of the primary drivers of increased dividends. So please vote when you get a chance: here.

CSWC Portfolio Update

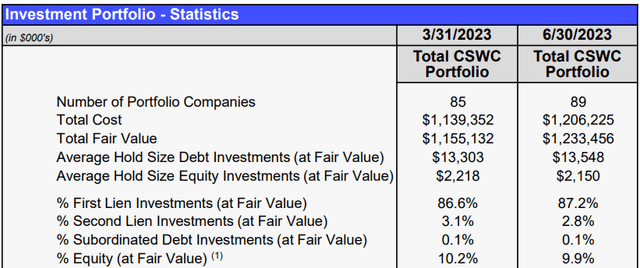

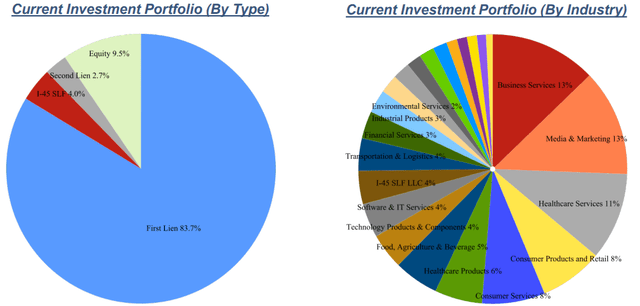

CSWC has a $1.3 billion portfolio of mostly first-lien debt and equity positions historically providing realized gains, especially in its lower middle market investments, similar to Main Street Capital (MAIN).

CSWC

Most BDCs typically do not directly invest in businesses with cyclical exposure such as automotive, consumer retail (discretionary/luxury/durables), restaurants/hospitality, airlines, oil/energy, etc., and if they do it’s a small portion of the portfolio. CSWC has a diversified portfolio of 89 portfolio companies across many industry segments:

CSWC

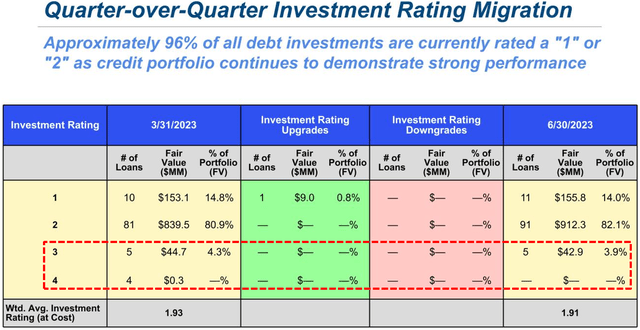

Non-accruals recently increased from 0.3% to 1.7% of the portfolio fair value due to adding its watch list investments in American Nuts and ArborWorks. However, the amount of “Investment Rating 3” declined from 4.3% to 3.9% which are “investments that may be out of compliance with financial covenants and interest payments may be impaired, however, principal payments are generally not past due.” These are likely some of its “watch list” investments that will be discussed in a follow-up article focused on credit quality.

It should be noted that CSWC’s NAV per share has increased by almost 10% over the three years which is much better than the average BDC, especially after taking into account the large amount of supplemental and special dividends paid to shareholders (especially in 2021). Also, the four investments previously considered “Investment Rating 4″ were exited during the quarter, driving realized losses of $12.8 million or $0.35 per share. Around 96% of debt investments are rated “1” or “2” implying “performing materially above underwriting expectations” or “performing as expected.”

CSWC

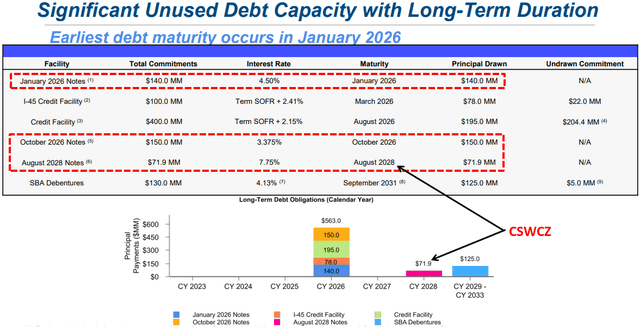

CSWC Investment-Grade Bonds/Notes

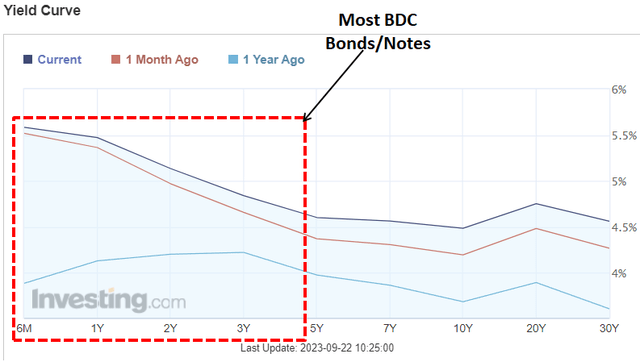

I like BDC bonds partially due to their quality and relatively shorter-term maturities, providing reduced price volatility during market drawdowns, and outperforming other higher-yield assets during market sell-offs. Most BDC bonds mature over the next three to five years which is excellent for investors given the current inverted yield curve (short-term rates higher than longer-term).

Investing.com

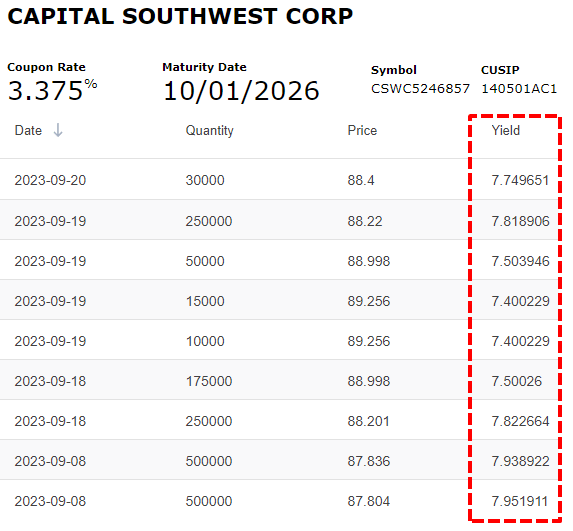

Also, I prefer the bonds/notes (with CUSIPs) to the Baby Bonds (with tickers), mostly related to the “make-whole premiums,” which compensate bondholders for the interest they would have earned if their bonds had not been called, or redeemed, by the issuer before the maturity date to ensure that bondholders are receiving fair compensation for the loss of the bond’s future coupon payments. CSWC has two investment-grade bonds (Moody’s Baa3, Fitch BBB-, CUSIPs: 140501AB3 and 140501AC1), and a Baby Bond which are included in the BDC Google Sheets.

CSWC

As shown below, CSWC’s 2026 bond (CUSIP: 140501AC1) currently has lower and erratic trading volumes which I’m hoping will improve (along with other BDC bonds) through highlighting with public articles. Please note that many of the other BDC bonds have much higher trading volumes including ARCC (discussed previously), BXSL (discussed previously), FSK (discussed previously), GBDC, GSBD, HTGC, MAIN, OBDC, OCSL, PSEC, and TSLX.

FINRA

CSWC Important Considerations

The following are many of the positive considerations for CSWC, some of which are discussed in this article:

- Investment Grade Rating from Moody’s and Fitch

- Continues to leverage its internally managed cost structure

- Lower expense ratio

- Continually increased its regular quarterly dividend from $0.19 to $0.56 per share, over the last six years

- Supplemental dividends of $0.20 per share in 2022 and $0.16 per share so far in 2023

- Additional supplemental dividends supported by harvesting additional gains

- Net realized gains of almost $30 million or $0.75 per share over the last eight years

- Quarterly recurring income has increased by over 100% over the last six quarters

- Lower-than-average leverage partially due to its ATM equity program

- SBIC license provides incremental source of long-term, low-cost capital

- No near-term maturities of borrowings with the earliest occurring January 2026

- Healthy amount of unsecured borrowings (more flexible)

- First-lien investments account for 84% of the portfolio fair value

- 96% of debt investments are rated “1” or “2” implying “performing materially above underwriting expectations” or “performing as expected”

- Diversified portfolio with an average investment hold size of 1.3%

- Potential upgrade mostly based on the potential for realized gains and improved valuations of some of its watch list investments

The following are many of the negative considerations for CSWC, some of which are discussed in this article:

- Non-accruals increased due to adding its watch list investments in American Nuts and ArborWorks

- Recent net realized losses of almost $13 million mostly due to exiting non-accrual investments

- Its second-lien position in Hybrid Apparel was previously downgraded to “Investment Rating 3”

- Paying higher amounts of supplemental dividends has had a negative impact on NAV

- The amount of “watch list” investments is only slightly better than average

- Higher amounts of equity positions typically result in higher NAV volatility

Read the full article here

Leave a Reply