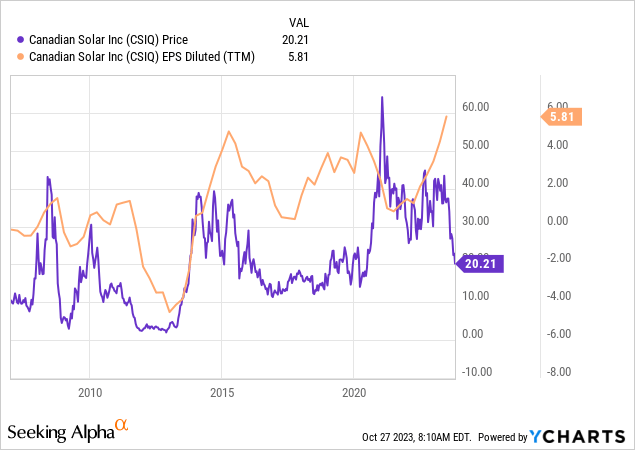

2023 has been a particularly challenging year for the solar industry. The solar ETF (TAN) has lost 40% of its value this year, with virtually all those losses occurring over the past three months. One notable example is Canadian Solar (NASDAQ:CSIQ), which has lost nearly half its value since August. However, CSIQ has had consistently bullish analyst opinions, with decent profitability, growth, and value metrics. Its price-to-earnings ratio is just 3.5X TTM, and its EPS has risen quickly since 2022. To many investors and analysts, Canadian Solar likely appears to be a rare Goldilocks opportunity with a very low valuation and strong growth potential.

Over the past month alone, CSIQ has plummeted by 20% due to a poor sales outlook and earnings report from its larger competitor SolarEdge (SEDG). Further, although solar stocks have lost considerable value this year, we must remember that most solar had risen by 3-4X during the 2020-2021 bull market. Like many growth stocks, most solar stocks are now pushing back against their pre-COVID fundamentals. Still, that does not explain the vast discrepancy between performance and fundamentals in Canadian Solar and the solar industry. To better understand the trend, we’ll need to look closer at the company’s financial position regarding the macroeconomic trends facing the solar industry.

The Boom and Bust Solar Cycle

Canadian Solar has been a publicly traded company since 2007. Since then, it has gone through four “boom and bust” cycles where it doubled (or more) in value and erased all those gains. The same pattern is mirrored in most other solar stocks. In general, the boom and bust cycle is correlated to changes in CSIQ’s EPS; however, there is a tremendous amount of speculative influence, considering there is often some overreaction in the stock price in either direction. See below:

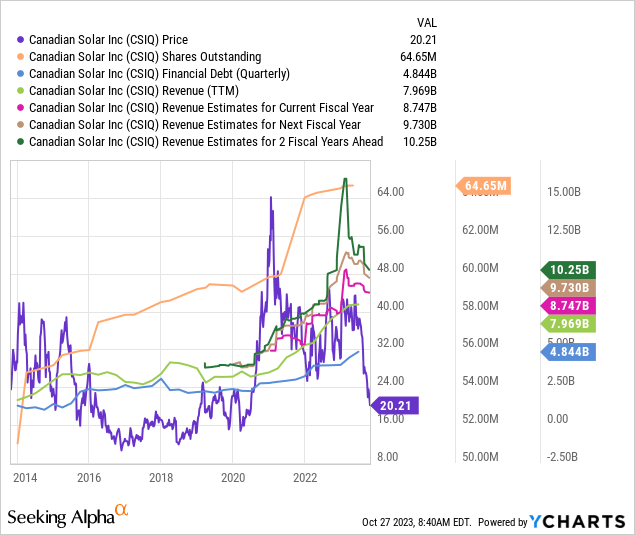

One key issue with solar companies is that the industry is not as firmly rooted as others in the energy space. These companies are very capital-intensive, with Canadian Solar spending over $630B in CapEx last year, or nearly half of its current market capitalization. Accordingly, they operate with a fair degree of competition and are highly exposed to broader manufacturing trends.

Many investors are attracted to solar companies because they see the long-term growth potential of the solar market. However, the greatest benefactors of that may not be the solar panel factories because they’re exposed to the same competitive, interest rate, and inflation risks as all other industrial manufacturers. A slight decline in demand combined with a continued increase in global solar panel production can quickly push the market into a glut, erasing the relatively thin profit margins found by factories. Additionally, these companies do not naturally grow organically as many others but require significant capital infusions to expand. Thus, substantial sales growth will almost always require considerable equity dilution or debt financing.

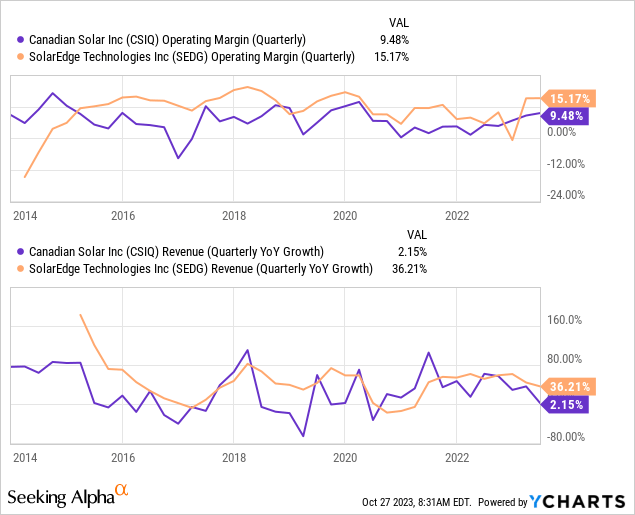

The operating margin and sales growth trends of Canadian Solar and its peer, Solar Edge, are very similar because they compete in the same market. See below:

The operating margins of these firms dipped dramatically from 2020-2022, mainly due to supply-chain challenges that increased production costs while solar installations began to slow. Today, solar panel prices are up dramatically as these companies adjust for rising costs, although they’re still lower than many years ago. That said, the price hike is likely sufficient to lower demand, particularly considering that electricity price growth has stagnated after two strong years. Thus, the sales outlooks for these firms are now deteriorating more quickly.

Canadian Solar is still expected to expand its revenue over the coming years. However, over the past year, there has been a significant decline in its immediate and longer-term revenue estimates, highlighting some potential for stagnation. See below:

Significantly, Canadian Solar relies on debt financing to grow its revenue, which comes at the cost of its equity stability. It has also diluted its equity to a small extent over recent years, though the pace has quickened. Further, we can expect that production costs, such as power, labor, and input materials, will continue to increase at or above inflation as in recent years. As a result, its EPS is expected to stagnate through at least 2025, but no significant declines are anticipated, with annualized EPS running around $5 and potentially rising after 2025.

The solar sector’s largest issues are interest rates and inflation. Combined, these factors dramatically increase solar installation costs and lower most solar systems’ ROI. Solar panel loans now carry around 8-35% APRs, erasing most of the gains received by adopting the panels. Problematically, the solar market has not been tested by such high interest rates ever before, increasing the probability of overestimation, as recently seen in SolarEdge’s significant revenue guidance cut.

At the same time, the production of solar panels, particularly from China, is rising very quickly today. In light of waning demand, this situation has already created a glut of solar modules in many markets, with that glut likely to grow as long as US and EU interest rates constrain residential demand (and corporate). Combined with increasing weakness in household financial stability, credit ratings, and rising solar panel production costs, I believe it may take longer than 2025 before we see a rebound in solar demand. Natural gas remains very cheap today, likely reversing some of the electricity price growth since 2020.

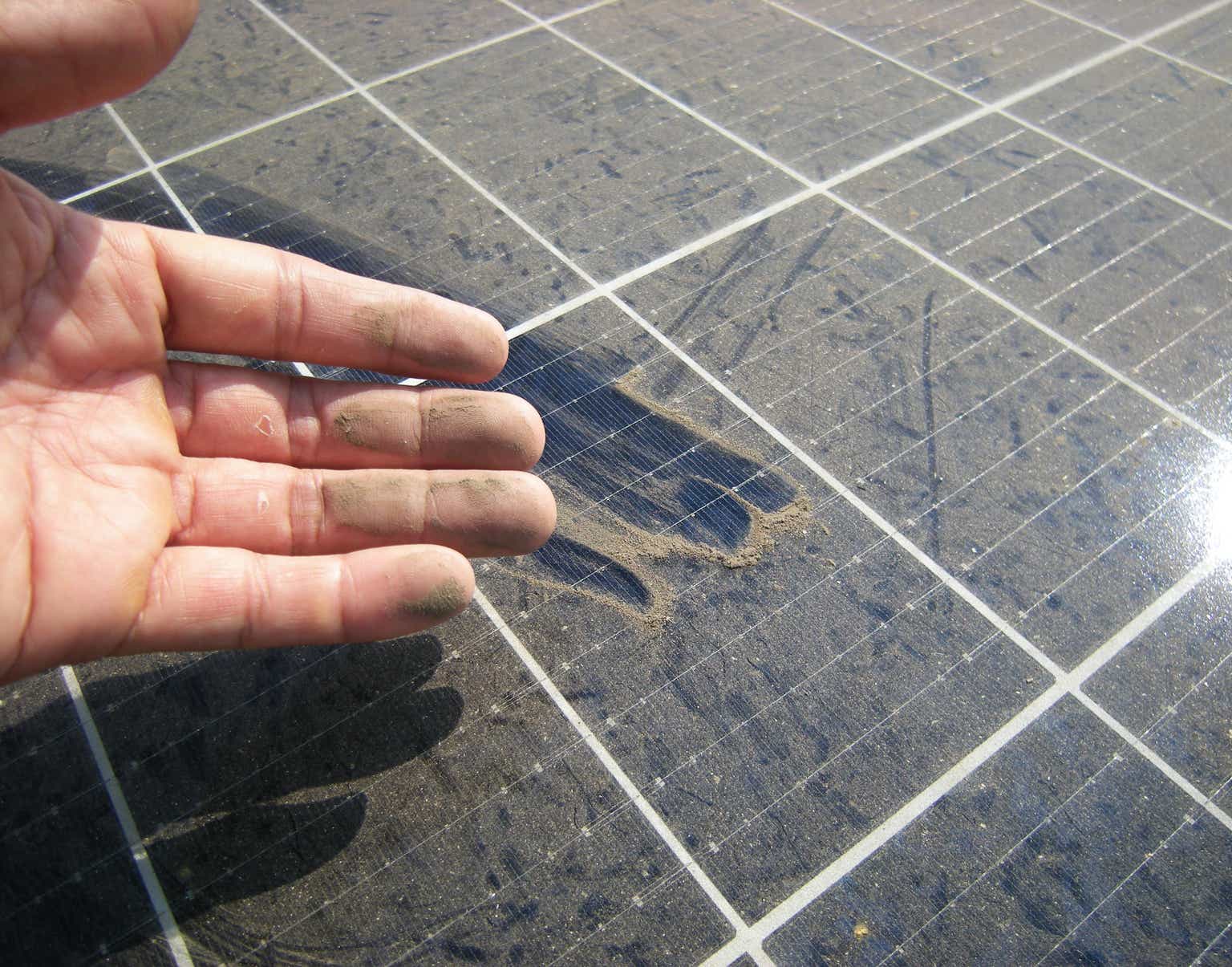

Not Exactly a Canadian Company

Most of the company’s manufacturing is in China, often viewed as a Chinese headquartered in Canada. At the end of 2022, 72% of its long-lived assets ($1.67B in total) were situated in China; an additional 12% were in Thailand, but less than 1% were in Canada (see 20-F pg. 63). Its annual report has 315 mentions of “China” and 365 of “PRC,” with immense details regarding associated risks relating to trade, ownership issues, geopolitical risks, taxation, and other factors. Additionally, 95% of its workforce is in Asia, while just 3% is in Canada.

Canadian Solar markets itself as a Canadian firm, which is technically accurate, but its core operations are mainly Chinese. China is essentially the only place in the world where solar panels can be manufactured cost-effectively due to other countries’ environmental and labor cost restrictions. Controversially, Canadian Solar has long-since been accused of using slave labor from Uyghurs in China. Unfortunately, The same is true for many Chinese-made items; however, unlike Nike and Apple, Canadian Solar cannot hide behind the issue through externally contracted factories since they indirectly own projects in Xinjiang. Although the company has since investigated the issue and sold those projects, third-party humanitarian organizations have claimed that is not entirely accurate.

Humanitarian issues aside, this controversy is a significant problem for CSIQ. For one, investors must realize that it is effectively a Chinese company that actively seeks to appear more Canadian than it truly is. That is not to say that it is dishonest, since its annual reports are clear on that fact, but it is true in investor marketing since very few other analysts have realized this fact. Of course, the US and other countries recently enacted significant laws against solar panel imports made by China’s forced labor factories. Aside from the slave labor issue, it is a problem that most of CSIQ’s assets are tied up in China because US investors do not necessarily own those assets, instead being indirectly owned through various workarounds that generally do not protect foreign investors.

What is Canadian Solar Worth Today?

In my view, in light of Solar Edge’s substantial guidance cut, the latest income and sales estimates for Canadian Solar are likely overestimated. Interest rates are now around 5% from today through 30-year Treasury bonds, so there is no reason to expect any reductions in short-term borrowing costs anytime soon. Considering we see the yield curve steepen without rate cuts, it is possible that the Federal Reserve may hike rates again next year. Inflation has slowed, but it can rebound as it had numerous times in the 1970s, which faced similar supply-side inflationary trends relating to geopolitics in the Middle East.

That risk factor compounds Canadian Solar’s woes because its COGS should now rise faster than its sales consistently as long as interest rates and inflation remain an issue. In my view, we may likely see the company’s operating margins slip back toward zero as they had been years ago. Higher interest rates also push the company’s borrowing costs up, just as its debt grows as it seeks to expand its operations. The company’s financial debt-to-EBITDA is relatively high at 6X, particularly considering I expect its EBITDA to crash due to the sales and profit margin reversal. Indeed, considering its thin margins and high capital overhead, I believe there is reasonable potential that CSIQ’s EPS will be back around zero by the end of 2024, far below current estimates.

The Bottom Line

Short interest on CSIQ is high at 9.6%, meaning many investors are betting against the stock. Most analysts love the company and believe it is undervalued today, but may be dramatically underappreciating its China-related risk factors and broader glut risks facing the solar sector. As solar loan costs soar and solar panel production costs rise with global labor and commodities, I firmly believe Canadian Solar and most of its peers will soon see enough price competition that their meager operating margins will be wiped out again. We’ve seen this pattern many times throughout the company’s history, so I do not see any strong reason to suspect it should not continue.

The fact is that Canadian Solar is not a green energy growth company but a relatively old-school manufacturing firm with tremendous cyclical risks and capital needs. Further, it faces high exposure to geopolitical trade issues between the West and China and associated labor issue allegations. This is not to say that I do not believe Solar itself will grow, just that Canadian Solar, as a stock, has minimal upside potential related to the long-term expansion of the solar industry. So long as supply and demand rise together, a factory will not generally expand its income without raising external capital. Thus, CSIQ’s sustained EPS upside, even with a great demand outlook for Solar, is minimal to me, while its downside risk associated with a glut is considerable.

Overall, I am slightly bearish on CSIQ today and believe it will continue to lose value over the coming months as its 2024-2025 EPS expectations decline due to the glut issue. If the allegations of labor issues in China result in actions from Western governments, then CSIQ’s downside would be even more significant. That said, the same can be said for most solar companies, given that essentially all solar panels are produced in Asia, 75% being in China. Personally, while the US has made laws to stop the labor issue, enforcement is generally low, potentially because green energy growth goals cannot necessarily afford higher prices.

At this point, it is difficult to say where exactly CSIQ may land once its bearish trend ends. It is just now reaching back into its pre-COVID price range, mirroring expectations of EPS deterioration. To me, given a near-or-below zero operating margin outlook, high leverage, and China-headquartered assets, I would not personally buy CSIQ at any price, given there is too much room for black-swan risk factors and financial deterioration. However, I would be surprised to see CSIQ cross below $10-$15 per share anytime soon, given it did earn substantial profits over the past year. Even if its prospects are in sharp reversal, it is unclear if this issue will last until 2024-2025 or longer. Thus, while I am bearish, I would not short CSIQ today because it has already lost so much value, and we will likely not know clearly how its financial position will be impacted by the macroeconomic shift until early 2024.

Read the full article here

Leave a Reply