Summary

Canada Goose Holdings (NYSE:GOOS) retails apparel. They offer a wide variety of offerings for women, men, and kids. Products offered range from outerwear to hats, gloves, and even footwear. Canada Goose Holdings serves customers worldwide with a roughly even split between APAC and the US, with the rest in EMEA (23% of revenue) and Canada (20% of revenue) as of FY23. This post is to provide my thoughts on GOOS business and stock. I am recommending a buy rating for GOOS as I am optimistic that management can continue hitting their strategic targets, thereby driving growth and increased profit performance.

Investment thesis

GOOS has been on a growing streak over the years, doubling its revenue since FY18 to CAD$1.2 billion in FY23, mainly driven by its successful plunge into the D2C (direct-to-consumer) channel, which saw revenue almost tripling from $255 million to CAD800 million. However, on the other hand, EBIT has grown in the same direction; but the EBIT margin was reduced from 22.8% in FY18 to 14.7% in FY22. I believe this margin movement was due to the shift in focus from wholesale to D2C, which improves gross margin but also increases overheads at the operating expense level (logistics, e-commerce portal management, inventory management, etc.). With D2C momentum playing a major role, 1Q24 total revenue grew 21.3% to CAD84.8 million, surpassing the consensus estimate of CAD73.6 million. Consistent relationship streamlining likely contributed to the 18.4% drop in wholesale revenues to CAD27.1 million. Management attributes the increase in gross margins to favorable trends in D2C sales mix, pricing, and product mix. EPS came in at -CAD0.78 due to a weak EBIT performance of -CAD91 million.

My overall outlook for GOOS is a positive one, as the business reported a very strong 1Q24, driven by solid D2C momentum. GOOS is also progressing well against its strategic targets of D2C expansion, expanding product categories, and expanding its consumer base.

My main focus was on the strategic progress in D2C expansion. Clearly, GOOS has executed extremely well, again, where D2C sales grew 60.3% to CAD55.8 million. Strong in-store retail sales were a major contributor to the DTC momentum, recording 28% global D2C comp growth. The underlying demand and momentum appear to be going strong as GOOS opened three new permanent stores during 1Q24. I anticipate a further rise in gross margins as D2C sales take up an increasing share of the company’s revenue stream. Next, the strategy to expand product categories continued to work out well too. A key takeaway from the recent conference was management’s emphasis on how expansion into new product categories has been outpacing that of the company’s core. This suggests that consumer preferences are being met by new product categories, which means that the addressable demand for GOOS is higher. It’s further evidence of GOOS’s ability to branch out into different product segments. This achievement has bolstered my confidence as a manager and increased my determination to expand into new product categories. During 1Q24, GOOS not only successfully expanded into new product categories but also saw a growth in their female customer base in the mid-teens percentage range. Theoretically, this means that GOOS now has a larger consumer base where it can sell.

On inventories, compared to the previous quarter, 1Q24 saw a sequential increase in inventory growth of 3.4%. If management continues to drive increased flexibility and control over its inventory, I anticipate further improvements in inventory management, which should further improve gross margin quality (lessen risk to volatility). This was clearly demonstrated by the quarter’s decision to merge two Montreal factories into a single facility in an effort to increase overhead leverage and manufacture a larger share of the company’s products in-house.

Viewed together, GOOS has been executing really well, and I expect all of these to drive growth in the quarters ahead. The concern with GOOS likely stems from its EBIT performance, which is negative at the moment. I am positive that EBIT will track to a positive region eventually based on gross margin improvement, scale in revenue, and supply chain efficiency.

Valuation

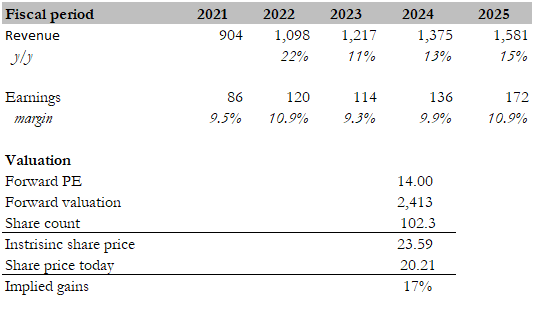

Own calculation

I believe the fair value for GOOS based on my model is CAD23.59. My model assumptions are that growth will continue to improve and accelerate as management continues to execute on its key strategic targets, which have had strong momentum so far. Successful execution should come with improving gross margin and scale, which should drive improvements in net income margin back to the 10+% levels that were seen historically. That said, I remain conservative on assuming a strong multiple re-rating upwards as the industry (i.e., peers) valuation has trended down over the past few quarters. Therefore, I expect multiples to stay at the current level of 14x.

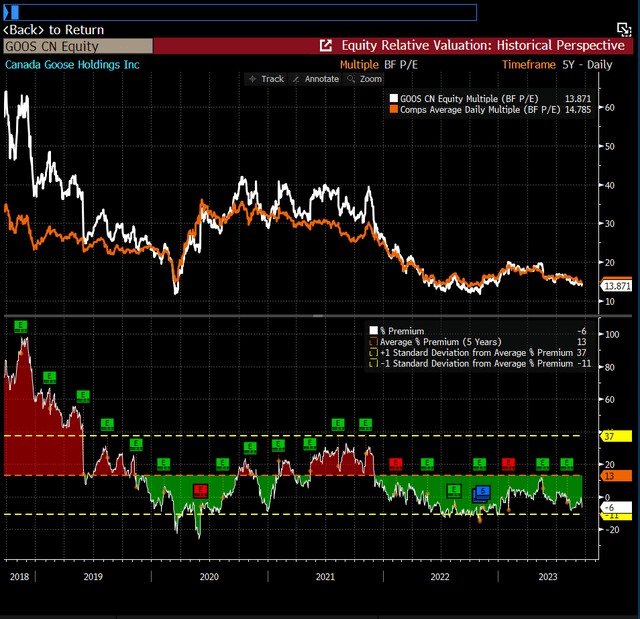

Peers include Moncler, Descente, Columbia Sports, and VF Corp (VFC). The median forward earnings multiple peers are trading at is 14x, with Moncler trading at the higher end because of its higher margin profile (40% EBITDA margin vs. GOOS 20%) and Descente trading at the higher end because of its higher growth profile (expected to grow 19% next year based on consensus estimates). Columbia Sports is the closest peer with a similar margin and growth profile.

Bloomberg

Risk

My assessment of GOOS’s risk is that margins might not recover as fast as I expect. Management could choose to continue reinvesting in the business in order to continue hitting their strategic targets. While this is great for the medium-to-long term, I am afraid it might further weigh on the stock’s performance in the near term. Aside from this, GOOS operates in an industry that faces constant changes in consumer preferences. The success that GOOS saw with recent product launches might replicate itself in the future

Conclusion

I recommend a buy rating for GOOS based on their strong strategic execution and positive performance indicators. The recent 1Q24 results highlight robust D2C momentum, expanding product categories, and a growing consumer base, all contributing to a positive outlook. GOOS’s focus on D2C expansion and inventory management improvements bode well for future gross margin enhancements. While concerns about the negative EBIT persist, I anticipate a return to positive territory as gross margin improves, revenue scales, and supply chain efficiency increases.

Read the full article here

Leave a Reply