The last time I wrote about Cal-Maine Foods (NASDAQ:CALM) was more than a year ago when I warned that the company was trading at inflated valuations based on the short-term impact from the Highly Pathogenic Avian Influenza (“HPAI” aka Avian Flu) pandemic on egg prices. I was worried that once egg prices normalize, CALM’s extraordinary earnings would also revert back to historical levels.

Since my article, the Avian Flu pandemic crested in late 2022 (fiscal 2023 for Cal-Maine), and egg prices have indeed normalized. Cal-Maine’s share price have also eased, down 7% since my article and 20% from December levels (Figure 1). However, CALM was able to pay a few hefty dividends to shareholders, so total returns since July were positive.

Figure 1 – CALM stock has underperformed (Seeking Alpha)

With egg prices reset lower, has Cal-Maine’s valuation also returned to normalized levels and is it a good investment now?

Brief Company Overview

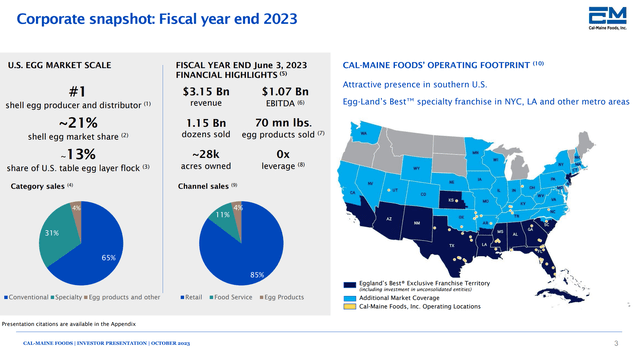

Cal-Maine is the largest shell egg producer and distributor in the US with a dominant 21% market share (Figure 2). Cal-Maine’s business is centred around the retail sales (i.e. grocery stores) of conventional and specialty (i.e. Omega-3, Free-Run, etc.) eggs to consumers.

Figure 2 – Cal-Maine overview (CALM investor presentation)

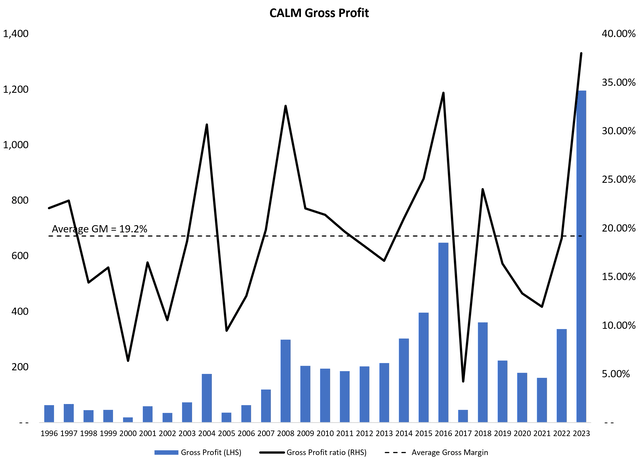

Historically, Cal-Maine’s financial performance is highly impacted by egg prices, which in turn goes through cycles dictated by HPAI. As I noted in my initiation article, when HPAI hits, Cal-Maine is capable of generating extrarodinary profits since the cost of production is mostly fixed (Figure 3). For example, in 2016, CALM’s gross margin hit 34%, the highest ever, only to be surpassed in fiscal 2023 when gross margin hit 38%.

Figure 3 – CALM gross margins (Author created with data from roic.ai)

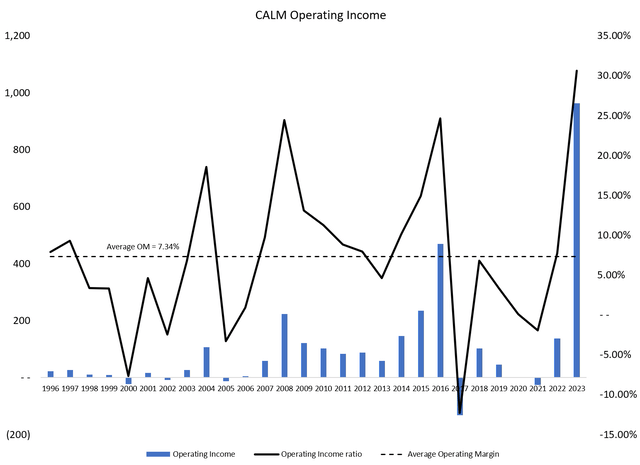

However, over a cycle, Cal-Maine’s profitability is often far lower, with average operating margins of 7.3%, inclusive of the extraordinary 31% operating margin in 2023 (Figure 4).

Figure 4 – CALM operating margins (Author created with data from roic.ai)

2022 Was The Mother Of All Avian Flu Pandemics

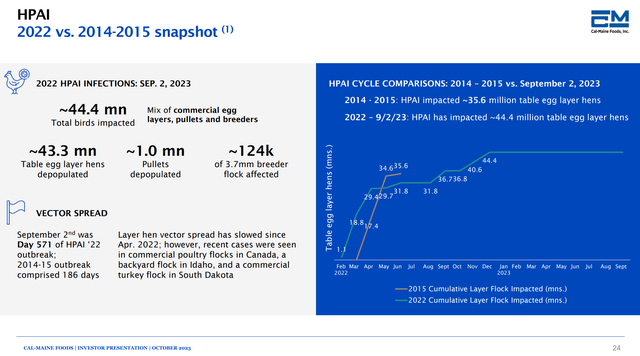

By many measures, the 2022-23 Avian Flu outbreak is one of the worst on record, with the outbreak still ongoing, almost 2 years since it was first detected. A total of 44 million table egg layer hens have been culled to date, leading to egg shortages in 2022 (Figure 5).

Figure 5 – 2022 HPAI is one of the worst on record (CALM investor presentation)

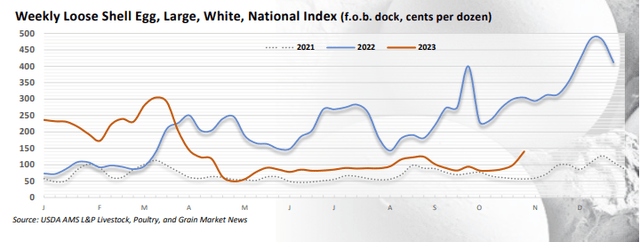

However, American poultry farmers have been very resilient and weathered the storm well, with egg prices mostly back to pre-outbreak levels of ~$1.00 – $1.50 / dozen as they were able to replenish their flocks (Figure 6).

Figure 6 – Egg prices have normalized (USDA)

Unless the current outbreak worsens again, we are unlikely to see surges in egg prices like we saw in 2022 and early 2023.

Cal-Maine’s Financials Crashing Back To Earth

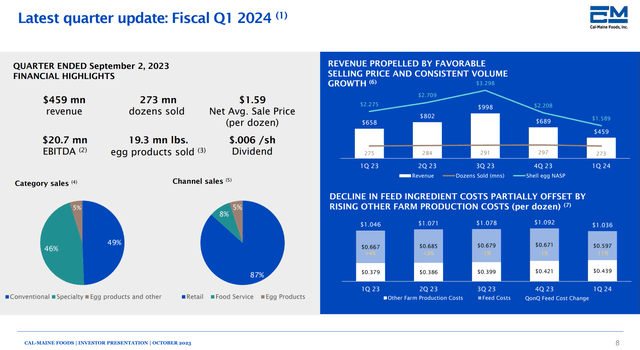

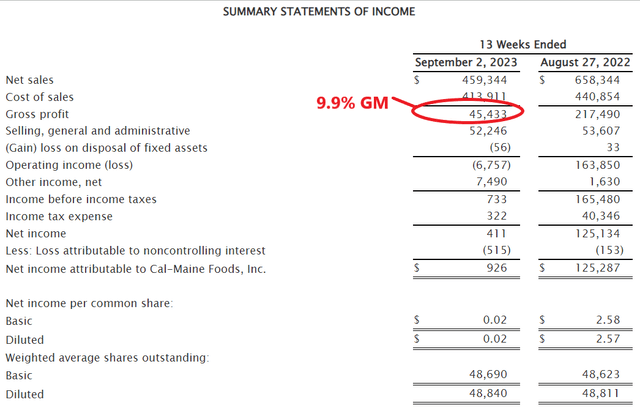

With normalized egg prices, Cal-Maine’s financial performance have also come back to earth, with the company recently reporting its Q1 fiscal 2024 results. Revenues declined by 30% YoY to $459 million while operating profits collapsed to -$6.8 million from $163.9 million in Q1/F23 (Figure 7).

Figure 7 – CALM Q1/F24 overview (CALM investor presentation)

If not for $7.5 million in interest income from cash in the bank, Cal-Maine would have reported a net loss in the quarter.

Dividends was reduced to almost nil at only $0.006 / share for the quarter, as the company has a variable dividend policy of paying 1/3 of trailing quarterly income.

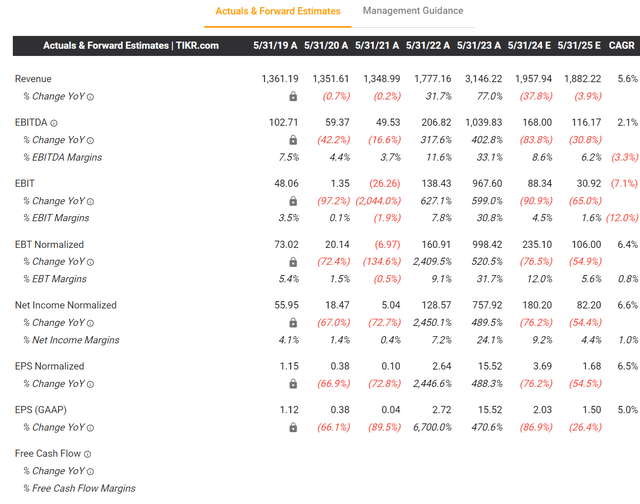

Wall Street Is Far Too Aggressive For 2024

Despite the poor start to the fiscal year, Wall Street analysts continue to drink the Kool-aid, with consensus estimates still seeing the company generating $1.96 billion in revenues for fiscal 2024 and $2.03 in dil. EPS (Figure 8).

Figure 8 – CALM 2024 estimates are too aggressive (tikr.com)

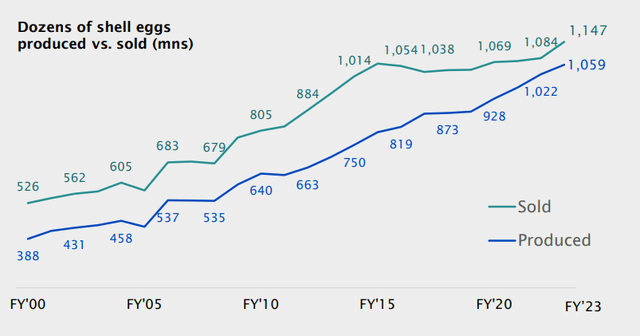

Analysts estimates appear reasonable for top-line sales, as Cal-Maine is capable of selling ~1.2 billion dozen eggs, give or take a few million (Figure 9).

Figure 9 – Cal-Maine egg production and sales (CALM investor presentation)

In Q1/F24, Cal-Main sold 273 million dozen eggs at an average price of $1.59 / dozen. So if we use analyst estimates for $1.96 billion in sales and 1.2 billion dozen eggs, that implies average sale price of $1.63 / dozen, which is close to Q1’s figure.

But notice that in Q1, Cal-Maine had a negative operating margin of -1.5%. Unless the company is able to magically lower the cost of production in the upcoming three quarters, it is highly unlikely that Cal-Maine will be able to deliver $2.03 / share in EPS on $1.96 billion in revenue.

In fact, if we look at Q1’s financials in more detail, the gross margin of 9.9% is very similar to Cal-Maine’s fiscal 2017 collapse in gross margin following the 2014/15 HPAI outbreak (Figure 10).

Figure 10 – Cal-Maine Q1/F24 financials (CALM Q1/F24 press release)

The collapse in gross margin following the 2014/15 HPAI outbreak makes sense as costs were likely geared for the higher egg prices during the Avian Flu outbreak and could not be adjusted quickly when egg prices collapsed, similar to what happened recently in Q1.

To achieve $2.03 in EPS would require ~4.0% operating margin or ~15.0% gross margin. However, if we look at Figure 7, we can see the cost of production has been steady at $1.036 / dozen eggs in Q1/F24 vs. $1.046 / dozen in Q1/F23, so I simply do not see where the gross margin expansion is going to come from.

Valuation Still Expensive

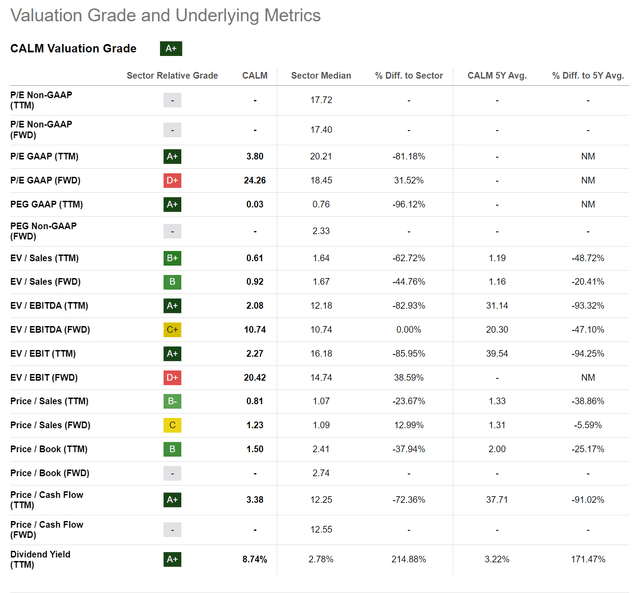

Furthermore, Cal-Maine is currently trading at 24.3x Fwd P/E, based on the aggressive earnings estimates I noted above (Figure 11). This is far above the 18.5x Fwd P/E the Consumer Staples sector trades at.

Figure 11 – CALM stock is expensive (Seeking Alpha)

Investors should also not forget that with the company’s variable dividend policy, if earnings are normalized, then the extraordinary dividends CALM paid in the past 2 years will also be a thing of the past.

Risk To Cautious Stance

The biggest risk to my cautious stance on Cal-Maine is if Avian Flu makes a comeback and egg prices rise in response, then Cal-Maine’s stock will likely rally.

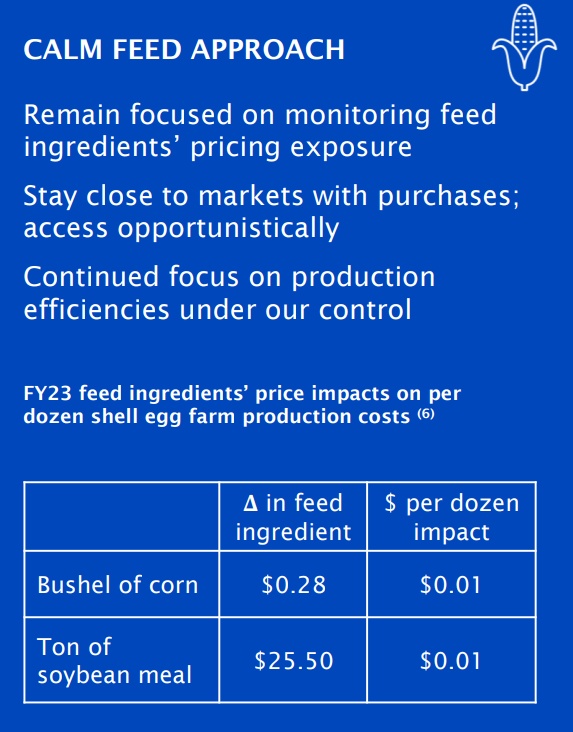

Another positive risk to Cal-Maine is if corn prices collapse, then feed costs could come in lower than expected, which would benefit gross margins. According to the company’s estimates, a $0.28 change in corn prices will have a $0.01 impact to cost per dozen eggs (Figure 12).

Figure 12 – CALM sensitivity to feed prices (CALM investor presentation)

Conclusion

As I warned last year, good times for Cal-Maine was unlikely to last for long as egg prices were artificially inflated by the Avian Flu. As egg prices have normalized, so has Cal-Maine’s earnings.

At normalized egg prices, Cal-Maine’s stock price looks overvalued, trading at 24.3x Fwd P/E based on earnings that look too aggressive. Balanced against Cal-Maine’s valuation is the risk of a resurgence in Avian Flu, which could cause egg prices to spike again. I would stay on the sidelines until valuation improves or we see a return of the Avian Flu.

Read the full article here

Leave a Reply