I wrote about Cal-Maine Foods (NASDAQ:CALM) in May here, explaining how the egg shortage (bird-flu created) of 2022-23 has allowed the company to totally recapitalize its balance sheet. Honestly, today CALM owns one of the strongest balance sheets in the food industry, especially from a leader in its food category – eggs.

The stock has been able to generate a small +4% total return over four months measured from my May effort, and this may be indicative of what lies ahead for late 2023 and early 2024. Decent but not spectacular returns for investors, however, might be a welcome development in a topsy-turvy financial world surrounded by recession, inflation and high interest rate headlines.

If you are OK owning the #1 leading egg gatherer/seller in America, with slow growth, low levels of excitement, and a super-conservative balance sheet backing up the whole story, CALM may be one go-to investment idea to buy and forget about in long-term accounts.

Company Background

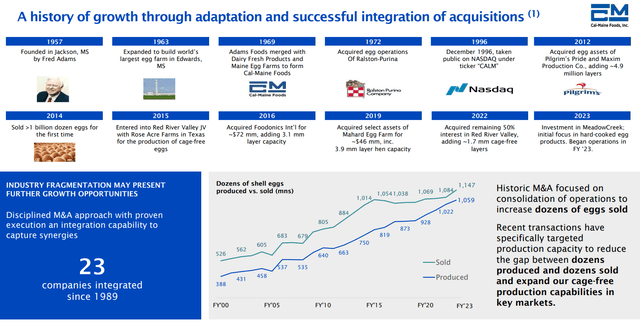

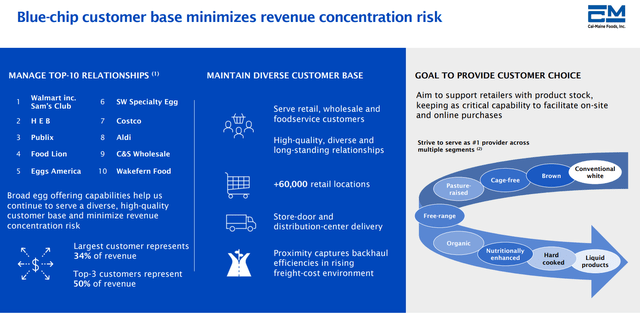

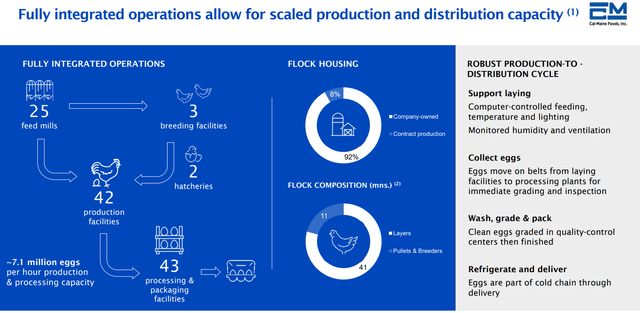

Management has grown the company “organically” for 60+ years, the old-school way. It shuns debt, while using cash flow/earnings to acquire competitors or assets to make the business model more fully integrated. Today it owns 80% of the hens laying the eggs. CALM owns chicken farms, feed mills, buildings to sort and box eggs, plus a transportation and storage network to move product to retailers like Walmart (WMT), Aldi, Costco (COST) and your local grocery chain.

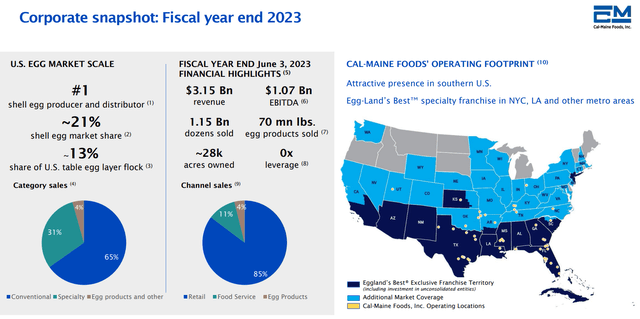

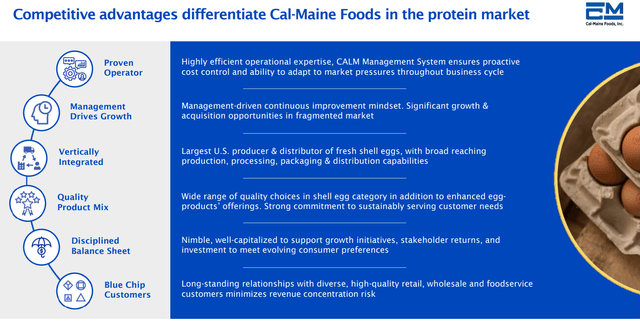

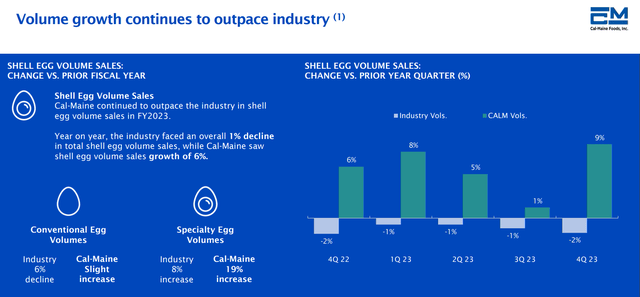

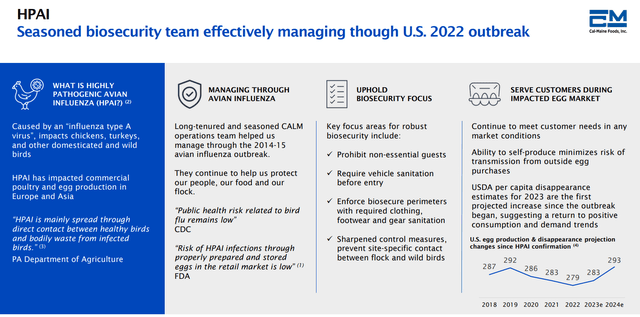

Below are some slides pulled from CALM’s Q4 FY 2023 earnings presentation, released a few weeks ago. If you want to get to know the business, this is a great summary of what you are acquiring for your investment dollar. Of particular note, I like the full-circle hen to grocer asset ownership idea to control costs, alongside the amazing ability of the company increase egg market share nationally over the last few years (largely through cash acquisitions).

Cal-Maine, Q4 FY 2023 Earnings Presentation

Cal-Maine, Q4 FY 2023 Earnings Presentation

Cal-Maine, Q4 FY 2023 Earnings Presentation

Cal-Maine, Q4 FY 2023 Earnings Presentation

Cal-Maine, Q4 FY 2023 Earnings Presentation

Cal-Maine, Q4 FY 2023 Earnings Presentation

Cal-Maine, Q4 FY 2023 Earnings Presentation

Balance Sheet

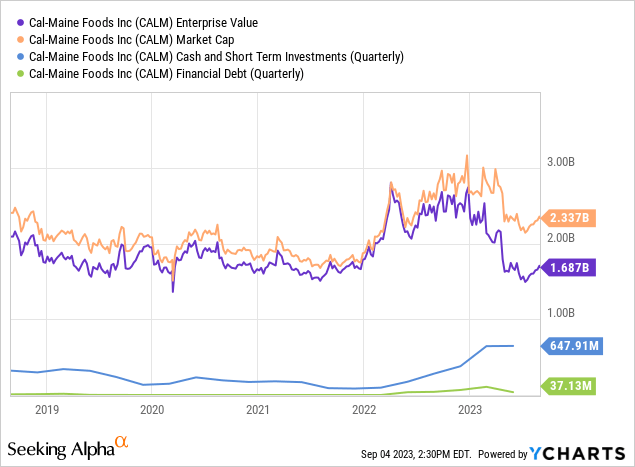

The bird-flu outbreak of 2022-23 also provided a bonanza for profits at Cal-Maine. The company paid huge dividends to shareholders, but also kept much of the one-time proceeds to incrementally expand the business in the future without debt. Now that egg prices are coming down, management can opportunistically add to its limited presence in areas of the U.S. like the Northwest and Northeast.

Further, when we subtract $647 million in cash (with only $37 million in total debt) from the equity market capitalization, you can see how CALM’s “enterprise value” is hovering near 10-year lows currently.

YCharts – Cal-Maine Foods, Equity Market Capitalization vs. Enterprise Value, 5 Years

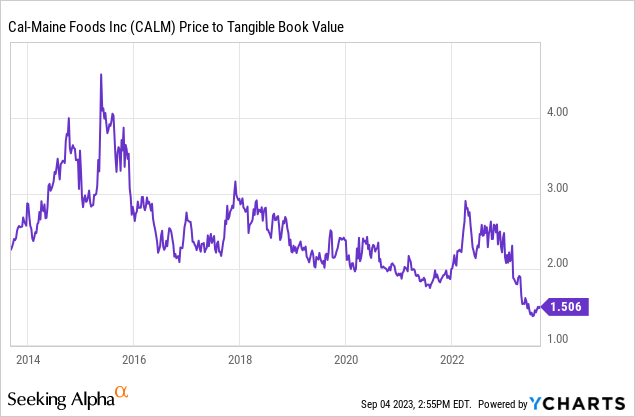

And, sound asset accumulation execution has combined with the cash windfall for the business since 2022 to push tangible book value numbers dramatically higher. Even with a slightly better stock quote vs. 2021, price to tangible book value readings under 1.5x have been trading at a multi-decade low this summer.

YCharts – Cal-Maine Foods, Price to Tangible Book Value, 10 Years

Valuation

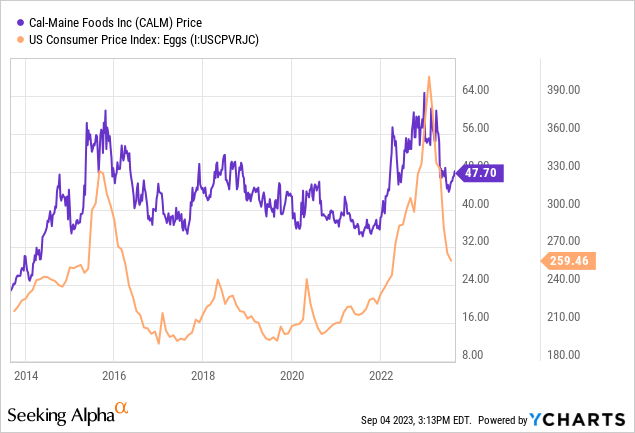

Many on Wall Street like to simplify the CALM investment proposition with egg prices. And, we can see a clear correlation between the bird-flu spike in egg prices during 2015 and 2022-23 vs. peaking share quotes.

YCharts – Cal-Maine Foods, Share Price vs. Egg Prices, 10 Years

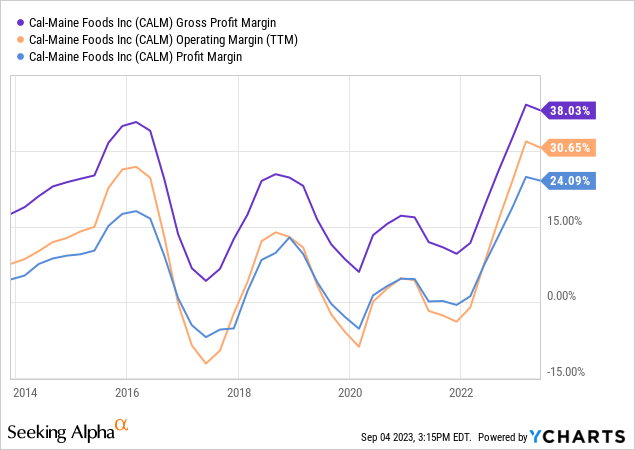

Profit margins also zigzag as a function of egg selling prices, with costs largely controlled near the overall CPI inflation rate in the economy.

YCharts – Cal-Maine Foods, Profit Margins, 10 Years

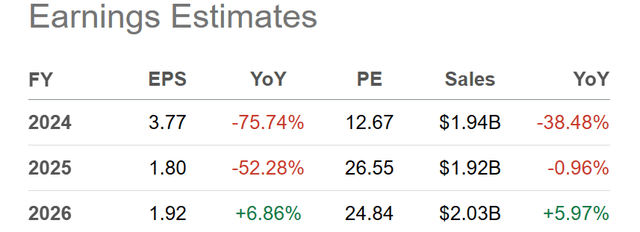

Analysts are projecting a decline in sales and profit margins as egg prices decline the rest of 2023. Yet, projections past the next 12 months are overly bearish in my opinion, where flat revenue results are not expected to support EPS.

Seeking Alpha Table – Cal-Maine Foods, Analyst Estimates for FY 2024-26, Made September 4th, 2023

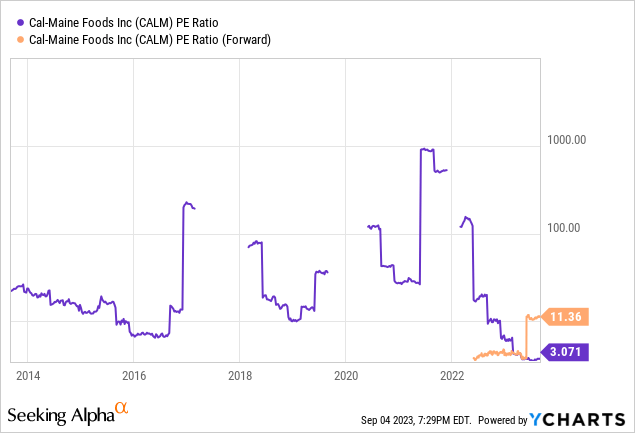

In terms of the immediate future, the price to earnings ratio of 3x on a trailing basis is expected to bump up to 11x using forecasts into the middle of 2024. Still, if we are nearing a bottom in egg pricing soon, a P/E of 11x would still be one of the lowest ratios of the last decade.

YCharts – Cal-Maine Foods, P/E Ratio, 10 Years

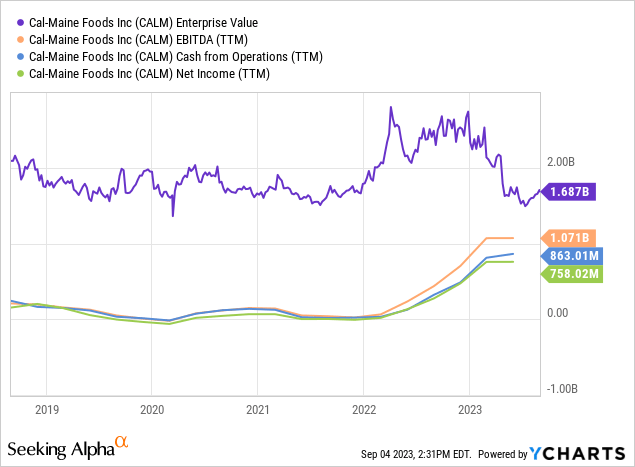

Then let’s properly account for next to zero debt and exceptional cash holdings in the summer of 2023. On enterprise value, EBITDA, cash flow and net income levels are under 2x trailing results. (Compare under 2x to Big Tech high-flyers with equivalent trailing ratios in the 20x to 50x range currently!)

YCharts – Cal-Maine Foods, EV vs. Cash Generation, 5 Years

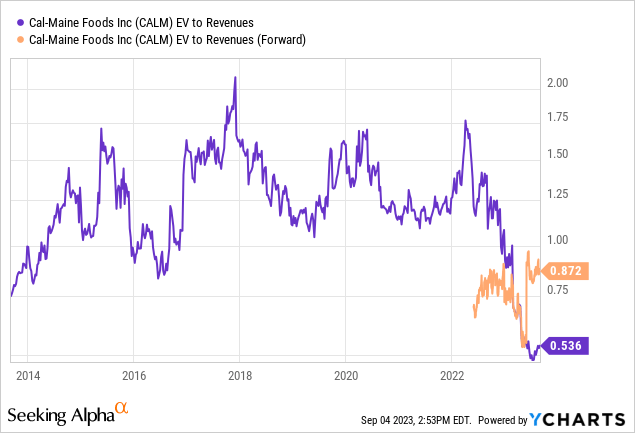

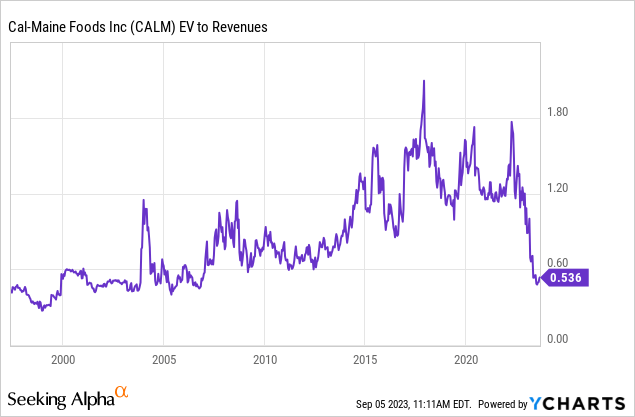

In addition, the enterprise value to revenues multiple of 0.5x is sitting at the lowest level since 2007 (when the company was much smaller) and projected to stay well under 1x in coming years. It’s not hard to argue CALM is a bullish selection from the EV metrics alone. For example, on EV to forward sales, the stock is selling for a rough 40% discount vs. a 10-year average of 1.3x., while still 20% below its 20-year average.

YCharts – Cal-Maine Foods, EV to Sales, 10 Years

YCharts – Cal-Maine Foods, EV to Sales, Since 1996

Final Thoughts

So, with CALM trading at all-time to multi-decade record lows on book value, sales, earnings, EBITDA, cash flow and the like (especially when we back out abnormally high cash levels held on the balance sheet), why are investors not flocking to this name?

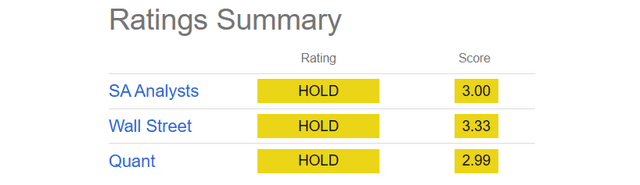

Part of any prediction for Cal-Maine Food’s share price outlook is based on conventional wisdom’s view of egg pricing. Right now, the market is expecting flat to lower egg prices to be the new normal, following bird-flu shortages over the last 12-18 months. Logical and conservative for estimates. Seeking Alpha’s analysts, Wall Street experts, and SA’s own computer-based Quant rating system are all uncommitted to not-interested in terms of investment attractiveness for CALM.

Seeking Alpha Table – Cal-Maine Foods, Analyst Ratings, September 4th, 2023

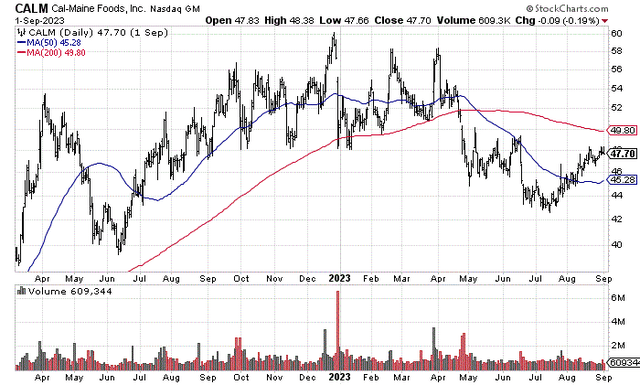

The bird-flu episode is over, and the stock quote has declined -25% since December. What’s to get excited about is mainstream thinking today.

StockCharts.com – Cal-Maine Foods, 18 Months of Daily Price & Volume Changes

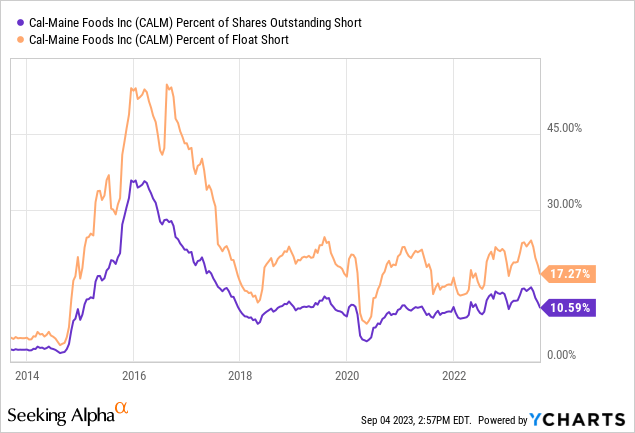

Also holding down the share price, CALM has been a favorite short seller destination since 2015. I know the company can experience a year or two of little to no EPS, as the egg marketplace is extremely competitive on price generally. But, this company is the low-cost producer nationally with its fully-integrated business design, uses no serious debt, and has brand-name awareness at your local store. The company is not going out-of-business anytime soon, and the valuation setup is ultra-cheap. My view is the large short position will cover over time, and support price more than other food companies going forward.

YCharts – Cal-Maine Foods, Monthly Short Position, 10 Years

For upside arguments, what if a recession causes another round of money printing and egg inflation a few years out? What if the bird-flu situation comes back again sooner, rather than later? What if CALM has better pricing power in the future because of its leading size and integrated setup vs. 5-10 years ago?

My view is income and cash flow levels could easily outperform currently BLAH expectations over the next 2-3 years. In this case, CALM’s inexpensive valuation may turn out to be something of a bargain in hindsight.

Often, the best time to buy a blue-chip business is when a clear undervaluation argument can be made, at the same moment as the average investor is not paying attention or showing little interest.

If the downside is limited and you can patiently wait 12-24 months for better days to reappear, Cal-Maine may prove an excellent choice for long-term appreciation at rates of +10% to +15% annually. On top of solid price gains over time, the company has committed to paying 1/3rd of income as a dividend going forward. The 5-year average cash distribution yield is around 2.5% per annum.

Assuming the egg market stabilizes for supply/demand, and prices do not drop much from today (egg prices are about 20% above pre-pandemic levels, which is nearly the same rate of increase as overall U.S. CPI inflation), a CALM valuation using 10-year “normal” metrics argues for a +50% price jump sometime during 2024-25.

Putting all the pieces of the puzzle together, I am targeting a $55 share quote in 12 months and $65 goal in 24 months to reach a more-fair valuation. This optimistic take would be equal to +20% or greater total returns annually (depending on the dividend) the next couple of years. Not spectacular, but if the S&P 500 is set to decline again in a recession or stagflation environment, conservatively-run food plays able to produce positive shareholder gains are an idea worth pursuing in my book.

I rate shares a Buy. I am looking to reenter a position on any minor price weakness back to $45-46 per share.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Read the full article here

Leave a Reply