The enterprise artificial intelligence (“AI”) software business continues to struggle to gain momentum based on the fiscal Q1 results from C3.ai, Inc. (NYSE:AI), unlike AI GPU chips. The stock is falling in after-hours due to the company forecasting investing more in the business and prolonging ongoing losses. My investment thesis is Bearish on the stock due to the company needing to boost investing in AI in order to generate superior growth.

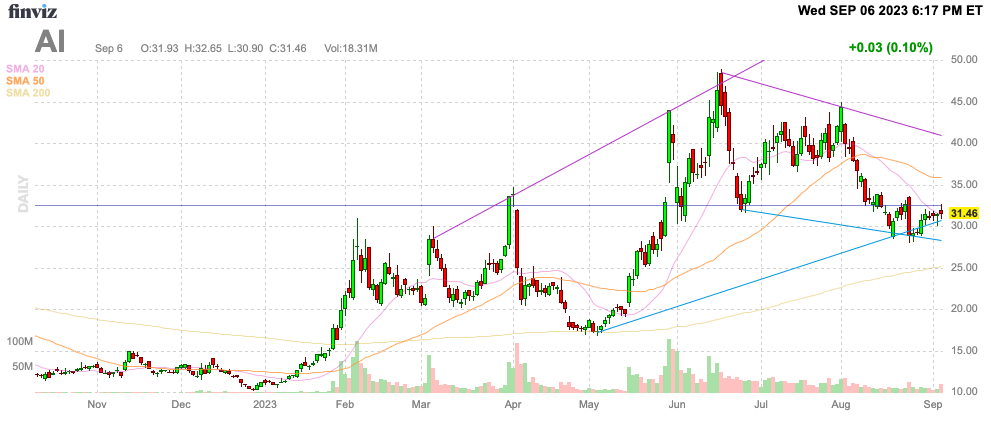

Source: Finviz

Nothing Spectacular

C3.ai reported FQ1’24 numbers after the close. The consensus analyst estimates weren’t for anything spectacular, and the enterprise AI software company delivered a slight beat:

Source: Seeking Alpha

The company delivered nearly 11% sales growth for a stock trading at 12x revenue targets. C3.ai shifted to an enterprise software consumption model last year limiting growth in the short term, but investors were expecting some boosts in growth targets, with the stock soaring into the $30s and peaking at nearly $50 back in June.

The company announced 20 new customer agreements in the quarter and 8 related to the C3 Generative AI product. The product was launched in March 2023 and the company has a pipeline of supposedly 140+ qualified enterprise AI opportunities.

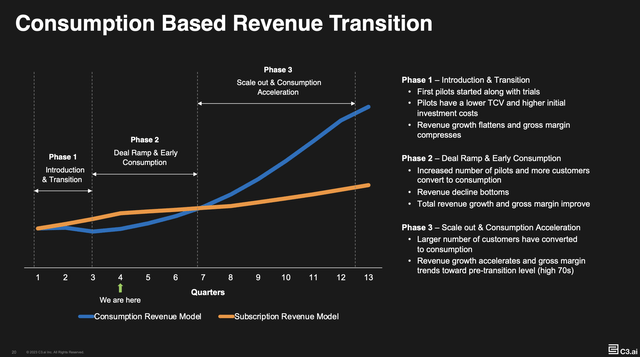

C3.ai is in a void where customers transferred to the consumption model still aren’t producing more revenue yet with up to another year before the new model explodes to the upside. In addition, the enterprise AI product sales cycle still takes a lengthy amount of time with limited deals actually signed at only 12 deals now nearly 6 months after the product was launched.

Source: C3.ai FQ2’24 presentation

The problem here is that these generative AI deals are only for $250,000 over a 12-week pilot period. The 8 new generative AI deals signed in FQ1 would only amount to $2 million in quarterly revenues.

Investing Again

C3.ai announced plans to invest further into the generative AI opportunity in a major disappointment to investors wanting the company to turn profitable. The company projects a massive opportunity in AI, but the sales cycle remains lengthy with a pilot program that lasts 3 months after signing up a new enterprise to try out the software products.

The worst part of the additional investments is the focus on sales, marketing, and branding. The real potential in AI software is creating a better product that doesn’t require major branding to attract customers.

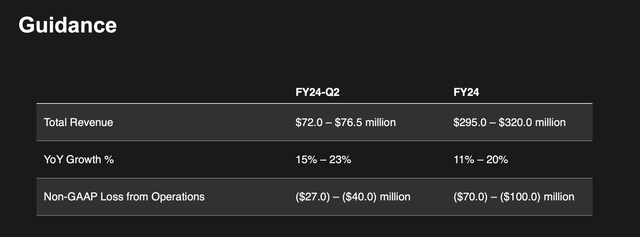

C3.ai maintained FY24 revenue guidance at $295 to $320 million, but the non-GAAP loss surged to between $70 and $100 million for a nearly 30% negative operating margin. The updated guidance boosts the yearly loss by $20 million to $25 million above the target from just last quarter.

Source: C3.ai FQ2’24 presentation

The enterprise AI software company is pushing out the goal to be profitable by FQ4’24. C3.ai has a large cash balance of $810 million and the company generated positive operating cash flows in FQ1.

The company can definitely afford to invest aggressively in the massive generative AI software opportunity, but the market just isn’t likely to reward those investments without further signs of revenue growth. The FQ2 guidance projects upwards of 20% sales growth in the current quarter ending in October, but the yearly guidance doesn’t project the 20% growth being sustainable.

C3.ai consistently beats analyst estimates, but the beats aren’t very large. The stock is just too expensive at 12x analyst FY24 revenue targets at $306 million.

Using a final FY24 revenue target of just $310 million, the stock should trade in the following ranges with investors looking to buy C3.ai at the lower end of the range:

- 5x EV/FY24 revenues of $310M = $20.

- 8x EV/FY24 revenue of $310M = $28.

Takeaway

The key investor takeaway is that C3.ai stock continues to not reach the accelerated revenue targets expected by the market. The stock isn’t attractive any longer at ~$30, with the limited growth rates and the expectation for far larger losses in FY24 due to investing in branding, not higher software development costs for generative AI products.

Down at $20, C3.ai provides a better risk/reward scenario where an investor could actually profit from generative AI pilot deals turning into large contracts and existing enterprise software consumption deals finally ramping up to exceed prior subscription revenue levels. The stock just doesn’t trade at the right price for the present opportunity.

Read the full article here

Leave a Reply