Introduction

Per my August article, BYD (OTCPK:BYDDY) is having success with lithium iron phosphate (“LFP”) batteries such that they’re changing the global landscape with battery electric vehicles (“BEVs”). BYD has sold hundreds of thousands of additional BEVs since the time of that article. Recent headlines have made readers aware of the fact that BEV sales have hit a speedbump in the US. Naturally some may assume this is a global phenomenon but the numbers say otherwise. My thesis is that BEV growth has been continuing nicely at BYD.

At the time of this writing, RMB 1,000 is about $136.70.

The Numbers

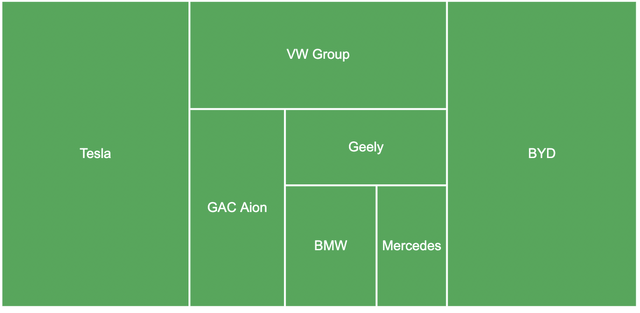

Rather than worrying about headlines from companies that deliver fewer than 50,000 BEVs per quarter globally, I think it is more important to pay attention to the largest producers worldwide. Here are most of the key BEV producers on a relative basis for 3Q23, a quarter in which BYD sold 431,603 BEVs which was very close to Tesla’s figure of 435,059 units. I left out some major BEV producers like Hyundai/Kia (OTCPK:HYMTF) and Stellantis (STLA) as their BEV numbers aren’t as easy to pull as the others:

3Q23 BEV sales (Author’s spreadsheet)

All BEV units are not equal as some vehicles are driven more than others. Tesla (TSLA) models have serious batteries such that they can be driven long distances without the need for charging. BYD’s Seagull BEVs, on the other hand, have small batteries and they are more suited for city trips. I left GM Wuling (GM) BEVs out of the picture above altogether as their mini BEVs have small batteries.

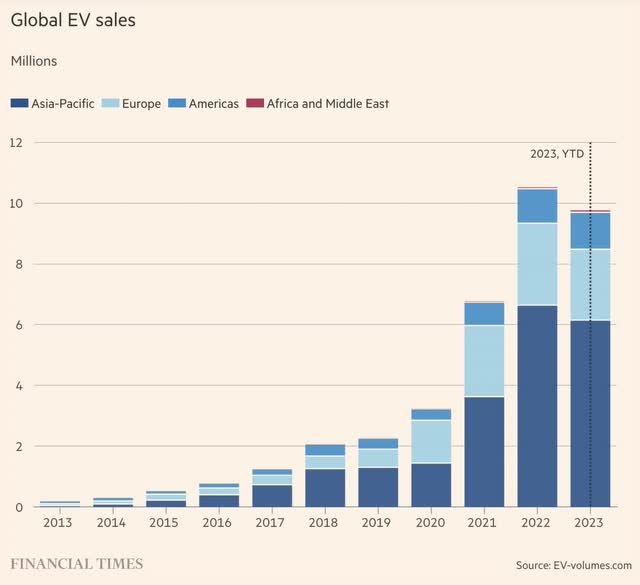

There will be more global BEV sales in 2023 than in 2022 per an October 27th article from the FT but the growth rate from 2022 to 2023 will be lower than it was from 2021 to 2022:

Global EV sales (FT)

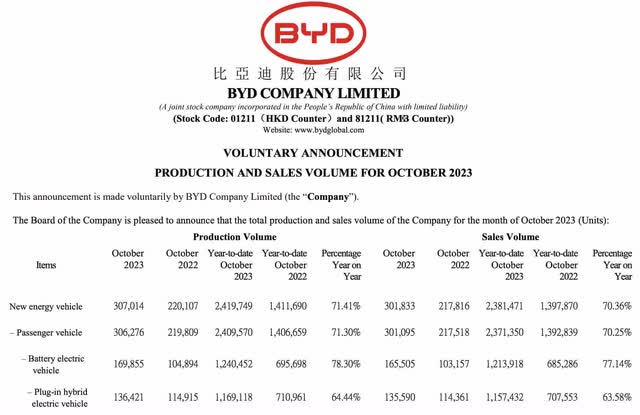

The BEV market in China is enormous and BYD is selling more units than ever. BYD’s October production and sales announcement shows a prodigious BEV figure of 165,505 units delivered for the month:

October units (BYD’s October production and sales announcement)

Regarding the 165,505 BEV units above for October, CnEVPost gives us some breakdowns by model as follows:

Seagull 43,350

Yuan 41,449

Dolphin 35,189

Other models like the Qin, Han and Song have sold in both BEV and PHEV varieties in the past and I don’t see a distinction for October.

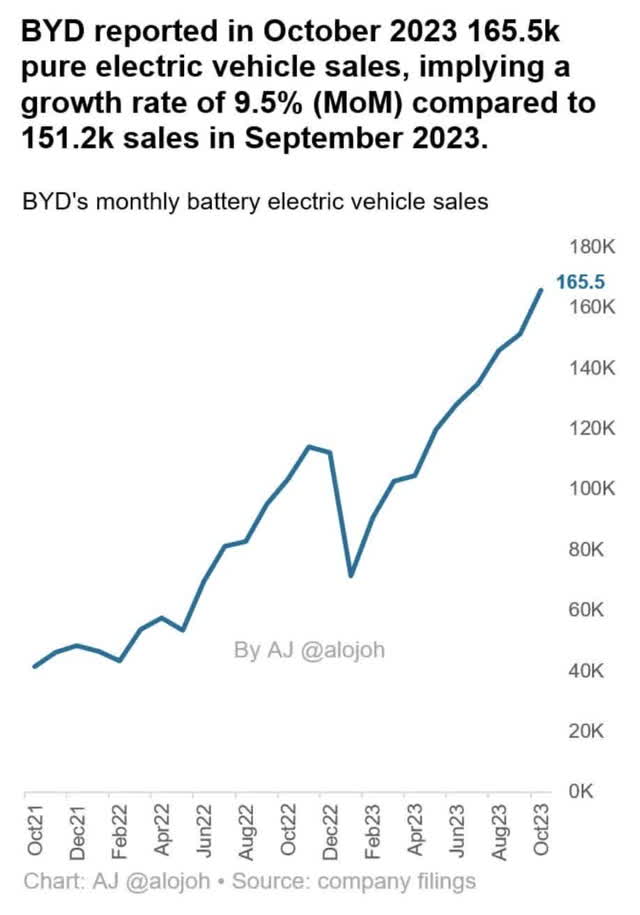

@alojoh put BYD’s October growth in perspective in a recent tweet:

Monthly BEVs (X/Twitter)

Valuation

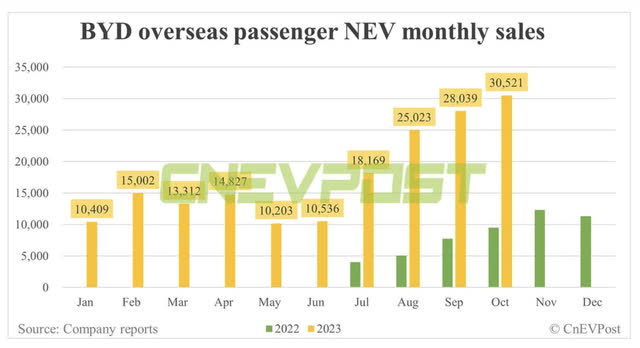

I believe much of BYD’s valuation depends on how much cash flow they’ll generate from selling vehicles outside China in the decade ahead. Again, BYD sold 165,505 passenger BEVs in October plus 135,590 passenger PHEVs for a total of 301,095 passenger NEVs. Despite this prodigious figure, they only managed to sell 30,521 NEVs overseas in October per CnEVPost:

Overseas sales (CnEVPost)

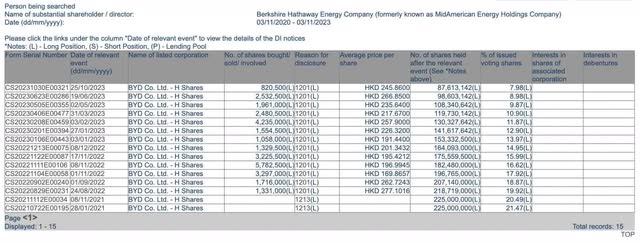

It’s hard for me to see BYD as a strong buy seeing as legendary investor Warren Buffett has been selling shares. Per HKEX, Berkshire’s (BRK.B) ownership of BYD has fallen from 225 million H shares prior to August 2022 down to 87.6 million H shares on October 25th:

Berkshire shares (HKEX)

I don’t see BYD’s gross profit broken out explicitly in the 3Q23 report but the 3Q23 gross margin was 22.12% per CnEVPost and their graph shows it is at the highest level since 3Q20. Looking at the 3Q23 report and the 2022 annual report, we have trailing twelve month (“TTM”) revenue of RMB 578,648 million or RMB 422,275 million + RMB 424,061 million – RMB 267,688 million. If we apply a hypothetical gross margin of 20% on TTM revenue then we have a TTM gross profit approximation of about RMB 115,730 million which is equivalent to about $15.8 billion. I can see BYD being worth 5 to 7x this amount which is $80 to $110 billion when rounding to the nearest $5 billion.

The 1H23 report shows 2,911,142,855 shares. We divide this in half since 2 BYDDY ADRs represent 1 regular share. We then multiply by the November 2nd BYDDY ADR price of $60.28 to get a market cap of nearly $88 billion.

The market cap is within an understandable valuation range so I think the stock is reasonably priced.

Forward-looking investors should keep an eye on BYD’s overseas units and see if these markets will bring in significant amounts of cash in the years ahead.

Disclaimer: Any material in this article should not be relied on as a formal investment recommendation. Never buy a stock without doing your own thorough research.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply