A woman holds a shopping bag in one hand and a credit/debit card in the other.

As I’m writing this article, it’s hard to believe that it is already the day before Thanksgiving. You know what that means. Before you know it, it’ll be time to meet up with your family. If you’re a typical family, your crazy Uncle Bob and somebody (maybe even you) will squabble over something, be it politics, sports, etc. If you’re not yet married and are currently single, your relatives may bother you about when you’re going to settle down and have kids. There will also be plenty of laughs and everybody will eat more than they should.

You or your relatives will probably also be planning out Black Friday or Cyber Monday purchases. After all, 132 million Americans are expected to shop the pre-holiday sales this year. A staggering $60 billion will be spent in the U.S. on these purchases, which is equal to the gross domestic product of Myanmar!

As a minimalist by American standards, I won’t be materially participating in the pre-holiday sales. However, I’m all for making purchases when I know that they will meaningfully improve my standard of living in some way.

But if I weren’t busy strengthening my emergency fund, the only market I would be shopping at for Black Friday is the stock market. This is because, God willing, I am intent on achieving at least basic financial independence by the end of the decade. What I mean by this is enough dividend income to support my non-discretionary expenses (e.g., housing, healthcare, groceries).

With that out of the way, here are two dividend stocks that would be at the top of my buy list when I anticipate resuming investing in January or February.

Enbridge (ENB): The Glue That Holds North America’s High Standard Of Living Together

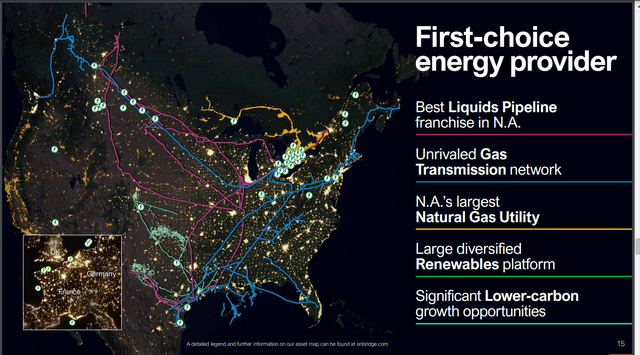

Enbridge Investor Day 2023 Presentation

Whether you’re buying anything this pre-holiday shopping season or not, none of us have a sincere desire to live without fossil fuels. Almost everything you can think of and most of what you can’t think of off the top of your head is a product derived from petroleum. Everything ranging from consumer electronics to clothes, medicines to mops, and shoes to shampoo is a byproduct of black gold.

Every time you use or consume an everyday product, you can take a moment to thank Enbridge. As I touched on last month, the midstream giant moves around 30% of North America’s crude oil production and 20% of all U.S. natural gas consumption.

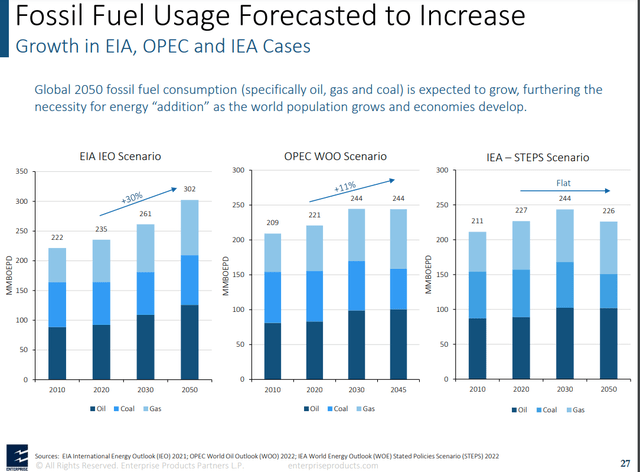

Enterprise Products Partners November 2023 Investor Presentation

Unless you know of some substitute compound in great supply that hasn’t been formally discovered yet, the demand curve for fossil fuels will continue to trend up and to the right (please let me in on that hot tip if you do). Short of unprecedented disaster and hardship, the global population will keep expanding and many more people will be lifted out of poverty into the global middle class. That is why various energy forecasts foresee global fossil fuel consumption gradually rising between now and 2050.

As you would predict, this stands to benefit Enbridge immensely. The company also is prepared to lead an energy transition, with considerable investments in emerging technologies such as carbon capture storage and the like. Thus, FactSet Research thinks that Enbridge will grow by 5% annually long term, no matter what the future may hold.

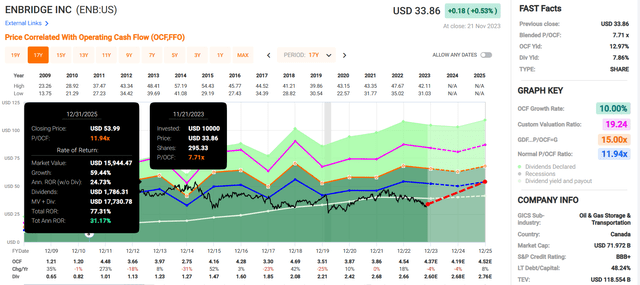

Besides its promising long-term operating fundamentals, the company also pays a highly sustainable 7.6% dividend yield to shareholders. Enbridge’s 65% DCF payout ratio is much less than the 83% that credit rating agencies like to see from midstream companies. Better yet, the company enjoys a BBB+ credit rating from S&P on a stable outlook. These factors should support mid-single-digit annual dividend growth for shareholders. As a side note, investors can avoid the 15% Canadian withholding tax on the dividend altogether by purchasing it in a retirement account.

Topping it all off, Enbridge appears to be quite undervalued. Its $45 fair value estimate per Dividend Kings is 32% above its current $34 share price. If the company matches growth predictions and returns to fair value, here is what investors could stand to gain in the next 10 years:

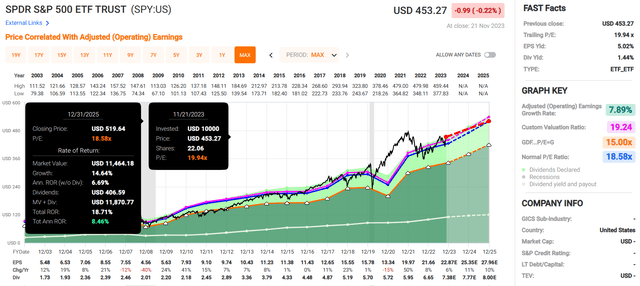

- 7.6% yield + 5% annual growth potential + 2.8% annual valuation multiple expansion = 15.4% annual total return potential or a 319% cumulative total return compared to the 9% annual total return potential of the S&P (SP500) or 137% cumulative 10-year total return

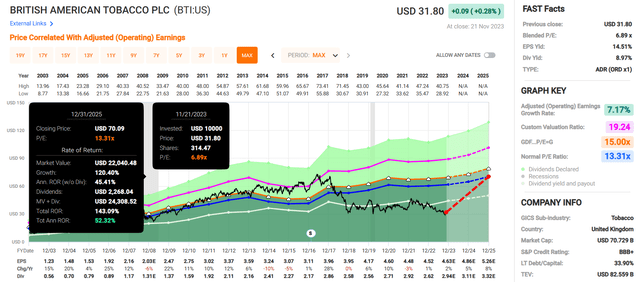

FAST Graphs, FactSet

FAST Graphs, FactSet

British American Tobacco (BTI): An Exceptional Product Portfolio To Thrive In The Future

For thousands of years, tobacco and nicotine have been consumed by humans. Over that time, the mediums of consumption have changed. In the past few decades, consumers have become turned off by the health risks associated with smoking cigarettes.

That is why British American Tobacco has heavily invested in alternatives to traditional cigarettes in recent years. Whether these alternatives like vaping, e-cigarettes, and nicotine pouches are any less harmful is still the subject of scientific debate. But in the tobacco industry, perception is everything. If consumers perceive these other options as less harmful, big tobacco can both survive and do well long after everybody reading this is gone.

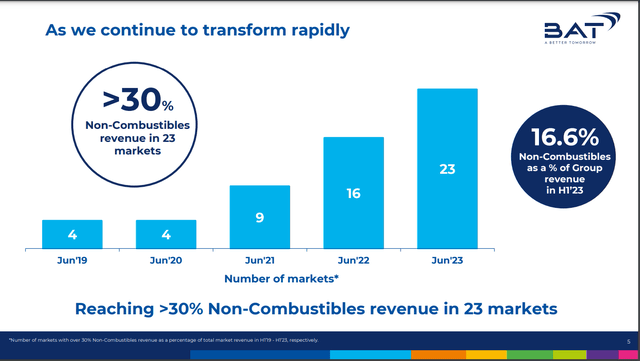

BTI H1 2023 Investor Presentation

BTI’s portfolio includes the top vaping brand in the world Vuse, a leading nicotine pouch brand Velo, and the flagship tobacco heating product glo. Combustibles like Newport and Camel cigarettes are still the vast majority of the company’s sales mix. However, new category revenue grew by 29% over the year-ago period to 16.6% of first-half revenue. At this level of growth, it won’t take much longer for the non-combustibles business to majorly drive growth.

This is why FactSet Research thinks that BTI can grow by 4.6% annually for the long haul. Couple that with its massive 9.3% dividend yield and the stock is very interesting. This is especially true given that BTI’s EPS payout ratio is just 63% per Dividend Kings, which is well below the 85% that rating agencies want to see from tobacco companies. Like Enbridge, S&P also awarded a BBB+ credit rating to BTI.

As my colleague at Dividend Kings Dividend Sensei explained a few months back, the biggest reason to arguably like BTI is that it is trading near its cheapest valuation of this century. Based on historical dividend yield and P/E ratio, the stock is worth every bit of $66 a share. That suggests it is trading at a 52% discount to fair value relative to its current $32 share price.

If BTI can grow as expected and revert to fair value, here are the returns that investors could be in store from the current valuation for the next decade:

- 9.3% yield + 4.6% annual earnings growth + 7.5% annual valuation multiple reversion = 21.4% annual total return potential or a cumulative 10-year total return of 595%

FAST Graphs, FactSet

Summary: Legendary Total Return Potential Is Justified By The Fundamentals Of These 2 Businesses

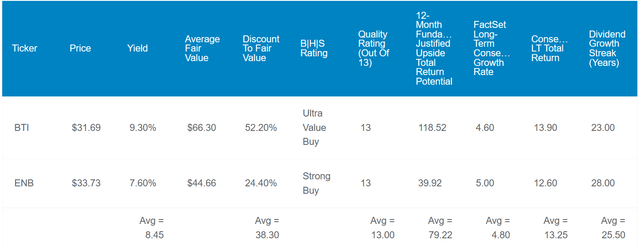

DK Zen Research Terminal

Thanks to steady operating fundamentals, decent balance sheets, and safe dividends, Enbridge and BTI are two of the highest-quality dividend payers in the world.

The two could provide average annual total returns of 18.4% over the next 10 years. For context, that would equate to a staggering 441% cumulative total return. That’s about triple the 137% cumulative total return potential of the S&P 500.

This is the kind of total return potential that could put investors in the company of all-time greats like Warren Buffett, Peter Lynch, John Templeton, and so forth. That’s all the while you’re not sacrificing on quality, either. Ergo, Enbridge and BTI are both no-brainer buys right now in my opinion.

Read the full article here

Leave a Reply