Foreword

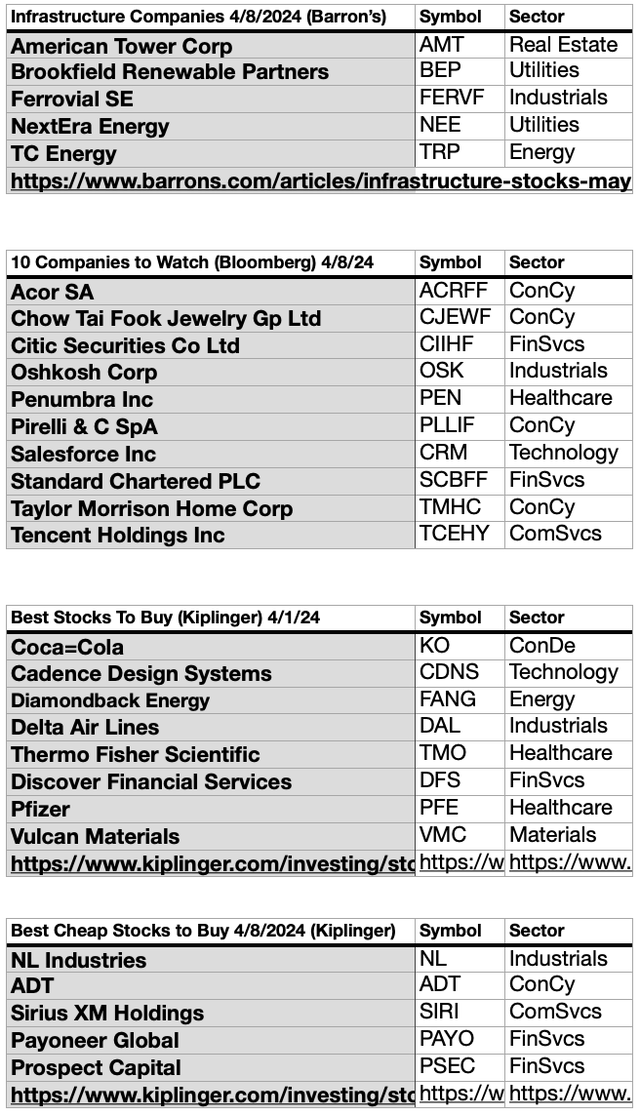

This article is based on four Barron’s, Bloomberg Businessweek, and Kiplinger articles, aimed at finding “ProActive,” stocks for Q2 2024. The title and links to the articles follow:

Why Infrastructure Stocks Make Sense

By Lawrence C. Strauss, Barron’s

April 04, 2024, 1:30 am EDT

While not all infrastructure stocks pay dividends, mainly due to the heavy capital investments that many such companies make, they can provide stable and growing income for investors. Next year should bring more strong price increases, analysts say, advantaging firms with the strongest capital and ability to self-fund growth. These are stocks for protection, not excitement.

Companies to watch

Bloomberg Businessweek

April 08, 2024 (Sorry, no link, paywalled).

These stocks are in the spotlight – for better or worse – at Bloomberg Intelligence.

Accor SA hotel properties are benefitting from stable pricing and a recovery of occupancy in Asia. – Conroy Gaynor.

ChowTai Fook Jeweller this Hong Kong-based retailer faces a challenge from a destined 4% decline in city sales for 2024. – Catherine Lim.

CSC Financial Co is China’s second-biggest broker by market value, but may post disappointing results as banking revenue falls. – Sharnie Wong.

Oshkosh Corp as a commercial equipment maker expects strong earnings growth and has a contract to build new vehicles for the USPS. – Chris Colin.

Penumbra Inc. has a medical-device named Indigo that sucks clots from blood vessels without the need for anticoagulants, aiding people with strokes. – Matt Henriksson.

Pirelli & C SpA is boosting profits by moving production from Europe to lower cost nations of Romania and Mexico and making more premium priced tires. – Gillian Davis.

Salesforce Inc is a large cloud-based software provider with opportunities from IT higher spending, AI generative projects for clients, and expanding demand. – Anurag Lana.

Standard Chartered PLC A combination of wealth management growth, prudent financial moves and lower costs should help this UK bank’s revenue outpace expenses. –Tomasz Noetzel.

Taylor Morrison Home Corp is an Arizona developer poised to generate double-digit growth in orders for the coming year by building larger scale communities and cheaper houses. – Drew Reading.

Tencent Holdings Ltd the Chinese e-Commerce giant is likely to see a return to earnings growth as short videos and AI enhanced ads drive profit margins. – Robert Lea.

Best stocks to buy

BY ANNE KATES SMITH, Kiplinger Reports

April 01, 2024

To compile the list of the best stocks to buy, Kiplinger looked for high-quality companies with solid fundamentals like strong earnings and revenue growth, as well as free cash flow, and many with a value tilt as measured by their forward price-to-earnings (P/E) ratios.

The names featured here vary by size and industry and are not meant to compose a diversified portfolio. But all, for one reason or another, are well positioned to benefit in an uncertain market environment.

Best cheap stocks to buy

BY JEFF REEVES, Kiplinger Reports

April 01, 2024

To compile this list of cheap stocks, Kiplinger focused on:

“companies that are traded on major exchanges vs over-the-counter penny stocks, which tend to be riskier. Additionally, this list includes stable low-priced stocks with healthy dividends, as well as tech companies with growth potential in a digital age. And some are simply the best stocks to buy after recent price declines.”

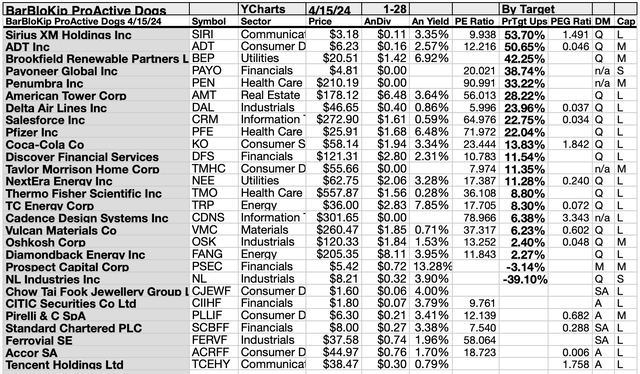

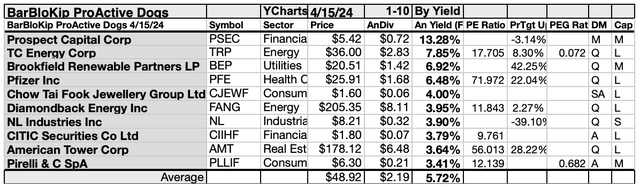

Any collection of stocks is more clearly understood when subjected to yield-based (dogcatcher) analysis, this collection of Barron’s, Bloomberg, and Kiplinger articles, aimed at identifying “ProActive,” stocks is perfect for the dogcatcher process. Below are the 28 April 15, 2024, ProActive candidates as parsed by YCharts.

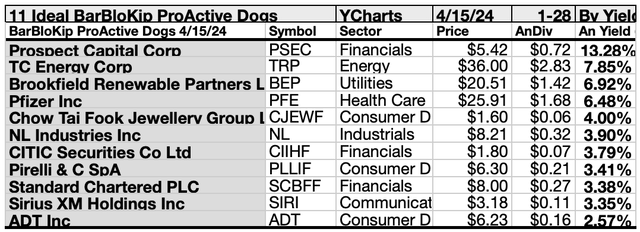

The prices and yields of 11 of these 28 made the possibility of owning productive dividend shares from this collection more viable for first-time investors.

Those 11 Dogcatcher Ideal “ProActive” stocks for April are: Prospect Capital Corporation (PSEC); TC Energy Corporation (TRP); Brookfield Renewable Partners L.P. Limited Partnership Units (BEP); Pfizer Inc (PFE); Chow Tai Fook Jewellery Group Limited (OTCPK:CJEWF); NL Industries Inc (NL); CITIC Securities Company LTD (OTCPK:CIIHF); Pirelli & C SpA (OTCPK:PLLIF); Standard Chartered PLC (OTCPK:SCBFF); Sirius AM Holdings Inc (SIRI); ADT Inc (ADT).

Those eleven all live up to the ideal of annual dividends from $1K invested, exceeding their single share prices. Many investors see this condition as a “look closer to maybe buy” opportunity.

Which of the 11 are “safer” dividend dogs? To find the answer, find my ‘Safer’ April Dividend Dogcatcher follow-up detailing these Barron’s, Bloomberg, and Kiplinger [BBK] selections, aimed at identifying ProActive, stocks in Seeking Alpha’s Dividend Dogcatcher Investing Group appearing on or about April 23. Simply click on the link in the last summary bullet point above.

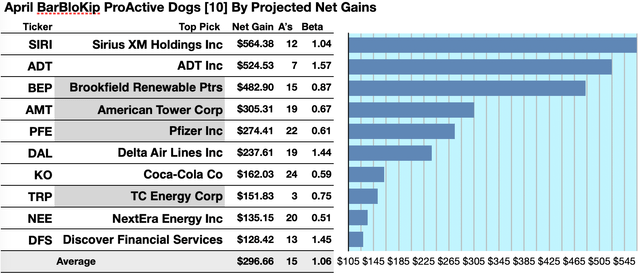

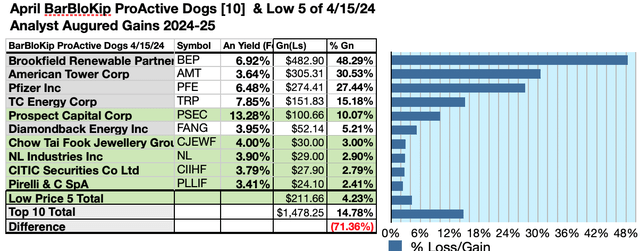

Actionable Conclusions (1-10): Analysts Estimated 12.84% To 56.44% ProActive Dividend Top 10 Net Gains By April 2025

Four of ten top ProActive dividend stocks by yield were also among the top-ten gainers for the coming year based on analyst 1-year target prices. (They are tinted gray in the chart below). Thus, the yield-based forecast for these April dogs was graded by Wall St. Wizards as 40% accurate.

Source: YCharts.com

Estimated dividends from $1000 invested in each of the highest yielding ProActive stocks, added to the median of aggregate one-year target prices from analysts (as reported by YCharts), generated the following results. Note: one-year target prices by lone analysts were not included. Ten probable profit-generating trades projected to April 2025 were:

Sirius XM Holdings was projected to net $564.28, based on dividends, plus the median of target price estimates from 12 analysts, less broker fees. The Beta number showed this estimate subject to risk/volatility 4% greater than the market as a whole.

ADT Inc was projected to net $524.53 based on dividends, plus the median of target estimates from 7 brokers, less transaction fees. The Beta number showed this estimate subject to risk/volatility 57% greater than the market as a whole.

Brookfield Renewable Partners was projected to net $482.90, based on dividends, plus the median of target price estimates from 15 analysts, less broker fees. The Beta number showed this estimate subject to risk/volatility 13% under the market as a whole.

American Tower Corp (AMT) was projected to net $305.31, based on dividends, plus the median of target price estimates from 19 analysts, less broker fees. The Beta number showed this estimate subject to risk/volatility 33% under the market as a whole.

Pfizer was projected to net $274.41, based on the median of target price estimates from 22 analysts, plus dividends, less broker fees. The Beta number showed this estimate subject to risk/volatility 39% less than the market as a whole.

Delta Air Lines (DAL) was projected to net $237.61, based on the median of estimates from 19 analysts, plus dividends, less broker fees. The Beta number showed this estimate subject to risk/volatility 44% over the market as a whole.

Coca-Cola Co (KO) was projected to net $162.03, based on dividends, plus the median of target price estimates from 24 analysts, less broker fees. The Beta number showed this estimate subject to risk/volatility 41% under the market as a whole.

TC Energy was projected to net $151.83 based on the median of target price estimates from 3 analysts, plus annual dividend, less broker fees. The Beta number showed this estimate subject to risk/volatility 35% under the market as a whole.

NextEra Energy (NEE) was projected to net $135.15, based on dividends, plus median target price estimates from 20 analysts, less broker fees. The Beta number showed this estimate subject to risk/volatility 49% under the market as a whole.

Discover Financial Services (DFS) was projected to net $128.42, based on the median of target estimates from 13 analysts, plus dividends, less broker fees. The Beta number showed this estimate subject to risk/volatility 45% greater than the market as a whole.

The average net gain in dividend and price was estimated at 29.67% on $10k invested as $1k in each of these ten stocks. These gain estimates were subject to average risk/volatility 6% over the market as a whole.

Source: Open source dog art from dividenddogcatcher.com

The Dividend Dogs Rule

Stocks earned the “dog” moniker by exhibiting three traits: (1) paying reliable, repeating dividends, (2) their prices fell to where (3) yield (dividend/price) grew higher than their peers. Thus, the highest yielding stocks in any collection became known as “dogs.” More precisely, these are, in fact, best called, “underdogs.”

28 ProActive Equities For 2024-25 Per April Analyst Target Data

Source: YCharts.com

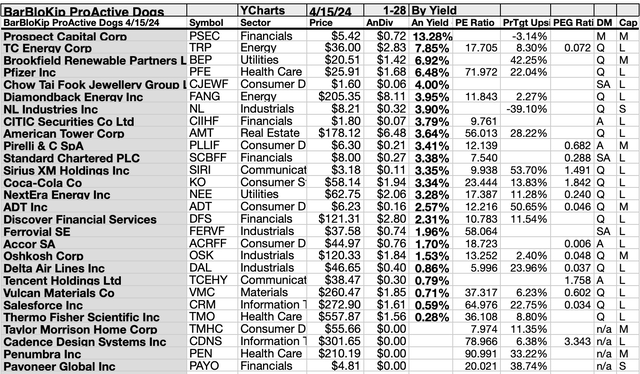

28 ProActive Equities 2024-25 By April Yields

Source: YCharts.com

Actionable Conclusions (11-20): Ten Top BBK ProActive Equities

The top ten 2023-24 BBK ProActive Equities by yield for April represented seven of eleven Morningstar sectors. First place went to one of two financials members, Prospect Capital Corp [1]. The other financial placed eighth, Citic Securities [8].

Then second place was captured by the first of two energy sector representatives, as represented by TC Energy [2], The other energy member placed sixth, Diamondback Energy (FANG) [6].

A lone utility representative was third, Brookfield Renewable Partners [3]. The healthcare representative placed fourth, Pfizer [4].

Then two consumer cyclical (discretionary) representatives placed fifth, and tenth, Chow Tai Fook Jewellery [5], and Pirelli 10].

The seventh slot was claimed by the lone industrials sector member: NL Industries [7].

Finally, a lone real estate sector representative placed ninth, American Tower [9] to complete the top ten BBK Proactive equities by yield for 2024-25 as of April 15.

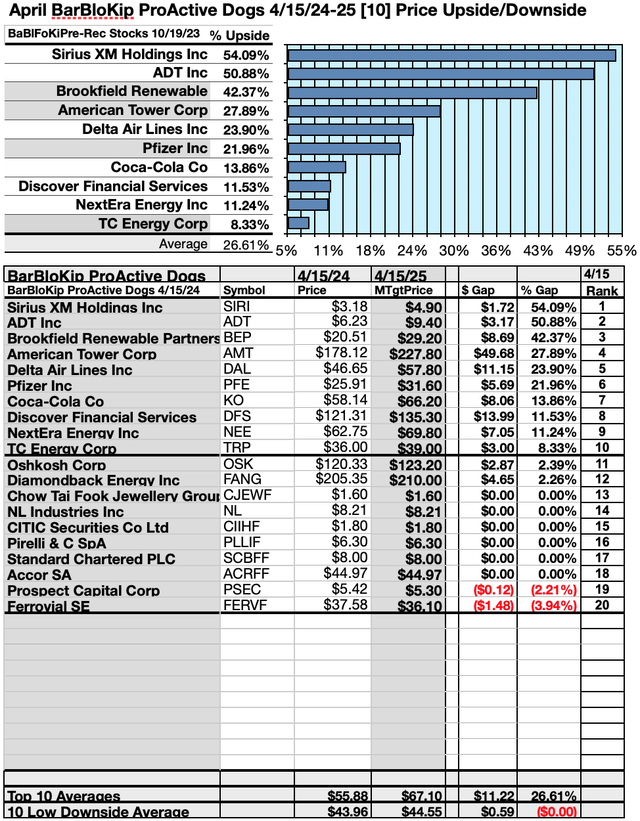

Actionable Conclusions: (21-30) Ten Top BBK ProActive Dividend Payers For 2024-25 Showed 8.33%-54.09% Upsides, While (31) Two Down-siders Were Noted For April

Source: YCharts.com

To quantify top dog rankings, analyst median price target estimates provided a “market sentiment” gauge of upside potential. Added to the simple high-yield metrics, median analyst target price estimates became another tool to dig out bargains.

Analysts Forecast A 71.38% Disadvantage For 5 Highest Yield, Lowest Priced, of 10 BBK ProActive Stocks for April 2024-25

Ten top Barron’s, Bloomberg, and Kiplinger dividend selections, aimed at finding the ProActive equities for 2024-25 were culled by yield 4/15/24 for this update. Yield (dividend / price) results provided by YCharts did the ranking.

Source: YCharts.com

As noted above, the top ten Barron’s, Bloomberg, and Kiplinger dividend selections, aimed at finding the best ProActive stocks, as screened 4/15/24, showing the highest dividend yields, represented seven of eleven in the Morningstar sector scheme.

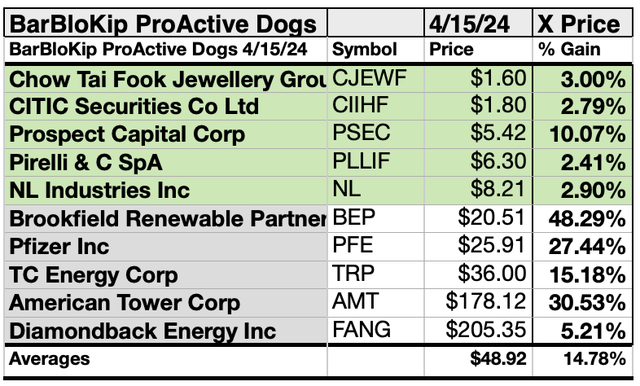

Actionable Conclusions: Analysts Predicted 5 Lowest-Priced Of The Top Ten Highest-Yield “Pre-Crash Recovery” Dividend Stocks for 2023-24 (32) Delivering 4.23% Vs. (33) 14.78% Net Gains by All Ten Come April 2025

Source: YCharts.com

$5000 invested as $1k in each of the five lowest-priced stocks in the top ten Barron’s, Bloomberg, and Kiplinger dividend selections, aimed at finding Proactive Dividend Stocks for 2024-25 by yield, were predicted, by analyst 1-year targets, to deliver 71.38% LESS gain than $5,000 invested as $.5k in all ten. The sixth lowest-priced selection, Brookfield Energy, was projected to deliver the best net gain of 48.29%.

Source: YCharts.com

The five lowest-priced top-yield Barron’s, Bloomberg, and Kiplinger dividend selections, aimed at finding ProActive Stocks as of April 15 were: Chow Tai Fook Jewelry; CITIC Securities; Prospect Capital; Pirelli; NL Industries, with prices ranging from $1.60 to $8.21.

Five higher-priced Barron’s, Bloomberg, and Kiplinger dividend selections, aimed at finding ProActive stocks as of April 15 were: Brookfield Renewable; Pfizer; TC Energy; American Tower; Diamondback Energy, whose prices ranged from $20.51 to $205.35.

The distinction between five low-priced dividend dogs and the general field of ten projected Michael B. O’Higgins’ “basic method” for beating the Dow. The scale of expected gains, based on analyst targets, added a unique element of “market sentiment” gauging upside potential. It provided a here-and-now equivalent of waiting a year to find out what might happen in the market. Caution is advised, since analysts are historically only 15% to 85% accurate on the direction of change and just 0% to 15% accurate on the degree of change.

The net gain/loss estimates above did not factor-in any foreign or domestic tax problems resulting from distributions. Consult your tax advisor regarding the source and consequences of “dividends” from any investment.

Afterword

This article features 28 Barron’s, Bloomberg, and Kiplinger dividend selections, aimed at finding ProActive selections for 2024-25. The article focuses on the top 20, or so, dividend payers. Therefore, below are the four complete lists of 28 stocks.

Sources: Kiplinger.com, Barrons.com, Bloomberg BusinessWeek, YCharts.com

If somehow you missed the suggestion of which stocks are ripe for picking at the start of this article, here is a reprise of the list at the end:

The prices of 11 of these 28 Barron’s, Bloomberg and Kiplinger, ProActive selections for 2024-25 made the possibility of owning productive dividend shares from this collection more viable for first-time investors.

Those 11 Dogcatcher ideal ProActive dividend stocks for April are:

Source: YCharts.com

Those 11 all live up to the ideal of having their annual dividends from a $1K investment exceed their single share prices. Many investors see this condition as a “look closer to maybe buy” opportunity.

Which of the 11 are ‘safer’ dividend dogs? To find the answer, find my ‘Safer’ April Dividend Dogcatcher follow-up detailing these Barron’s, Bloomberg, and Kiplinger selections, aimed at identifying ProActive, stocks in Seeking Alpha’s Dividend Dogcatcher Investing Group appearing on or about April 23. Simply click on the link in the last Summary bullet point above this article.

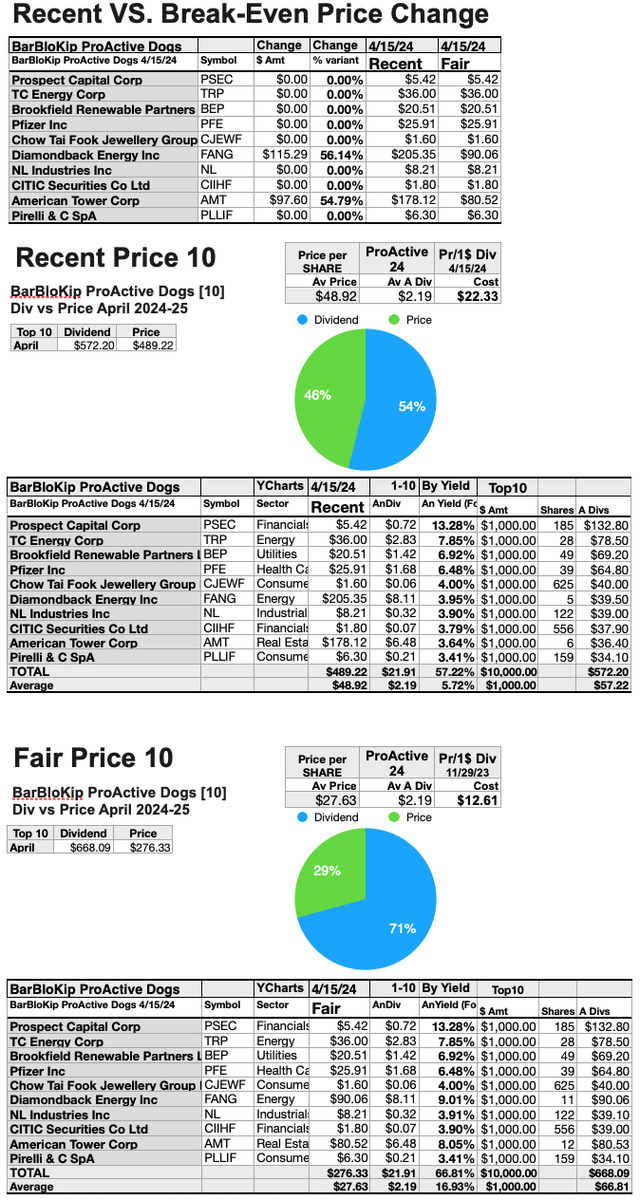

How Ten Top ProActive 2024-25 Stocks Could Become Ideal Fair Priced Dogs

Source: YCharts.com

Since eight of the top-ten Barron’s, Bloomberg, and Kiplinger ProActive stocks for 2024-5 shares are now priced less than the annual dividends paid out from a $1K investment, the above charts compare those two against fair prices.

The dollar and percentage differences between recent and fair prices are detailed in the top chart. The recent prices are shown in the middle chart with the fair pricing of all ten top dogs conforming to the dogcatcher ideal are detailed in the bottom chart.

With downside market pressure to 56.14% all ten highest-yield Barron’s, Bloomberg & Kiplinger ProActive stocks, could be better-than fair-priced with their annual yield (from $1K invested) meeting or exceeding their single share prices. The comparison shows how much the two recent prices must go down meet the (arbitrary but logical) price limit.

Stocks listed above were suggested only as possible reference points for your purchase or sale research process. These were not recommendations.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply