Introduction

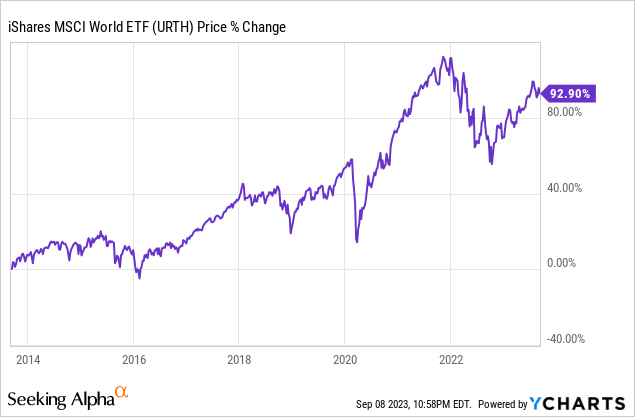

iShares MSCI World ETF (NYSEARCA:URTH): In today’s fast-paced world of finance, the pursuit of a truly diversified and as close to a risk-free investment strategy as possible remains a desirable plan for many. The original concept behind investing in an MSCI World Index seemed to offer a solution to this quest: capturing the returns of every economic entity across the globe, or more preciously, the average Return on Equity (ROE) of the global economy. This approach promised a tangible, risk-free path to earning returns from the collective endeavors of companies worldwide. However, in an era characterized by growing market concentration and individual companies reaching market valuations in the trillions of dollars, it is imperative to reevaluate whether this traditional investment approach can still be effectively realized through instruments like the iShares MSCI World ETF.

The Composition of URTH MSCI World ETF – The Concentration Problem

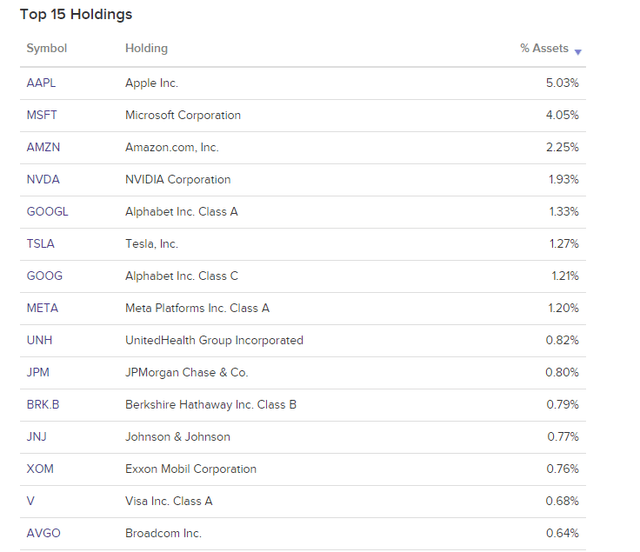

Enter the URTH MSCI World ETF, a widely recognized fund designed to mirror the performance of the MSCI World Index. This ETF boasts approximately 1,200 holdings, but it’s critical to consider the top holdings, which wield a disproportionate influence, making up about 20% alone. Notably, Apple (AAPL) and Microsoft (MSFT) combined account for 10% of the holdings, followed by corporate giants within this ETF, such as Amazon (AMZN), Tesla (TSLA), Alphabet (GOOGL), and Nvidia (NVDA) – companies often regarded as fundamental components of the digital age and therefore highly successful.

URTH – Top Holdings (VettaFi)

While acknowledging the merits of the size and significance of these companies, we must also recognize the profound impact of this concentration. The fundamental concept of diversification, in the context of investing in the world and capturing its average returns while mitigating risk, appears to erode under the weight of this market cap-weighted ETF and its concentration in a few select companies. This concentration might not hold the same weight when viewed through the lens of earnings rather than mere market capitalization.

The essence of risk-free investing, at its core, aims to avoid making assumptions about the future. Yet, with such a high concentration in a handful of behemoth companies, are we inadvertently making predictions about the future? Which effectively means that we are loading up on risk instead of mitigating it as much as possible?

The Quest for True Diversification

To truly embrace the essence of investing in the world, diversification must take center stage. It’s not merely about spreading investments across an array of assets; it’s about capturing the collective strength of global economic forces. In this context, the concept of antifragility and the inherent functioning of a capitalist system come into play.

Capitalism, as we know it, thrives on dynamism and adaptability. It’s an economic system that has displayed remarkable resilience throughout history. The equation can be simplified to explain that there are continuously individual companies unable to achieve high returns on equity, resulting in their facing the harsh verdict of extinction. While this is certainly not pleasant for these particular companies and their employees, it fuels the overall system’s ability to emerge stronger from crises in terms of equity returns. This phenomenon, described in the words of Josef Schumpeter as “creative destruction,” has become more pronounced in our era of globalization and the fast-paced environment we observe today.

In essence, the total return on equity of the entire market remains positive over time; otherwise, companies would cease to exist.

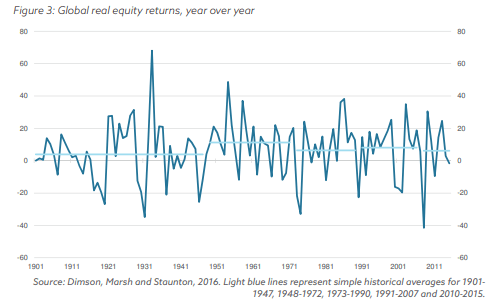

In this context, it becomes apparent that an optimal portfolio with respect to risk should mirror the earning power of the global economy as closely as possible. One might think this is achievable through buying the MSCI World Index; however, concentration on a few behemoths based on their share price, meaning market capitalization, rather distorts the whole idea and instead creates risks. The true compass for portfolio structure should be profitability, not market capitalization. By doing so, we also prioritize the compounding effect of fundamentals-tangible real corporate earnings-over short-term price fluctuations. The average return you can expect on this investment strategy over time is basically the company’s average return on equity in the long run, which has typically been around 7-8%, roughly equaling the performance of the MSCI World Index. Doubling one’s investment in ten to twelve years becomes the standard.

Historic Global Equity Returns – 1902 / 2011 (Norges Bank)

Crises as Catalysts for Change – A Dynamic System Perspective

A few more words about risk in the context of a crisis. Within an approach that aims to capture everything, crises become catalysts for change rather than harbingers of doom. In static systems, such as a single company, crises often spell disaster, leading to system breakdown when faced with disruptions. However, in dynamic systems like the ‘World Corporation,’ crises take on a different role. They initiate an adaptation process, transforming the system in response to external stress events. While the pattern of crises may share similarities, the specific events and outcomes remain unpredictable. In essence, crises in dynamic systems represent a transition from a static state (an individual company) to a dynamic one (the ‘World Corporation’). This phenomenon, akin to “emergence” in the natural sciences, signifies that systems exhibit self-dynamics and adapt to their changing environments.

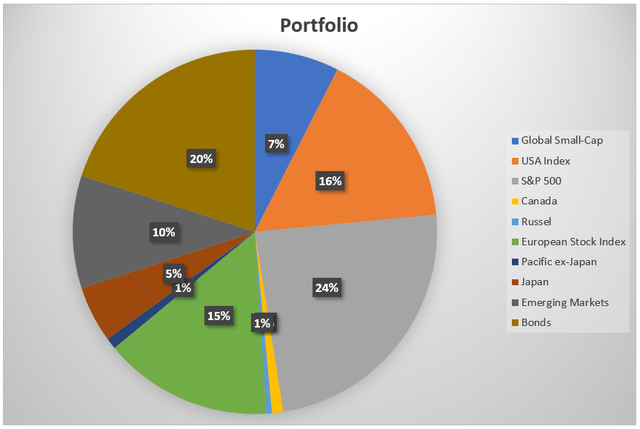

Building Your Ultra-Stable World-Portfolio:

With these foundational principles in mind, constructing an ultra-stable portfolio becomes a pragmatic endeavor. The key is to select a portfolio of Exchange-Traded Funds (ETFs) that encapsulates the essence of the global economy’s earning power, grounded in real profits generated by companies, rather than weighing holdings solely based on stock prices or market capitalization, which may unnecessarily distort reality.

Ideally, the portfolio should also include safe bonds like Swiss Franc Fixed-Rate or bonds of a similar rating. Considering bonds is especially attractive since they recently began earning a yield again. With that, you even have the flexibility to take advantage of crises when you can buy more of the “World Corporation” when overall prices fall.

With these in mind, you’re ready to embark on portfolio construction aligned with the strategy described. This could result in an overall portfolio like the following I created:

Conceptional World Portfolio (Author)

Conclusion

I have examined the MSCI World Index and its ETF replication, URTH; however, I highlighted that due to market concentration as a result of the skyrocketing valuations of a few giants, the effectiveness of this ETF and the world index it captures doesn’t really align anymore with my logic when thinking about investing in the world through an ETF as an investment approach.

Furthermore, my exploration in that context underscores the importance of avoiding assumptions about the future in a truly risk-free investment strategy. Instead, focusing on profitability over market capitalization can provide more stable returns.

With that setup, it’s also evident that crises in dynamic systems drive positive overall returns rather than disaster.

So, in truly building an ultra-stable world portfolio, I would rather consider a blend of weighted global earning power and safe bonds.

In summary, while no investment is entirely risk-free, this approach comes as close as possible to a “free lunch”-not an extravagant one, but a decent meal overall. So, investors should weigh the concentration, profitability, and adaptability when considering URTH and, in my opinion, instead explore true diversification for resilience in their world portfolio investment strategy.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply