The BlackRock Credit Allocation Income Trust (NYSE:BTZ) is a closed-end fund, or CEF, that can be employed by investors who are seeking to earn a very high level of income from the assets in their portfolios. As of the time of writing, the fund boasted a very respectable 10.29% yield, which is obviously significantly higher than most other things in today’s market. However, unfortunately, it is not particularly high when compared to many other fixed-income closed-end funds on the market. For example, many of PIMCO’s funds have yields surpassing 12% and other credit allocation funds have higher yields. For example, consider the following:

|

Fund |

Current Yield |

|

BlackRock Credit Allocation Income Trust |

10.29% |

|

Apollo Tactical Income Fund (AIF) |

11.20% |

|

Ares Dynamic Credit Allocation Fund (ARDC) |

11.08% |

|

Nuveen Credit Strategies Income Fund (JQC) |

12.86% |

With that said BlackRock funds have a tendency to be somewhat less aggressive when it comes to things such as leverage or other strategies that can significantly boost a fund’s yield. While this results in somewhat lower yields, it also makes them somewhat safer for investors.

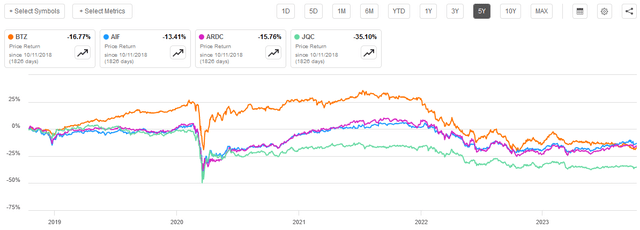

For example, as we can see here, the BlackRock Credit Allocation Income Trust outperformed many of these other funds during most of the past five years. The fund’s performance only deteriorated once the Federal Reserve started hiking interest rates in earnest:

Seeking Alpha

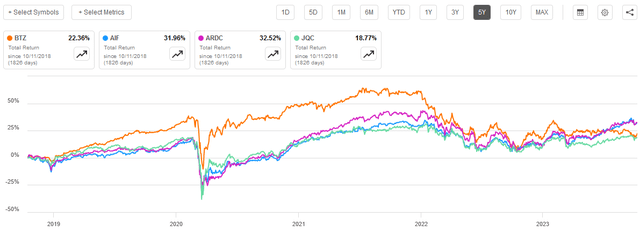

We actually see the same thing when we look at the performance of these funds with their distributions included:

Seeking Alpha

Thus, it appears that the BlackRock Credit Allocation Income Trust was outperforming many of its peers during the low-rate environment that dominated much of the time period surrounding the pandemic, but it may have been slower to adapt its strategy now that higher rates have fully settled in. This actually could make this fund a nice complement to either the Apollo or the Ares funds if it delivers comparable performance when and if interest rates start to decline again. This is something that we want to investigate, as its holdings will largely determine the fund’s performance in response to changing interest rates.

About The Fund

According to the fund’s website, the BlackRock Credit Allocation Income Trust has the primary objective of providing its investors with current income, current gains, and capital appreciation. This is a very strange objective for a fund that invests in credit securities, as this one does. From the webpage:

“BlackRock Credit Allocation Trust’s investment objective is to provide current income, current gains and capital appreciation. The Trust seeks to achieve its investment objective by investing, under normal market conditions, at least 80% of its assets in credit-related securities, including, but not limited to, investment grade corporate bonds, high yield bonds (commonly referred to as ‘junk’ bonds), bank loans, preferred securities or convertible bonds or derivatives with economic characteristics similar to these credit-related securities. The Trust may invest directly in such securities or synthetically through the use of derivatives.”

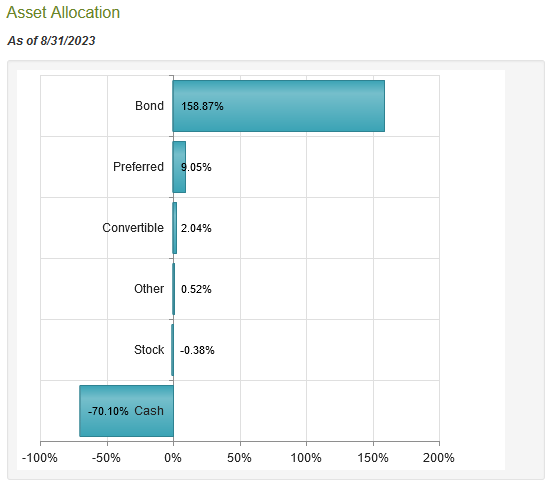

While the description above mentions preferred stock and convertibles, we can see that at the moment the fund has very little exposure to either of those asset types. In fact, right now, the fund has 158.87% of its net assets invested in bonds, 9.05% in preferred stock, and only 2.04% of net assets invested in convertible securities. The fund has a substantial negative net cash position:

CEF Connect

The reason that this is all possible is that the fund employs leverage as a method of boosting its returns. This is something done by just about every debt closed-end fund in the market. We will naturally discuss this later in this article. The important thing for right now is that this fund invests primarily in bonds and other debt securities.

The fact that this fund invests in bonds and other debt securities is the reason why current gains and capital appreciation are both strange objectives to pursue. As I have explained in numerous previous articles, bonds have no net capital gains over their lifetimes. An investor purchases a bond at face value, receives a regular payment from the issuer of the security, and then receives the face value back at maturity. Thus, there are no net capital gains because the only investment return over the life of the bond is the coupon payment.

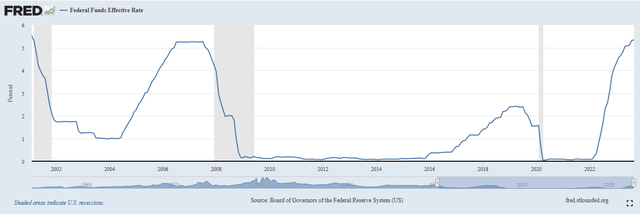

With that said, the fund may be able to achieve some current gains by taking advantage of the fact that bond prices rise when interest rates fall. However, that is very difficult in the current environment. As everyone reading this is likely well aware, the Federal Reserve has been aggressively hiking interest rates in an effort to combat the tremendously high levels of inflation that have been prevailing in the economy over the past two or three years. As of the time of writing, the effective federal funds rate sits at 5.33%, which is the highest level that we have seen since February 2001:

Federal Reserve Bank of St. Louis

The sequence of rate hikes that brought us to this point has devastated bond prices, as well as the price of just about anything with a fixed yield. For example, in addition to bonds, utility stocks have been getting punished because most of them deliver much of their investment returns via their dividends and their yields have been quite low over most of the past decade. The BlackRock Capital Allocation Income Trust is no exception to this. Investors in the fund have lost 10.52% over the past three years even after we take the effects of the distribution into account. However, the fund still managed to outperform the Bloomberg U.S. Aggregate Bond Index (AGG) over the period:

Seeking Alpha

The fact that the fund outperformed the index over the period is something that investors should be able to appreciate. However, we can also see that this fund fell far more than the Bloomberg U.S. Aggregate Bond Index did once the Federal Reserve started hiking rates in early 2022. For example, here is the same chart from January 3, 2022 to today:

Seeking Alpha

As we can see, investors in the BlackRock Credit Allocation Income Trust took much greater losses than investors in the broader market index. Once again, this chart takes the distributions into account. As the BlackRock Credit Allocation Income Trust has a significantly higher yield than the index, this is important because the fund’s distributions will do a more effective job of offsetting the price declines.

This is curious as the fund’s webpage description that was quoted earlier explicitly states that this fund has the ability to invest in bank loans. As I explained in a recent article, bank loans tend to be floating-rate debt instruments with remarkably stable cash flows. As such, the fact that the fund has this ability should have allowed it to reposition its assets once the rate hikes started and avoid the worst of the rate hikes, much like the Apollo Tactical Income Fund was able to do. However, even that fund did see some share price declines in 2022 before rebounding sharply:

Seeking Alpha

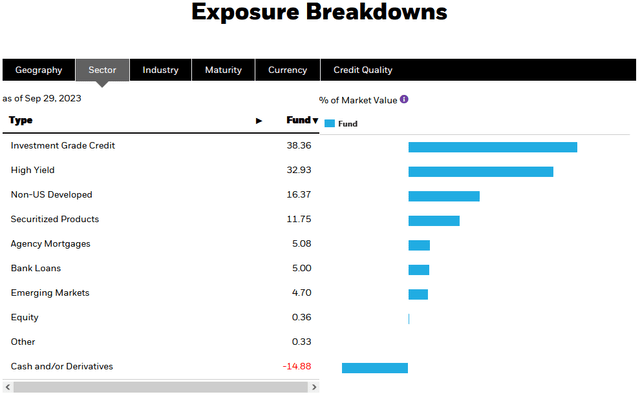

The BlackRock Credit Allocation Income Trust has not been taking advantage of the opportunity in floating-rate securities, however. As of the time of writing, only 5% of the fund’s assets are invested in bank loans. Its largest position is in investment-grade bonds, which constitute 38.36% of the fund’s net assets:

BlackRock

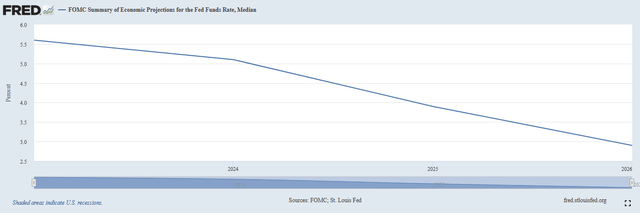

The large position to junk bonds is not bad right now, as investors have been bidding those up because they want to lock in the receipt of a high yield while they can. After all, the market still believes that the current high-interest rate environment will not last for very much longer, despite the most dovish members of the Federal Open Market Committee predicting that the federal funds rate will be at 5% at the end of 2024. However, for the most part, this fund still appears to be positioned for a falling rate environment like the one that was present over most of the 2010s. While that could certainly work out over the next few years, it will be a long-term theory. As we can see, the current median projection of interest rates from the Federal Open Market Committee members points to rates still being about 5% at the end of 2024 and at 3.9% at the end of 2025:

Federal Reserve Bank of St. Louis

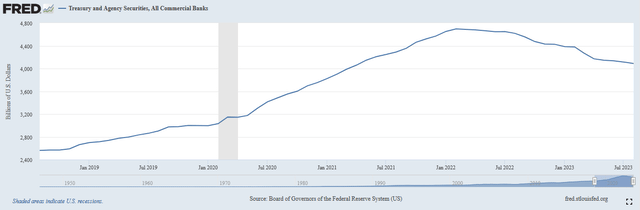

This, of course, assumes that there will be no recessions in the intervening period, which is a tough call as a majority of American consumers and business executives believe that there will be a recession sometime in 2024. Another potential bump here is that the Federal Government’s incessant borrowing is starving the private economy of capital. There is basically no money supply growth right now, so every dollar that the Federal Government borrows is a dollar that cannot be used in the private economy. Historically, America’s commercial banks are one of the largest borrowers of capital, but they have been scaling back their willingness to lend to the Federal Government in recent months:

Federal Reserve Bank of St. Louis

Finally, foreign nations that were historically large buyers of U.S. Treasuries such as China and Russia are certainly not lending to the United States (they are actually slowly selling off Treasuries in order to buy gold bullion). This basically means that unless the U.S. Government fixes its budget problems, it will be pressuring interest rates upward due to the simple law of supply and demand. Basically, it is demanding more money than the system is willing or able to provide. It is uncertain if the members of the Federal Open Market Committee are taking that into account with their projections, but I doubt it.

In short, this fund does not appear to be as well-positioned for the environment which will probably persist over the next few years as some of its peers that are more heavily invested in floating-rate assets. The BlackRock Credit Allocation Income Trust does have some exposure to foreign markets, which is nice as not all countries are under the same financial pressures, nor do they all have the same problems that were just discussed. In many emerging markets, for example, government finances are in much better shape than in developed markets.

There are also a few things that could change the above discussion about interest rates dramatically. A near-term recession could result in a rate cut, for example. Another possibility would be political pressure applied to the Federal Reserve to reinstitute quantitative easing and monetize the debt issuance to avoid a financial crisis caused by the Federal Government’s budgetary problems. In this scenario, rates would decline, and the prices of the bonds held by this fund would go up. It may be a good idea to hold this fund alongside something like the Apollo Tactical Income Fund in order to have your portfolio prepared for either possibility when it comes to interest rates.

Leverage

As mentioned earlier in this article, the BlackRock Credit Allocation Income Trust employs leverage as a method of boosting its investment returns and effective portfolio yield. I explained how this works in numerous previous articles on other closed-end funds. To paraphrase myself:

In short, the fund borrows money and then uses that borrowed money to purchase bonds and other debt securities. As long as the interest rate that the fund pays on the borrowed money is less than the yield that the fund receives from the purchased securities, the strategy works pretty well to boost the effective yield of the portfolio. As this fund is capable of borrowing money at institutional rates, which are considerably lower than retail rates, this will usually be the case. It is important to note though that this strategy is not as effective today with borrowing rates at 6% as it was two years ago when the borrowing rate was basically 0%.

However, the use of debt in this fashion is a double-edged sword. This is because leverage boosts both gains and losses. As such, we want to ensure that a fund is not employing too much leverage because that would expose us to an excessive amount of risk. I do not typically like a closed-end fund’s leveraged assets to exceed a third of its portfolio for this reason.

As of the time of writing, the BlackRock Credit Allocation Income Trust has leveraged assets comprising 38.01% of its portfolio. This is certainly above the one-third level that we really like to see. It also explains why the fund appreciated so much more than the index following the end of the COVID-19 lockdowns, as well as declined to a much greater degree when the central bank started to raise interest rates. This fund’s leverage is not really out of line with what other debt-focused closed-end funds possess though, and as I have pointed out before, debt funds can typically carry a bit more leverage than equity funds due to the fact that their assets are not nearly as volatile as common stocks. As such, we probably do not need to worry too much about the fund’s leverage right now. We should be sure to keep an eye on it though, as we do not want it to get too much higher.

Distribution Analysis

As mentioned earlier in this article, the primary objective of the BlackRock Credit Allocation Income Trust is to provide its investors with current income, current gains, and capital appreciation. However, bonds and other debt securities provide the overwhelming majority of their investment returns in the form of direct payments to investors. When we consider that most bonds have a yield that is significantly above the 4.624% current yield of the ten-year U.S. Treasury, we can quickly see that the fund’s income from this source can be significant. This is amplified by the fact that the fund applies a layer of leverage to boost the effective yield of the portfolio beyond that of any of the underlying assets. The fund also might be able to generate some capital gains by trading bonds prior to maturity and profiting from changes in interest rates. That naturally boosts the amount of cash that the fund has coming in. The fund then collects the money that it receives from both of these sources and pays it out to its investors, net of the fund’s own expenses. This can be expected to result in a very high yield for the fund’s own shares.

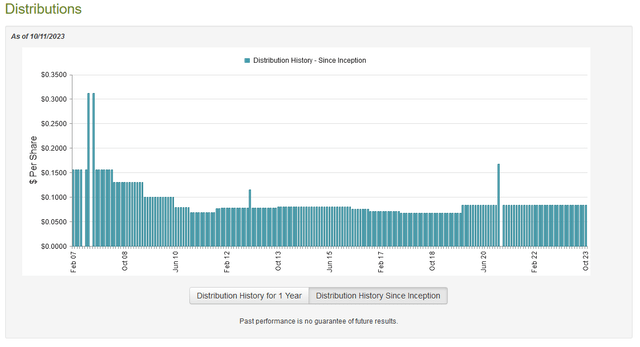

This is indeed the case. As of the time of writing, the BlackRock Credit Allocation Income Trust pays a monthly distribution of $0.0839 per share ($1.0068 per share annually), which gives the fund a 10.29% yield at the current price. Unfortunately, the fund has not been completely consistent with respect to its distribution over the years, but it has done better than many other fixed-income closed-end funds:

CEF Connect

Perhaps the most important thing that we note here is that this is one of the only funds that has not cut its distribution since the rate hikes started in early 2022. The other ones that have not are generally the tactical income funds that invest much more heavily in floating-rate securities than this fund. As such, we want to investigate the fund’s performance during the past twenty months or so, since the losses that it took in 2022 might be sufficient to necessitate a distribution cut even though this fund has not actually imposed one at this time.

Fortunately, we do have a relatively recent document available that can be consulted for the purpose of our analysis. As of the time of writing, the fund’s most recent financial report corresponds to the six-month period that ended on June 30, 2023. As such, it should give us a good idea of how well the fund performed during the first half of this year. That is important because the first half of this year was characterized by a remarkably optimistic market that was widely expecting interest rates to be reduced in the near future. As such, it was bidding up the price of bonds in accordance with this belief. That could have provided this fund with some opportunities to realize capital gains by selling appreciated assets.

During the six-month period, the BlackRock Credit Allocation Income Trust received $1,292,909 in dividends and $49,732,746 in interest from the assets in its portfolio. When we combine this with a small amount of income from other sources, we see that the fund had a total investment income of $51,194,440 during the six-month period. It paid its expenses out of this amount, which left it with $31,344,782 available for shareholders. That was, unfortunately, not nearly enough to cover the $47,071,475 that the fund paid out to its shareholders in distributions during the period. At first glance, this is quite concerning as we typically like any debt-focused fund to be able to fully cover its distributions out of net investment income.

However, there are other methods available through which this fund can obtain the money that it needs to cover its distribution. For example, it might be able to sell some assets that go up in price when interest rates fall. This obviously gives the fund some realized capital gains that could be paid out to the investors. Unfortunately, the fund had mixed results in this task during the period. It reported net realized losses of $45,590,272 but these were more than offset by $63,944,106 in net unrealized gains.

Overall, the fund’s net assets went up by $2,627,141 after accounting for all inflows and outflows during the period. Thus, it did technically manage to cover its distributions over the period. However, the fund had to rely on unrealized gains to accomplish this task. One of the problems with this is that unrealized gains do not become permanent until the fund sells the securities. As such, they can be easily erased by a market correction, such as the one that occurred in the bond market over the past two months. As such, we cannot be certain how well the fund actually managed to cover its distribution. As such, we should keep a close eye on the fund’s finances going forward and buy with caution, as there is certainly a risk that it will end up cutting at some point.

Valuation

As of October 11, 2023 (the most recent date for which data is available as of the time of writing), the BlackRock Credit Allocation Income Trust has a net asset value of $10.79 per share but the shares only trade for $9.82 each. This gives the fund’s shares an 8.99% discount on net asset value at the current price. This is not as good as the 10.54% discount that the shares have had on average over the past month, although it is still a discount. As such, it may be possible to obtain a better price by waiting a bit. The shares are below their intrinsic value right now though, so it is not really the end of the world if someone were to purchase shares today.

Conclusion

In conclusion, the BlackRock Credit Allocation Income Trust is a debt-focused closed-end fund that currently boasts a very high yield. As such, it could potentially be attractive to someone who is looking to obtain a high level of income from their portfolios.

However, the fund’s portfolio appears to be better suited to a period of falling interest rates than to today’s situation. That could pay off in the event of a recession or something else that forces the central bank to cut rates in the near future, but that is by no means guaranteed. As such, it might be best to use this fund alongside something that performs well in today’s high-interest rate environment.

Read the full article here

Leave a Reply