BRW overview

Saba Capital Income & Opportunities Fund (NYSE:BRW) is a closed-end fund that seeks to add value by investing in global opportunities across various asset classes. It can also use both public and private instruments, private funds, and may use derivatives. Closed-End Funds “CEFs” and Special Purpose Acquisition Companies “SPACs”, often represent a large part of their investments. A range of derivatives instruments can be used either to enhance returns or reduce overall portfolio risk.

Some of the above strategies are beyond the efforts of private investors to implement themselves so that is one reason to consider BRW. Such strategies are not expected to be highly correlated to equities markets generally, yet may still have scope for high returns. Saba Capital is renowned for its shareholder activism. This is also an alpha source that is beyond the scope of the average individual investor to implement.

Income investors may be attracted to the high distribution yield of circa 12%, with monthly payments. BRW trades at a discount of approximately 11% at the time of writing, investors can check the BRW website for updates.

Whilst I wouldn’t show a huge degree of confidence that such high yields are sustainable, the income seeking investor might at least be attracted to the fund’s stated goals. To quote from the website just referred to, the fund “seeks to provide investors with a high level of current income, with a secondary goal of capital appreciation.”

The size of the fund is close to $400 million, with expense ratios of 1.7% on a net basis, with leverage of 18.5%. It is important to note that these figures were also based off their website, and some information is listed as at the end of July. Whilst it is a high fee fund, one should not necessarily rule it out on that fact alone. Performance may possibly justify fees to some extent.

Who is Saba Capital’s Boaz Weinstein?

Boaz Weinstein rose to prominence in the US hedge fund industry a few years after founding Saba Capital Management in 2009. He was on the successful side of a trade against the “London Whale” trader from JP Morgan, who racked up huge losses in 2012.

Whist I refer to an event a long time ago, the relevance today is that Weinstein still makes trading moves within BRW. This differentiates it with alternative products that may focus on CEF opportunities but are far more diversified.

What is the Saba Capital closed-end fund strategy?

Saba Capital will search for CEFs that are trading at significant discounts to NTA to generate superior returns compared with similar high yield ETFs and other instruments. Once again differentiating it from some other funds, Saba Capital will often pursue an activist approach to monetize the discount to NAV.

Does shareholder activism work?

This has been a topic of much debate over the years, and I have read studies arguing either way. In the case of the BRW though, we are more interested to know if it is successful when applied in to the CEFs sector rather than all companies.

It can be complicated though for those who study this area to measure the results accurately. For example, perhaps an activist acquires most of their stake at a 20% discount, but the activism campaign is not widely known until later. By such a later date, what if the discount has already contracted to 10% due to anticipation of activism? Many activist campaigns start behind the scenes.

Warren Buffett and closed-end funds

If CEFs excited Warren Buffett in his younger days, then perhaps we should be warming to them now that the discounts are historically wide.

Boaz Weinstein himself pointed out earlier in the year in an interview that before Buffett took Benjamin Graham’s class in 1950, he was interested in CEFs. Weinstein was also name dropping some other CEF investors according to this article, but let’s just stick to Buffett. To quote Weinstein, “The majority of Warren Buffett’s holdings when he was about to enter that class were discounted closed-end funds.”

BRW history and performance

Perhaps a reason BRW trades at almost a double-digit discount to NAV could be that at an initial glance performance appears underwhelming. This, however, may fail to appreciate a couple of factors that paint their performance in an uninspiring light.

Firstly, some may be viewing the longer term published returns of BRW. This fails to consider that Saba Capital only took over running it in June 2021.

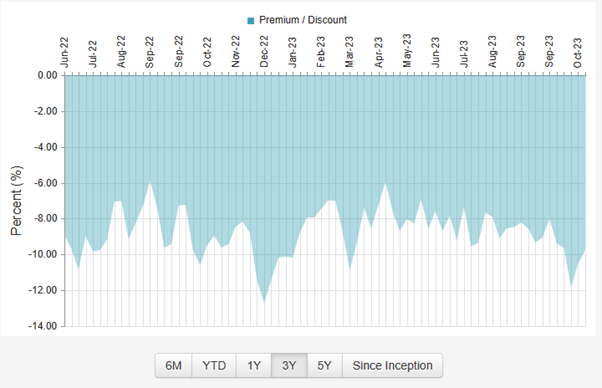

Secondly, others may do their own performance analysis on shareholder return since then. From that date, the discount has moved to almost its widest point now. Note the chart below only begins from mid-2022, but when BRW took over management though a year earlier the discount was initially smaller.

cef connect

I would argue from this point on given the discount is already wide, this potential headwind on future returns is likely removed.

I prefer to view the shareholder return from when Saba Capital took over BRW, then in the back of my mind note how the widening of the discount impacted this.

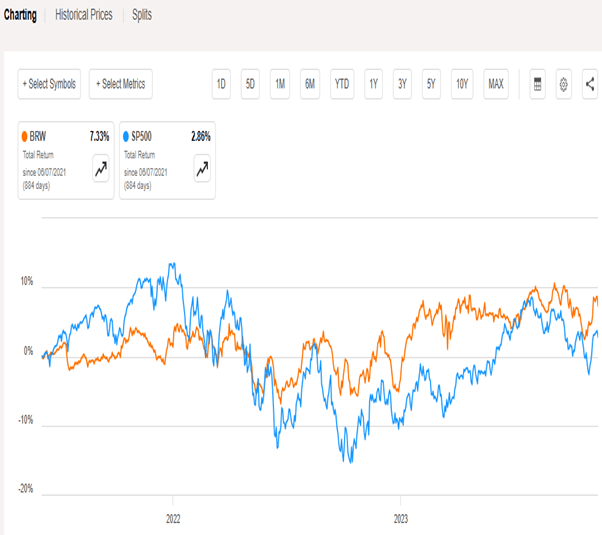

total return BRW from Saba management date

Even though the recent widening of the discount to NAV has been unhelpful to the total returns on BRW, it still looks good compared to the S&P500.

We can see from the chart that BRW has seen lower drawdowns, indeed reflecting my earlier comments on how their strategies are not highly correlated to equities.

BRW has only been managed by Saba Capital for around two and a half years. In the middle of this period, we know that 2022 was a very tough year for investors in both equites and fixed income markets.

BRW in fact was a rare example of a fund producing positive returns for calendar year 2022. Going into that year they had almost 80% of their portfolio in SPACs. That is worth highlighting as it shows they can be very active and shows they have made a shift more towards CEFs in 2023.

With the above context, one could argue BRW has done quite a respectable job in this period. From here onwards, arguably the opportunity set is now more conducive to them posting better returns.

How to judge the performance of BRW?

Taking into account their investment style, I may not necessarily expect them to match the S&P500 in the very long run. That is, BRW will often hold much of the fund in fixed income instruments and hedge out plenty of underlying market risk.

I would be looking at BRW as an investment to provide relatively stable positive returns over the medium term, high and consistent distributions, with lower drawdowns. I would also be hoping that Saba Capital demonstrates their skills such that this CEF outperforms similar products.

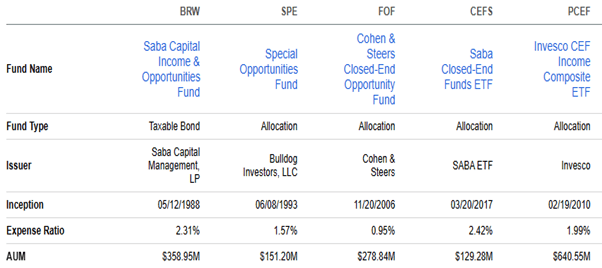

Let’s consider some funds that also hold plenty of CEFs, SPACs in some cases, and target paying high distributions. It is difficult though to come up with alternative comparable funds given the flexibility BRW shows. At times however, I have observed other investors have looked at these alternatives.

BRW peers comparison, Seeking Alpha

I shall focus on the time from June 2021 whereby Saba Capital took over the management of BRW.

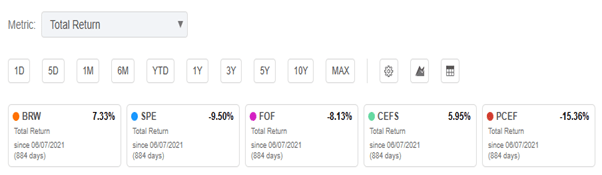

Total Return since June 7, 2021 (date BRW managed by Saba), Seeking Alpha.

Should I buy BRW now?

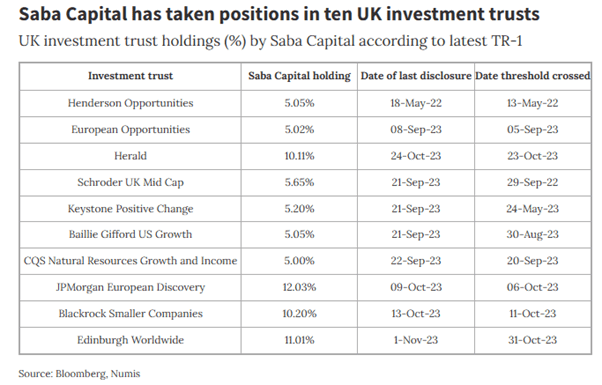

CEFs are historically at wide discounts to NAV. Saba looks to be focusing more on this area with shareholder activism, meaning now might be an opportune time to consider BRW.

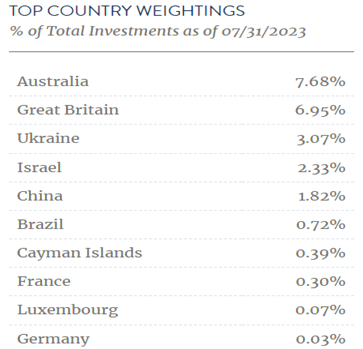

Note that Saba Capital also has their ETF that invests in CEFs in the US, the Saba Closed-End Funds ETF (BATS:CEFS). That may well also be a decent opportunity at the current time. I may explore that more in depth in a future article. For this article, BRW grabbed my attention more for the moment. One reason being that itself is trading at a historically wide discount to NAV. I have also been observing how it has been increasing holdings in CEFs in the UK and Australian markets.

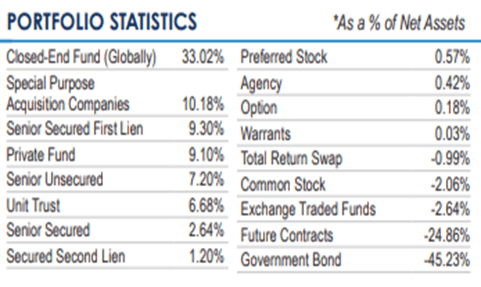

Whilst I realize BRW will not be 100% invested in CEFs like some of the alternatives I had in the charts above, I note BRW lifted their CEFs exposure considerably this year. (Early in 2022 they only had circa 10% in CEFs).

BRW factsheet as at July 31, 2023

sabacef.com

Once again, I note the data here is a bit stale, so we should also monitor towards the end of the year when they release their Annual Report for more information.

Judging from other information in recent months however, I suspect BRW if anything may have continued to accumulate more in CEFs.

Boaz Weinstein has made news both in the UK not so long ago, and also in Australia that indicates CEFs there are ripe for activism. In Australia, Saba Capital have filed various substantial shareholder notices in recent months. With ASX stock VGI Partners Global Investments, they continued steadily buying over this period, which may indicate they still see value in CEFs more generally. In that situation, a handful of activists appear to be circling VG1 for either a wind up or conversion to open end structure.

Reports as recently as two weeks ago suggest Saba Capital was raising new funds to target an activist strategy in UK trusts trading at large discounts.

Bloomberg, Numis

Are Closed-End Funds A Good Investment For 2024?

It is not just Weinstein alone suggesting CEF discounts are wide and now is a good time to be hunting for activism opportunities.

CEF Discount Stats suggest that at the time of writing discounts have rarely ever been wider than now. The main exceptions when discounts were wider were around the 2008 financial crisis and more recently the “covid crash” of 2020.

Recent activism battles: Saba Capital’s Boaz Weinstein vs. BlackRock

The main battle fought by Saba Capital this year has been against BlackRock as this article outlines. To quote Weinstein directly “What they are doing to entrench with respect to stripping shareholder rights, banning shareholder proposals which they’ve done, puts them at the G side of governance as the worst company in the S&P 500.”

For those investors wanting more direct exposure to this campaign, the CEFS ETF that I mentioned briefly earlier has large exposures there to the BlackRock funds.

We can see from the above quote that Weinstein does not hold too much back in speaking out against targeted funds.

I can only hope he is aware that the small investor in other jurisdictions such as the UK and Australia would also welcome such honesty on CEFs in my opinion.

I had noticed with these targeted BlackRock funds that discounts had already contracted somewhat from their wide points. In that regard, I suspect there might even be more attractive targets for BRW which focuses more on the CEFs outside of the US.

As you will see from the listed top holdings from back in July, they also made some successful trades in the Grayscale Trusts. At the end of last year these were highly out of favor and at large discounts to NAV.

Bloomberg

BRW top holdings

sabacef.com

Conclusion

Sentiment is quite depressed in the CEFs space generally. The level of discounts are sitting so large overall to be in the 95th percentile when examining the last couple of decades. That provides a good backdrop for BRW to improve returns from here. There is also the chance for BRW to see its own discount contract from here.

Saba Capital is doing a lot of work in both raising awareness of this opportunity, and getting their hands dirty on various individual activism campaigns.

A risk with BRW is that they are not afraid to be very active with the portfolio and deviate from consensus. Whilst this helped them protect capital in a difficult 2022, if equity markets happen to be in a new bull market now, I suspect BRW might underperform.

For what it is worth, my sense is that markets will still be challenging over the next six months. In that environment, I see BRW as a reasonable buy now, due to their ability to add value from strategies not correlated to the overall market.

Read the full article here

Leave a Reply