Itaipu Hydroelectric Dam

On our last coverage of Brookfield Renewable Partners (NYSE:BEP) (BEP.UN:CA) and its corporate sibling Brookfield Renewable Corporation (NYSE:BEPC) (TSX:BEPC:CA), we suggested investors leave the company for its preferred shares. The preferred shares in question were the ones trading on NYSE (there are a ton of others on TSX), i.e. Brookfield Renewable Partners L.P. 5.25% PFD CL A (NYSE:NYSE:BEP.PR.A). This seemed like a yield chasing call, designed for higher income. But as always, we had capital preservation in mind.

This yield is a good 2% higher than BEP’s yield of 5.39%. While we think BEP’s yield is safe for the foreseeable future, there is no question that BEP.PR.A’s yield is even safer. We think this defensive security also would benefit from the rate cut cycle and could deliver similar returns to BEP, with less risk. In our last coverage of this specific security, we had rated it as a “hold” as it was trading at $20.52. There were far better values back then in the preferred share Universe. Today, we are upgrading this to a “buy”.

Source: Switch To The Higher Yield Alternative

We look at what has happened since then and tell you how we see the renewable energy landscape shaping up.

The Acquisition

BEP got back into the acquisition game, making a bid for Neoen.

- Brookfield has entered into exclusive negotiations with Impala, the Fonds Stratégique de Participations managed by ISALT, Cartusiai and Xavier Barbaro, and other shareholders to acquire approximately 53.32% of the outstanding shares of Neoen at a price of 39.85 euros per share.

- The acquisition price represents a 26.9% premium over the last closing price and premia of 40.3% and 43.5% over the 3- and 6-months volume-weighted average price, respectively. Brookfield’s offer implies an equity value for 100% of the shares of 6.1 billion euros.

Source: BEP

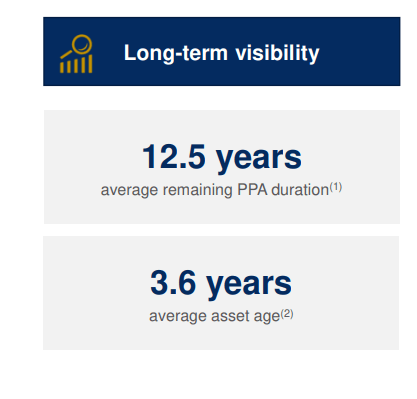

This is unlikely to move the needle right away, as Neoen is fairly small relative to the enterprise value of BEP. In addition, thanks to the massive premium, the multiple differential between the two was fairly small at the time of the announcement. So why is BEP getting in here? Neoen does have a set of quality asset of about 5GW of renewable energy. But it also has a 3GW under construction and a long runway of projects that may be as much as 20GW. There is the future growth here that BEP is trying to secure. The assets are fairly young and have leverage down the line to higher power prices.

NEOEN Presentation

The price paid was not the worst we have seen, but they likely could have gotten an even better deal today, as multiple contract everywhere.

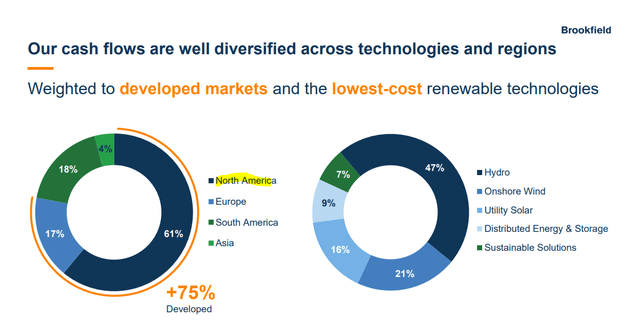

The Political Situation

Without getting into the political mud-slinging area, we can just report the facts. The odds of a Trump win have increased materially over the last few weeks, and this is playing on the renewable energy theme. We don’t believe this should impact a company like BEP materially. Yes, North America is a big piece of the current pie for BEP. 61% of its cash flows come from this region. But BEP’s global reach and opportunity board allow it to follow the dollar (or yen for that matter) signs wherever they may lead.

BEP May 2024 Presentation

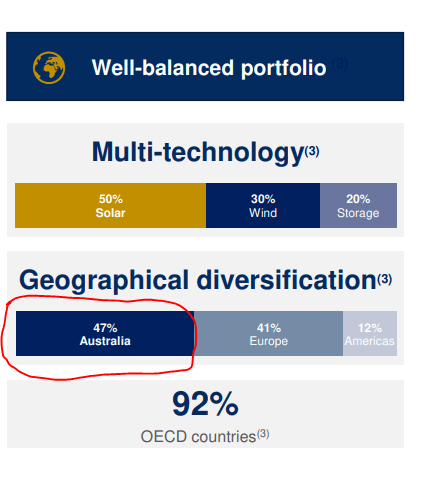

The Neoen acquisition opens an expansion doorway into Australia.

NEOEN Presentation

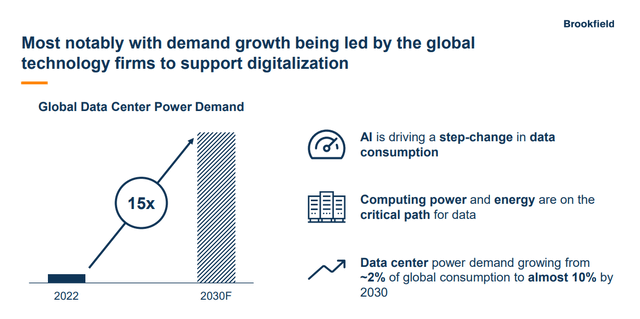

So we don’t see these risks as material. There are some who believe that the AI growth will be a huge source of electricity demand even with North America and that could support renewable markets.

BEP May 2024 Presentation

We disagree on this front and think the bulk of AI applications will have zero revenues or will be unprofitable. We see this imploding down the line, and all those fanciful growth rates will disappear at the same pace as clichés like Metaverse and Web 3.0.

Valuation

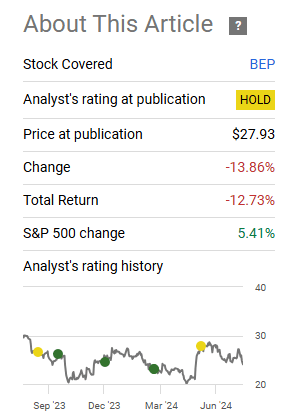

We are still moving here from a “hold” to a “buy” on BEP. With most companies with an extremely steady set of revenues and cash flows, the primary driver of returns at any point on the time spectrum is price. More precisely, it is valuation. Since our last update, this is what we have seen. BEP has dropped steeply. A 14% drop in under 3 months is quite a move, especially for a low beta stock when the S&P 500 is up 5.41%.

Seeking Alpha

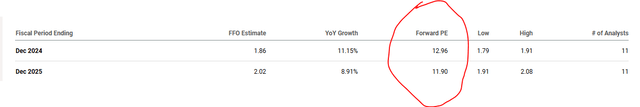

At the same time, our suggested play BEP.PR.A is up about 7% inclusive of dividends (ex-dividend July 15, 2024). In other words, BEP.PR.A has outperformed BEP by 22% in 80 days. At present, we think this beautiful trade has run about as far as it can run. BEP has also grown more attractive with the price drop and now trades at 13X 2024 funds from operations (FFO).

Seeking Alpha

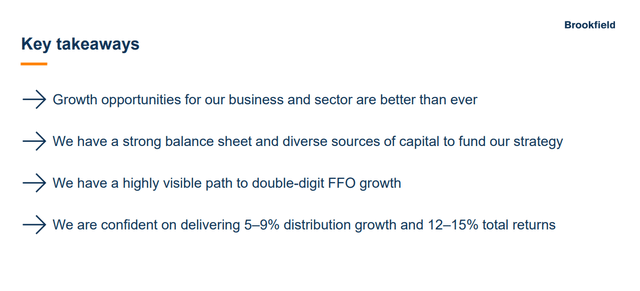

Investors might rush to conclude that is the best thing since sliced bread, but we would ask them to look at the debt outstanding first. Debt to EBITDA is still near 6.5X and likely bumps up with the Neoen acquisition. In such a climate, with moderately high interest rates, we see 11X-14X FFO has the right multiple for BEP. We still like it here and think the common units now offer an advantage over the preferred. The yield differential between them has also collapsed thanks to the 22% difference in their returns since May. Currently, BEP yields 5.9% and BEP.PR.A has a stripped yield of 7.15%. That is not enough of a bump on the preferreds to keep recommending it at this point. While we don’t think BEP will be able to generate the distribution growth it states below, we think even extremely conservative assumptions warrant a change in stance.

BEP May 2024 Presentation

We are downgrading BEP.PR.A to a Hold. We are upgrading BEP to a Buy with a $27 price target. That gives it the potential of making a total return of 18% from here in one year.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Read the full article here

Leave a Reply