Last month, Broadcom (NASDAQ:AVGO) unveiled its Q3 earnings (ending July) which surpassed sell-side expectations. The stock surged nearly 10% in the two days leading up to the announcement, mirroring investor anticipation reminiscent of Nvidia’s standout performance. However, lacking the expected blowout, the stock dipped 4%, eventually settling back to its pre-run-up levels.

I initially published on Broadcom in conjunction with Tom Lott in October 2021. Our initial analysis of Broadcom underscored its potential. I published a follow up article in March of this year, reiterating a strong buy on the stock as the company was clearly positioned to benefit from investments in AI and this had not yet been reflected in the stock price. The stock has turned out to be a great investment, returning 78% since our initial write-up and 32% since my article in March.

While AVGO has seen its trailing 12-month EPS soar by 76% over the last 2 years, the stock has also experienced significant multiple expansion. The stock’s P/E has increased from 15x to over 18x, which is attributable to the company’s role in AI.

Even though demand for AI-related products has counterbalanced a slump in other sectors like smartphones, AVGO’s forward returns could be somewhat modest. As AI hype moderates, Broadcom could re-rate lower. I believe that the current stock price already reflects strong expectations as the stock hovers around 17.2x and 15.2x our 2024 and 2025 EPS estimates.

Given the stock’s latest move and its forward valuation at the high end of the stock’s range, it seems prudent to take some profits.

Q3 Results Strengthened the Case for a Soft Landing

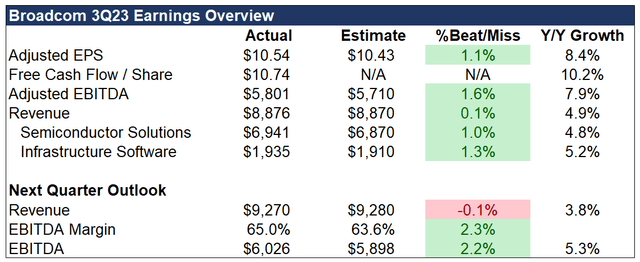

Broadcom delivered a solid but not blowout performance in Q3, beating expectations on both revenues and profits. The company’s revenue climbed by 4.9%, fueled by growth in both the Semiconductor Solutions and the Infrastructure Software segments. However, management’s revenue forecast fell slightly short of estimates by $10 million, or 0.1%, a disparity that appeared to disappoint investors.

NJV, Bloomberg, Company Filings

Investors perhaps were expecting a performance akin to Nvidia’s exemplary quarter, as trading activity was heightened in anticipation of a large beat. While a blowout quarter did not materialize, Broadcom’s financials have undoubtedly been bolstered by the surging demand for AI-related products, particularly during a decline in semiconductor demand.

It is noteworthy that increased demand for AI-centric products counteracted the subdued momentum in Broadcom’s other segments like wireless, server and storage, broadband, and industrial. Broadcom’s networking related products, which constitute about 40% of semiconductor solutions revenues, are the primary beneficiary of the increased investments in AI.

The networking segment registered 20% year-on-year growth for the quarter. Furthermore, management sounded optimistic on the call, projecting an acceleration in this growth trajectory. They forecast networking revenues to rise by 50% sequentially and to double on a year-on-year basis in the upcoming fourth quarter.

This AI-driven revenue surge has been a silver lining, especially when compared to other segments that are either stagnating or registering modest single-digit growth rates. The foresight of Broadcom’s management team has been evident, as they had been alluding to the potential for strong networking-related product sales growth to offset weakness in other areas.

During the earnings call, Broadcom disclosed that excluding AI-related products, the Semiconductor Solutions segment has plateaued at quarterly revenues of approximately $6 billion (up 5% in Q3 but will be flat YoY in Q4 excluding AI).

While Q3 earnings might not have met the market’s elevated expectations, Broadcom has exhibited resilient growth in key segments. The company owns a diverse array of businesses and will likely create further shareholder value through its acquisition of VMware, which looks on track to close in the coming months.

VMware Acquisition on Course for an October Completion

Despite the hurdles that typically accompany M&A undertakings in the current political climate, Broadcom’s acquisition of VMware is nearing its final stages. In a significant communication update on August 21st, Broadcom kept its investors in the loop about the progress of this notable acquisition.

The press release stated:

Broadcom Inc. (AVGO), a pioneering force in the global technology landscape, specializing in semiconductor and infrastructure software solutions, today reconfirmed its projection regarding the successful closure of its VMware, Inc. (NYSE: VMW) acquisition by October 30, 2023. The update also highlighted the advancements made with multiple regulatory agencies. As of August 21, 2023, Broadcom secured the final nod for this transaction from the United Kingdom’s Competition and Markets Authority. This approval succeeded the earlier received clearances from the European Union and countries like Australia, Brazil, Canada, Israel, South Africa, and Taiwan. Additionally, in the realm of foreign investment controls, all required clearances have been acquired. In the U.S. context, the stipulated Hart-Scott-Rodino pre-merger waiting periods have concluded, paving the way for the deal’s completion as per U.S. merger regulations.”

During the earnings call, the management seemed quite confident in closing the deal.

However, one prominent challenge remains: securing the green light from China. As reported by Seeking Alpha, rumblings suggest that preliminary discussions regarding potential remedies between the concerned parties have been initiated and the initial feedback seems promising.

Outlook and Valuation

The broader macroeconomic backdrop presents a mosaic of challenges and opportunities for Broadcom. Given the current ebb in the semiconductor demand cycle, this weakness is likely to persist for a few more quarters before an uptick emerges.

Despite these macro headwinds, Broadcom is well-positioned for mid-single-digit growth in the coming year, excluding the contributions from VMware. The sustained demand for AI-centric products should continue to drive growth. Upon closing, the VMware deal provides a solid opportunity for shareholder value creation through significant synergy realization.

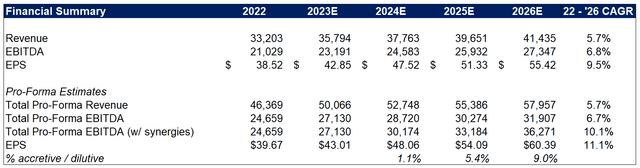

The VMware acquisition stands to enhance earnings by approximately 9% three years post-closure. Beyond that, EPS growth has the potential to grow in the low double digits.

NJV Estimates

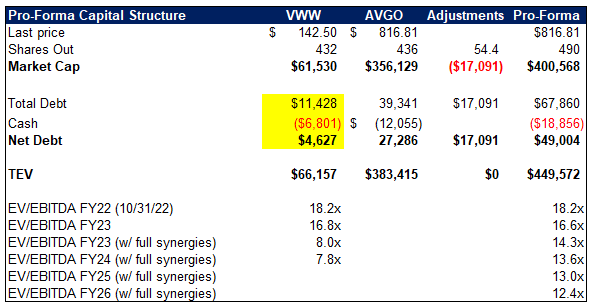

Over the last five years, AVGO’s stock has traded at an EBITDA multiple of 12x, with the 14x being one standard deviation above this average. With VMware in the fold, Broadcom will triple the size of its capital light recurring SaaS business. However, the stock seems to be already baking in projected benefits of the VMware deal. While the AI-driven multi-year growth narrative justifies a marginal upward adjustment in valuation, pegging AVGO at more than a 13x-14x EBITDA multiple range seems overly optimistic.

Note below that Broadcom now is trading at 14.3x this year and 13.6x next year’s valuation (proforma with synergies).

NJV, Company Filings

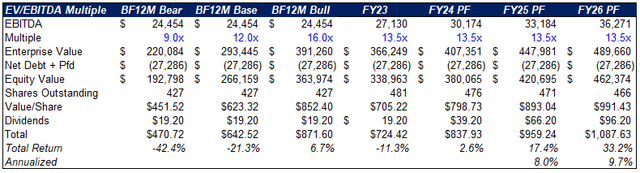

NJV

Given AVGO’s valuation, annualized return between 6% and 11% over the medium term seems probable. This aligns comfortably with the broader market’s historic average return rate of 7% but is below a variety of other lower risk/less cyclical industries.

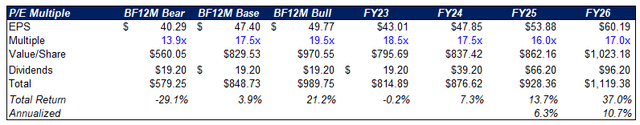

Looking at AVGO on a P/E multiple basis offers similar conclusions.

Historically, Broadcom has traded around a 14x P/E multiple. Given its robust growth prospects and sector leadership, a premium of 15% to 20% versus historical levels is justified, aligning it with the market’s longer-term average P/E levels.

A potential re-rating towards this benchmark implies an annualized return of between 6.3% and 10.7%.

NJV

If Broadcom were to re-rate to its historical average P/E of 14x, then the stock would only generate a total return of 4.6% annualized over the next few years. This warrants caution about the shares at recent prices.

The upside risk worth pointing out is that Broadcom’s CEO, Hock Tan, has been a terrific allocator of capital. Likely the VMW deal will have more synergies than forecast and another transaction could be transformative for Broadcom. For longer-term oriented investors, keeping some shares make sense.

Conclusion

Broadcom has unquestionably been a great performer for the last 2+ years. Hock Tan is one of the best out there. Nonetheless, the stock’s surge indicates it may already be reflecting anticipated growth over the coming years. This is a recurring pattern in AVGO’s stock, notably in 2013, 2017, and 2021. During these periods, the stock climbed to high-teen multiples, only to plateau for several years, allowing the company’s earnings to catch up with its valuation.

However, predicting a turn in the semi-cycle has proven to be challenging. An upswing in semiconductor demand could provide upside, hence why it could be prudent to just trim one’s position rather than exiting entirely. AVGO is a stock I want over the long term, but given the run I have reduced it to a much smaller position.

If AVGO’s pulled back 15% to 20%, to levels near the $650 mark, I would be inclined to revisit adding to my position again. At this level, the stock would be trading roughly one standard deviation below its historical valuation benchmarks based on my estimates.

Read the full article here

Leave a Reply