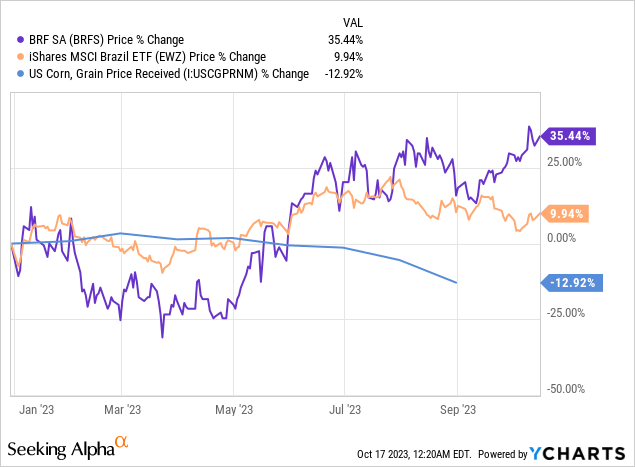

BRF S.A. (NYSE:BRFS) has outperformed the Brazilian stock market this year, particularly in the second half. This impressive performance can be attributed to a rebound following a challenging period, during which the company faced significant pressure on its margins due to high global corn and soybean prices. However, since June, there has been a noticeable decline in the prices of agricultural commodities, leading to a substantial correction in BRF shares and a strong performance in 2023.

In my previous article on BRF, I had taken a cautious stance on investing in the company based on the challenges the company was facing in generating consistent profits, as noted in the Q2 results amidst the uncertainty of the current commodities cycle.

Although I see the current momentum with a more positive slant in the face of more optimistic poultry and pork outlooks, I see the company still trading at valuation multiples above its main competitors.

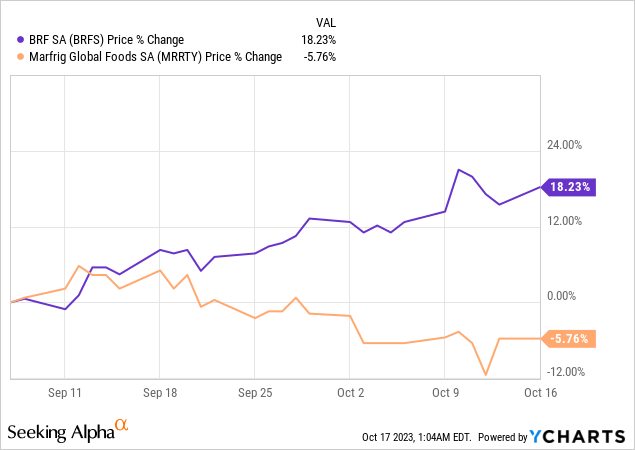

However, Marfrig’s (OTCPK:MRRTY) increased controlling stake in BRF could be a positive sign for the company, as since Marfrig has been building its position in mid-September, the market has reacted positively, causing BRF shares to engage in a rally of around 20%.

Poultry and Pork Market Outlook for H2

Supply restrictions in competing countries, declining production in China, and lower grain costs are poised to benefit Brazil’s chicken and pork exports in the second half of 2023 in terms of volume and profitability. This scenario holds promise for companies such as BRF and its main competitor, Seara, controlled by JBS (OTCQX:JBSAY). These companies lead the segment in Brazil and experienced lower-than-expected results in the first half of the year.

According to recent projections released by the Brazilian Animal Protein Association (ABPA), the country’s shipments are expected to reach between 5.1 and 5.2 million tons in 2023, marking an 8% increase compared to the previous year. From January to July, there were 3.061 million tons, an 8.2% increase compared to the same period in 2022, representing approximately US$ 6 billion, a 7.2% increase in revenue.

The slower revenue growth can be attributed to a decline in average sales prices that gained momentum in July. However, ABPA anticipates this trend to reverse. Competing exporters like the United States, Turkey, Ukraine, and Chile face challenges in expanding production. In contrast, China, which recently increased its domestic supply, has reduced breeding stock between late 2022 and early 2023 and has already shown signs of slowing down in the coming months.

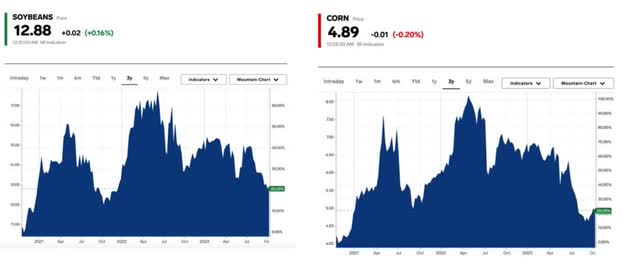

This combination of factors is advantageous for Brazil, which leads the world in meat shipments with a 35% market share. Additionally, decreasing corn and soybean prices provides further incentives for increased production. ABPA projects a potential growth of up to 3% in Brazil’s production in 2023, ranging between 14.8 million and 15 million tons.

Market Insider

The growth prospects depend on Brazil continuing to report no cases of avian influenza in commercial farms, likely leading to import barriers from China and possibly other regions. It’s worth noting that even if a disease outbreak occurs in commercial farms, embargoes tend to be regional, as has been the case with the United States, which is currently dealing with avian influenza in its production chain.

In the second quarter, there was an oversupply of chicken meat in the global market, negatively impacting BRF, Brazil’s largest chicken exporter. Additionally, the weakening of the dollar against the Brazilian real led to a 75% decrease in EBITDA from the company’s international operations compared to the same period in the previous year, with the figure at R$241 million.

However, BRF’s management is optimistic about the upcoming quarters, anticipating a trend toward supply and demand rebalancing, even though the company has not released any specific guidance.

BRF Should See an Improvement in Operations and Deleveraging

BRF is poised to witness improved operations and a debt reduction. The deceleration in inflation, declining unemployment rates, and rising income in Brazil bolstered the year-end sales prospects for BRF.

At BRF, the parent company of brands such as Sadia and Perdigão, primarily focusing on poultry and pork, the anticipated improvement for the second half of 2023 is closely linked to grain costs. During the second-quarter earnings call, BRF’s Chief Financial Officer noted that a substantial 7% decrease in the cost of goods sold (COGS) in the second quarter was primarily attributed to this factor.

Furthermore, he mentioned that the full impact of the drop in grain prices on the index is yet to be realized, signaling the potential for improved profit margins in the upcoming months.

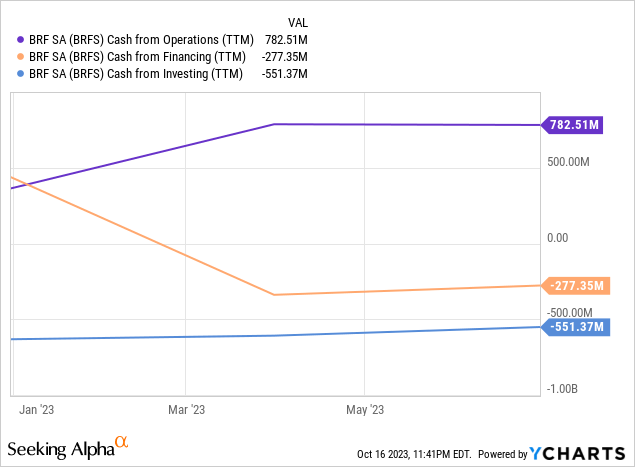

Moreover, the company’s ongoing restructuring efforts have exhibited a positive outlook for the near future. BRF’s operational improvement plan has been highlighted, contributing R$540 million in efficiencies. This underscores that the management is on the right path to provide a more optimistic profitability outlook. Generating higher-than-expected cash flow has been a critical factor in the company’s financial position.

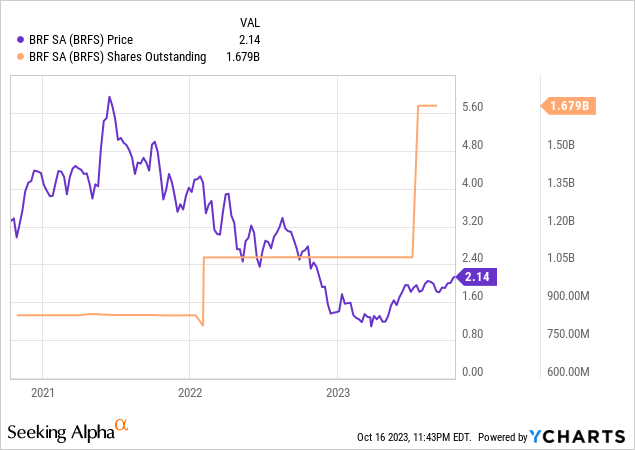

In recent years, BRF has adjusted its trajectory, including conducting two follow-on offerings raising a significant amount of cash, apart from asset sales planned for the near future. However, these changes have generated concerns, particularly regarding the dilution of the company’s share float, which has exerted pressure on the stock price.

BRF’s management has emphasized its intent to utilize the funds raised from its latest follow-on offering, which amounted to R$5.4 billion, to substantially reduce its debt, which exceeded R$15 billion in the second quarter. According to the company’s management, potential savings are anticipated, ranging from R$550 million to R$700 million through debt repurchase. BRF has clearly stated its preference for capital market transactions for debt repurchases instead of bilateral operations with banks.

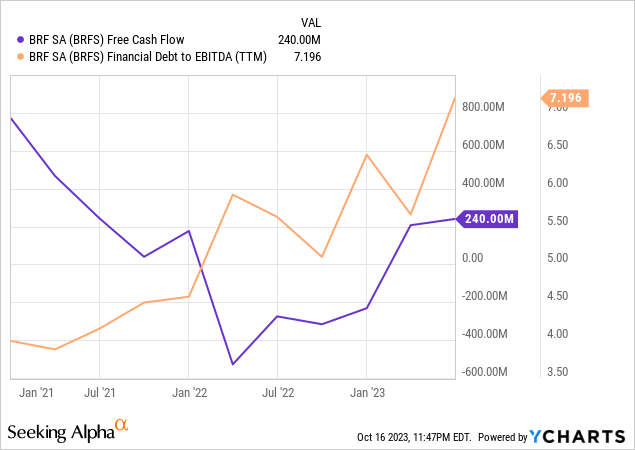

BRF’s net debt/EBITDA stands at 7.1x, marking its highest level in the past three years. Despite the company having more debt than equity, it continues to generate positive cash flow. This implies that BRF is producing more cash from its operations than it is expending, which is a positive indicator of its cash generation capability, at least for a certain period.

Marfrig Boosting Its Stake in BRF

Since the end of September, Marfrig has been steadily increasing its stake in BRF, announcing that it now holds a 40.05% share of the company.

According to Marfrig’s statement, this increase in stake is not intended to alter the current composition of BRF’s control or management structure. Still, it is solely aimed at expanding its ownership in the company. Additionally, Marfrig clarified that it has not entered into any agreements related to voting rights or agreements governing the purchase or sale of BRF shares.

While this rise in ownership doesn’t come as a surprise, both Marfrig and the Arab fund Salic were the most prominent buyers of BRF shares during the recent share offering in July, which raised R$5.4 billion.

Nevertheless, this increased stake is part of Marfrig’s broader strategy to enhance its control over BRF, an initiative that commenced in 2021.

This increase in ownership is expected to take Marfrig’s stake in BRF to around 50% and that of Salic to 25% (currently, the fund holds a 10.7% stake), with minority shareholders retaining 25%.

Considering two significant developments, Marfrig’s ultimate goal could be to secure complete control of BRF. Firstly, the poison pill provision, which prevented any shareholder from acquiring more than 33% without making an offer for the entire company, was recently removed from BRF’s bylaws. Secondly, a commitment signed by the new investor, Salic, limits its stake in BRF to 25% (from the current 11%), suggesting that Marfrig is concerned about becoming the largest shareholder.

However, the timeline for Marfrig to gain complete control over BRF remains uncertain. On the one hand, the seven-year limitation on Salic’s ownership of a maximum of 25% of BRF indicates a potentially more extended timeframe. Additionally, Marfrig has been grappling with reduced margins in the US beef market, which could persist for another year, limiting its cash flow.

Nevertheless, it’s worth noting that Marfrig recently sold assets worth R$7.5 billion to Minerva (OTCPK:MRVSY), a sum that could potentially finance the needed R$1.7 billion to reach a 50% stake in BRF. This suggests the timeline for achieving complete control could be shorter than expected.

Is a Merger Between Marfrig and BRF on the Horizon?

Recent developments suggest that a merger between Marfrig and BRF may be a less likely scenario. Salic has made investments in BRF, not Marfrig, and it’s unclear if they intend to expand their presence in the beef segment further, especially considering their existing stakes in Minerva. This raises doubts about the feasibility of a merger. Nevertheless, the potential for synergies could be seen as an argument favoring such a move.

If Marfrig’s acquisition of 50% of BRF materializes, it could positively impact BRF’s share price due to increased buying pressure. However, for Marfrig, there might be investor concerns about financial leverage.

Since Marfrig began increasing its position in BRF in early September, BRF’s shares have exhibited a strong positive response, helping to recover from their underperformance throughout the year partially. In contrast, Marfrig shares have moved in the opposite direction.

Valuation: Trading at a Premium Compared to its Peers

Despite its substantial and challenging debt position, BRF continues to generate cash and is poised to benefit in the coming quarters as the commodities cycle improves, further facilitating the company’s ongoing deleveraging efforts.

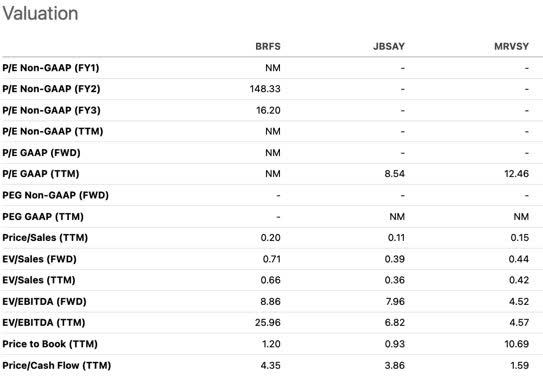

Due to the complexity of estimating an implied share price for a food processing company that involves high capital expenditures, experiences seasonal cash flow patterns, relies on the commodity price cycle, and also maintains a significantly higher level of debt compared to its equity, I believe that analyzing BRF in comparison to its peers provides a relative assessment of its value.

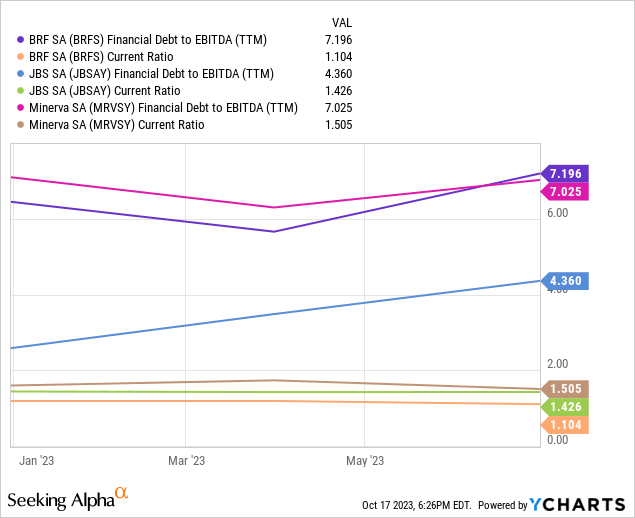

As we can observe, BRF has a higher debt-to-EBITDA ratio than its Brazilian peers, such as JBS, which is its primary competitor to Sadia and Perdigão through its Seara brand. It also competes with Minerva, which, despite its primary focus on beef, offers a competitive line of processed products in the domestic market. Additionally, BRF maintains a lower current ratio than its peers, indicating a reduced ability to meet its short-term obligations with its current assets.

Given the nature of the meat production and processing industry, I believe the P/CF (Price/Cash Flow) metric is suitable for making peer comparisons.

When we examine valuation multiples, we find that BRF is currently trading at a P/CF ratio of 4.35x, representing a premium compared to JBS and Minerva. Considering that BRF carries a higher level of leverage and greater liquidity risk, it is unclear why the stock trades at a premium rather than a discount.

Seeking Alpha

Conclusion

The fact that corn prices are currently at their lowest levels in the last three years and soybean prices in the previous two years should support an improvement in BRF’s operational margins, particularly in the second half of this year. Additionally, the company appears to be on track with its deleveraging efforts.

These favorable conditions could make it an opportune time to consider investing in BRF shares. However, it’s worth noting that the company’s shares have seemingly already reflected this trend, and their recent boost following the news of Marfrig’s increased stake in the company has led to a valuation that I view as a hindrance to investing in BRF.

Therefore, I would only consider adopting a bullish stance on BRF if the company traded at a discount in its P/CF multiple relative to its peers.

Alternatively, I may favor considering other companies in the same sector facing similar challenges but offering a more attractive valuation.

Read the full article here

Leave a Reply