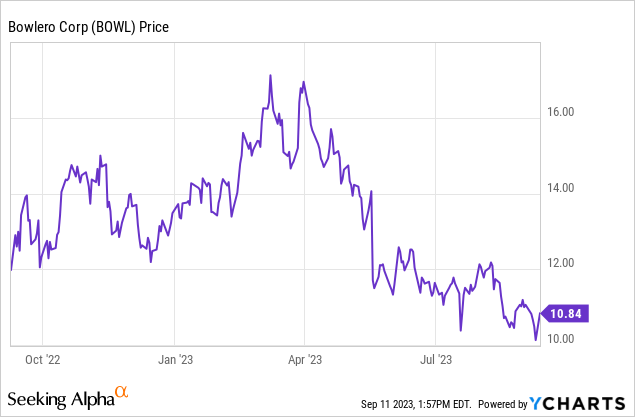

Bowlero Corp. (NYSE:BOWL) is the world’s largest operator of bowling entertainment centers. The stock has been crushed over the last few months.

We are highlighting the name today and initiating coverage with a buy rating ahead of what should be a major year for the company. The company dealt with financial irregularities in Fiscal 2022, but now we have started Fiscal 2024. Throughout fiscal year 2023, management implemented measures that were designed to remediate these issues. Now, Management has determined that the issue has been fully remediated as of July 2, 2023.

Our buy call is on the premise of a profitable fiscal year ahead, with attractive forward valuation. Let us discuss the just announced results for the fiscal Q4 and fiscal 2023, as well as the forward look.

The play

Target entry 1: $10.65-$10.85 (40% of position)

Target entry 2: $10.00-$10.10 (60% of position)

Target exit: $12.50

Stop loss $8.75

Performance discussion

The company had 328 total bowling centers operating at the end of the quarter. The big negative of the quarter was that revenue was $239.4 million, down $28.3 million or 10.6% from $267.7 million in the prior year, in which so called out-of-period Service Revenue and the 53rd week & related calendar shift totaled $29.7 million. This missed consensus estimates. Revenue was up 54.0% versus the pre-COVID fourth quarter fiscal year 2019. Total bowling center revenue grew $5.4 million or 2.4% versus prior year and 54.1% versus the pre-COVID fourth quarter fiscal year 2019. Normalized calendar same store revenue declined 2.6% versus the prior year but showed growth of 29.3% versus the comparable pre-COVID quarter. Factoring in expenses, we saw adjusted EBITDA of $64.5 million and net income of $146.2 million. The company is earnings positive, now and will be for fiscal 2024. However, for the year, net income was weak.

For fiscal 2023, revenue was $1.06 billion, up $147.1 million or 16.1% versus $911.7 million in the prior year. Total bowling center revenue grew $165.2 million or 19.4% over 2022 with same store revenue growth of 12.8% versus last year. Adjusted EBITDA was $354.3 million but net income was just $82.0 million.

The CEO Tom Shannon has us bullish. He stated:

“While April began with a decline versus the prior year, we saw an improving trend over the course of the quarter in conjunction with innovating our offerings to encourage more retail spend in our centers. We are in the early stages of pioneering new ways to increase wallet share from our vast customer base, and these changes are resonating with our guests. Fiscal Year 2024 will be an investment year to drive top and bottom line growth.”

We like what is in store for the company. We rate shares a buy. The capital deployment opportunities are significant. There are a few things underway, including the acquisition of Lucky Strike adding centers, and there is a robust M&A pipeline. Further, the company is looking for new builds of centers in urban markets and is working to convert and upgrade older centers into modern entertainment centers. We also think it is worth noting there is a nice share repurchase program ongoing. During the quarter, Bowlero repurchased 6.4 million shares of Class A common stock at an average price of $12.64, bringing the total shares acquired under the program to 11.3 million and the average purchase price to $11.90. On September 6, 2023, the Board authorized an increase to the share repurchase program to $200 million. There is about 160 million shares outstanding. At $10 per share at the time of this writing, that means the company can repurchase 20 million more shares, which would reduce the float by 12%.

As we look ahead, we are bullish. Bowlero Corp. management is setting the company up for a transformational year. The company is planning $160 million in acquisitions, $40 million to new builds, and $75 million to conversions. From a performance standpoint, we are looking for sales to be up 10% to 15% to $1.14 billion to $1.19 billion, nice growth from fiscal 2023. Adjusted EBITDA margin is expected to be 32% to 34%, resulting in adjusted EBITDA of $365 million to $405 million. From a net income standpoint, we are looking for $150 million for the year.

Read the full article here

Leave a Reply