I provide monthly overviews for orders, cancellations, deliveries, and other order book mutations for The Boeing Company (NYSE:NYSE:BA). While the release of monthly orders and other order news does not always directly impact the stock price, it’s important to keep track of orders and deliveries because this provides the smallest blocks of information from which we can assess how things are going for the U.S. jet maker and detect trends early on. The monthly pieces also are the building blocks for the longer term, making a careful study of the numbers extremely meaningful. In this report, I will be analyzing the Boeing orders for September 2023, as well as its deliveries.

Boeing Stock Falls

|

Boeing Stock Price Development |

|||

|

Timeframe |

Boeing |

Market |

Performance |

|

September |

-14.2% |

-5% |

Underperformance |

|

Year-to-date |

+3.1% |

+13.5% |

Underperformance |

Boeing stock has not shown appreciable performance in September and not in the year-to-date timeframe, either. That is not a major surprise given the lower outlook delivery outlook for Boeing’s key supplier Spirit AeroSystems (SPR) and Boeing’s expectations that Boeing 737 delivery numbers for the full year will be at the low end of the guided range. All of that is offsetting positive order news and planned production rate increases..

Why I Continue To Buy More Boeing Stock

One may wonder why I would even bother buying a stock that I believe is running ahead of its fundamentals. In my view, it’s actually very simple: any stock price weakness offers an opportunity for the long-term investor. Buying BA stock has been an easier decision for the following reasons:

- Boeing has a backlog of over 5,000 airplanes valued at nearly $400 billion.

- Its net orders are up multiples compared to pre-crisis levels despite near-term challenges.

- The delivery profile is improving despite near-term pressures.

- The return of Boeing 737 MAX airplanes in China is trending strongly, and is in fact 99% complete, paving the way to deliveries and ultimately new orders from Chinese operators.

- Free cash flow will be used to reduce debt and cut interest costs.

- Boeing will open a fourth production line for the Boeing 737 MAX, which could see the company pushing single-aisle production toward 80 airplanes a month in the second half of the decade.

- The Boeing 787 is seeing strong sales momentum.

While Boeing has a lot to catch up on to justify its stock price, I believe that just the above prospects do offer a compelling reason to position yourself for Boeing’s surge in cash flow. There will be hurdles along the way, as we saw in recent months, and the defense business remains rather disappointing. However, the long-term picture remains bright, and you might actually miss the boat (or airplane) if you wait for Boeing to trade at justified prices.

Having watched the market during the pandemic and throughout the MAX crisis, one thing that became extremely clear is that it requires big crises to bring BA stock down, and at this time, I don’t see a crisis or combination of crises that could once again bring Boeing down. Macroeconomic factors could become an issue, but even that should not have a huge impact if we were to compare it to the scale of the two other crises that Boeing has faced in recent years.

Boeing Airplane Order News in September 2023

The Aerospace Forum

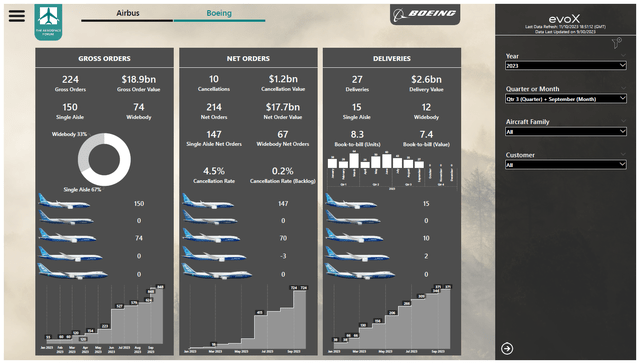

In September, Boeing booked 224 gross orders, marking a sequential increase of 145 orders, with 67% of the order inflow for single-aisle jets and 33% for wide-body airplanes:

- Air Canada (AC:CA) ordered 18 Boeing 787-10s.

- Ryanair (RYAAY) finalized its order for 300 jets announced earlier this year.

- United Airlines ordered 50 Boeing 787-9 airplanes.

- An unidentified customer ordered four Boeing 787-9 airplanes.

- An unidentified customer ordered two Boeing 787-10 airplanes.

During the month, the following changes were made to the order book:

- Aerolineas Argentinas canceled an order for one Boeing 737 MAX.

- A business jet customer canceled an order for one Boeing 737 MAX.

- An unidentified customer canceled an order for one Boeing 737 MAX.

- Air Canada cancelled orders for two Boeing 777Fs.

- LATAM (OTCPK:LTMAY) cancelled orders for one Boeing 777F and four Boeing 787-9s.

- CALC Aicraft Assets Limited transferred orders for 64 Boeing 737 MAX airplanes to DAE Aviation.

- Saudia selected General Electric (GE) as the engine supplier for its existing order of 18 Boeing 787-9s.

- Saudia selected GE as the engine supplier for its existing order of 22 Boeing 787-10 including one airplane that was identified as being a Saudia order.

During the month, Boeing booked 224 orders valued at $18.9 billion and two 10 bringing the orders to 214 airplanes valued $17.7 billion. A year ago, Boeing booked 96 orders and six cancellations, bringing its net orders to 90 units, with a net order value of $9.3 billion. The year-over-year change in order inflow can be attributed to the finalization of the Ryanair order for 150 Boeing 737 MAX airplanes.

Year to date, Boeing booked 848 orders and 124 cancellations, bringing its net orders to 724 valued at $61.6 billion. As a reference, last year Boeing booked 542 gross orders and 428 net orders valued at $32.3 billion. So, year-over-year, Boeing is exceeding last year’s order numbers, which can be attributed to the large order from Air India as well as the order from Ryanair.

During the month, ASC 606 reduced by 14 units: 11 for the Boeing 737 MAX, one for the Boeing 777 and two for the Boeing 787 program. ASC 606 adjustments adjust for orders for which a purchase agreement exists but additional requirements beyond the existence of a purchase contract are not met. An increase means that more orders are doubtful, while a decrease means that the additional requirements are met or the order that was considered doubtful was cancelled. Boeing currently has 611 orders for which the additional criteria are not met.

Boeing Commercial Airplane Deliveries in September 2023

Boeing

In September, Boeing delivered just 27 jets compared to 35 in the previous month. The U.S. jet maker delivered 15 single-aisle jets and 12 wide-body aircraft with a combined value of $2.6 billion:

- Boeing delivered 15 Boeing 737 MAX airplanes.

- Boeing delivered no Boeing 767 airplanes.

- Boeing delivered two Boeing 777Fs.

- Boeing delivered ten Boeing 787s consisting of one -8s, six -9s and three -10s.

The September deliveries were clearly on the soft side and that was driven by the production issues at Boeing’s supplier Spirit AeroSystems. Similar to what I observed with Airbus, there was no end-of-quarter surge in deliveries, and while that is clearly driven by the problems at Spirit AeroSystems, it also begs the question how good the overall supply chain health really is.

Compared to last year, September delivery decreased sharply from 51 airplanes to 27, while the value of those deliveries increased from $3.9 billion to $2.6 billion, displaying lower delivery volume partially offset by a favorable delivery mix. Single-aisle deliveries decreased by 22 units while wide-body deliveries increased by two units, led by higher Boeing 787 but offset by lower quantities on the other wide body programs. Year-to-date, Boeing delivered 371 airplanes valued $27.3 billion compared to 328 deliveries valued $22.1 billion last year marking an increase in deliveries of 13% and a 24% increase in delivery value.

The book-to-bill ratio for the month was 8.3 in terms of orders and 7.4 in terms of value. The book-to-bill ratio for the year is looking extremely strong, with a ratio of 2.3 measured by units and 2.6 measured by value. As I noted previously, we’re looking for book-to-bill ratios higher than one, but even when that’s achieved, these ratios should also be placed in context, as we see strong demand but significant pressure from the supply side to translate orders into deliveries.

What Is Boeing’s Delivery Target For 2023?

For 2023, Boeing has not provided an official delivery target, but the company expects 400 to 450 Boeing 737 deliveries and around 70-80 Boeing 787 deliveries. Overall, I’m expecting around 515-525 deliveries, which is lower than the 535-590 deliveries I previously expected.

How Do Boeing Airplane Deliveries Compare To Airbus?

Boeing delivered 27 airplanes to customers in September, while Airbus (OTCPK:EADSF, OTCPK:EADSY) delivered 55 airplanes. Year-to-date, Boeing delivered 371 jets compared to 488 for Airbus. Boeing and Airbus have been delivering roughly the same number of airplanes in the first quarter, but due to the issues with the Boeing 737 MAX production, the U.S. jet maker is trailing its European rival by the end of the second quarter. Previously, Boeing could still take some pride in having the better relative growth in delivery numbers, but that is also fading at this stage, as deliveries are up 13% compared to 12% for Airbus.

Conclusion: Boeing Stock Is A Buy With An Eye On The Future

Boeing’s orders are nice to have at this point, as they underline the demand for commercial airplanes which provides a negotiation strength in the jet maker’s favor. The big orders won this year are providing Boeing with a skyline against which it can compile a production schedule and potential rate increases.

However, Boeing’s problem despite delivering 13% more airplanes so far this year is that it is not hitting the desired levels to be profitable in the commercial airplane business. The problems at Spirit AeroSystems have been persistent this year, and that is a shame for Boeing as the company would otherwise be able to produce significantly more airplanes but in more than one way given Spirit AeroSystems’ past as part of the Boeing issues are of Boeing’s own making. This year is going to be a somewhat disappointing year in terms of deliveries. Until now, Boeing has been able to show superior growth rates in deliveries compared to competitor Airbus, but that difference has faded over the past month.

It leaves Boeing as a stock that is currently under pressure, as its 2023 delivery numbers supporting the balance sheet repair is ending up on the weaker end of the guided range. In that regard, the short term weakness could provide long-term entry points, as over the longer term the growth fundamentals are still in place.

By 2024, The Boeing Company free cash flow should have more than doubled compared to the 2022 free cash flow. This free cash flow should enable Boeing to significantly deleverage, which adds to the long-term appeal of the stock. So, in the short term, Boeing stock likely is more a hold, but I would say that the long-term drivers are what make the stock attractive – and that also means that at present, you cannot buy Boeing stock at a discount.

What we’re already seeing is strong demand for commercial airplanes and a strong increase in delivery volumes. The strong demand environment is likely going to persist this year and possibly into next year as other growth drivers come back online for Boeing. As a result, I continue to add modestly to my Boeing position while recognizing the company’s stock price is running ahead of its fundamental recovery. However, over the long term even a slightly overpriced entry point will be rewarding. In case there will be a market selloff, I would add more aggressively to my Boeing position, as it would allow to add to the position at a lower or even no premium. The risk to Boeing is that it continues to fail to deliver on its growth aspirations.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply