A few weeks ago, Bloomberg reported that Beijing is about to approve the deliveries of Boeing’s (NYSE:BA) 737 MAXs to Chinese customers after it prohibited it a few years ago due to safety concerns. So far, China is the only country that still prohibits the deliveries of this type of aircraft, but at the beginning of this year, it nevertheless approved the resumption of operations of 737 MAXs for those airlines that already had them in storage on the Chinese soil. The potential approval of deliveries signals that Beijing is looking for ways to meet the growing demand for air travel within the country and is ready to deal with American manufacturers despite the worsening of Sino-American relations.

This is undoubtedly a positive development for Boeing, considering that China is the largest aviation market in the world. It’ll likely give the company’s shares a boost in the short term once the approval is announced, and it already makes Boeing’s stock an attractive investment with a decent upside at this stage. However, as for the long-term, there are risks that as Sino-American relations continue to worsen, Boeing’s operations in China could once again be disrupted, especially as Beijing scales the production of its domestic narrow-body airliner C919 that has been in commercial service since May 2023.

Is The 737 MAX Fiasco Finally Over?

Back in May, I noted that Boeing’s turnaround after years of underperformance has likely started thanks to the revival of air travel and the increase of new orders from emerging economies. A few months later, the company revealed its Q2 earnings results, which proved that the recovery is indeed on the horizon as Boeing’s revenues during that period increased by 18.4% Y/Y to $19.75 billion, while its non-GAAP EPS of -$0.82 was above the estimates by $0.07.

Add to all of this the rise of air travel in China, and it becomes obvious that Boeing stands to benefit the most from this situation. This is due to the fact that Beijing needs more airplanes to meet the growing demand for travel and approving the deliveries of 737 MAXs that have been made for Chinese airlines and are currently sitting in Boeing’s storages is the quickest way to do so. At the same time, there are reasons to believe that China can’t afford to completely cut off its ties with Boeing just yet, as Beijing continues to greatly rely on American suppliers to manufacture its own narrowbody C919s. The potential ban on Boeing’s operations in China would certainly backfire and force American policymakers to act. That’s why it makes sense to believe that the restart of deliveries of 737 MAXs to Chinese customers is indeed on the horizon, considering that some airlines that had them in storage on Chinese soil are already using them for commercial flights.

In addition to all of that, Boeing has been able to mitigate China-related risks so far by diversifying its customer base across the globe. Back in December, I already noted that the company is in talks with Indian customers to sell its airplanes to new airlines and later in June it was announced that Air India has finalized the order to purchase 290 aircraft made by Boeing. On top of that, the recent trip of President Biden to Vietnam after the G20 Summit resulted in multi-billion dollar deals for Boeing, as it received new orders for its planes from Vietnam Airlines and SMBC. Add to all of this the new deals with the U.S. government, and it becomes obvious that Boeing’s recovery is finally in full swing.

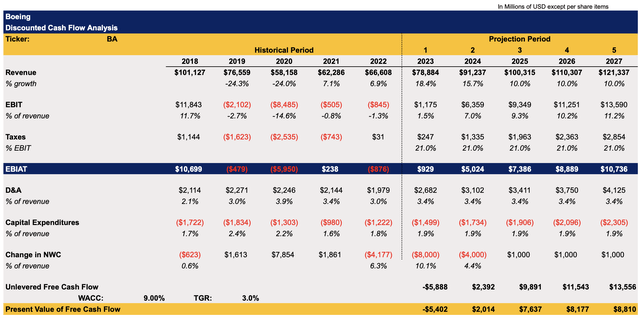

All of those growth catalysts are already expected to ensure that Boeing once again grows its revenues at a double-digit rate and finally becomes profitable once more after years of sluggish performance caused by the 737 MAX fiasco. That’s why my DCF model below assumes a decent upside for Boeing’s shares as the business’s recovery accelerates. The revenue and earnings assumptions in the model are mostly in line with the street estimates for the following years, while the tax rate stands at 21%. The D&A and capital expenditures are mostly averages of previous years. The change in net working capital is expected to greatly decrease in FY23 considering the company’s performance in recent quarters, after which it starts to slowly balance itself out by the terminal year. The WACC in the model stands at 9% while the terminal growth rate is 3%.

Boeing’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

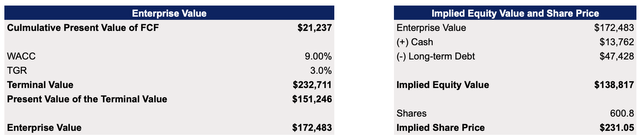

This model shows that Boeing’s fair value is $231.05 per share, which represents a ~10% upside from the current market price.

Boeing’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

My calculations are also close to the street’s consensus price target which is ~$256 per share and also represents an upside from the current levels. If the geopolitical risks indeed continue to decelerate, then Boeing’s shares would be able to appreciate and trade closer to those levels.

Beijing’s Policy Is Still A Long-Term Threat

While it seems that the worst for Boeing is finally behind it, it’s still important to understand that the geopolitical risks are not going to disappear anytime soon. As the Sino-American relations worsen, there’s a risk that once Beijing becomes more self-reliant in the aviation industry, it could fully shift to the production of its own narrowbody airliner without fearing retaliation from the Americans. After all, the orders for its domestically-built C919 jet continue to rise, while Airbus (OTCPK:EADSY) is now expanding its production in China and capturing Boeing’s market share there, thanks to the warm Sino-French relations.

Add to all of this the fact that a year ago the Chinese government already sanctioned the CEO of Boeing’s defense division, and it becomes obvious that the geopolitical risks for the American manufacturer are not going anywhere. Considering that Boeing continues to engage in arms sales to Taiwan, there’s always a risk that the company’s position in the Chinese market could be undermined even more by the government, especially after Beijing sanctioned Lockheed Martin (LMT) and Northrop Grumman (NOC) over Taiwan just last week.

The Bottom Line

There’s no denying that the resumption of 737 MAX deliveries to China is going to become a major growth catalyst for Boeing, which would likely help its stock to appreciate further given the importance of the Chinese market for the company. Add to all of this the fact that the company has been diversifying its markets in recent quarters while its stock appears to be undervalued at the current price, and it becomes obvious that the worst for Boeing is likely to be over for now. However, there’s also no denying that geopolitical risks will continue to put additional pressure on the company for years to come since Beijing is also working on becoming more self-reliant when it comes to industries such as aviation.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply