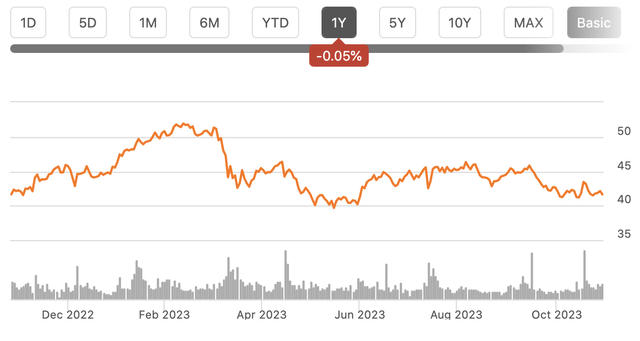

Shares of Bank of New York Mellon (NYSE:BK) have traded flat over the past twelve months, outperforming some regional banks that were hurt by the deposit crisis after the failure of Silicon Valley Bank, but also underperforming the broader market. Ultimately, I see BNY as essentially trading around fair value given the lack of growth in its business and exposure to interest rates. While at 9x earnings the stock is not cheap, I do not anticipate scope for much multiple expansion.

Seeking Alpha

In the company’s third quarter, BNY earned $1.27 on $4.4 billion of revenue, $0.13 ahead of consensus. This was also 5% higher than a year ago as its buyback has reduced its share count by 5% over the past year. BNY Mellon is one of the three major custody banks, alongside State Street (STT) and Northern Trust (NTRS). It holds and administers assets on behalf of funds and large investors.

Over the past year, assets under custody or administration rose by 8% to $45.7 trillion. This was primarily due to increased market levels. BNY also has several investment management boutiques and a wealth management unit. Here, assets under management rose by 3% to $1.8 trillion, adjusting for the divestiture of Alcentra, an investment management boutique. Again, the market was the driver of the growth. Concerningly, BNY continues to suffer fund outflows. In the third quarter, there were $15 billion in outflows from long-term strategies, following $11 billion in Q2. $19 billion has been lost over the past year with fixed income assets coming under particular pressure.

Even with the growth in assets, fee revenue was flat, pointing to ongoing pricing pressure. Additionally, long-term asset management is among the higher fee operations BNY has, so seeing outflows there while custodied assets rise is likely to be a net revenue detractor. Just given ongoing wage growth and the needs to spend on technology, adjusted operating expenses rose by 3%. Ongoing cost increases with no fee revenue growth are squeezing noninterest income.

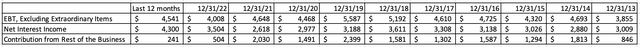

It also should be noted that BNY’s core custody business is extremely low-margin to begin with. BNY is a bank, but unlike banks you think of with branches, making loans to small businesses and homebuyers, BK is primarily holding and administering assets. It earns just about 3.5bp in fee revenue per dollar of assets. So a $1 billion account pays BNY just $350,000. BNY really operates this business because clients house cash with them, which BK can reinvest. In fact, because of ongoing fee pressure and natural cost increases over time, its noninterest income has been steadily declining.

As pulled from Seeking Alpha, I removed net interest income from its pre-tax adjusted earnings to calculate earnings from the rest of its business. These have fallen from $1.5-2.0 billion to just $500 million last year as a tight labor market has raised wages, fund outflows have continued at its asset manager over the past year, and it has limited ability to raise fees.

Seeking Alpha, my own calculation

BK now gets about 80% of its profits from net interest income, and shifts in net income are going to be primarily driven by moves in interest rates, rather than activity in the custody bank. BNY has benefitted from the rise in interest rates with net interest income (NII) up 10% to $1.02 billion. This was primarily because interest-bearing assets have a yield of 6.45% from 2.24% last year and 5.77% last quarter. That increased yield has been able to offset asset declines and increased funding costs.

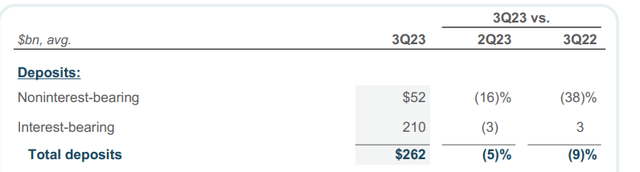

Indeed, interest-earning assets of $339 billion are down 6% from last quarter and 4% from last year. BNY has had to shrink its balance sheet in response to declining deposits. Total deposits are $262 billion, down 5% sequentially and down 9% from last year.

BNY Mellon

There has been a notable mix shift in deposits away from noninterest-bearing (NIB) deposits. These accounts are largely transactional, which is why BK does not pay interest on them. When rates were 1%, it was not a big deal to have extra cash in an NIB account, but with rates above 5%, that becomes more expensive. As such, customers have been moving balances in their NIBs lower and reallocating to interest-bearing accounts. The good news is BK is seeing interest-bearing deposits rise relative to last year, so it likely is still retaining customer cash, even though it pays more for it.

Noninterest-bearing deposits were down $32 billion over the past year. They were down $10 billion last quarter, a tick-up from $7.7 billion in Q2. This increase is a little concerning, but management blamed it on the debt ceiling artificially leading clients to hold more in cash and less in treasury bills in Q2.

Management said the bank has seen some deposit growth in September and the first two weeks of October. They think we are now at a more natural level of deposits. This is encouraging to see. NIBs make up 20% of deposits, and BK expects this to be the floor as there are minimums that need to be held in transactional accounts to ensure there is enough cash to actually make payments when they are due.

While BK has to pay more interest as balances shift from NIBs to interest-bearing deposits, the cost of those deposits is also rising. BK is paying 3.62% on interest-bearing deposits, up 38bp from last quarter and 267bp from last year. With deposits rising so far in Q4, it seems like BK is now at a point where rates are high enough to retain customers, but this will be something to watch.

Given some of the deposit rate hikes were made in Q3, I do mathematically expect to see higher funding costs in Q4 as these higher rates are in place over the full quarter. Given assets fell during the quarter, I also expect to see average assets slightly lower. This combination means NII should be flat to down 3% in Q4, and barring any rate shocks thereafter, I believe this is a level BNY can continue to operate at in 2024.

I would also note that BNY is very well capitalized. Its tier one common equity ratio (CET1) was 11.4%, up from 10.1% last year, as risk-weighted assets have fallen. During the quarter it did $450 million of buybacks, and as noted above, its share count is down by 5% over the past year. I expect BNY to maintain a similar pace of buybacks, and its dividend is very secure.

Given this outlook for interest income and assuming roughly flat noninterest results, BK has about $4.80 in earnings power over the next year, for about an 8.75x multiple. This is not an expensive stock, but interest income is driving its results, which is masking the lack of growth in its business. Given that dependence on short-term rates with no underlying growth to speak of, I struggle to see a catalyst for a major rally, while its valuation limits downside. In other words, just as the stock has been a flattish “collect a dividend” stock the past year, I expect that to remain the case.

As such, I view shares as a “hold.” There is no urgency to sell, but there are likely to be better opportunities elsewhere. In particular, if investors want interest-rate exposed stocks, I prefer those that also have core business growth, like Chubb (CB), which also trades at a fairly low multiple, of 11x.

Read the full article here

Leave a Reply