Summary

This post is to provide an update on my thoughts on the Bayerische Motoren Werke (OTCPK:BMWYY) business and stock. I believe BMW has executed really well in repositioning its business to meet the growing trends of EVs and has done so without diluting its margin. The growth ahead is bright, and management is confident about it.

Investment thesis

BMW reported 2Q23 revenue of €37.2 billion, gross profit of €8.9 billion, and EBIT of €4.3 billion, which was in line with consensus at an 11.7% margin. Within EBIT, automotive EBIT saw €2.9 billion at a 9.2% margin.

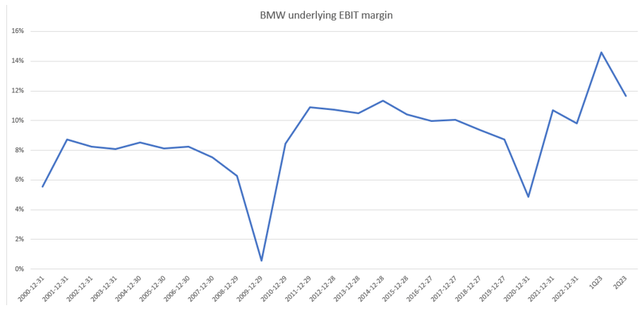

I think it’s important to take a step back and acknowledge that BMW is still a formidable competitor before discussing the near-term guidance and outlook. BMW, among the major OEMs, has done exceptionally well in adapting its brand to the expanding EV trend with minimal margin dilution (ignoring the COVID years). This speaks volumes about the effectiveness of the management’s budgeting, allocation of resources, response to changing conditions, and ability to put plans into action. In addition, the company has effectively launched a proprietary operating system that was primarily developed in China, allowing the brand to integrate local customer interfaces across the group’s primary markets. In light of the current geopolitical situation, I believe this decision has proven to be the right move, as it is less likely to receive scrutiny from the Chinese government.

Own calculation

Getting back to the near-term outlook, management seems quite optimistic about future growth, which I attribute to the timely release of new products like the 5-Series and i5. Regarding demand, I am less concerned as it continues to recover and the business continues to see its order book remain high. Margin is more central to this discussion. The new range for automotive EBIT margin guidance from management is 9–10.5% for FY23, up 75bps at the midpoint from the previous range of 8–10%. This means that the introduction of these products has a positive effect on both revenue and profit margins. This adds credence to my belief that BMW is successfully making the transition, and it raises the possibility that the company’s EBIT margin profile will increase structurally as a result of increased EV penetration in the future.

What is clear our products with all drive technologies are in demand and our plants around the world are operating at high capacity. Our order book remains high. 2Q23 earnings results call

BMW’s FCF profile is my main short-term worry. For the second year in a row, management has increased capex in anticipation of BEV penetration reaching the upper end of planning much sooner than the initial 2030. The increased CAPEX is primarily going toward increasing Gen 5 battery pack output and beginning Gen 6 capacity building in late 2025 with the introduction of the Neue Klasse, which is expected to bring a 50% reduction in pack cost. In light of the impending high investment phase (for FY24, which I expect to be the park in CAPEX), the stock price may come under some pressure.

Valuation

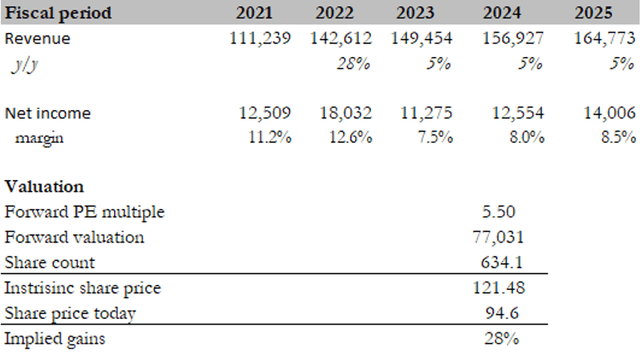

Own calculation

I believe the fair value for a BMW based on my model is $121. My model assumptions are higher than consensus, as I have confidence that the current growth trajectory is sustainable, supported by the upcoming product launches and BMW’s continuous transition to having more presence in the EV world. Margins will follow a similar trajectory as the penetration towards EV is profit-accretive. The closest competitor that I think is suitable for BMW is Mercedes, which is trading at a premium vs. BMW at 6.2x forward PE. I believe this premium is due to the EBIT margin difference between the two businesses. As the gap closes, I expect valuation to gradually improve over time. But, just to be conservative, I assume no change in valuation multiples. Even at the current valuation, the upside is appealing, in my opinion.

Risk

The biggest risk with BMW is that the competition in the EV space continues to rack up, especially with the Chinese brands growing really strongly. While I am happy about BMW’s current EV success, it might face strong competition and pricing pressure at some point, which will make it hard for the group to pass down the incremental cost of producing EVs.

Conclusion

I am positive about BMW. The group has exhibited strong execution in adapting to the EV trend without sacrificing margins, making it a formidable competitor in the automotive industry. The recent financial performance, with a solid 2Q23 report, underscores this success. BMW’s strategic decisions, such as the development of a proprietary operating system in China, have been astute given the current geopolitical climate. Moreover, the company’s optimistic outlook, driven by new product releases and a high order book, aligns with my confidence in its growth trajectory.

While near-term concerns regarding increased capex and FCF are noted, they are indicative of BMW’s commitment to EV development and cost reduction. The stock’s fair value estimate of $121, supported by sustainable growth and narrowing valuation gaps with competitors, further bolsters my positive view. However, it’s crucial to acknowledge the risk of intensifying competition in the EV market. In the face of growing Chinese brands, BMW may encounter pricing pressures and increased competition, posing challenges in maintaining profitability.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply