Investment Thesis

Block, Inc. (NYSE:SQ) is sitting at a 52-week low as of writing this, so I wanted to see if it would be a good time to re-enter after a couple of years away from it. From a financial perspective and the lack of catalysts, I think the shares have further down to go as the negative sentiment persists, therefore, I assign Block a hold rating until operating expenses improve and the company finds a clear path to GAAP profitability.

What Went Wrong?

I have a bittersweet relationship with Block, formerly known as Square. The very first time I went in on Square was back in April of ’18 for around $45 a share, purely as a speculative play that worked out tremendously well. The share price ballooned to over $270 a share and I managed to sell at around $250 a share. After that, I decided to play the technical analysis game when it went from the top and it looked like it was going to bounce off the bottom, so I bought a couple of LEAPs. Then, another strain of COVID came out which sent the markets down, and then the Russia-Ukraine debacle started, followed by inflation fears, and my LEAPs were gone. It’s funny to see the company sitting at the same share price as it was back when I first invested.

I believe the company has made a few missteps over the last while when it changed its business for the worst in my opinion and focused on the wrong businesses. First of all, I didn’t like the idea of switching priorities to the blockchain, which led the company to change its name to an even less attractive name than before to differentiate the Square brand that was for the Seller business. Since the company has a lot of exposure to bitcoin, it was no wonder that its share price followed suit as the cryptocurrency saw massive declines in value over the last couple of years. I was playing around on Trading View and happened to come across this comparison of SQ’s share performance to BTCUSD’s performance in percentages and it’s an interesting one.

SQ stock performance vs BTC (TradingView)

I don’t think it’s such a good idea to rely upon a cryptocurrency that tends to fluctuate quite a lot over time. And sure, it may come back up to that $60k per coin eventually, but it may not and that is quite a risk in my opinion. Revenue of CashApp in FY22 dropped significantly because BTC revenue saw a massive decline. As of June 30th, ’23, this has improved due to BTC’s price stabilizing, so people are trading more once again.

Buy Now Pay Later Model

This business model looked to be very promising just a while ago. It is still very promising as many research sites see outstanding growth in ’23 through ’30, around 26.1% CAGR. The acquisition of Afterpay seemed to be a good idea at first, however, in my opinion, it was a bit too expensive at $29B. According to the Q2 ’23 quarterly report, Afterpay generated around $460m in the six months ended June. It’s a good acquisition if we look at synergies, however, the management needs to step up and prioritize Afterpay because I think the performance since it was acquired is lackluster. I can see the synergy with Afterpay, but I don’t know why Dorsey acquired Tidal.

Outlook

I would like to see the company starting to tame its operating expenses, as these have played a large role in the company’s share price performance too. The management is trying to improve the numbers by cutting some weaker regions of CashApp in the EU, including Clearpay in Spain, France, and Italy. It’s a good start, but I will want to see some numbers to back this decision up.

Jack Dorsey is going to take over as CEO of Square as Alyssa Henry steps down. This can be a good thing or a bad thing, but only time will tell how focused Dorsey is on righting the ship.

I do not see many catalysts for the company right now, and I wouldn’t be surprised if the company’s going to experience further volatility in its share price and goes further down.

Financials

As of Q2 ’23, the company had around $5.8B in liquidity, against $4.1B in long-term debt. Interest expense on debt is very small once you take into account interest income from investments. As of Q2 ’23, the company was earning more than it was paying out in interest, which tells me the debt is sustainable, even though the company is not making operating income. So, I would say debt is not an issue.

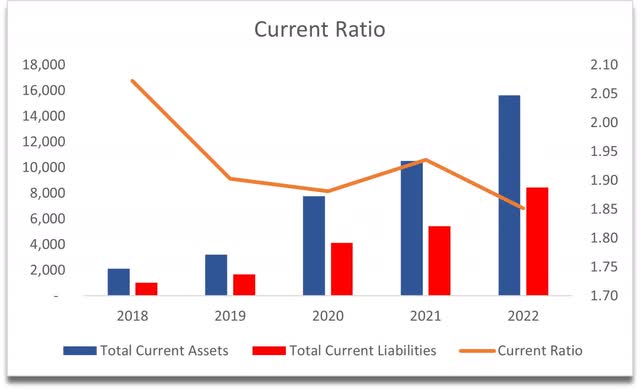

Block’s historical current ratio has been between the range of what I consider to be efficient, which is 1.5-2.0. The company can easily cover its short-term obligations and still have assets like cash to further its growth. It’s safe to say Block has no liquidity issues.

Current Ratio (Author)

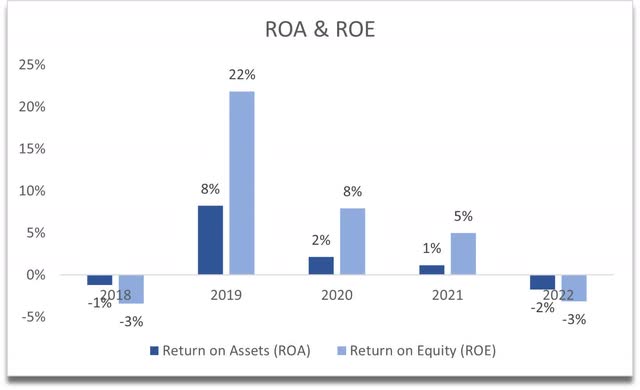

The company’s ROA and ROE were hit particularly hard in ’22 as the company made $500m in net losses. I’m looking for at least 5% on ROA and 10% for ROE, which the company hasn’t been at since FY19 and that is not a good sign.

ROA and ROE (Author)

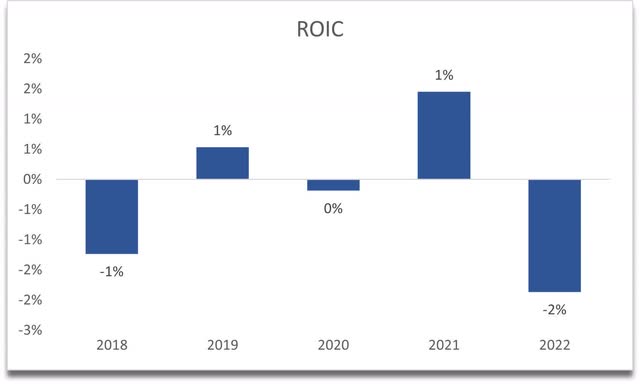

Return on invested capital is also abysmal and has been at these levels for a while now. This tells me that whatever past investments it made; they are not generating substantial profits relative to the money the company invested. Also, it tells me the company has no competitive advantage and no moat. This is one of the main metrics I like to look at in an investment and anything over 10% is good in my book, so Block is not performing well, to say the least.

ROIC (Author)

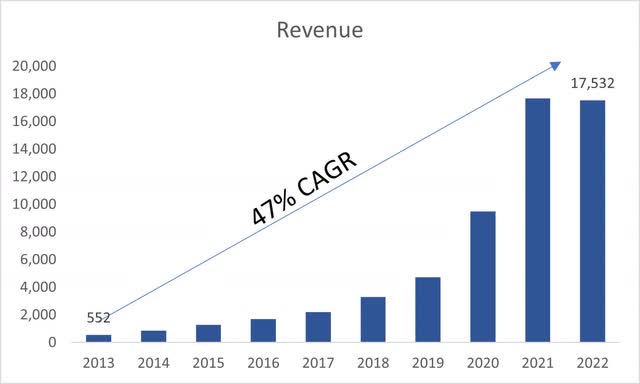

In terms of revenue, Block has seen phenomenal growth over the last decade. It is truly a growth company, or at least has been in the past. For FY23, analysts are projecting revenue growth to be around 23%, which is still good, however, a far cry from the company’s average. I will consider this for my valuation analysis. We can see that the company hasn’t seen any growth from FY21, which may be concerning, however, I don’t think revenues peaked.

Revenue (Author)

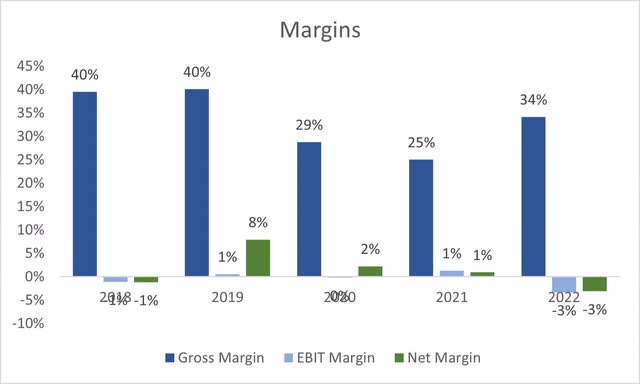

In terms of margins, it’s been a mixed bag too. The margins have been all over the place, with no clear direction, and I don’t like that. It is too speculative, and as of FY22, GAAP margins have been negative.

Margins (Author)

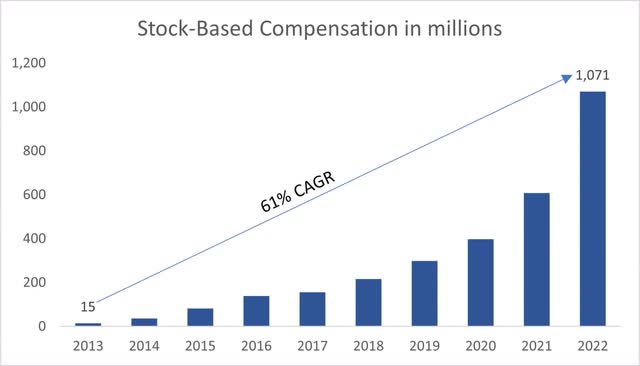

Stock-based compensation has been steadily growing all these years and it is showing no slowing down, which may or may not affect the company’s current shareholders.

SBC (Author)

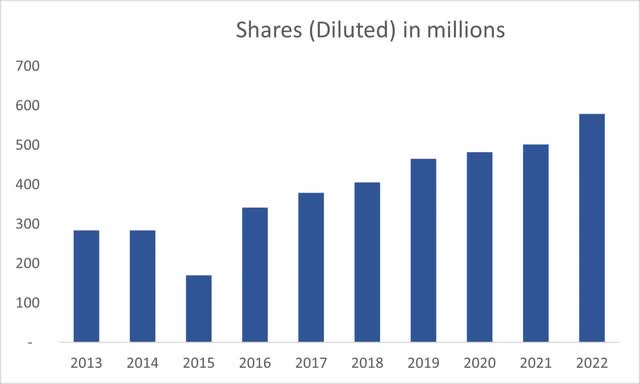

Speaking of dilution, the company is not shy at eroding shareholder value here too, increasing share count by 8% CAGR in the last decade.

Shares Outstanding (Author)

Overall, there is very little to like in terms of financials, apart from the impressive revenue growth and its liquidity position, as I don’t think it is at any risk of going under. I will have to assign a higher margin of safety if I was to re-invest in the company to match my risk/reward profile.

Valuation

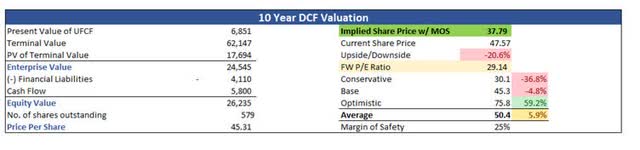

I cannot grow the company’s revenues at a historical pace any longer since the company is not as small as it used to be, and it will be much harder to perform at such a high caliber going forward. For my base case scenario, I decided to grow revenues at a respectable 14.5% CAGR for the next decade. For the optimistic case, I went with 17.5% CAGR, while for the conservative case, I went with 12.5%.

In terms of margins, I went with non-GAAP measures which show the company in a much better light than what GAAP tells us, which I’m not a fan of, however, I will entertain the idea. I decided to go with adjusted EPS numbers of $1.6 a share for FY23 and will increase it by around 27% CAGR for the next decade. This growth is still more conservative than what the analysts are assuming, but that just gives me an extra cushion of safety.

On top of these estimates, I decided to add a 25% margin of safety to be even more on the safer side, which will protect me further from the current negative sentiment that the company has been experiencing over the last while and provide a better risk/reward outcome.

With that said, Block’s intrinsic value is around $38 a share, meaning the company is trading at a 20% premium to its fair value still.

Intrinsic Value (Author)

Closing Comments

The company has been plagued with negativity ever since it topped off in August of ’21, and it seems it has not gotten any better still. It is trading at around where I bought the very first time in ’18, however, as I said, that was a speculative play that worked out very well in the end. Right now, for me to take on the risks of the company, I would like it to come back down further, which is not out of the realm of possibilities since the bad news is just piling on and it’s not going to be the first 52-week low we see for the remainder of the year.

I will say it is a much better time to invest in the company right now than any other time before, however, the company needs to prove it is worth investing in. After analyzing the company’s financials, there is a lot to be desired still, and it looks like the profitability metrics aren’t improving yet.

What I believe to be a relatively safe play to start a small position or average down would be selling cash-secured puts at around $40 strike price about a month out. This way an investor can get in at an even lower price than today, and since you’ll be collecting a premium, your cost basis will be lowered also. A lot of the negative has been priced in already and I believe there isn’t much downside risk left, however, I wouldn’t mind seeing further decrease before I jump back in.

Read the full article here

Leave a Reply