Introduction

The financial sector is exciting these days, with the Federal Reserve preparing to lower the interest rates. While some banks may suffer from lower rates on their loans, other institutions look forward to an increase in the valuation of assets as more capital will flow into risk assets. Investment banks and managers will likely benefit from the lower rates as money used to gain real interest in cash will flow again to stocks, bonds, and alternative assets.

One leading investment manager that is likely to be affected by the macro change is BlackRock (NYSE:BLK). The firm has over $9 trillion in AUM (assets under management), and any change in inflows will influence it. I have shares of BlackRock in my portfolio, and I believe that as the Federal Reserve is about to pivot its policy, it is an excellent opportunity to revisit the company.

Seeking Alpha’s company overview shows that:

BlackRock is an investment manager. The firm primarily provides its services to institutional, intermediary, and individual investors, including corporate, public, union, and industry pension plans, insurance companies, third-party mutual funds, endowments, public institutions, governments, foundations, charities, sovereign wealth funds, corporations, official institutions, and banks. It also provides global risk management and advisory services. The firm manages separate client-focused equity, fixed income, and balanced portfolios. It also launches and manages open- and closed-end mutual funds, offshore funds, unit trusts, alternative investment vehicles, and structured funds.

Fundamentals

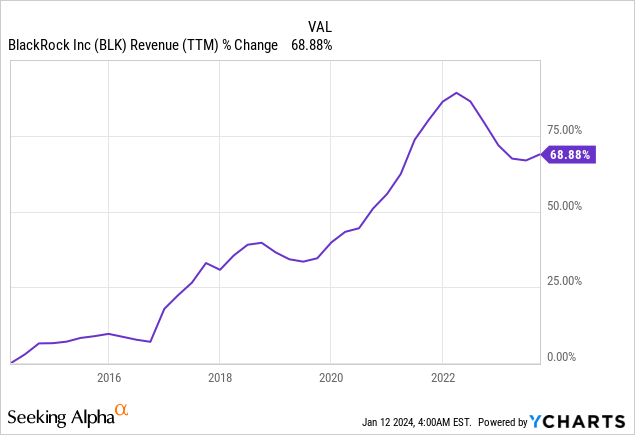

The revenues of BlackRock have increased by almost 70% over the last decade. BlackRock increases its sales mostly organically, as inflows and increases in the value of assets support AUM growth. Moreover, it uses M&A activity to improve its value proposition and help more inflows. It acquired Kreos Capital to add venture debt capabilities to its portfolio and eFront to enhance its technology offering. In the future, as seen on Seeking Alpha, the analyst consensus expects BlackRock to keep growing sales at an annual rate of ~7% in the medium term.

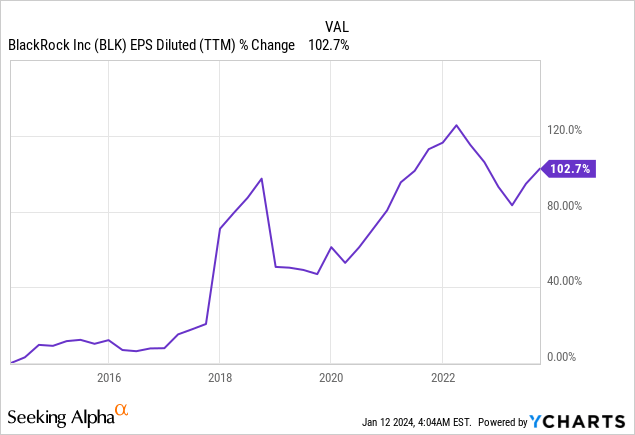

The company increased its EPS (earnings per share) by over 100% during the same decade. The EPS is doubling results from sales increases and executed buybacks. The company saw some decline in its EPS during 2022 due to lower margins as the markets declined and investors preferred safer assets. In the future, as seen on Seeking Alpha, the analyst consensus expects BlackRock to keep growing EPS at an annual rate of ~8.3% in the medium term.

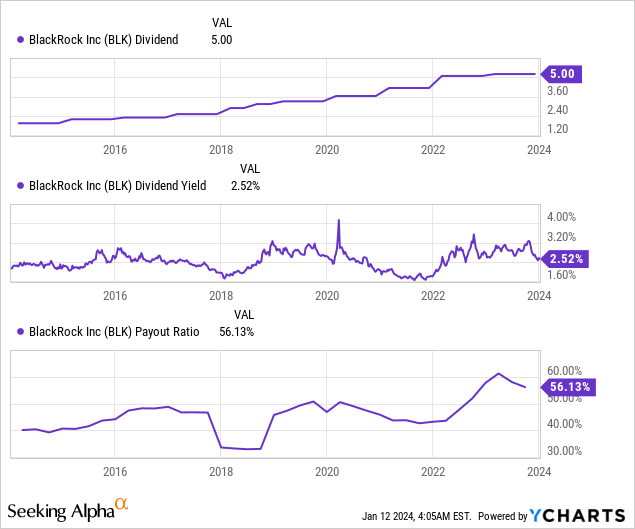

The dividend of BlackRock has been increased annually for the last 13 years and wasn’t reduced over the previous 19 years. The last dividend increase was a year ago, and it was low at 2.5% as the level of uncertainty was high in the markets. The company will likely announce its subsequent dividend increase in the coming days, as it usually does in January. The company pays a decent 2.5% dividend, which is probably safe as the payout ratio stands at 56%, leaving the company with enough safety margin.

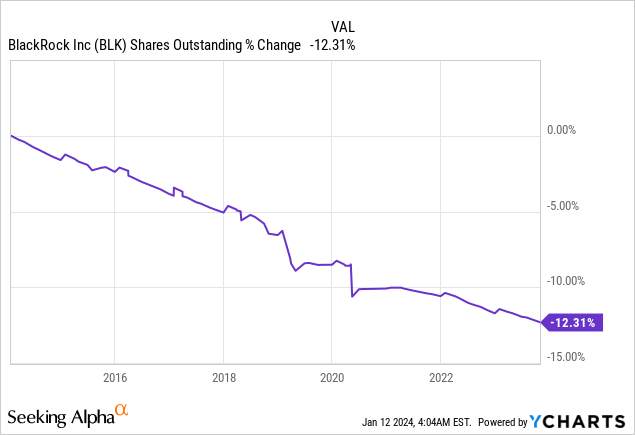

In addition to dividends, the company also returned capital to shareholders via buybacks. The company bought back over 12% of its shares last decade. Buybacks support EPS growth as they decrease the number of shares outstanding, thus supporting EPS growth even if the net income has not changed. Buybacks are highly efficient when the share price is attractive. Therefore, I believe this is not the time for aggressive buybacks.

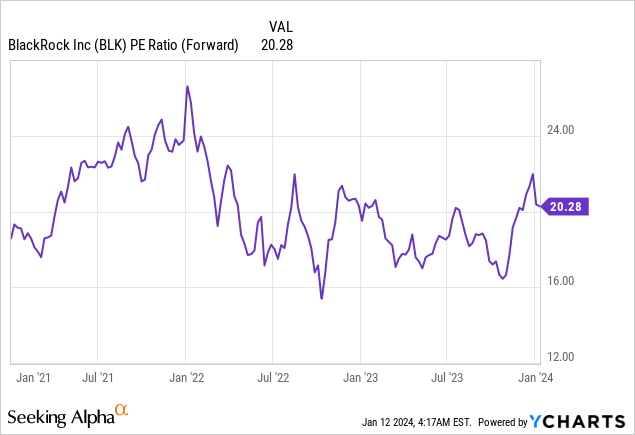

Valuation

The company’s P/E (price to earnings) ratio stands at 20.3 when using the EPS expectations for 2024. The P/E ratio for 2023 is slightly higher at 21. The company is trading for a P/E ratio that aligns with the average valuation over the last twelve months. I believe the shares are slightly overvalued, with an expected growth rate of 8.3% annually in the medium term. The current valuation, with the recent growth, implies that investors are paying a premium to own BlackRock.

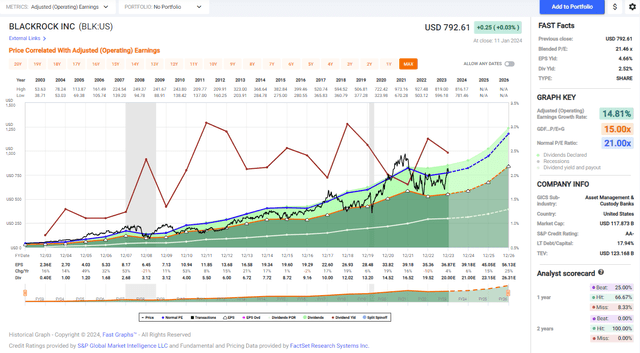

The graph below from Fast Graphs shows that the company is also slightly overvalued compared to its historical valuation. The company’s average annual growth rate over the last decade was 15%, and the current expected growth rate is lower at 8.3% annually. At the same time, we see that the company’s valuation with a P/E ratio of 20.3 aligns with the company’s historical P/E ratio, which stands at 21. Therefore, it is slightly overvalued unless the company has extraordinary growth opportunities.

Fast Graphs

Opportunities

The company sees a significant growth opportunity in cash management due to the pivoting of the Federal Reserve. As a result of rate hikes over the last 18 months, clients can now earn a real return in cash. Central bankers’ pause in interest rate hikes offers investors more clarity about time frames and entry points into fixed income and equities. As clients will return to stocks and bonds before the rates decline, BlackRock is strategically positioned to capitalize on this trend with its $9.1 trillion in assets under management. Clients actively engage with BlackRock to redesign portfolios, and the company expects a resurgence in client activity once there is more certainty in markets.

“Clients entrusted BlackRock with $193 billion of total net inflows in the first nine months of 2023, representing 3% annualized organic asset growth. While our clients’ decisions to take advantage of safe haven cash as they redesign portfolios are reflected in our third quarter flows, clients are actively engaging to do more with BlackRock.”

(Martin Small, Chief Financial Officer, October 2023)

BlackRock sees significant growth opportunities in private markets, driven by solid demand for illiquid alternative strategies. In the third quarter, the company generated nearly $3 billion in net inflows in private markets, particularly infrastructure and private credit. BlackRock aims to unlock future revenue and earnings potential by scaling its private markets platform, bridging successor funds, facilitating co-investments, and seeding new fund launches. BlackRock’s global network and relationships, alongside its tech and data capabilities, position it to capitalize on more significant and better private market opportunities.

“We’re investing as we scale our private markets platform by using our financial strength to bridge successor funds, facilitate growing co-investment activity, and seed new fund launches. These investments can unlock future revenue and earnings potential for our shareholders.”

(Martin Small, Chief Financial Officer, October 2023)

BlackRock has growth potential in its technology services revenue (9% of total revenues), which increased by 20% compared to the previous year. The sustained demand for technology offerings, including Aladdin’s broadening capabilities, contributes to the company’s commitment to low- to mid-teens annual contract value growth over the long term. BlackRock aims to leverage technology and automation to variable expenses, generate fixed cost scale, and align investment spending with organic revenue growth potential, driving differentiated organic growth and operating leverage. Its leading offering, Aladdin and eFront, allows it to cater to firms investing in liquid and alternative assets.

” Approximately half of the year-over-year technology services revenue increase resulted from these eFront contract renewals. Annual contract value, or ACV, increased 10% year-over-year. We remain committed to low- to mid-teens ACV growth over the long-term, driven by demand for Aladdin’s broadening technology capabilities and the growing value proposition it presents for clients.”

(Martin Small, Chief Financial Officer, October 2023)

Risks

The risk of lower inflows and even outflows is due to increased rate hikes. It may impact BlackRock’s performance. Like previous periods in 2013, 2016, and 2018, rate hikes and policy uncertainty have weighed on industry flows, including at BlackRock. If we see slower-than-anticipated rate decreases or even rate hikes due to another surge in inflation, it may hinder growth. The potential for shifts in client risk appetite and industry dynamics can temporarily affect assets under management and revenues.

“Investors have been able to generate positive returns (using cash) while waiting for inflation to cool and for more policy certainty from central bankers. This weighting has weighed on industry flows, including here at BlackRock, consistent with prior periods of policy uncertainty like 2013, 2016, and 2018.”

(Martin Small, Chief Financial Officer, October 2023)

Another risk is the current macro environment. The current macro environment, with clients pausing due to uncertainty, is causing an overall slowdown in the asset management industry. The company recognizes that the slowdown in client activity may persist until there is a higher conviction in a terminal rate, the yield curve, inflation, and growth. If we see a significant slowdown or recession, the company may see slower growth even if rates are lower.

“The current macro environment is causing some clients to pause, slowing overall activity in the asset management industry. Nevertheless, BlackRock has delivered positive organic asset and base fee growth over the last 12 months.”

(Martin Small, Chief Financial Officer, October 2023)

BlackRock also suffers from a risk of sensitivity to fixed-income flows, especially with the anticipation of a resurgence in fixed-income flows as interest rates peak. The company is well-positioned to benefit from this reallocation with its comprehensive $2.6 trillion fixed-income platform. However, the dynamics of fixed-income flows are influenced by market conditions and client preferences. The performance in fixed-income flows fluctuates based on market conditions and client risk preferences, potentially impacting revenues. This is the segment that is suffering the most from the anticipation of the Fed’s actions. Investors will likely try to “lock” on high yield to maturity, but their timing may vary based on the Fed’s actions.

Conclusions

With almost $10 trillion in assets under management, BlackRock is a leading blue-chip company in the financials sector. The company has strong fundamentals with growth in sales and EPS, leading to dividends and buybacks. The high likelihood of rate decreases, together with its fast-growing tech business and the appetite towards alternative assets, will drive the company forward in the medium term.

At the same time, every delay in rate decreases or higher macro environment uncertainty may significantly slow the company’s growth. When I am looking at the company’s valuation, investors have no margin of safety. The company is priced at a double-digit growth rate. Therefore, I believe shares are a HOLD, and I will consider adding to my position when the P/E ratio reaches 17-18.

Read the full article here

Leave a Reply