Introduction

There aren’t many financial stocks that readers bring up as often as BlackRock (NYSE:BLK), the financial giant that has become one of the titans of the modern financial world.

It’s no surprise that readers keep bringing up this stock:

- It is the biggest ETF provider in the world, even beating Vanguard. While I usually don’t invest in ETFs, many family members and friends of mine have invested their hard-earned cash in BlackRock-owned ETFs (iShares).

- It has increasingly made headlines, as the giant has used its power to push for its agenda on some of the companies it owns. According to the renowned Australian Financial Review:

[…] Fink has made himself the face of the movement since 2016, when he began urging the chief executives of the companies in BlackRock’s portfolio, in increasingly strident terms, to make their businesses more sustainable. – AFR

As I have often said in various comments, I have an issue with the way BLK has used its power. It has become a highly politicized company that consistently makes news headlines (not always voluntarily), including this one from last year, when it was targeted by two Republican candidates for the Presidency.

CNBC

That said, I’m not writing this article as an activist. I respect the company for what it has done for its shareholders and investors using its products, which brings me to the third point that explains why people keep bringing up BLK in the comment sections of my articles.

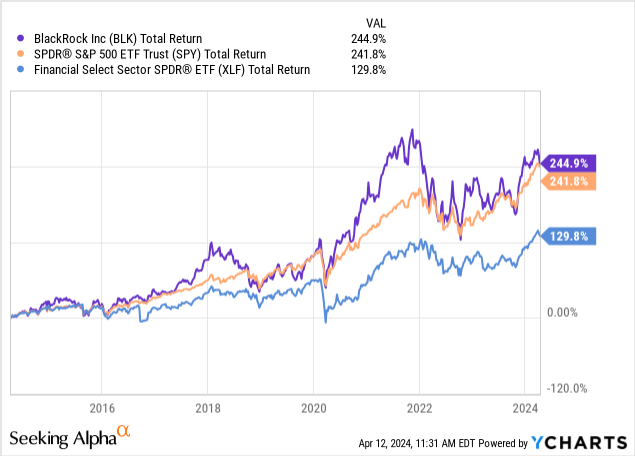

- Since 2004, the stock has returned 15% per year, which has helped countless people reach their financial goals. Over the past ten years alone, the BLK ticker has returned 245%, beating the S&P 500 by roughly 3 points and the Financial Select Sector ETF (XLF) by more than 110 points.

My most recent article on this stock was written on December 6, when I went with the title “It May Be Pointless To Bet Against BlackRock.”

Back then, I wrote the following:

On a long-term basis, I’m bullish on BLK, as it seems to be a powerhouse that will only improve its moat in the years ahead, letting shareholders benefit from consistent dividend growth, buybacks, and earnings growth along the way.

A few months later, BLK is trading 5% higher after just revealing its quarterly earnings.

Now, it’s time for an update.

So, without any further ado, let’s get right to it!

BlackRock Firing On All Cylinders

I just mentioned that BLK is “large.”

Let me provide some more evidence of that.

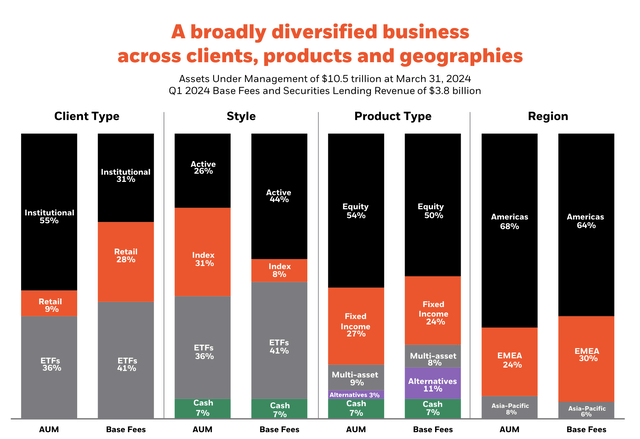

As of March 31, 2024, the company has $10.5 trillion in assets under management. While it’s a pointless comparison, it’s roughly 2.6x the German GDP in 2022.

More than half of these assets are managed for institutional clients. 45% is managed through retail accounts and ETFs.

You probably wouldn’t have guessed it, as BLK is known for its ETFs, but 44% of its fees are generated through active management.

BlackRock

The Americas account for 64% of total fee income, which leaves a lot of room for growth in “international” markets, which the company is targeting through new product offerings and services.

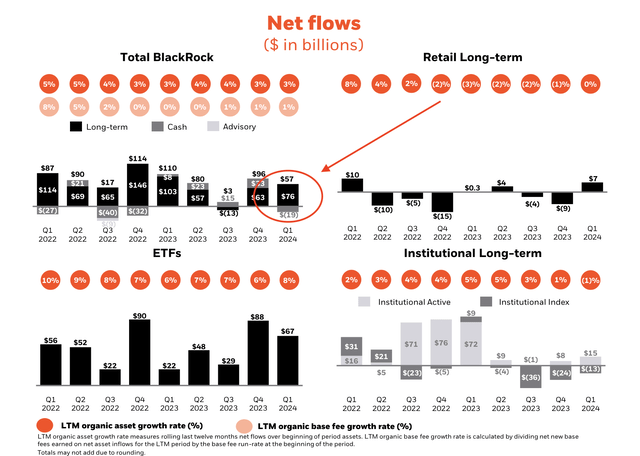

One of the most important metrics for BLK is the net inflows of cash. After all, the more cash it manages, the more fees and performance income it can generate.

In the first quarter, the company saw long-term net inflows of $76 billion. I highlighted this number in the overview below.

BlackRock

According to the company, this exceeds industry standards and provides a strong basis for organic base fee growth – which is somewhat obvious.

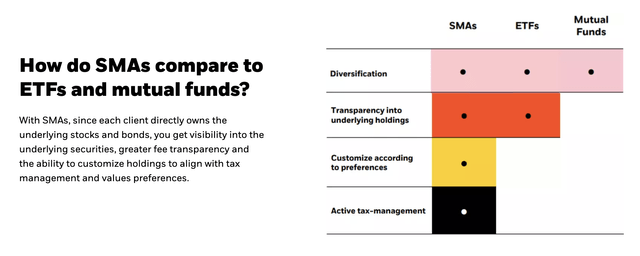

Notably, ETF net inflows were led by core equity and fixed-income ETFs, while financial advisers are increasingly looking for customized portfolio solutions. These contribute to growth across BlackRock’s SMA (separately managed accounts) and managed model platforms.

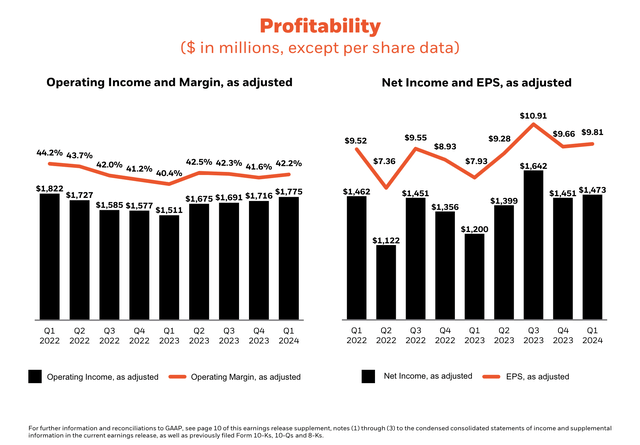

Moreover, the company’s revenue surged by 11% year-over-year, reaching $4.7 billion, driven by market appreciation and increased revenue from performance fees and technology services.

Adjusted operating income also saw a notable uptick of 17% compared to the previous year. Earnings per share (“EPS”) came in at $9.81, which is 24% higher compared to the prior-year quarter.

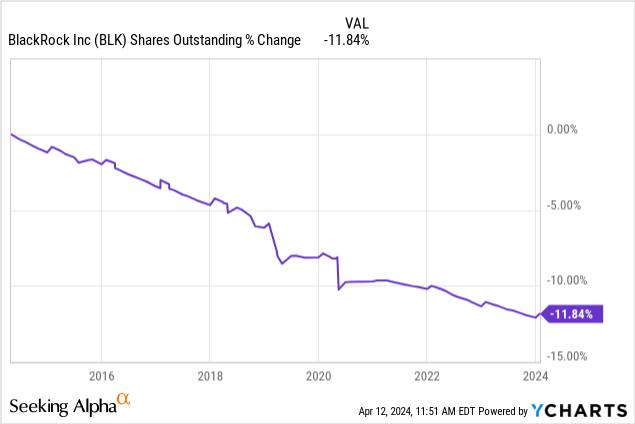

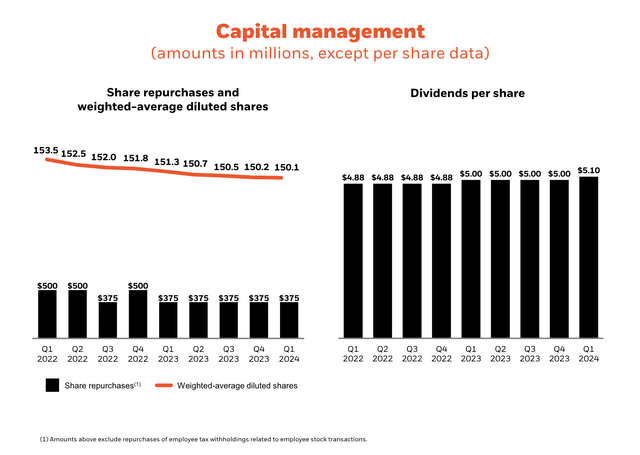

On a side note, the EPS number benefits from buybacks, as it shows earnings PER SHARE. Over the past ten years, BLK has bought back 12% of its shares.

That does not make it an overly aggressive buyback company, but it certainly added to its impressive total return.

Moreover, the company reported an increase in operating income margins.

Operating margins in 1Q24 were higher on a month-on-month and year-over-year basis. Especially in an inflationary environment, maintaining strong margins is key.

BlackRock

As a result of strong fundamentals, the company hiked its dividend to $5.10.

This translates to a $20.40 annual per-share dividend and a yield of 2.6%. Assuming analysts are right and BLK generates $41 in EPS this year (FactSet data), we’re dealing with a highly favorable payout ratio of just 50%.

BlackRock

So far, so good.

What matters even more is how the company is evolving, as this paves the way for future growth.

A Path To Consistent Growth

During its earnings call, the company made clear that it remains very optimistic about its growth prospects, especially as clients continue to “re-risk” (a fancy way of saying investors are returning to the market) and market conditions become more supportive.

Even better, because of these tailwinds, the company expects to expand its market share.

Looking ahead, as markets trend to be more supportive and clients rerisk, we see significant opportunity to expand our market share and consolidate our position to clients. We’ve set ourselves up to be a structural grower with the diversified platform that we’ve built. – BLK 1Q24 Earnings Call

Moreover, during the call, Mr. Fink highlighted the growing demand for infrastructure investments globally, driven by factors such as technological advancements, globalization, economic growth in emerging markets, and the need for new infrastructure.

He has discussed this topic a lot this year, and I included it in some articles this month (like this one).

In this case, the company’s infrastructure platform saw 19% organic asset growth compared to last year. Moreover, the planned combination with GIP (Global Infrastructure Partners) is expected to further expand the company’s solutions in this area.

BlackRock

Moreover, the company is seeing great benefits from the launch of new ETFs.

For example, its Bitcoin fund, which launched in January, became the fastest-growing ETF in history! It now has $20 billion in Bitcoin AUM.

On top of that, active ETFs also saw strong inflows.

Generally speaking, the company is seeing increased demand for customization in its wealth business, mainly through separately managed accounts (the aforementioned SMAs).

BlackRock

To capitalize on higher demand, the company continues to strengthen its SMA capabilities through acquisitions and organic growth.

It is also increasingly focusing on a topic that is getting more attention in my Seeking Alpha articles: retirement investing.

According to Mr. Fink, the company is committed to providing retirement solutions, with a focus on helping individuals both save for and spend throughout retirement.

For example, the company’s LifePath target date franchise has seen significant growth and evolution over the years, and the introduction of LifePath Paycheck aims to address the de-accumulation challenge by providing a potential lifetime income stream.

BlackRock

Last but not least, Larry Fink addressed political polarization.

I’ve spoken before about the fear we see today, some is stoked by increasingly political polarization in the world. Our industry and BlackRock have been a subject of political dialogue, mostly in the United States. We recognize some of this with being the industry leader. We have done a better job now of telling our story so that people can make decisions based on facts, not on lies and not on misinformation or politicization by others. – BLK 1Q24 Earnings Call

Moreover:

As a fiduciary, politics should never outweigh performance. I do believe that with the vast majority of our clients, our long-term fiduciary approach and performance are resonating. We heard it in our dialogue with them and we see it in our flows, and I know all of you as shareholders see it in our flows. – BLK 1Q24 Earnings Call

So, what about the valuation?

Valuation

Technically speaking, BLK remains in a great position to generate substantial returns.

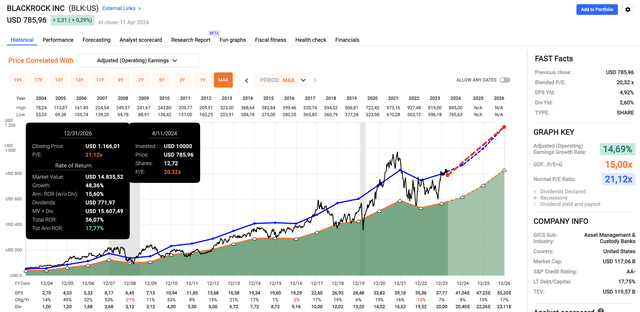

Using the data in the chart below, the company is trading at a blended P/E ratio of 20.3x, which is slightly below its long-term normalized P/E ratio of 21.1x.

This year, EPS growth is expected to be 9%, potentially followed by 15% and 17% growth in 2025 and 2026, respectively.

FAST Graphs

Assuming the company keeps a 21.1x multiple, it could return north of 15% per year, including its 2.6% dividend.

That said, this is completely theoretical.

Given that inflation numbers keep coming in hot and the Fed may be forced to keep rates higher for longer, the economy is prone to risks that were not expected going into this year.

Hence, I would not be surprised if we were to see a decline to the $600-$650 range.

If I were looking for more financial exposure, I would be looking for an entry in that range – assuming the economy does not worsen.

All things considered, I stick to a Buy rating, as I believe that BLK has the right tools to continue to exploit massive growth opportunities in the global financial sector.

Takeaway

In conclusion, BlackRock continues to dominate the financial world with its massive assets under management and impressive growth trajectory.

Despite occasional controversies, its consistent performance and commitment to shareholder value make it a compelling investment choice.

With a diverse platform and a focus on expanding market share, BLK is well-positioned to capitalize on emerging opportunities, particularly in infrastructure and retirement investing.

While we may see some volatility this year, I maintain a Buy rating, as I expect that BLK will continue to stand out in a highly competitive financial sector.

Pros & Cons

Pros:

- Strong Performance: BLK has delivered impressive returns over the years, outperforming the market and its financial sector peers.

- Diverse Offerings: With a wide range of ETFs and active management options, BLK caters to various investor types.

- Growth Opportunities: The expansion into infrastructure investments and retirement solutions presents promising growth opportunities.

- Dividend Growth: BLK’s consistent dividend increases (and buybacks) reflect its commitment to rewarding shareholders.

Cons:

- Political Sensitivity: BLK’s proactive stance on sustainability and political issues may cause potential backlash.

- Valuation Risks: Despite its strong fundamentals, concerns over inflation and interest rates could lead to volatility.

- Market Dependency: In general, BLK’s performance is closely tied to market conditions, making it prone to fluctuations and economic uncertainties.

Read the full article here

Leave a Reply