Investment Thesis

BlackLine (NASDAQ:BL) shares are down by about 45% since it peaked earlier during the year as a result of continued macro pressures and muted demand outlook. While the bottom line beat remains a silver lining as a result of headcount optimization and operating efficiencies, the decline in net new ARR along with dollar churn amongst both its enterprise as well as mid-market customers remains a cause of concern in the near term. It recently announced a 9% reduction in force, or RIF, its second within a year, with software players largely underperforming the index compared to the 1st RIF pointing to continued demand headwinds. We Initiate at Neutral and await stability on the ARR growth and dollar churn.

Company Background

BlackLine is a leading provider of comprehensive cloud solutions for accounting and finance automation to a wide range of mid-market and enterprise organizations. Key platform functionalities include Financial close management, Accounts receivable, Intercompany accounting and related services. It enables customers across functions from balance sheet substantiation, transaction matching to cash applications helping customers improve process efficiency and maximizing working capital to drive a faster closure of the financials. The company has about 4,200 paying customers at the end of 2022.

Historical Track Record

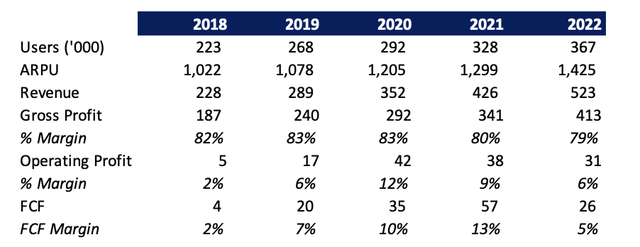

The company has reported revenues growing at a robust 23% CAGR during the 2018-2022 period driven by strong double-digit growth in customers as well as improving ARPU due to cross-selling and growing customer spends. However, gross margins declined over the period, particularly during the past two years, as a result of increasing spends on cloud hosting services as well as additional costs due to the migration of its cloud hosting services to Google Cloud and higher employee expenses. Operating margins also remain volatile as the company has spent substantial amount of money in customer acquisition which has not been absolutely fruitful. Customer Acquisition Costs have increased by 27% over the 2018-2022 period surpassing the revenue growth which has also contributed to the declining operating margins along with a drop in gross margins.

Company filings

Slowing Growth

BL reported Q2 revenues largely in line with the estimates, up 13% YoY, a deceleration from 16% growth last quarter. Subscription revenue also grew 13% YoY, a deceleration from the 15% growth last year, also largely in line with estimates. Pro-forma Gross margins came in at 79% flat compared to the previous year and in line with consensus expectations. Sales and Marketing % decreased 5% YoY primarily as a result of headcount optimization and lower incentives and professional fees. In addition, R&D spends and G&A also improved on the back of strict cost controls and operating efficiencies which enabled them to report a strong beat to the operating margins at 14.4%, up about 12 percentage points. This resulted in an EPS beat by $0.12 partly also helped by higher net interest income.

However, ARR growth remains muted as net new ARR declined 13% YoY to $16 mn, a third straight quarter of decline which raises the concern of demand worries. Additionally, management noted that the FY revenue guidance implies a flat environment for the remainder of the year with respect to billings and raised its revenue guidance slightly lower by ~$5 mn at the higher end and implying a 12-13% growth at mid-point. Sales cycles continue to be elongated with management pointing at de-prioritization in budgets and pauses in pipeline development. In addition, renewal rates for enterprises continue to be around 97%, lower than its long-term average of 98-99% due to dollar churn as well as losing customers amidst vendor consolidation. Gross retention in mid-market customers also implies a decline of ~2-3 points compared to its long-term average of 92-93% as a result of continued dollar churn at the lower end of the market.

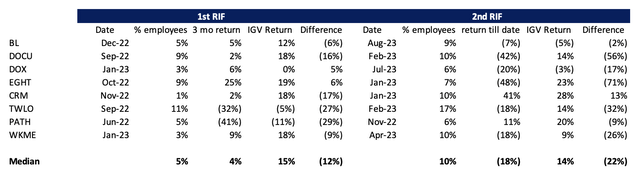

Continued slowing growth led to the company announcing its second RIF in less than a year for 9% of its employees following the company’s 5% RIF in December. This further points to a greater-than-anticipated demand deceleration and further pain on the way ahead. We compare software companies which have done two RIFs in a year lately and believe the companies have largely been underperformers compared to the Tech-software ETF (IGV). Compared to 1 RIF, % of employees reduced has grown from 5.0% to 9.5% and has underperformed the index by about 22% compared to a 12% underperformance during the 1st RIF.

Author

Q3 and FY23 Preview

We expect a continued muted quarter driven by continued macro pressures as well as a continued decline in net new ARR while management expects a flat growth for the remainder of the year. The continued dollar churn remains a concern among the mid-market segment (where it added the lowest net customers during the quarter since COVID) as a result of significant macro headwinds leading to delayed client spends. We believe the macro environment for the mid-market segment continues to be in line with the previous quarter, however, large enterprise deals continue to remain muted amidst dollar churn and muted billings.

We expect Q3 revenues to be slightly at the lower end of the guidance of $149 – $151 mn and further expect FY23 revenues to be ~$586 mn, implying a further deceleration in sales growth for Q4 at ~10% YoY. Operating margins are likely to remain strong on a YoY basis despite the severance-related costs in relation to the second RIF and conference-related costs. It expects non-GAAP EPS of $1.48 at mid-point, which remains above the consensus expectations, however, we believe the muted ARR growth is likely to cause significant pressure in the near term.

Valuation

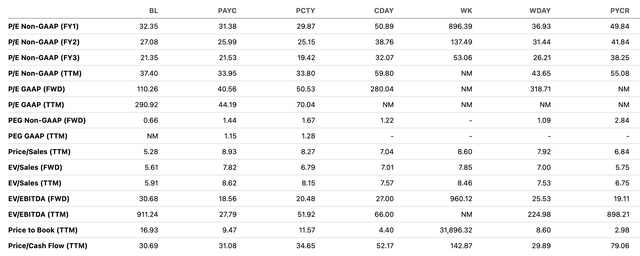

BL trades at 32x Fwd P/E and 5.6x Fwd EV/Sales, which is at a discount to its peer average of 40x Fwd P/E (excluding WK) and 7.0x Fwd EV/Sales. We believe the discount is warranted given the significant challenges in the near term and the weak outlook as a result of intensifying macro pressures and user churn. Its decelerating growth and higher debt load compared to its peers remains a concern in a challenging environment. We initiate with a Neutral rating as we believe there is limited margin of safety and more pronounced downside risks.

Seeking Alpha

Risks to Rating

Risks to rating include:

1) Continued delays in client spends as a result of challenging macro conditions which can hamper business growth.

2) Inability to drive customer retention or net new customer addition with higher customer acquisition costs (as witnessed historically) can suppress operating margins.

3) Its ability to drive Intercompany hub product which streamlines intercompany accounting could enable higher sales growth.

4) International expansion forms only about less than a third of revenue and its ability to expand internationally can lead to incremental revenue growth.

Final Thoughts

BlackLine had a tough few quarters as a result of continued muted growth in its ARR amidst dollar churn. It has reported a strong improvement in operating margins as a result of operating efficiencies and stable gross margins which remains a silver lining. However, there are still significant near-term headwinds and we believe intensifying macro headwinds and competitive intensity as a result of vendor consolidation would continue to pressure near-term growth. The company trades at a discount to its peers and its long-term averages which we believe is warranted as a result of its weakening outlook. We initiate at Hold.

Read the full article here

Leave a Reply