Thesis Summary

Bitcoin (BTC-USD) has shattered through the $30,000 level and is up 20% in the last five days, reaching close to $35,000 as I write this.

We have had big news in the last few weeks regarding a Bitcoin ETF, and on Monday, BlackRock listed the iShares Bitcoin Trust on the Depository Trust and Clearing Corporation.

This may have very well sparked the breakout.

We also have some other “fundamental” factors which are very bullish for Bitcoin, including the China stimulus and the upcoming halving.

From a technical perspective, it’s only normal that a breakout above $30K would spark new YTD highs.

In my last article on Bitcoin, I did say I was expecting a deeper pull-back, but with the recent moves, we could be taking a more direct route up.

I present both a bullish and “less immediately bullish” scenario for Bitcoin in this article.

Bitcoin is Back

Without wanting to jump the gun, it’s hard not to get excited about Bitcoin following this latest rally. Many technical and fundamental factors seem to be lining up, and a new BTC bull market could be imminent.

In the last few weeks, we have been inching closer and closer to a BTC ETF, which has helped ignite the Bitcoin price.

As I wrote about last week, the SEC did not appeal the court ruling on GBTC’s ETF application. This could be interpreted as a sign that the SEC might actually be ready to approve Bitcoin ETFs.

Bitcoin’s price began to react, rallying as markets opened last Monday.

If this wasn’t already a clear sign of what’s to come, today, BlackRock listed the iShares Bitcoin Trust on the Depository Trust and Clearing Corporation.

What does this mean exactly?

By registering in the DTCC, BlackRock is prepping the iShares Bitcoin Trust, which already has a ticker, IBTC, for launch.

A DTCC subsidiary – National Securities Clearing Corporation (NSCC) – has a process for clearing ETFs that includes “the ability to review…the ETF’s portfolio constituents, which is also used to automate the creation and redemption of ETF shares and their subsequent settlement,” according to the company.

Source: Yahoo Finance

On top of that, Eric Balchunas from Bloomberg also noted that following BlackRock’s amendment to its ETF filing on October 18th, the company has even specified a date for the fund to be seeded, i.e., funded.

The filing also contained language that seed creation baskets were to be purchased in October “subject to conditions” but did not specify a date or amount.

Source: Blockworks

I’m not sure what other investors and the SEC think, but BlackRock’s actions signal that they are pretty confident in their ETF being approved.

Adding even more wood to the fire, MicroStrategy (MSTR) is now turning a profit on its Bitcoin holdings, and the company has said that it will be purchasing more Bitcoin in the coming months.

Perfect Timing

The timing for the Bitcoin ETF, in my opinion, could not be better. We have a lot of factors coming together that could push Bitcoin into a full-blown bull market.

China’s Also Back

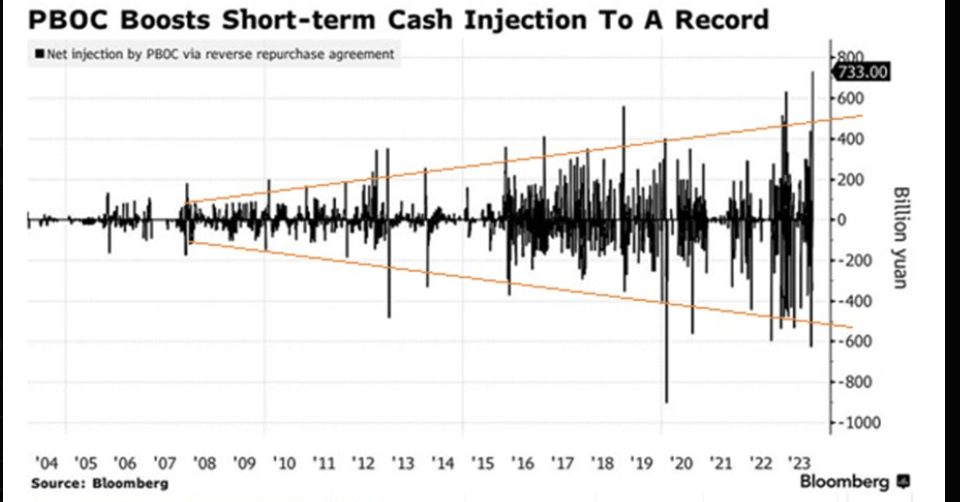

This one has gone unnoticed by many, but it’s important. China is injecting record stimulus.

PBOC liquidity injections (Bloomberg)

The Chinese economy has been struggling, and the PBoC has been loosening monetary policy over the last few months. As these liquidity injections make their way through the system, a lot of other assets will benefit, and Bitcoin perhaps the most.

In fact, this is a dynamic I talked about back in February when markets and Bitcoin began to rally on the back of a trillion-dollar increase in global liquidity.

The Bitcoin Cycle

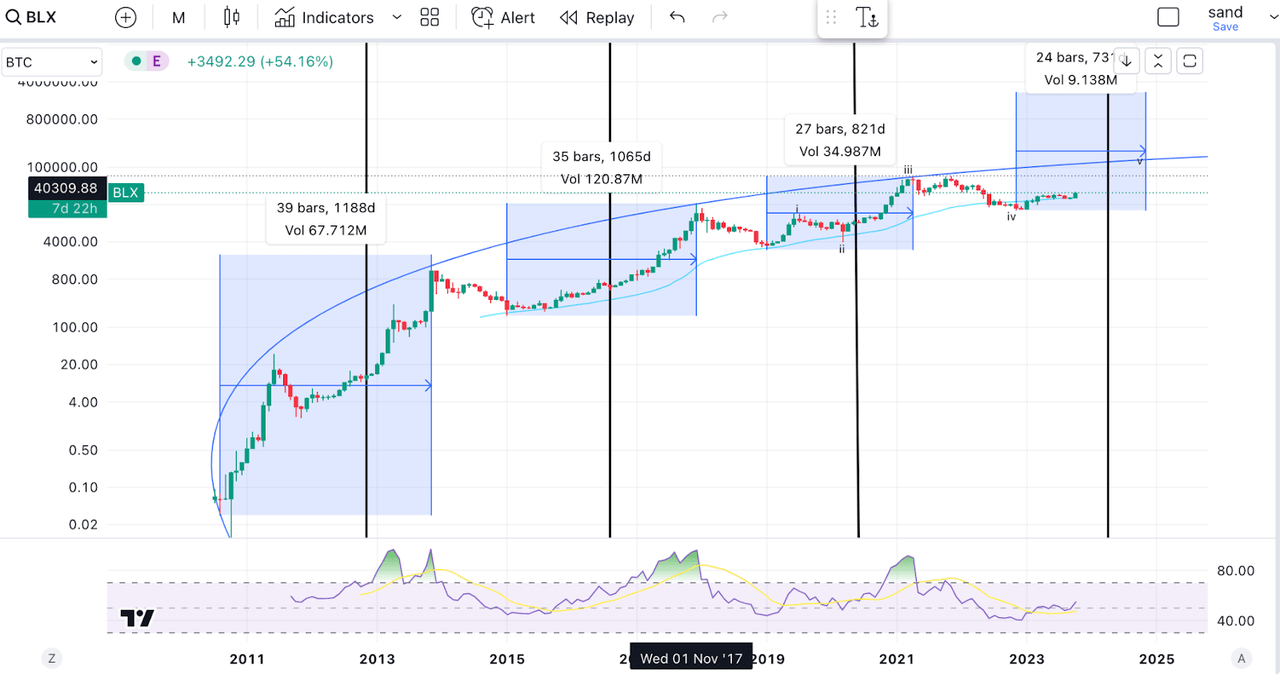

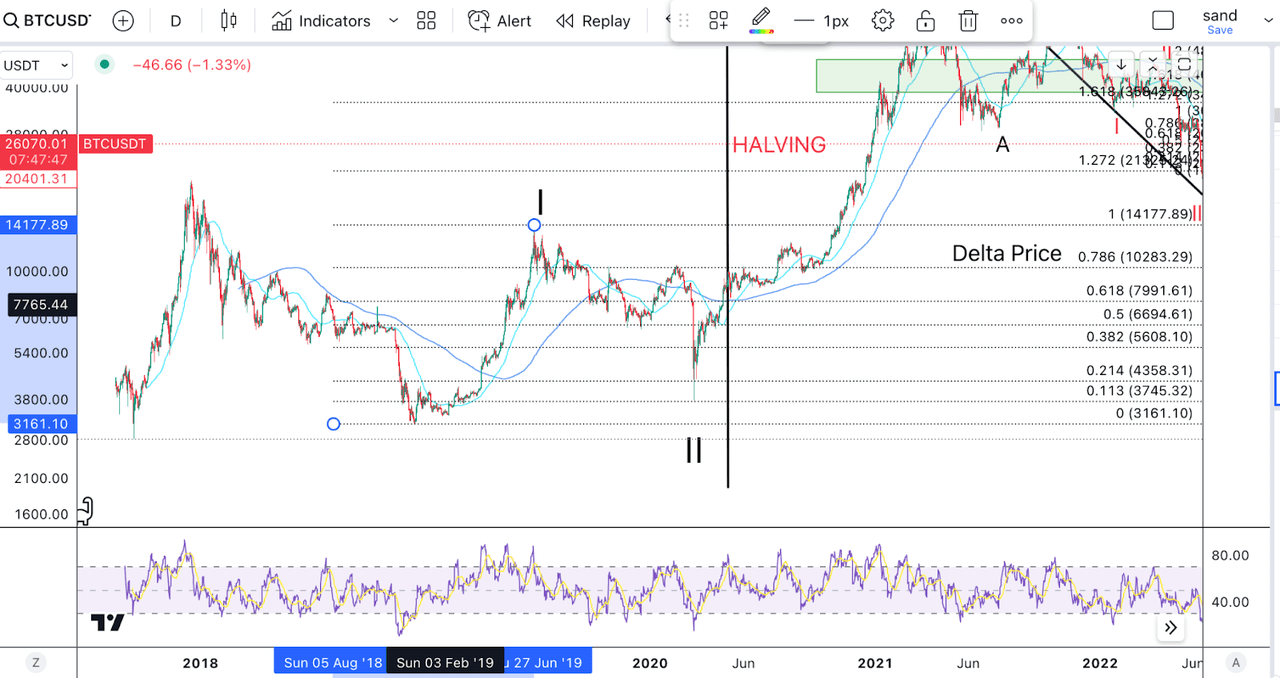

BTC Long-term chart (TradingView)

Anyone who follows Bitcoin knows that the price seems to react quite strongly to the halving.

Typically, we see Bitcoin enter a bull market following the halving. The bear market ensues, and then we get a distribution phase as we approach the next halving.

We have been in a distribution phase for the last few months, and the next halving is now estimated to be 171 days away. Based on history, this suggests that a bull market could be close, if not already upon us.

Flight To Safety

Lastly, I propose another reason why Bitcoin could be rallying. The recent rise in rates has taken a toll on stocks, and the recent release of bank earnings has, once again, brought the issues of bank health and unrealized losses to the forefront.

Could Bitcoin be acting as a “safe haven”, much like it did back in March?

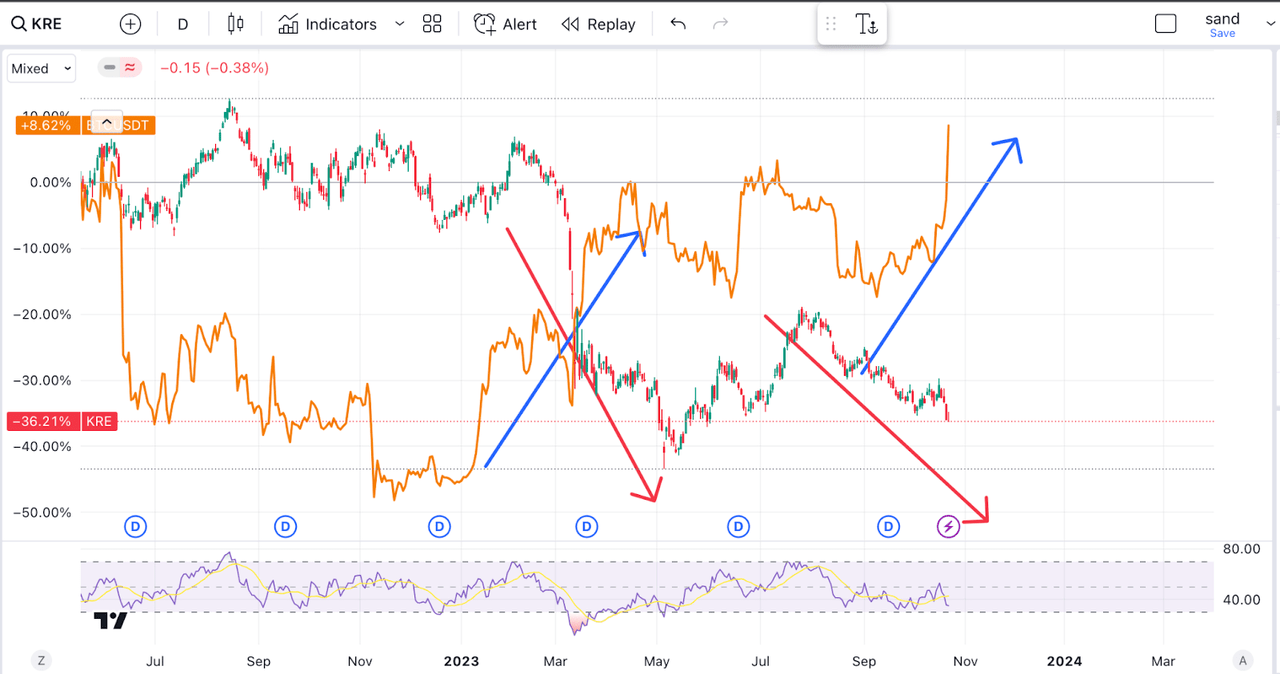

BTC and KRE (TradingView)

The above chart shows the Bitcoin price in orange and the KRE in red/green.

It seems like Bitcoin has a nasty habit of rallying when the financial system struggles.

Technical Analysis

With the latest rally, it seems like a bull run to new all-time highs could begin.

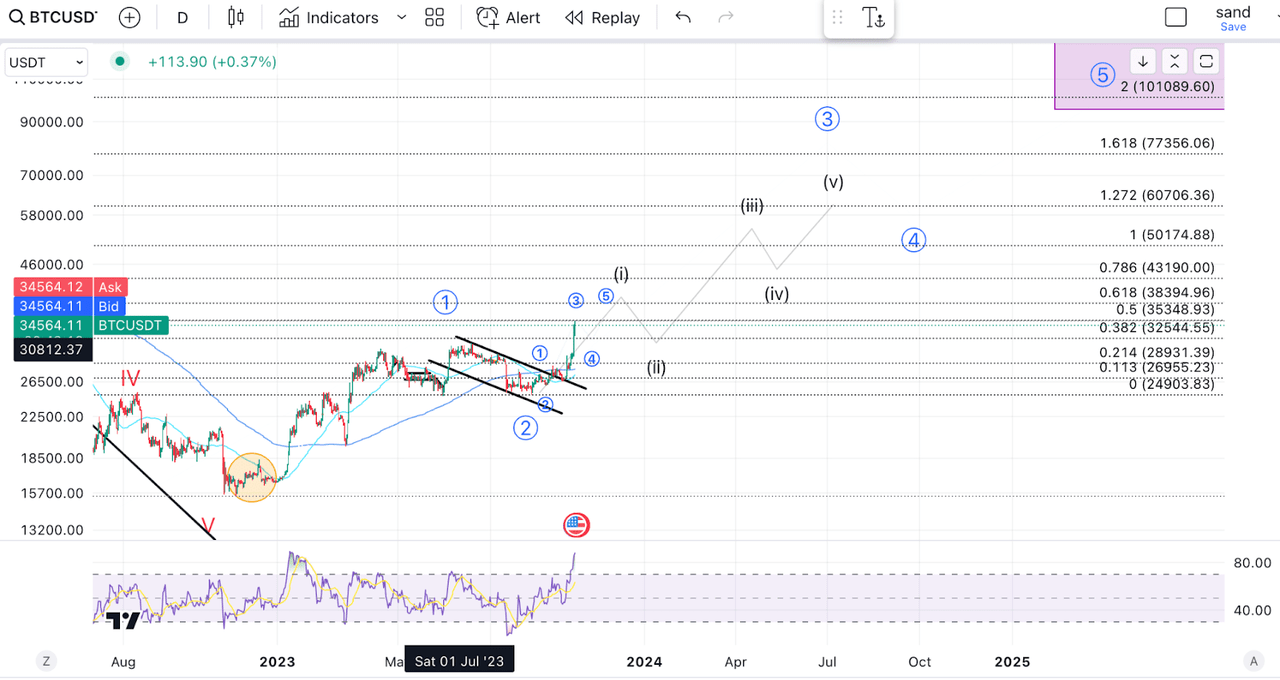

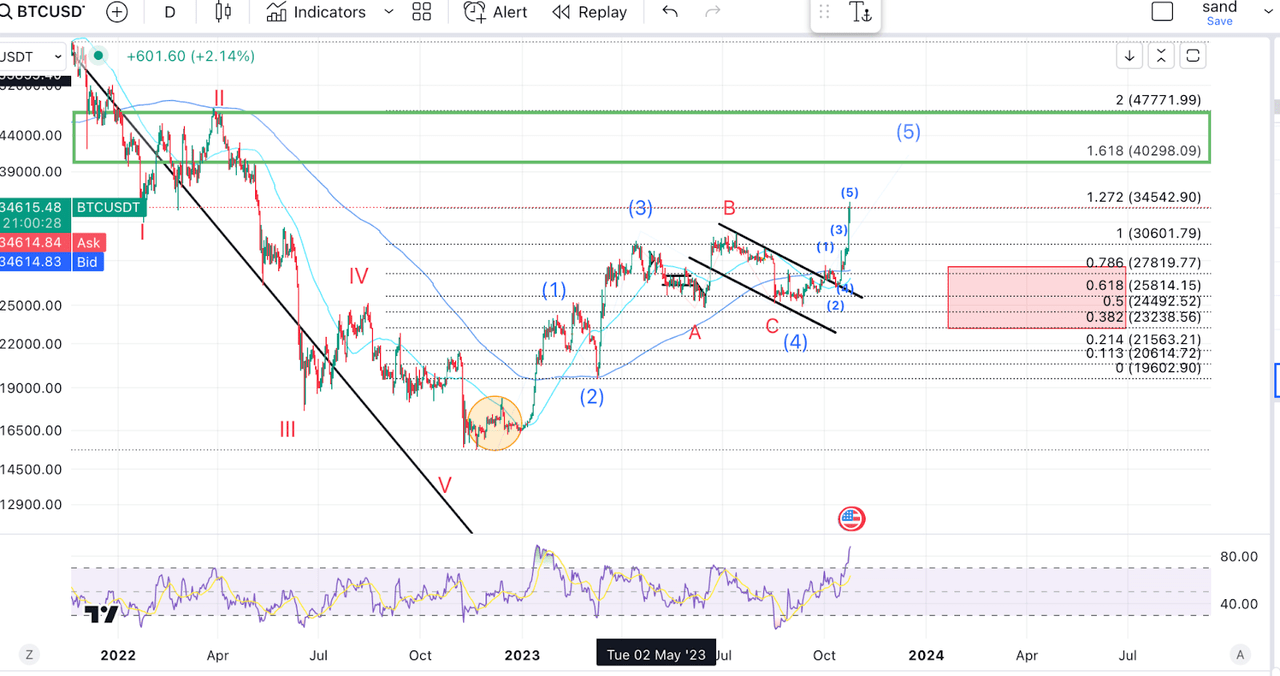

Bitcoin TA (Author’s work)

Arguably, we completed wave 1 when we rallied into $30,000 back in June. Since then, we have been correcting in wave 2, and with the break above the previous high, we can now confirm that an initial impulse in wave 3 has begun.

Based on the length of our large degree wave 1, wave 3 could take us into the $77.000 region, which is the 1.618 ext, and the final bull market for Bitcoin could end with new all-time highs just above $100.000.

With that said, it’s worth mentioning that this would mean that Bitcoin is playing out a bit differently than in previous cycles. As I mentioned in my last article, Bitcoin has sold off just ahead of the halving in previous cycles.

BTC previous halving (Author’s work)

This is what happened in 2020, though arguably, this was aided by the COVID situation.

In any case, I don’t think we are necessarily out of the woods yet. I could also conceive of a more immediately bearish scenario where Bitcoin has yet to complete a deeper sell-off.

BTC bear case (Author’s work)

I could also make the case that Bitcoin is still working on a much larger impulse, which would end around the $40,000 level.

This would be a lot more bullish in the long-term, as it would project us even higher in the long term, but it would mean that after rallying to $40,000, Bitcoin could sell off in a wave 2, and retrace back into the $25,000 range.

The $40,000 area is also a critical volume level, so this will be an important hurdle for Bitcoin.

Final Thoughts

All in all, I remain cautiously bullish on Bitcoin. While I would have preferred to see a deeper pull-back, and I believe we could still see one later on, this doesn’t affect my long-term outlook and conviction.

Bitcoin is setting up for a big rally; that seems clear to me. Institutions will start buying, liquidity dynamics could be turning, and the halving is nearing.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply