Germany’s footwear maker, Birkenstock Holding Limited (NYSE:BIRK), after 250 years of operations, went public this Wednesday, seeking a $9.2 billion valuation. However, the share price fell 12.6% on its first day of trading, leaving the company with a valuation of $7.5 billion, and a share price of $40.20. This was far from the indicated offer range of $44 to $49 per share. Despite experiencing a late-period renaissance, the company’s offer price was always excessive, and investors should brace themselves for more declines. Our analysis will show that nearly 72% of the price is built on nothing more than assumptions about the business’s ability to defy the gravitational pull of competition.

Walking Naturally

The guiding principle of the firm is “Naturgewolltes Gehen” (German for “Walking naturally”), and encapsulates the firm’s belief that people are made to walk barefoot on “yielding ground”, and so, Birkenstock’s footwear is designed to give an experience as close to walking naturally as possible, with the wearer’s weight evenly distributed to reduce stress and friction and promote foot health.

Birkenstock’s revenues are largely derived from “footbed-based products”, with some 700 silhouettes, of which the Core Silhouettes are the Madrid, Arizona, Boston, Gizeh, and Mayari.

Source: Birkenstock Holding Limited 2023 F-1/A

Diversified Revenue Streams

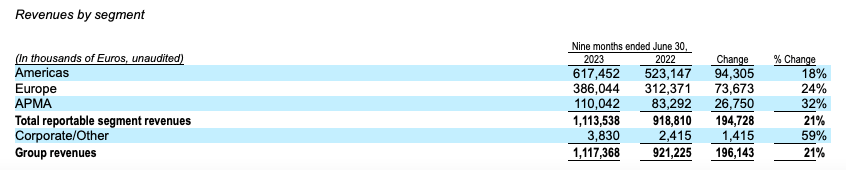

In fiscal 2022, some 54% of the firm’s revenues were generated in the Americas and 36% were generated in Europe, with the Asia-Pacific, Middle East and Africa (APMA) region accounting for the residual reportable segment revenues. Although the APMA region is growing, the firm has been unable to really tap into that because it has prioritized the Americas and Europe, given resource constraints.

Source: Birkenstock Holding Limited 2023 F-1/A

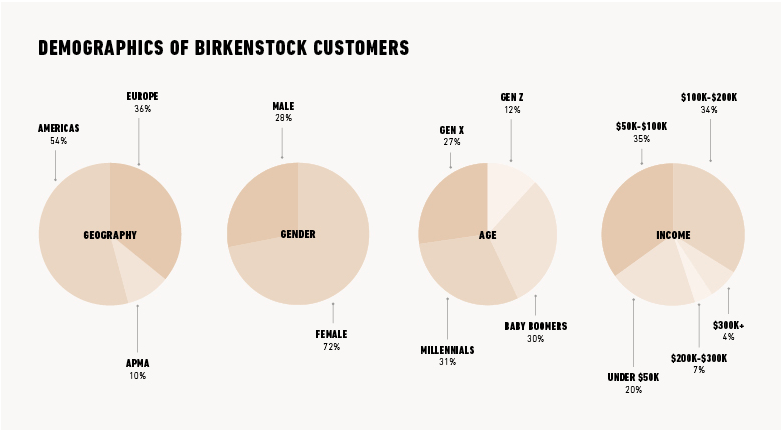

The firm’s products are distributed through its multichannel direct-to-consumer (DTC) and business-to-business (B2B) strategies. The firm’s customer base is quite diverse. In terms of gender, the customer base is skewed, with 72% of the firm’s customers being female, and 28% male. In terms of age, the customer base is more spread out, with Baby Boomers making up 30% of the customer base, millennials making up 31%, Gen X making up 27%, and Gen Z making up 12%. With 39% of customers being Gen Xers and Gen Zers, the firm already has a strong foothold among the youngest customer demographic with its stocks trading at significant markups among this group. Birkenstock’s products are attractively priced, which has made them accessible to a broader income spectrum, so, for instance, 20% of the firm’s customers earn less than €50,000.

Source: Birkenstock Holding Limited 2023 F-1/A

A Fast-Growing 250-Year Old Firm

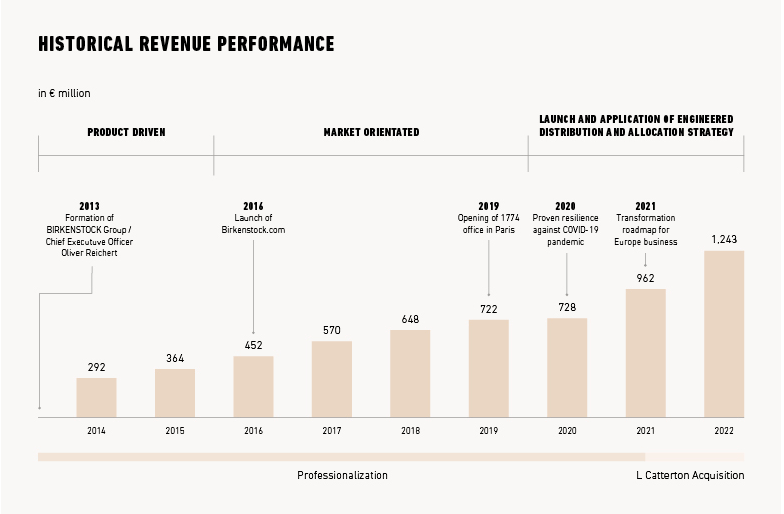

Founded in 1774 by Johann Adam Birkenstock, Oliver Reichert, the company’s CEO and first non-Birkenstock manager, describes Birkenstock as the “oldest start-up on earth”. Under Reichert, who became General Manager in 2009 and CEO in 2013, the firm has evolved away from being a production-focused family business, to a professionally managed business. Reichert has turned the fortunes of this aging business around, finding growth pathways at a time in which most 250-year-old businesses are in terminal decline.

In 2012, the firm received an added boost, when the designer, Phoebe Philo, released a collection of sandals at her Paris show that were inspired by the Arizona silhouette. This was the moment that made Birkenstock a fashion symbol, a status that the brand enjoys to this day. Margot Robbie wearing pink Birkenstock sandals in the movie Barbie, has earned the firm new customers while also growing revenues. Reichert has done a good job at working with partners such as Rick Owens, Stüssy, Dior and Manolo Blahnik, amplifying the brand’s cultural impact, and growing its brand value. It should also be said that Birkenstock produces all of its products within the European Union, and its suppliers are mostly located in Europe. This is to ensure that its products are made to the highest standards. Indeed, most of the products are still made in Germany, which not only ensures quality control but helps to maintain brand value by associating the firm with Germany rather than so many different supply sources. The combination of comfort, attractive pricing and cultural impact has turned customers into repeat buyers, with the typical US buyer owning 3.6 pairs of sandals. Although it is easy to think of the firm’s growth as being simply a “moment”, Reichert writes that, “I always reply then ‘this moment has lasted for 250 years, and it will continue to last.” Given his success and the heritage of the business, it would be wise to back Birkenstock’s ability to keep growing.

Since 2012, revenues have risen from €200 million in 2012 to €1.2 billion in 2022, compounding at 18.07% per year. In the last twelve months (LTM), the firm earned €1.4 billion in revenue.

Source: Birkenstock Holding Limited 2023 F-1/A

In the 2020-LTM 2023 period, Birkenstock has enjoyed a 3-year compound annual growth rate (CAGR) of 31.3%. This post-pandemic surge in growth could be because more people are choosing to walk and choose the most comfortable pair of shoes they can find.

A Profitable Enterprise

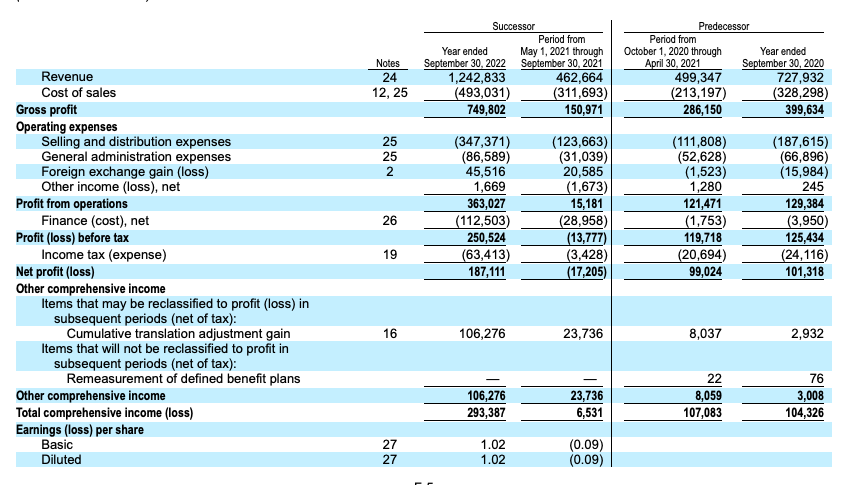

In order to find out how profitable the business is, it’s important to strip away the business’ non-recurring, non-core elements, in order to derive an estimate of core earnings, and thereafter, of net operating profit after taxes (NOPAT). This is important because financial statements are less concerned with being useful to investors than with being useful for the business’ lenders, and so, operating and non-operating items get mixed up. For example, Birkenstock’s earnings are a mix of operating items such as revenue and operating expenses, and non-operating items such as finance (cost), net.

Source: Birkenstock Holding Limited 2023 F-1/A

Before we attempt to get a better view of the firm’s performance, it should also be said that we have to be cautious about the company’s financial statements, given that the firm said that,

“We have identified material weaknesses in our internal control over financial reporting in connection with the preparation of our IFRS financial statements. If we fail to remediate our material weaknesses or if we fail to establish and maintain an effective system of internal control over financial reporting when we are subject to compliance with the Sarbanes-Oxley Act of 2002, we may not be able to report our financial results accurately, meet our reporting obligations or prevent fraud. Any inability to report and file our financial results accurately and timely could harm our business and adversely impact the trading price of our securities.”

Now, buried within the management discussion & analysis (MD&A) and the footnotes, are other items such as IPO-related expenses. By stripping all these items away, we can get a sense of the firm’s true profitability, with NOPAT rising from €64.98 million in 2021, to €208 million in 2022. The company earned €172.96 million in NOPAT in the first nine months of the year. (The filings are absent quarterly estimates from which I can build a profile for the last twelve months).

|

NOPAT |

|||

|

Economic Category (Values in thousands of euros except per share amounts) |

2021 |

2022 |

Nine Months of 2023 |

|

Revenue |

962 011,00 € |

1 242 833,00 € |

1 117 368,00 € |

|

Operating Expenses |

|||

|

Cost of sales |

524 890,00 € |

493 031,00 € |

436 532,00 € |

|

Gross Profit |

437 121,00 € |

749 802,00 € |

680 836,00 € |

|

Gross Margin |

45,44% |

60,33% |

60,93% |

|

Selling and distribution expenses |

235 471,00 € |

347 371,00 € |

309 521,00 € |

|

General administration expenses |

83 667,00 € |

86 589,00 € |

86 836,00 € |

|

Foreign exchange gain (loss) |

22 108,00 € |

45 516,00 € |

51 350,00 € |

|

Other income (loss), net |

2 953,00 € |

1 669,00 € |

2 452,00 € |

|

Total Operating Expense |

869 089,00 € |

974 176,00 € |

886 691,00 € |

|

Total Hidden Non-Operating Expenses, Net |

– € |

29 177,00 € |

14 739,00 € |

|

Hidden Total Restructuring Expenses, Net |

– € |

– € |

– € |

|

– € |

– € |

– € |

|

|

– € |

– € |

– € |

|

|

– € |

– € |

– € |

|

|

Hidden Foreign Currency Expenses, Net |

– € |

– € |

– € |

|

Hidden Other Real Estate Owned Expenses, Net |

– € |

– € |

– € |

|

Hidden Acquisition and Merger Expenses, Net |

– € |

– € |

– € |

|

Hidden Legal, Regulatory, and Insurance Expenses, Net |

– € |

29 177,00 € |

14 739,00 € |

|

Hidden Derivative Related Expenses, Net |

– € |

– € |

– € |

|

Hidden Other Financing Expenses, Net |

– € |

– € |

– € |

|

Hidden Other Non-Recurring Expenses, Net |

– € |

– € |

– € |

|

Hidden Recurring Pension Expenses, Net |

– € |

– € |

– € |

|

Hidden Non-Recurring Pension Expenses, Net |

– € |

– € |

– € |

|

Hidden Company Defined Other Expenses, Net |

– € |

– € |

– € |

|

Adjusted Total Operating Expenses |

869 089,00 € |

944 999,00 € |

871 952,00 € |

|

Adjusted EBIT/EBT |

92 922,00 € |

297 834,00 € |

245 416,00 € |

|

Adjusted EBITA/EBTA |

92 922,00 € |

297 834,00 € |

245 416,00 € |

|

Interest for PV of Operating Leases |

861,00 € |

2 417,00 € |

4 217,00 € |

|

Net Operating Profit Before Tax (NOPBT) |

93 783,00 € |

300 251,00 € |

249 633,00 € |

|

Operating cash taxes |

28 802,82 € |

92 213,67 € |

76 667,77 € |

|

NOPAT |

64 980,18 € |

208 037,33 € |

172 965,23 € |

Source: Company Filings, and Author Calculations

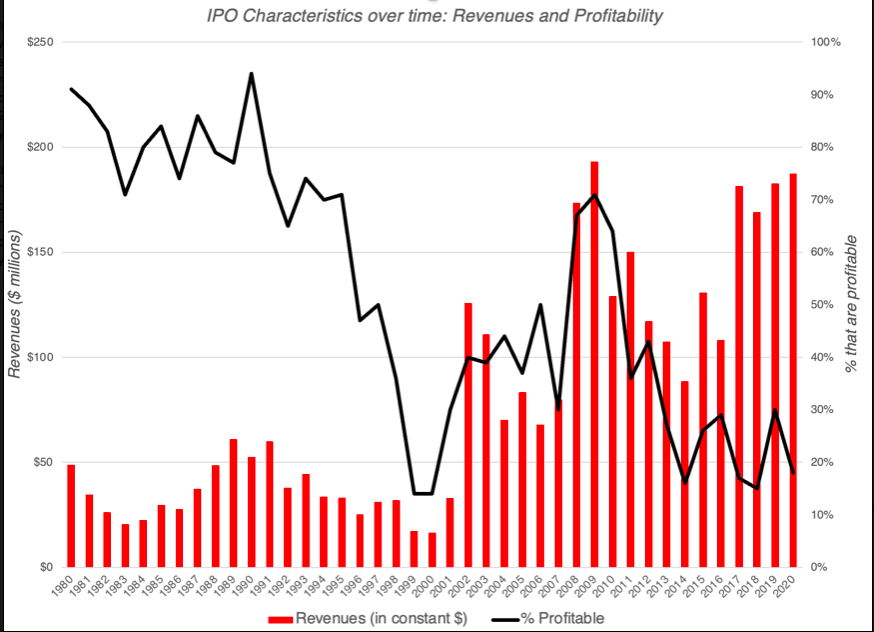

Birkenstock’s profitability is rare for an IPO, given the declining profitability profile of the typical IPO over the last few decades.

Source: Aswath Damodaran

It has to be said, though, that Birkenstock’s return on invested capital (ROIC) is a very unimpressive 5.2% in 2022, and nearly 2% in 2021, which gives a more nuanced perspective of the troubled economics of the business.

The Valuation is All About Growth

The prudent investor has to determine the value of the business in the event that whatever growth the company enjoys does not add additional value to the business. In other words, if the business’s RONIC associated with growth equals the cost of capital, which is the case for the typical business, new growth will not add anything to value. This pessimistic view of a business is necessary because, ultimately, that is where all businesses are headed, so we want to see how much of the price we are paying assumes that the business can be atypical and add value for shareholders. That logic leads us to use the convergence formula, which is grounded in the view that in competitive industries, the return on net new investment (RONIC) converges on the cost of capital, while excess profits are eliminated. So, we have an approach to measuring the convergence value of the business:

|

Convergence Value |

|||

|

Values in thousands of Euros (except per share values) |

2021 |

2022 |

2023 (Estimate) |

|

NOPAT |

64 980,18 € |

208 037,33 € |

230 620,31 € |

|

Discounted value |

8,00% |

8,00% |

8,00% |

|

Continuing Value |

812 252,29 € |

2 600 466,65 € |

2 882 753,83 € |

|

Adjusted total debt (including off-balance sheet debt) |

1 977 033,00 € |

1 528 821,00 € |

1 528 821,00 € |

|

Excess cash (inc. IPO proceeds at top price) |

187 242,45 € |

244 936,35 € |

726 671,46 € |

|

Unconsolidated Subsidiary Assets |

– € |

– € |

– € |

|

Net Assets from Discontinued operations |

– € |

– € |

– € |

|

Value of Outstanding Employee stock option liabilities |

– € |

– € |

– € |

|

Overfunded Pension Plan Assets |

– € |

– € |

– € |

|

Preferred stock |

– € |

– € |

– € |

|

Minority interests |

– € |

– € |

– € |

|

Net deferred compensation assets |

– € |

– € |

– € |

|

Net deferred tax assets |

(88 261,00) € |

(79 047,00) € |

(79 047,00) € |

|

Zero-Growth Shareholder Value |

(1 065 799,26) € |

1 237 535,00 € |

2 001 557,30 € |

|

Price to-date per share |

37,84 € |

37,84 € |

37,84 € |

|

Outstanding shares |

187 825,59 |

187 825,59 |

187 825,59 |

|

Convergence Value |

(5,67) € |

6,59 € |

10,66 € |

Source: Company Filings and Author Calculations

At a zero-growth value of €10.66 per share, or $11.32 per share, nearly 72% of Birkenstock’s share price is based on the assumption that Birkenstock can continue to defy the gravitational pull of competition and enjoy excess profits. If that gravity-defiance doesn’t happen, the share price has a long way to fall. The reader is, of course, encouraged to play around with the figures and see what it takes to justify the offer price range.

Conclusion

Birkenstock has had a late-period renaissance that has seen the brand become synonymous with fashion and comfort and affordability. The business has experienced enormous growth, which is particularly impressive given its 250-year history. However, despite this, the business’s profitability is weak, and 76% of the offer price is nothing more than assumptions about the business’s ability to grow value. That makes it a very dangerous stock to buy.

Read the full article here

Leave a Reply