Investment Action

I recommended a buy rating for BigCommerce (NASDAQ:BIGC) when I wrote about it the last time as I believe the sector BIGC operates in has significant room for expansion, and within this sector, BIGC still possesses numerous opportunities to capture a larger market share. Based on my current outlook and analysis on BIGC, I still recommend a buy rating. BIGC’s revenue growth was robust, and management provided positive guidance for future quarters. Additionally, the company’s focus on achieving profitability is yielding positive results. I expect this profitability trend to continue into FY24, with the potential for sustained positive Adj. EBITDA. The company’s strategic approach to efficient resource utilization, especially in targeting midmarket and enterprise merchants, is strengthening its business model.

Review

BIGC posted robust revenue growth of 11% y/y in 2Q, primarily driven by exceptional performance in the Non-Enterprise segment. The company’s Total Annual Recurring Revenue (ARR) increased by 12.0% compared to the same period last year, reaching $331.1 million. This represents a 4.5% sequential quarterly increase, a notable improvement from the previous quarter’s 1.6% sequential growth and a strong 12.9% YoY growth.

On the profitability front, BIGC reported positive Adj. EBITDA of $2.5 million, reflecting a remarkable 15.6 percentage point improvement in operating margins due to effective cost control measures. I am optimistic about the company’s prospects, and I believe there is a reasonable chance that BIGC could achieve its first positive operating income quarter in 2H23 (both Adj. EBITDA and non-GAAP operating income are approaching breakeven levels). I expect this trend of profitability to continue into FY24 and believe that the company has the potential to maintain positive Adj. EBITDA for the entirety of FY24, with the reset of FICA payroll taxes in 1Q serving as a potential factor that could impact this outcome. Moreover, management remains committed to efficiently utilizing its capital resources. They are directing a significant portion of their sales and marketing expenditure towards midmarket and enterprise merchants, prioritizing the superior unit economics in these segments. This strategic approach is contributing to the development of a more efficient business model, which I anticipate will strengthen further as it continues to take hold in an improving macroeconomic environment. The topline growth initiatives should also help drive the business to positive profitability. On the point of pricing, BIGC recently implemented a price increase, and some investors might worry that it would cause churn. I beg to differ as management mentioned that this pricing adjustment has had a limited impact on customer retention, underscoring the platform’s value to its users.

Finally, Steven will take the helm of BIGC’s sales, marketing, and services teams, with the goal of driving growth both within the Enterprise sector and across the entire company. Steven brings with him a wealth of experience from his previous roles at Delphix and PagerDuty, where he played key roles. Notably, he also served as the global sales leader at Demandware, overseeing the company’s successful transition to an upmarket focus before its acquisition. I see this decision as a positive one, given Steven’s excellent and highly relevant background. His addition to the team is expected to enhance collaboration across the executive leadership and sharpen the company’s focus on expanding into the upmarket segment. Overall, I maintain a positive view of the company’s vision and believe it is making the right strategic moves as it navigates a challenging business environment and allocates its resources to higher return-on-investment opportunities in the upmarket space.

Valuation

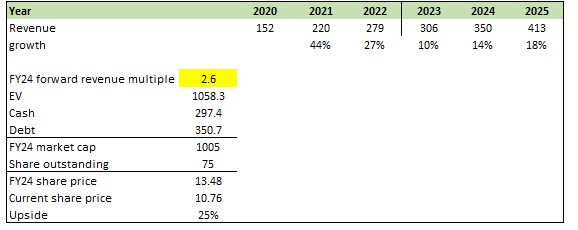

Author’s work

I believe BIGC can continue as management guided for FY23, followed by growth acceleration in the coming years (similar growth assumption as I had previously). My revenue projections are anchored in management’s optimistic guidance for the 4Q, bolstered by BIGC’s strong performance in 2Q23. BIGC’s recent results underscore the continued strength and growth potential of the ecommerce sector. I firmly believe that BIGC is well-positioned to capitalize on this ongoing trend and sustain its growth trajectory. However, I expect BIGC to continue trading (2.6x forward revenue) at a discount to peers like Shopify and Squarespace, 9.8x and 4.3x respectively, as it is still a much smaller player compared to them, with a lower margin profile (albeit turning profitable). The good news is, this also means that BIGC has room to catch up if they can show a similar fundamental profile in the long term.

Risk and Final Thoughts

As for risk, I believe current economic conditions may lead to a reduction or delay in corporate spending on enterprise software solutions. BIGC faces stiff competition in the competitive ecommerce platform solutions market, where it competes against larger and better-funded rivals who could potentially apply pricing pressure that might negatively impact its revenue growth.

My final thoughts are that I maintain a buy rating for BIGC based on its strong performance in 2Q23 and positive outlook. The company’s robust revenue growth, particularly in the Non-Enterprise segment, reflects its solid momentum. Positive Adjusted EBITDA results and improving operating margins indicate a favorable trend towards profitability, with the potential for sustained positive Adjusted EBITDA into FY24. BIGC’s strategic approach to efficient resource utilization, especially in targeting midmarket and enterprise merchants, strengthens its business model and contributes to profitability. The recent price increase, while significant at 33%, has had a limited impact on customer retention, emphasizing the platform’s value.

The addition of Steven to lead sales, marketing, and services teams is a positive move, enhancing collaboration and upmarket expansion. Despite the competitive ecommerce market and potential economic challenges, I believe BIGC is well-positioned to capitalize on the ongoing trend in the ecommerce sector.

Read the full article here

Leave a Reply