The COST Investment Thesis May Never Come Cheap

We previously covered Costco Wholesale Corp. (NASDAQ:COST) in June 2023, discussing its excellent prospects as inflation abated and comparable sales expanded.

Thanks to the elevated interest rate environment, more consumers also flocked to COST due to its attractively priced offerings, triggering its all-time high annual membership renewal domestically and internationally.

For now, COST has reported excellent YoY growth in its first 52 weeks of FY2023 sales to $232.95B (+4.6% YoY), mostly attributed to the Canada segment at +8% YoY and the international segment at +7.9% YoY.

While further financial details have not been released prior to its upcoming earnings call in September 26, 2023, it appears that the company may accomplish another stellar FQ4’23 earnings call ahead.

This is because the Canada segment has previously reported excellent operating margins of 4.1% (-0.1 points YoY) and International segment at 3.9% (-0.2 points YoY), compared to the US at 2.9% (-0.2 points YoY) and overall company at 3.2% (-0.2 points YoY) for the 36 Weeks ended May 7, 2023.

We believe these developments may eventually contribute to COST’s expanding profitability, building upon the growth that we have seen in the first three quarters of FY2023, with increasing operating incomes of $5.62B (+3.8% YoY) and steady operating margins of 3.4% (inline YoY).

Since most COST investors are likely also its loyal consumers, its membership fee strategy requires no introduction as well. Its growing membership revenues of $3.07B (+6.2% YoY) in the first three quarters of FY2023 have directly flowed into its bottom line as well, comprising 65.8% of its profitability (+6.3 points YoY).

This alone justifies the stock’s premium valuations and bellwether status, since it has performed extremely well in both normalized and elevated interest rate environment, thanks to the robust support base from both the members and long-term shareholders.

Market Sentiments Continue To Support COST’s Premium Valuations, Similar To AAPL

COST’s cadence strangely reminds us of Apple (AAPL), a stock that similarly defies peak recessionary fears, with its products’ “installed base reaching an all-time high across all geographic segments” by the latest quarter.

Most importantly, its most expensive iPhone 14 Pro Max priced at $1,099 is also “the single most popular of the new phones,” making up 35% of the overall sales during launch in September 2022.

Despite AAPL’s supposed hike of the iPhone 15 Pro Max price to $1,299 (+18.1%), we do not doubt its superior branding power and loyal fan base as well, with the Cupertino giant already guiding “iPhone and Services YoY performance (to) accelerate from the June quarter.”

Incidentally, both COST and AAPL chose to outsource much of their manufacturing to lower-cost regions, such as Africa/ Vietnam for the former and China for the latter.

While COST has chosen to pass on the savings to its consumers, thanks to its membership fee strategy, the excess Free Cash Flow has also been used to aggressively expand its presence to 861 global warehouses by August 2023 (+2 warehouses MoM/ +23 YoY/ +78 from FY2019 levels).

The increasing footprint has naturally grown its loyal member base to 69.1M paid household members (+1M QoQ/ +4.7M YoY) and 31.3M paid executive members (+0.7M QoQ/ +3.4M YoY) by the May 2023 quarter.

AAPL has also made great use of its excellent Free Cash Flow generation by retiring 2.63B of shares over the past four years, naturally validating its long-term shareholders’ conviction buy.

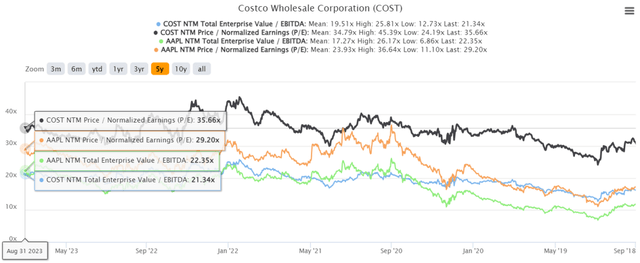

COST 5Y EV/EBITDA and P/E Valuations

S&P Capital IQ

Combined with Warren Buffett’s 5.8% stake in AAPL, we are not surprised by the premium embedded in both of their stock valuations, with COST trading at NTM EV/ EBITDA of 21.34x/ NTM P/E of 35.66x and AAPL at 22.35x/ 29.20x, respectively.

This is compared to the Food And Staples Retailing sector median of 9.63x/ 14.15x and Tech Hardware/ Software sector median of 13.23x/ 20.46x, respectively.

Then again, investors must be aware that Mr. Market continues to award these two companies their premium valuations, despite the projected deceleration in AAPL’s top and bottom line growth at a CAGR of +3.4%/ +5.7% through FY2025, similar to COST at +6.1%/ +9.3%, respectively.

This is compared to AAPL’s normalized CAGR of +10.6%/ +19.7% between FY2016 and FY2022, and COST’s at +11.4%/ +16.4%, respectively.

However, for so long that COST continues to execute well, thanks to its membership fee strategy, expanding global footprint, and stellar balance sheet with a net cash level of $7.21B (+35.2% YoY), we maintain our belief that the stock may never come cheap after all.

With its five/ six year anniversary coming soon, investors may also look forward to its eventual membership fee hike, further boosting its bottom line.

So, Is COST Stock A Buy, Sell, or Hold?

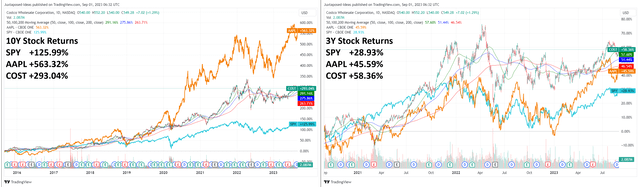

COST 3Y/ 10Y Stock Price

Trading View

Thanks to their long-term shareholders’ sustained support, the same outperformance by COST has also been observed over the past three years of hyper-pandemic period and ten years, further strengthening our long-term investment thesis.

Naturally, since past performance is no guarantee of future results, it remains to be seen how COST will perform over the next decade, especially due to its premium valuations.

On the one hand, COST’s valuations have steadily climbed over the past two decades, demonstrating its robust position as one of the bellwether stocks in the market.

On the other hand, there will be a ceiling to this climb after all, since it is uncertain if we may see its valuations further double as to how its EV/ EBITDA valuation has, from 10.91x in September 2013 to 21.34x in September 2023, and P/E valuation from 23.05x to 35.20x, respectively.

Based on its current valuations and the consensus FY2025 adj EPS of $17.32, we are looking at a long-term price target of $617.63, suggesting that most of its upside potential is already pulled forward as well.

As a result of the baked-in premium, it is naturally not easy to recommend a Buy for the COST stock, since it really depends on individual investors’ cost averages and investing style.

Therefore, since we will not be adding to our portfolio, thanks to our full position from our previous four buy rating articles, we shall be rating the COST stock as a Hold (Neutral) here. If any, interested investors may want to add at any pullbacks for an improved margin of safety.

Read the full article here

Leave a Reply