Berkshire Hathaway (NYSE:BRK.B)(NYSE:BRK.A) is one of the most iconic companies in America. Warren Buffett and Charlie Munger have built the greatest holding company that quite possibly will never be replicated. Over the years, they have acquired 77 operating companies and amassed a stock portfolio worth over $330 billion. Purchasing shares of Berkshire Hathaway provides direct access to a diversified portfolio of private operating companies within the insurance, manufacturing, services, retailing, railroad, utilities, and energy sectors. Berkshire Hathaway shares also provide an indirect investment across 48 publicly traded companies, which includes over 915 million shares of Apple (AAPL), over 1 billion shares of Bank of America (BAC), and 400 million shares of the Coca-Cola Company (KO). While Berkshire Hathaway owns shares in both the Vanguard S&P 500 ETF (VOO) and the SPDR S&P 500 Trust (SPY), and Mr. Buffett continuously preaches about investing in the S&P, shares of Berkshire Hathaway are up 32.71% over the past year, and have outperformed the S&P over multiple periods from a long-term perspective. While Berkshire Hathaway is making all-time highs, I think it’s still a solid investment as we head into 2024.

Seeking Alpha

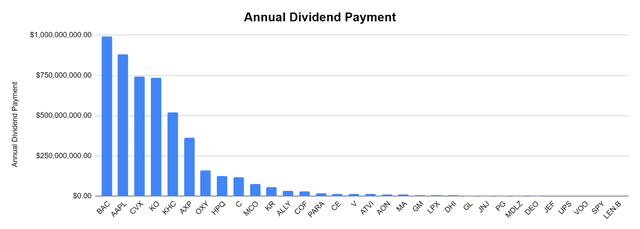

Berkshire has amassed a stock portfolio that is generating almost $5 billion in dividend income before a single dollar is made from its operating companies

Berkshire Hathaway’s balance sheet is one of the most intriguing reasons to own shares of Berkshire Hathaway. At the close of Q2, Berkshire Hathaway had $44.6 billion in cash on hand, $97.32 billion in short-term Treasury Bills, $22.35 billion in fixed maturity securities, and $353.41 billion invested in equities. This didn’t include its operating companies’ cash or other assets, either. Berkshire Hathaway is famous for having a large war chest and deploying capital opportunistically. Prior to generating a single dollar of profits, Berkshire Hathaway is rolling almost $100 billion in short-term treasury bonds to generate income and has a stock portfolio that generates almost $5 billion in annualized dividend income. Putting market cap aside, Berkshire Hathaway could be the greatest company because they have a built-in fortress of incoming capital prior to its business segments opening the doors.

Steven Fiorillo, Whale Wisdom

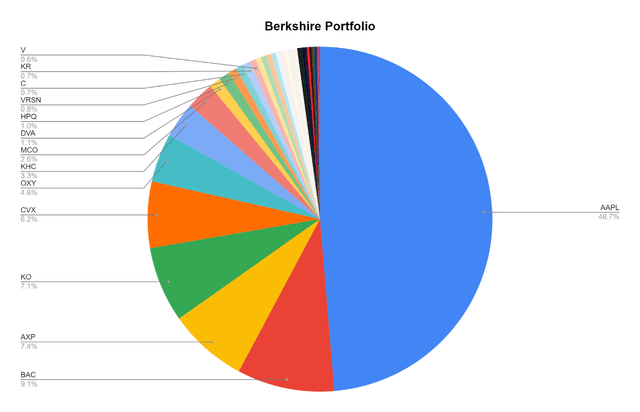

Berkshire Hathaway has invested in 48 public equities with investments across the communications, consumer discretionary, consumer staples, energy, finance, healthcare, information technology, materials, transport, and telecommunications sectors. After going through their 13-F filings, it looks like Berkshire Hathaway has deployed $162.32 billion toward these investments. Today, these investments are worth $330.55 billion, a profit of $168.23 billion or 103.64%. Berkshire Hathaway owns 915.56 million AAPL shares, representing 48.68 of its equity portfolio. Berkshire Hathaway paid roughly $36.27 billion for these shares, now worth $160.9 billion. Playing the long game has worked out well for Berkshire Hathaway and its shareholders.

What I find the most interesting is the amount of dividend income being generated from these holdings. Berkshire Hathaway is generating $4.95 billion in annualized dividend income from its equity portfolio. BAC is paying Berkshire Hathaway $991.54 billion in annualized dividend income, while its shares of AAPL are generating $878.94 billion in annualized dividends. There are 3 other companies within Berkshire Hathaway’s portfolio whose annualized dividend income exceeds $500 million, including Chevron (CVX), KO, and Kraft Heinz (KHC). There are currently 32 companies held on Berkshire Hathaway’s balance sheet that provide dividend income, and while both the investment and dividend metrics are top-heavy, this portfolio is a baby total market fund.

There may never be another Berkshire Hathaway, and while there are publicly traded companies that own strategic underlying assets, they haven’t amassed an equity portfolio in the fashion that Berkshire Hathaway has. Shares of Berkshire Hathaway may be the best of both worlds, as you’re getting indirect exposure to a mini ETF of publicly traded companies while having a stake in 77 privately held companies.

Steven Fiorillo, Whale Wisdom, Seeking Alpha

Berkshire Hathaway’s operating companies produce a windfall of revenues and profits for shareholders

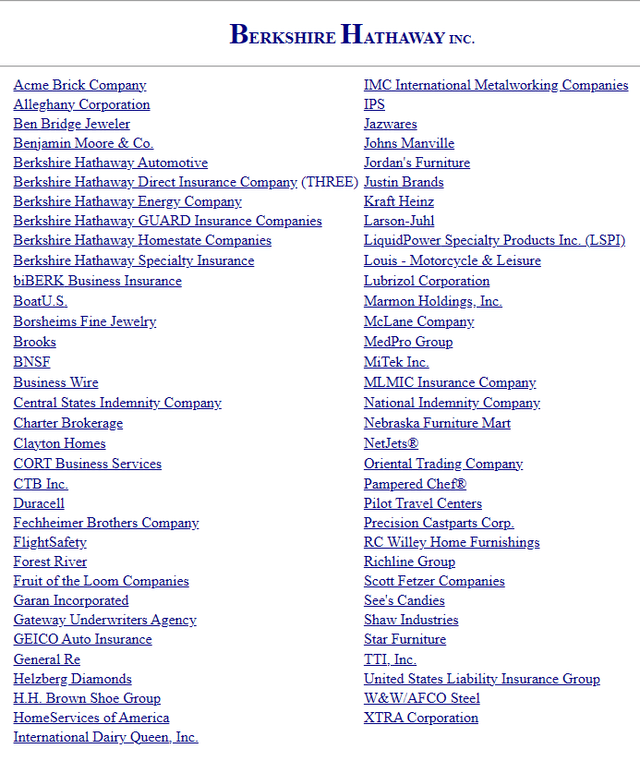

Berkshire Hathaway directly owns 77 operating companies. For those who are unfamiliar with their holdings, I put all the companies Berkshire Hathaway owns below. I think some would be surprised that companies such as Benjamin Moore, Business Wire, Duracell, Helzberg Diamonds, Dairy Queen, and NetJets are owned by Berkshire Hathaway.

Berkshire Hathaway

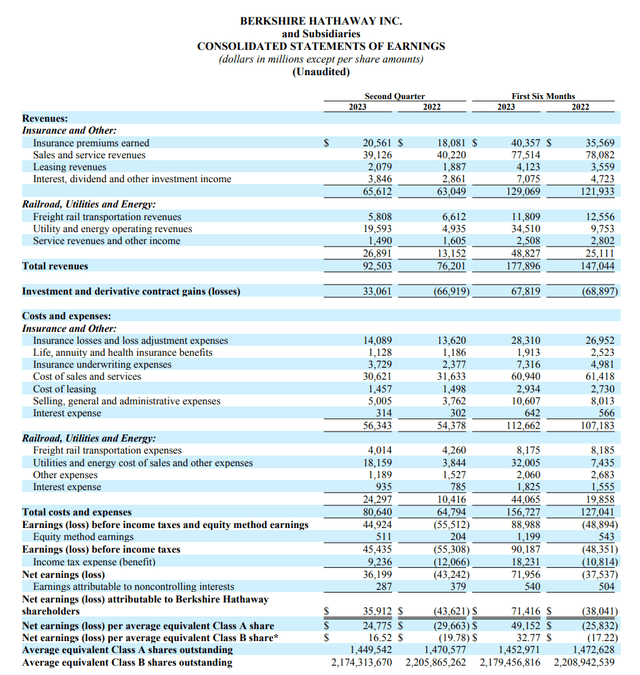

In Q2 2023, Berkshire Hathaway generated $65.61 billion in revenue. Its revenue mix comprises sales and service revenue ($39.13 billion or 59.63%), insurance premiums ($20.56 billion or 31.37%), leasing revenue ($2.08 billion or 3.17%), and investment income from interest, dividends, and other means ($3.85 billion or 5.86%). That’s very interesting, considering that Berkshire generated over $1 billion per month in investment income in Q2. BRK.B generated $92.5 billion in total revenue over the 3-month period in Q2 2023, which was more than AAPL’s $81.8 billion revenue or Alphabet’s (GOOGL) $74.6 billion revenue. Berkshire is also widely profitable, as their net earnings were $36.2 billion in Q2. These numbers aren’t a fluke, either, as Berkshire Hathaway generated $129.07 billion in revenue for the first 6 months of 2023 and produced $71.96 billion in net earnings.

Berkshire Hathaway

Many people discuss AAPL, GOOGL, and Microsoft (MSFT) being the most profitable companies, but Berkshire Hathaway is right up there with them. Berkshire Hathaway also uses its earnings power to generate value for shareholders through a robust share repurchase program. Berkshire Hathaway’s repurchase program allows Berkshire to repurchase its Class A and Class B shares at prices below Berkshire’s intrinsic value, determined by Mr. Buffett and Mr. Munger. Berkshire’s policy has a fail-safe within it where shares cannot be repurchased if the buyback reduces the total amount of Berkshire’s consolidated cash, cash equivalents, and U.S. Treasury Bills holdings below $30 billion. This ensures that Berkshire Hathaway will continuously be in a cash-rich position through redundant liquidity. In the first 6-months of 2023, Berkshire returned $5.8 billion to shareholders in the form of repurchasing its Class A and B common shares.

Shares of Berkshire Hathaway have outpaced the S&P 500 from a long-term perspective, not just in the past year

Over the past year, shares of Berkshire Hathaway appreciated by 32.71%. When I look at the S&P, I use SPY as my baseline metric because it’s arguably the most well-known S&P 500 index fund. SPY has trailed Berkshire, having appreciated by 14.13% over the past year. This isn’t a fluke, as when I look at Berkshire Hathaway compared to SPY over a 10 and 20-year period, Berkshire comes out on top.

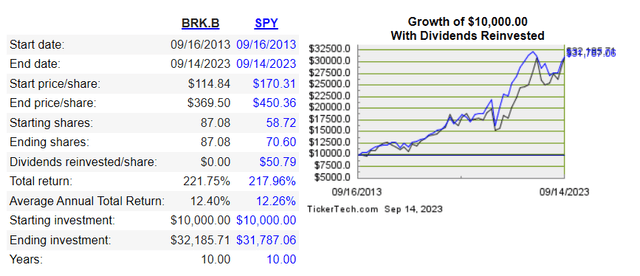

I like using the tool from the Dividend Channel because it calculates the total return of all dividends being reinvested. An investment of $10,000 in Berkshire Hathaway would have appreciated by 221.75% over the past decade, while that same $10,000 would have appreciated by 217.96% in SPY with the dividends reinvested. While they finished close, investing in Berkshire Hathaway outpaced an investment in SPY.

Dividend Channel

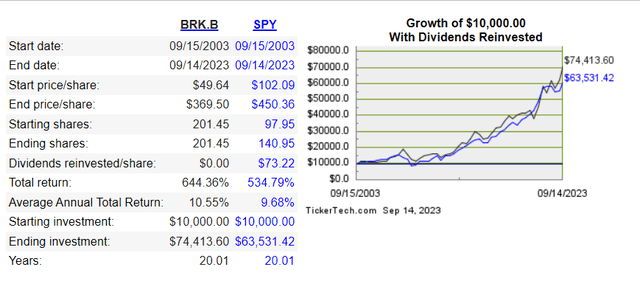

Looking back over a 20-year period gets interesting. While both investments have done excellent, investing in Berkshire Hathaway outperformed the market. Investing in SPY after the dividends were factored in turned an investment of $10,000 into $63,531.42 for a return of 534.79%. Without paying a single dividend, Berkshire Hathaway beat the market over the 20-year period and turned $10,000 into $74,413.60 for a return of 644.36%. Many investors who pick individual stocks have trouble beating the market over long periods, but investing in Berkshire Hathaway has provided investors with a diverse basket of investments and a track record of beating the market.

Dividend Channel

Conclusion

I am bullish on Berkshire Hathaway for the long haul, as the secret to its success can continue long after Mr. Buffet and Mr. Munger hand over the keys to the kingdom. When Berkshire Hathaway acquires a company, they are not just acquiring the company; they are acquiring the management team to run the company. Berkshire Hathaway has taken a hands-off approach to its operating companies as they acquire already fine-tuned companies. Berkshire Hathaway is in a position where it’s on track to generate over $10 billion from investment income alone in 2023, and when its operating companies are brought into the mix, Berkshire could exceed $100 billion in net earnings for 2023. Berkshire is one of the largest cash cows and is in a position to grow through allocating capital in both the public and private markets. I think Berkshire is the greatest holding company, and it will be exceptionally hard for anyone to replicate what has been built at Berkshire. Investing in Berkshire Hathaway provides a unique opportunity because you get 77 private operating companies, a stock portfolio of 48 public equities, and a pile of cash on the side. I think Berkshire Hathaway is positioned to continue outpacing the returns of the market, and even at all-time highs, I think Berkshire is a good investment.

Read the full article here

Leave a Reply