Dear readers/followers,

One of my very few forays into the semi industry has been investing in BE Semiconductor (OTC:BESIY). I’ve been covering the business for over a year at this point and mostly held very conservative overall targets for what I view as one of the better assembly equipment manufacturers on the planet.

What BESI does is not something all, or even many companies can do. These are the types of investments I like going into because they offer a substantial moat. However, while I went positive 2 articles ago and this article should be viewed as an update of my thesis on BESI, the latest article which can be found here, actually called for the company to be a “HOLD”.

Why?

Because while I was positive for most of 2022, calling again and again for investors to consider “BUY”ing the company, I did not expect things to go this high.

Have I sold my BESI position, which by the way is invested in the native ticker BESI on the AMS stock market?

I have not – not at this time – though the recent decline certainly made a case for why I, in this case, have been far too lenient in holding onto my shares, given the company’s current valuation.

Let’s look at recent BESI results and try to forecast where things might go from here.

BESI – An upside based on massive growth in semi equipment

The semi sector is both simple and complex. In essence, what you’re investing in here is betting on just “how high” the trends from things like AI and continued digitization are going to drive the results of companies within the sector. BESI is in a very good position to take advantage of this, despite a current forecasted earnings decline of almost 25% for the 2023 period.

Why?

Because BESI is without a doubt a market leader.

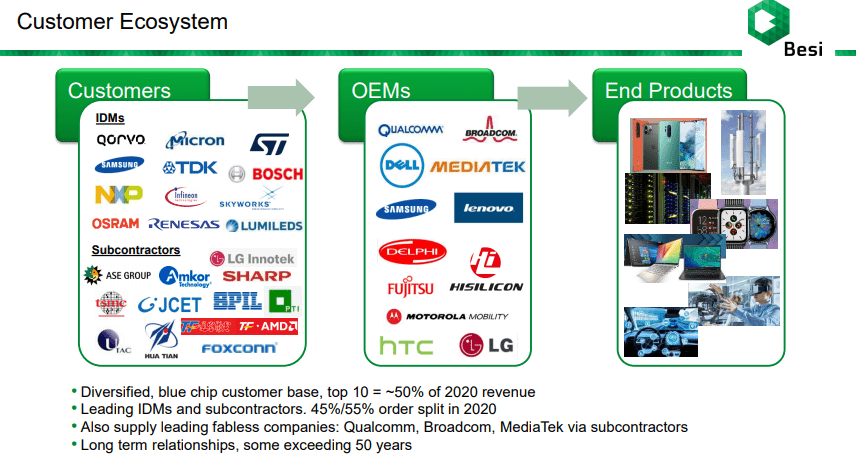

BESI IR (BESI IR)

The companies, with customers like Foxconn and other major players on the field, are perhaps one of the more important businesses in the entire ecosystem. I was asked often in 2022, when the company actually traded at below 20x P/E, why I was so confident that this company would eventually turn up.

This is what I answered.

Because simply put, the company’s current performance is significantly above where things have been in terms of the last industry cycle, which we saw between -17 and -18. Comparing 2018 troughs to 2022 troughs showcases massive, double-digit increases in revenue, operating profit, operating margin, and order sizes/volumes.

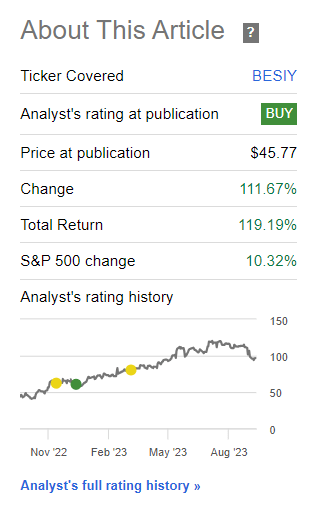

And certainly, if you’re willing to go back to 2022 when I was positive on the business, you can see why this has become a triple-digit RoR for me.

Seeking Alpha BESI IR (Seeking Alpha)

I know from the lack of messages and commentary that not many of you, dear readers, followed me on this company. It’s a failure on my part that I did not rotate or trim my position before now. But, compared to other things, it’s unfortunately a rather modest position, as I diversified my holdings in 2022. Still, I have an average cost basis that based on today’s share price has given me a 99.3% RoR for my position – and because this is in less than 2 years, this is nothing to sneeze at.

But, to be clear, I still failed to trim and secure some of those profits.

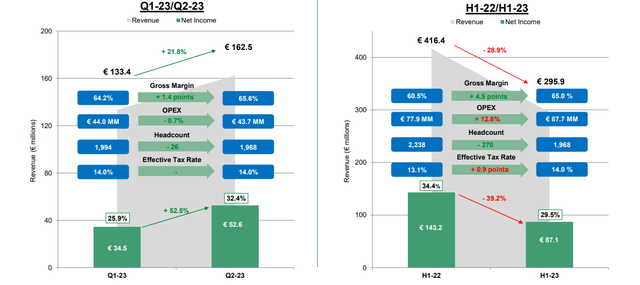

For 2Q23, the last set of results we have for BESI, the company reported significant margin improvement. Gross margins are up to 65.6%, which is a record level for the company, while also reducing company OpEx. Operating income is in fact up 50.8%, even if on a YoY basis it’s down 32%, due to how extremely uptrending 2022 was. Company EPS is showing the same trends – massive decline YoY, but significant growth sequentially. This was mostly the story of this quarter. (Source: 2Q23, BESI)

1H23 saw a significant impact from weakness in computing applications. It’s better to show the trends visually to show you just how extreme the variance is between sequential and year-over-year results.

BESI IR (BESI IR)

As you can see, very significant indeed. However, on the whole of it, BESI remains one of the more cyclical semi-companies out there. It really moves in accordance with industry equipment cycles – and the company’s current indicators call for a significantly improved performance versus the last industry downturn. BESI is also taking advantage of the robust cash inflow we’ve seen over the past few years, both in dividends and buying back shares. I am not a fan of the company buying back any shares at this inflated valuation, but share repurchases are nonetheless a continued component of the company’s capital allocation plans. (Source: 2Q23, BESI)

I have, thankfully, also received significant dividends since I first staked out my investment in the company. Therefore, my RoR as it stands today is at a point where I would consider it very attractive.

And while BESI remains a net cash company with millions, that cash position is now starting to decline. In 2021, it peaked at over €370M in company cash. The buybacks and other measures have seen this decline significantly though, to where we now are at €74M. (Source: 2Q23, BESI)

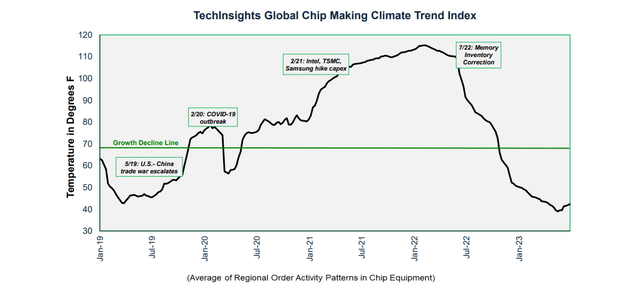

Understanding BESI’s market cyclicality and order patterns is key to being able to invest in BESI successfully. We’ve seen an extreme high during 2022, which logically means we’re cycling down now, much like we saw back in 2019.

BESI IR (BESI IR)

However, despite this trend, which according both to company results and data, as well as industry data, seems to have bottomed in 2Q23, the company still trades at what I would consider a downright prohibitive level of valuation. So when is this market going to rebound? 2024? 2025?

I would say, based on current industry growth trend forecasts (Source: TechInsights) which are working from a double-digit, 20%+ downturn in the fiscal of 2023, we can expect a reversal in 2024, but nothing close to 2022 until at least 2025E. However, beyond that, it will likely continue to grow into 2025-2026E, which should put 2026E at the same level as the record 2021.

BESI revenue peaked in 2021 at a level of €749M, with a current LTM of €757 (but this includes too much of 2022 to be accurate, I expect this to drop.). At the LTM 2Q23 level, we’re already below €560M for the year. (Source: 2Q23, BESI)

It’s my expectation and forecast that we’re going to see a significant decline in 2023 for both the company’s earnings as well as the company’s current revenue.

It’s my fond hope that the company’s share price will decline significantly as a result of this, to where we can see an upside again not just based on a significant P/E premium, but on a conservative P/E of around 15x.

It’s what I want to talk about when it comes to valuation. BESI’s business is a very solid one, and it’s improving. The company has seen a significant market cap expansion compared to the last 5 years, and an internationalization of its shareholder structure, with major shareholder positions going from local NL shareholders to US/UK, a typical sign that a publically traded company is growing. I was part of this trend, and for that, I am grateful, even if my position, in hindsight, was far too modest for how good things actually are.

Let’s look at the valuation and upside we could expect for BESI from here, and why I am not only at “HOLD”, but also why I trimmed my position in the company last week.

BESI – There are things to like, but valuation is not one of those things

Obviously, we cannot call a company like BESI, trading at over 38x P/E, cheap at this point in time. My YoC is close to 6.5% on a portfolio-wide basis, this is now at 3.11%. The company’s fundamentals continue to be absolutely stellar, but the problem is that there, in the context of company valuation, does not exist an “easy” sort of upside for the company.

If you forecast BESI at 38x, sure. You’re seeing almost 40% annualized return, implying a 2025E share price of almost €190/share – and you can probably guess how likely or attractive I consider such an estimate to be, given that I bought my shares under €50/share.

No, 38x P/E does not work for me. Even forecasting the company at its 5-year normalized 22x P/E from this valuation means you’re in for only 10% annualized – and that’s the more positive set of expectations I was willing to consider here. It does not meet my minimum requirements of a 15% annualized, conservative RoR. On a 15x P/E, which is more conservative, the current forward RoR is a negative 12% RoR.

The company’s current thesis is all about navigating and handling the downside that we’re seeing in the industry. Once this reverses and things go back up, the company will see growth again. Investments are being made in Vietnam and Singapore, expanding the company’s cleanroom and support functions in the meantime as the industry is coming to grips with the current order levels.

In my last article, I gave BESI a PT of €68/share. I’m bumping it as of this article, seeing a higher upside once the cycle goes up again. But not as much as you might think. I would forecast BESI at a conservative 18-20x P/E of the next upcycle, which currently comes to a €79/share PT for the company, on a conservative 2025E. But if you get the company below, or at this price, I believe you’re in for a good upside.

S&P Global analysts have far higher targets. 17 analysts following the company, but only 7 at a “BUY” rating, give the company a range of €68 to €128, with an average of €105/share. This, by the way, is up from a PT of less than €60 only 2 years ago. While my PT shift here is significant compared to how I usually adjust my price target, it sees BESI as a more permanent component of my portfolio and a long-term target.

I do believe that if you bought BESI as I did, and if you’re sitting on significant returns, you should be considering your portfolio goals and targets. On a 2-year forward basis, I believe it is more likely that BESI will continue to decline rather than go up, at least until the reversal becomes clearer.

I’ve rotated 50% of my position in BESI – and continue to look for investments that could mark good opportunities here.

Thesis

My thesis for BESI is as follows:

- BESI is a class-leading and market-leading company in the semi-sector, with several advantages over peers and similar companies. It has excellent RoR and a good yield but needs to be bought at a good valuation to offer a compelling, long-term upside. It can also be sold as sort of a trading play, offering good returns in the short term as well.

- At the right valuation, BESI represents a solid “BUY” – but most of my position at this time is down to around 20% of my original stake.

- However, the current valuation calls for a “HOLD” for the company, my PT is €79/share.

- I have now rotated 50% of my position at a RoR of almost 100%. I continue to look at trimming what remains.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

The company is neither cheap nor at an attractive enough upside. I’m calling it a “HOLD” here.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply