Welcome to another installment of our BDC Market Weekly Review, where we discuss market activity in the Business Development Company (“BDC”) sector from both the bottom-up – highlighting individual news and events – as well as the top-down – providing an overview of the broader market.

We also try to add some historical context as well as relevant themes that look to be driving the market or that investors ought to be mindful of. This update covers the period through the last week of September.

Market Action

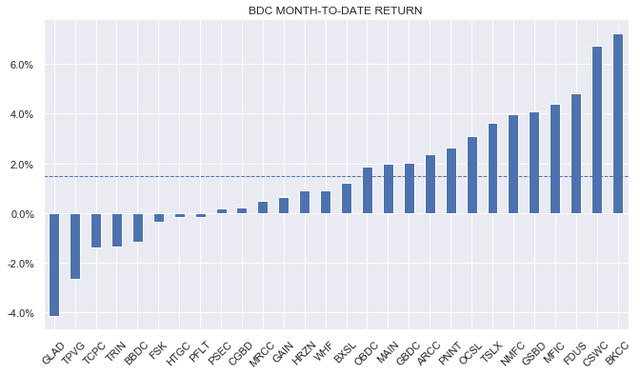

BDCs had a good week with a small positive return. For September, the sector has generated a total return of around 1.5% beating every other income sector save for MLPs.

Systematic Income

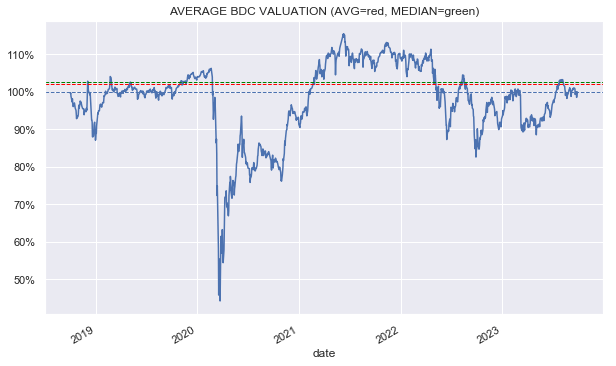

Aggregate sector valuations remain anchored around 100% – slightly below the longer-term sector average.

Systematic Income

Market Themes

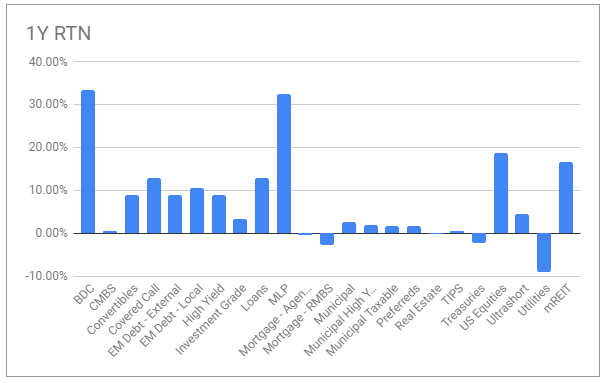

BDCs have remained resilient since the start of the higher volatility period in the income market that kicked off in 2022. Over the past year BDCs have delivered the best return across the various income sectors we follow as the chart below shows, narrowly edging out MLPs.

Systematic Income BDC Tool

What explains this strong level of performance for a sector that has tended to feature a high level of volatility historically?

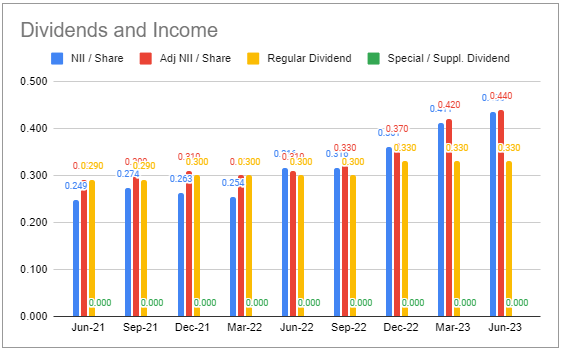

First, and most obvious, the sector has benefited from a mostly floating-rate profile. The median company in our BDC Tool coverage has 96% of its portfolio in floating-rate assets. Since the Fed started to hike rates last year, the income generated by these assets has increased sharply. For example, Golub BDC (GBDC) net income has increased by 42% since the end of 2021 as we can see below. An important point here is that BDCs, unlike loan CEFs, have roughly half of their borrowings in fixed-rate debt, much of which was acquired prior to the back-up in rates. This is a secondary factor that has caused a sharp rise in net income.

Systematic Income BDC Tool

Second, borrower distress has been relatively contained as sector non-accruals and realized losses have been modest. This has been in large part due to an economy that remains relatively strong, a less cyclical focus of BDC portfolios as well as greater flexibility that private lenders like BDCs have in managing their borrowers.

Finally, unlike in other income areas like CEFs, BDC valuations have remained very strong. For example, while the median loan CEF is trading at a discount of 8%, the median BDC in our coverage is trading at a 2% discount. This valuation resilience is due to the factors above as well as the fact that BDC NAVs tend to be significantly lower beta than investment vehicles holding public credit assets.

Overall, BDCs remain attractive holdings in the current environment, particularly as the Fed looks to be set for the higher-for-longer course. However, investors have to be mindful that the economy continues to slow while high base rates continue to put pressure on borrowers. In our view portfolios are likely to deteriorate somewhat over the coming quarters while valuations are more likely to cheapen than to richen from here.

Market Commentary

Trinity Capital (TRIN) announced an adjustment to the conversion of its 2025 6% convertible bonds. As a result the conversion price was adjusted lower to $13.17 per share of common stock from $13.40 previous. The stock closed the week at $13.92.

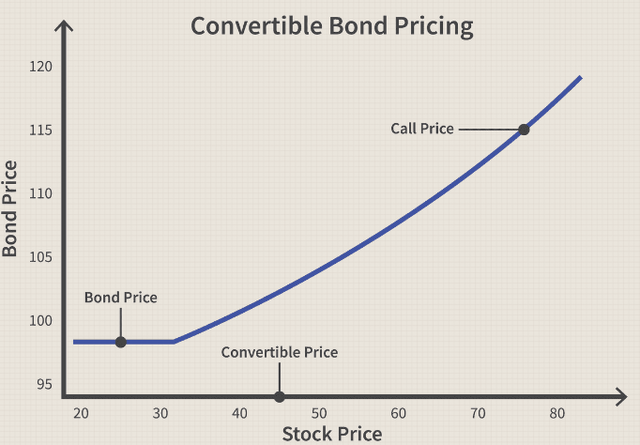

Convertible bonds are an attractive type of debt for issuers because they carry lower coupons than traditional bonds. This is because convertible bonds feature an option for holders which compensates for the low coupon. This option allows holders to convert the bonds into shares of common stock at the conversion price.

This means that while a traditional bond pays off $100 in the best case, a convertible bond can return significantly more than $100 to investors in case the stock price rises high enough, allowing holders to convert their bonds to common shares. Another benefit to the issuer is that a conversion to common shares reduces borrowings (without a need to deleverage), reducing leverage and interest expense.

Investopedia

However, there are two costs. First, if the stock rises fast enough, the company, in effect, sells shares too low – a dynamic familiar by anyone who has sold calls while the underlying moved well above the strike price.

And two, in case of conversion, net income to existing shareholders will be diluted since the same level of income is now spread out across more common shares. If all of the bond is converted, TRIN net income per share is due to fall by 5.5% to $0.52. This issue is likely to be only temporary as the company can issue additional debt to finance new assets, leading to a rise in net income to the previous level.

Overall, convertible bonds are a useful toolkit for issuers. Few BDCs that we are aware of have used convertible bonds, likely because the embedded option is not very valuable since BDC prices, unlike Tech companies where convertible issuance is more popular, are less likely to zoom higher. This lower option value means convertible bond coupons are not significantly lower than the coupons of traditional bonds.

Read the full article here

Leave a Reply