Introduction

The iShares Resources & Commodities Strategy Trust (NYSE:BCX) is a product that seeks to generate capital appreciation by investing an overwhelming majority of its assets in commodity and natural resource equities, or their associated derivatives. BCX also dabbles with derivatives and instruments that seek to profit from underlying movements of just commodities or natural resources.

Being a CEF, capital appreciation is, of course, only a secondary consideration, with the primary consideration being high current income. The income angle here is supplemented by BCX’s strategy of writing calls on the equity portion of the portfolio (currently, around a third of BCX’s portfolio has been covered by written call options).

Low Risk Vehicle For An Innately Volatile Space

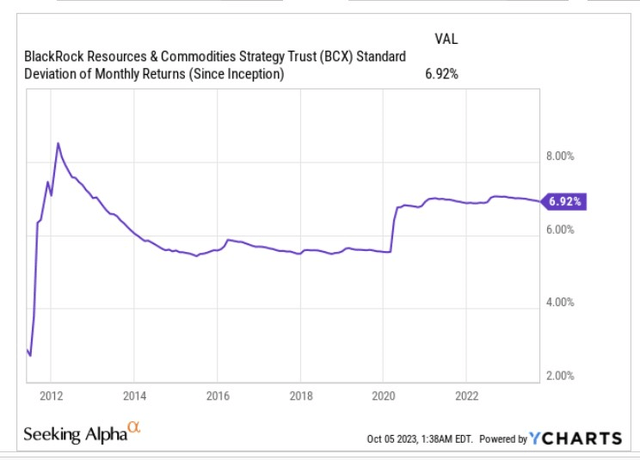

The call writing facet not only helps contribute to the income theme, but it also helps bring down the overall volatility profile of this product. This can be particularly useful when you’re exploring the commodity space, which is inherently just a very volatile space. Note that since its inception over 12 years ago, BCX’s volatility profile has been very commendable for a commodity-themed product, with its monthly returns varying by only single-digit percentage terms.

YCharts

Yield Enhancement Opportunity Beckons

As far as distributions go, note that BCX has been distributing a monthly figure of $0.0518 for well over a year now; given how long this has been going on, some investors may be wondering if this could pick up soon enough. Well, we wouldn’t bet on that happening any time soon, as on an annualized basis, and taking the current NAV per share ($10.25) into consideration, that would translate to a distribution rate of over 6%. According to Morningstar, that distribution rate would put it in line with what the average CEF pays out.

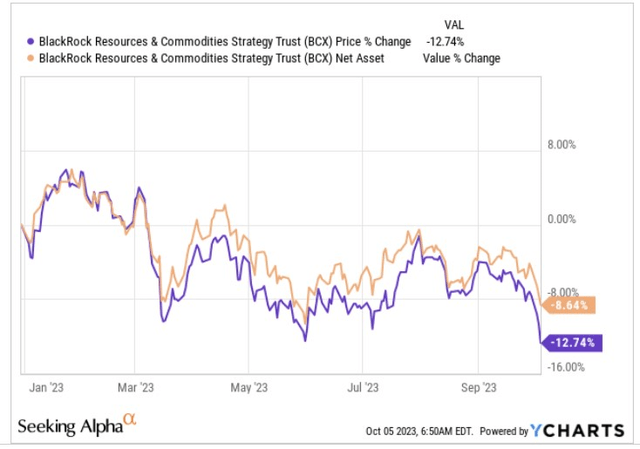

Having said that, we can also appreciate why some investors may want to take advantage of the yield enhancement opportunity (the difference between the distribution rate on the NAV and the distribution rate on the share price is now at around +110bps) that has widened even more recently, given the expansion in the price discount relative to BCX’s NAV.

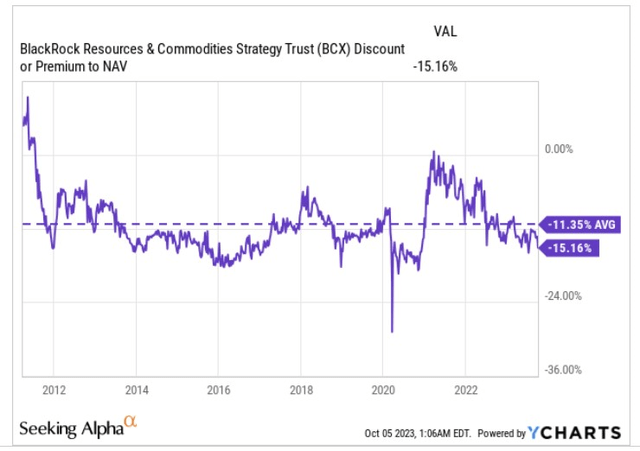

A lot of investors typically get enamored and buy if they just spot any available discounting opportunity, as they are content in the knowledge that a single dollar invested at that point would garner more than just a single dollar worth of assets. However, what investors also need to recognize is that across its entire listing history, BCX has traded at a discount, on average. Thus, the more pertinent gauge would be to ascertain if you have a significant gap between the current available discount to NAV, and BCX’s average discount across its entire lifetime.

Well, in that regard, BCX looks like a fairly attractive bet at this juncture, as the current discount to NAV of -15.16% translates to close to a 400bps differential to what has normally been available at this counter across its lifetime (-11.35% on average).

YCharts

Besides, just on a YTD basis, the gap between the price performance and NAV performance of BCX hasn’t been as wide as it is currently.

YCharts

Heightened Energy Exposure Is Not Ideal At This Juncture

The pronounced weakness on the price front could likely be linked to BCX’s strong exposure to the energy segment, which alone accounts for 43% of the 52 stocks in the portfolio. This could prove to be a bugbear of sorts in the short to medium term, as despite key supply cuts by the likes of Saudi and Russia, questions are certainly being asked if demand is resilient enough.

For instance, in the US, finished motor gasoline supplies have now dropped to 8m bpd, the lowest point in 2023, while gasoline consumption is also believed to be at its lowest point in 22 years. It also doesn’t help that long-dated bond yields are now at 16-17-year highs; this will only raise the allure of the dollar, with the dollar index now at 10-month highs. Given that commodities are priced in USD, you can imagine how damaging the dollar appreciation can be for their prospects.

Taking a longer-term view as well, even though there are plenty of question marks over whether the world can successfully transition away from the traditional energy systems that have been in place for decades, there’s no getting away from the likelihood that annual oil demand growth that is currently at around 2.4mb/d will likely slump to 0.4mb/d in around 5 years time.

Closing Thoughts-Technical Considerations

Even from a charting angle, it appears that investors may have to brace themselves for some negative turbulence ahead, at least in the short-term. We say this because if you look at BCX’s weekly price imprints, it’s rather evident that the CEF has been forming a symmetrical triangle pattern for a while now.

Investing

For the uninitiated, the symmetrical triangle pattern may come across as a neutral pattern, with two converging lines, but it can also serve as a useful precursor of things to come. Basically, what it tells us is that there is a contraction in volatility within a certain counter, and when the price contracts, it typically happens before a breakout or a breakdown.

The volatility contraction theme with BCX is further reiterated by the ATR (average true range) indicator, which had recently halved from the 0.7 levels seen around 15 months ago.

Unfortunately, this week we’ve seen a breakdown finally take place, not just from the lower boundary of the triangle, but also the trading range (area highlighted in blue) which BCX had formed over the last 6 months; both these developments will likely embolden the bears. Thus, given these recent charting dynamics, we wouldn’t advise investors to immediately buy into the weakness seen in the BCX counter but wait for some flattening of the price action.

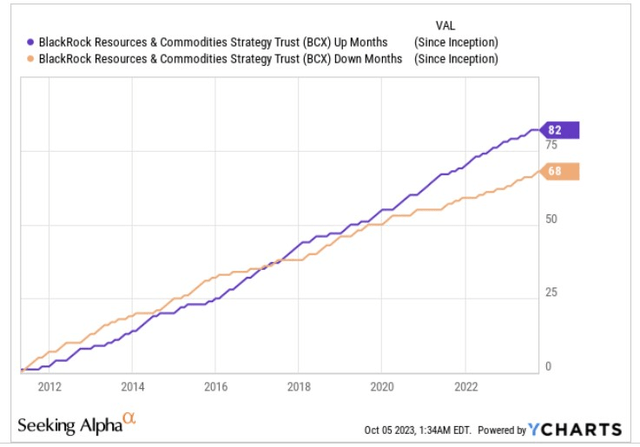

For what it’s worth, over the long-run, BCX is unlikely to prove too troublesome as its up-month-to-down-month ratio since its inception has been well over 1x, at 1.2x.

YCharts

To conclude, there are certainly good enough reasons to get on board with this CEF at some stage, but given some of the near-term concerns, we are not entirely convinced that investors need to rush in any time soon.

Read the full article here

Leave a Reply