On our last work on Bank of America (NYSE:BAC) we focused on the fact that margins were past their peak. These margins were of course the net interest margins and while we did like the value, we felt a buy rating would just not make sense. Whether or BAC’s margins have actually peaked for this cycle or not, the stock certainly agreed with our outlook and is now 16% lower.

Seeking Alpha

We go over the Q3-2023 results and tell you why we are giving this a tentative buy rating.

Q3-2023

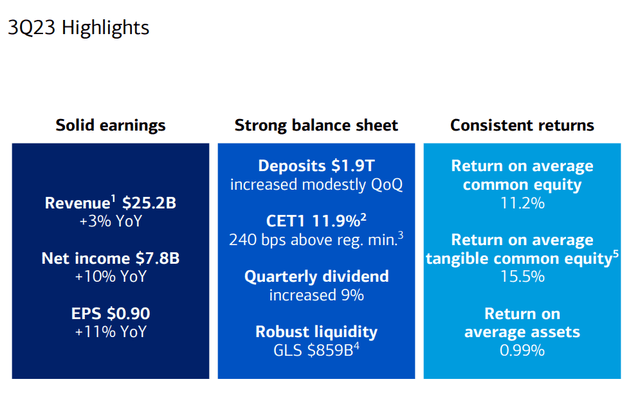

If bears wanted some fodder from the earnings report, they got none. The revenues were robust and net income increased 10% year over year. Earnings per share increased 11% on the back of small buybacks throughout the last 12 months.

BAC Q3-2023 Presentation

Return on assets was respectable and return on tangible equity was fantastic. The deposit flight which was the center of attention ever since regional banks started falling like dominos, was actually not an issue at all. 200,000 additional new checking accounts were added and total deposits within the organization remained steady.

BAC Q3-2023 Presentation

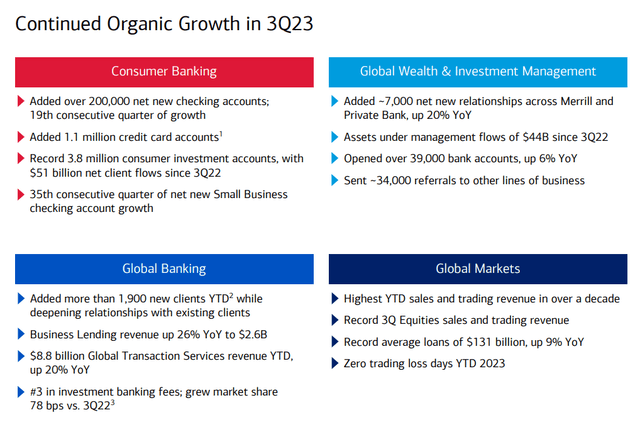

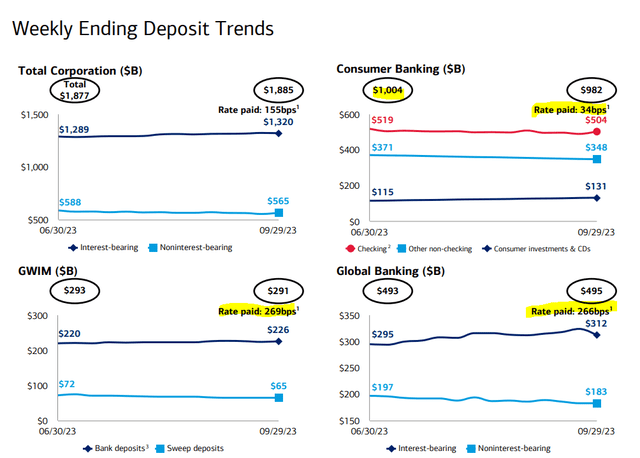

The key chart for the margin perspective was the amount paid on the trillion dollars ($1.004 trillion actually) of consumer banking deposits. This was surprising to say the least and it appears that investors only like chasing yield in the stock market. When given a choice of accessing 5.5% risk free they rather hit the snooze button. Case in point, BAC laughed all the way to their own bank as they paid 34 basis points to these geniuses.

BAC Q3-2023 Presentation

You can compare that rate with what they paid on their other divisions (also highlighted above). Sure, some minimum deposit amounts are required for the convenience of free banking. But there are amounts way in excess of that earning nothing.

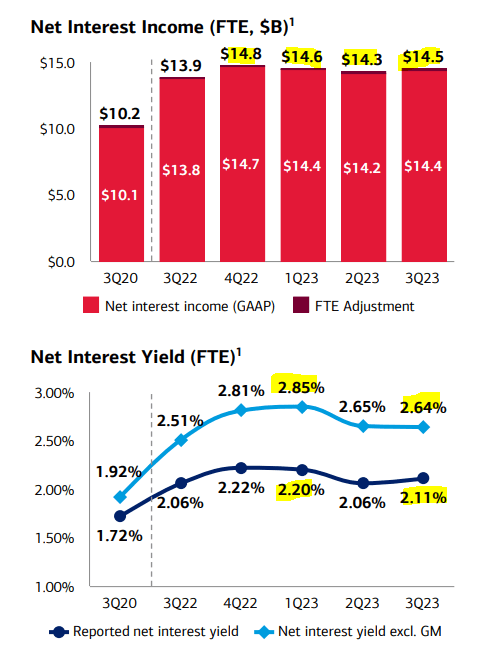

Despite the relatively slow rise of the cost of funds, BAC’s net interest income did not get the full benefit of the rate hikes.

BAC Q3-2023 Presentation

As we have previously made the case, BAC’s net interest margins are past their peak, though the decline so far has been slow compared to our expectations.

Outlook

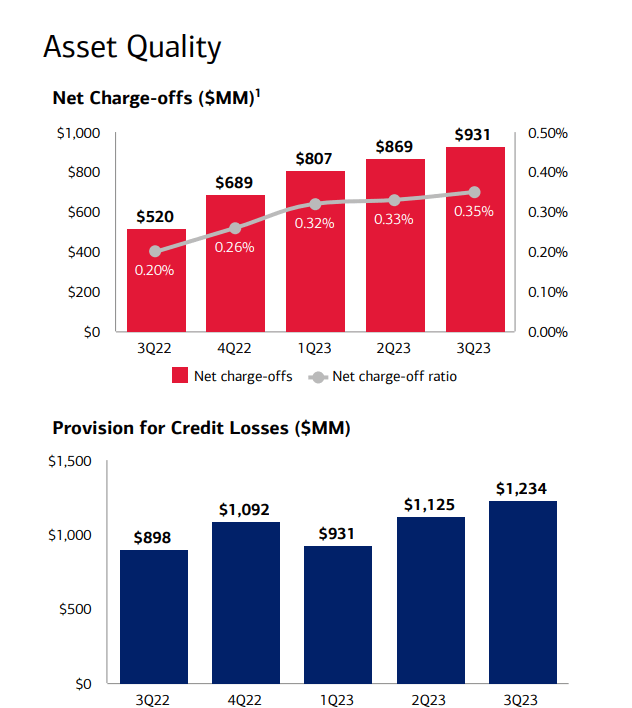

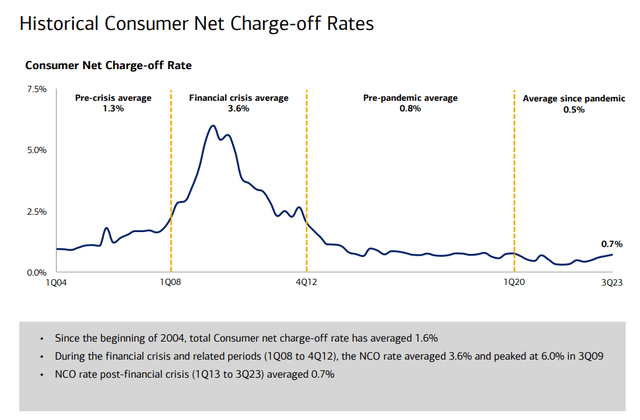

Net charge-offs have been increasing but they are still relatively low.

BAC Q3-2023 Presentation

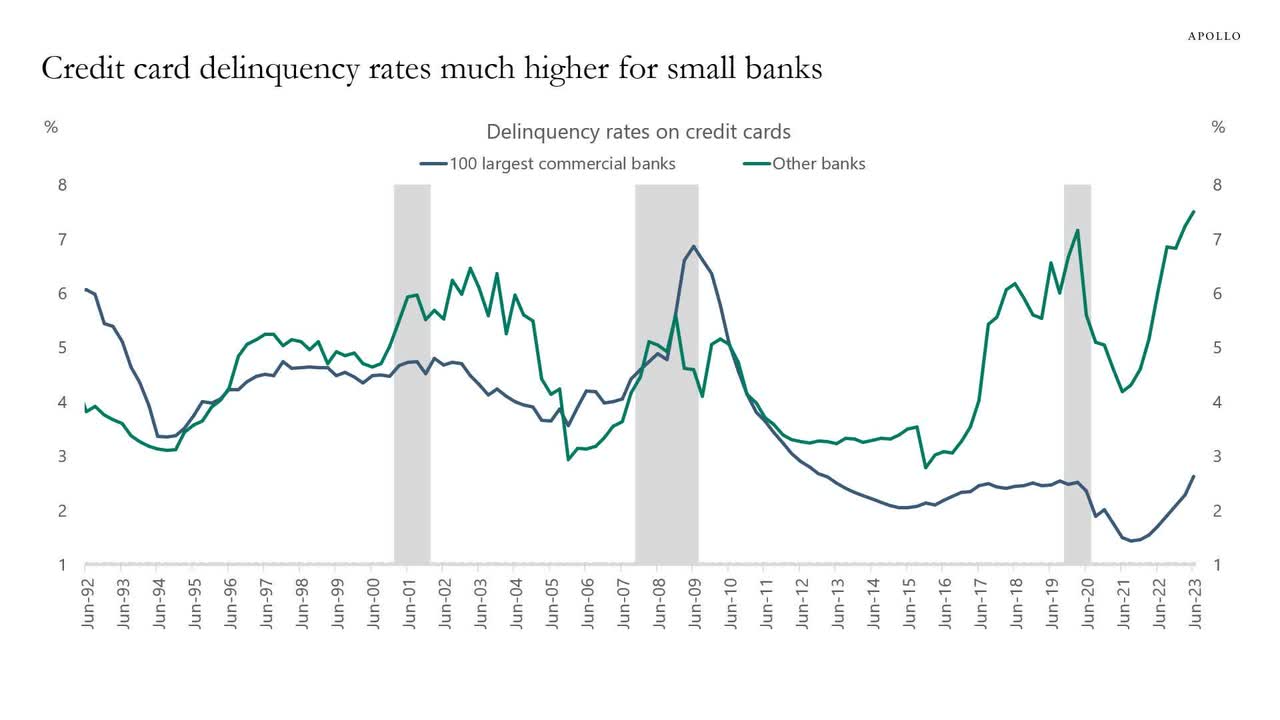

There is a very extreme divergence here when you compare the regionals with the large banks.

Apollo Credit Management

Perhaps the global financial crisis has permanently changed the mega banks and their underwriting standards. Perhaps there is some lag here and write-offs will increase dramatically even at BAC in the quarters ahead. We tend to wipe out a lot of built up equity in banks in mild recession and absolutely blow through the equity cushion in a major recession.

BAC Q3-2023 Presentation

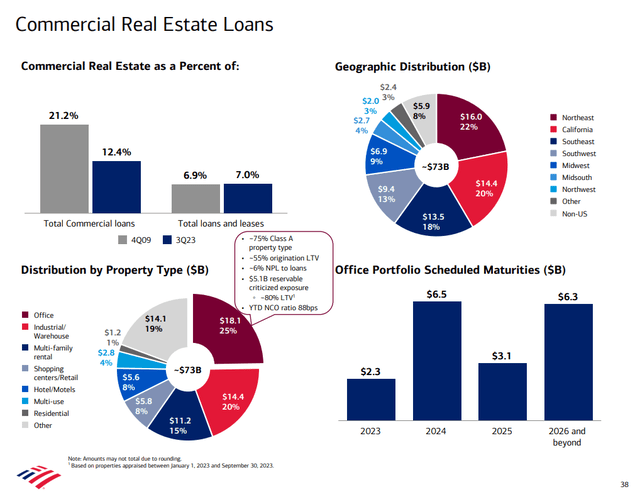

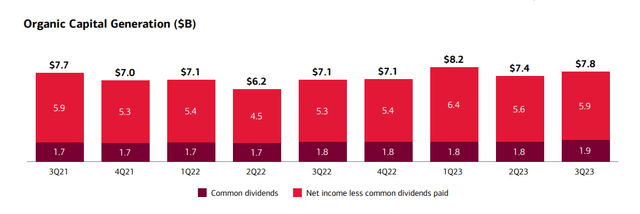

Again, so far we have not seen it, even in the sector where we are most afraid. The Commercial Real Estate or CRE area. Charge-offs have been mild even here and total portfolio size is very small relative to the extremely high levels of organic capital generation every quarter. You can get a sense of what we are talking about if you compare the BAC office sector total exposure ($18.1 billion) with the amount they generate after dividends every quarter.

BAC Q3-2023 Presentation

That latter amount tallies to almost $6 billion.

BAC Q3-2023 Presentation

So overall, we don’t see any problems on the traditional metrics. But we still have to address the elephant in the room.

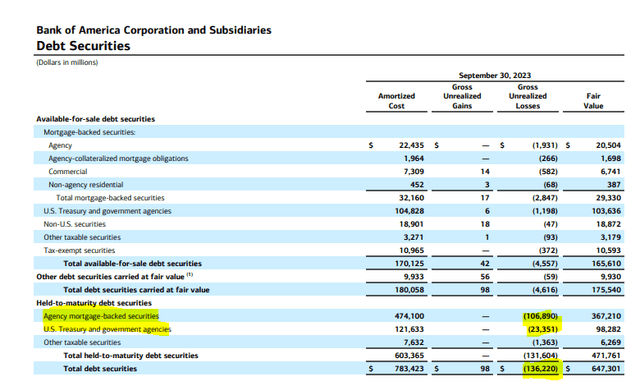

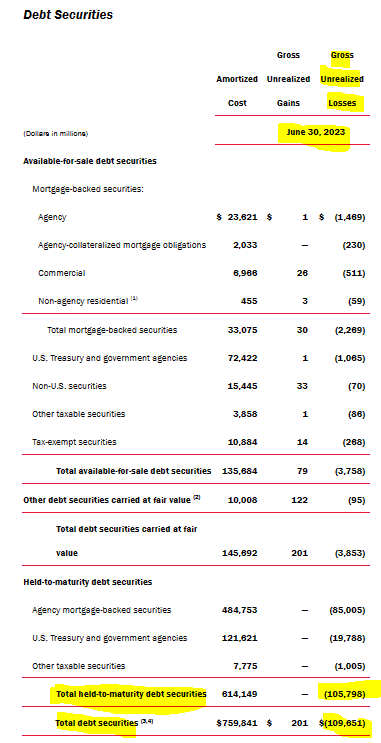

The held to maturity losses ballooned once more and hit an unprecedented $136.2 billion.

BAC Q3-2023 Supplemental

This number was at $109.6 billion last quarter.

BAC 10-Q

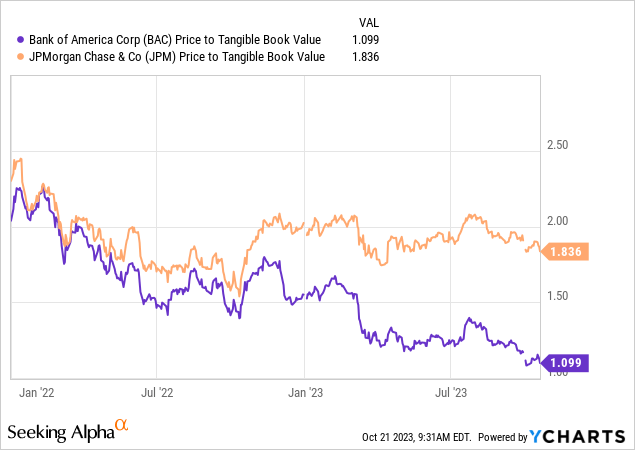

The market participants are obviously worried about this and the biggest proof is the multiple difference between JPMorgan (JPM) and BAC.

But from our perspective there are reasons to be positive here.

Why BAC Could Go Up In A Mild Recession

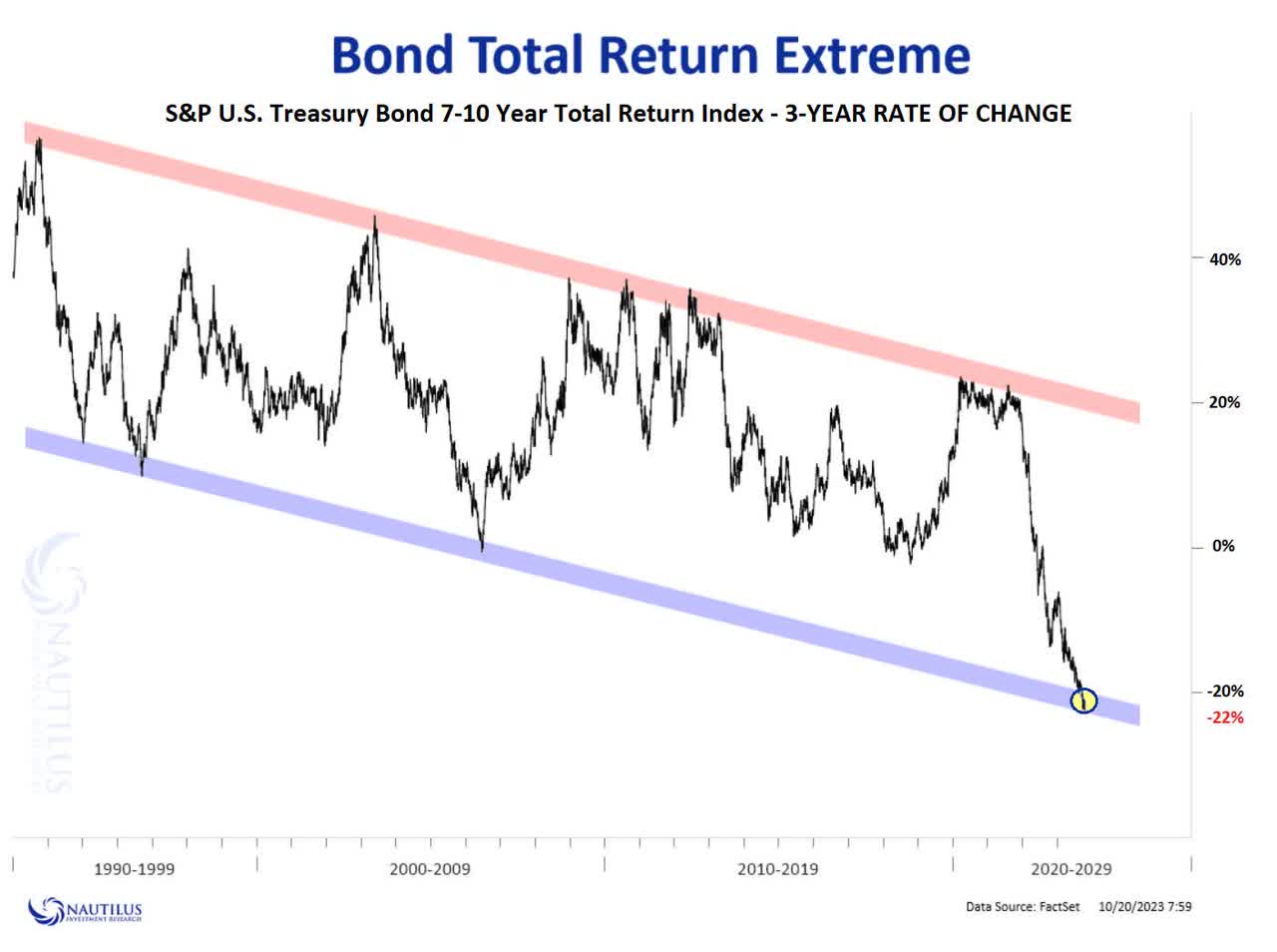

Recessions are inevitable. Financials obviously are quite vulnerable due to the extreme levels of leverage they employ. But we are going in here with one of the most extreme setups for bonds.

Nautlius Research As Shared On X

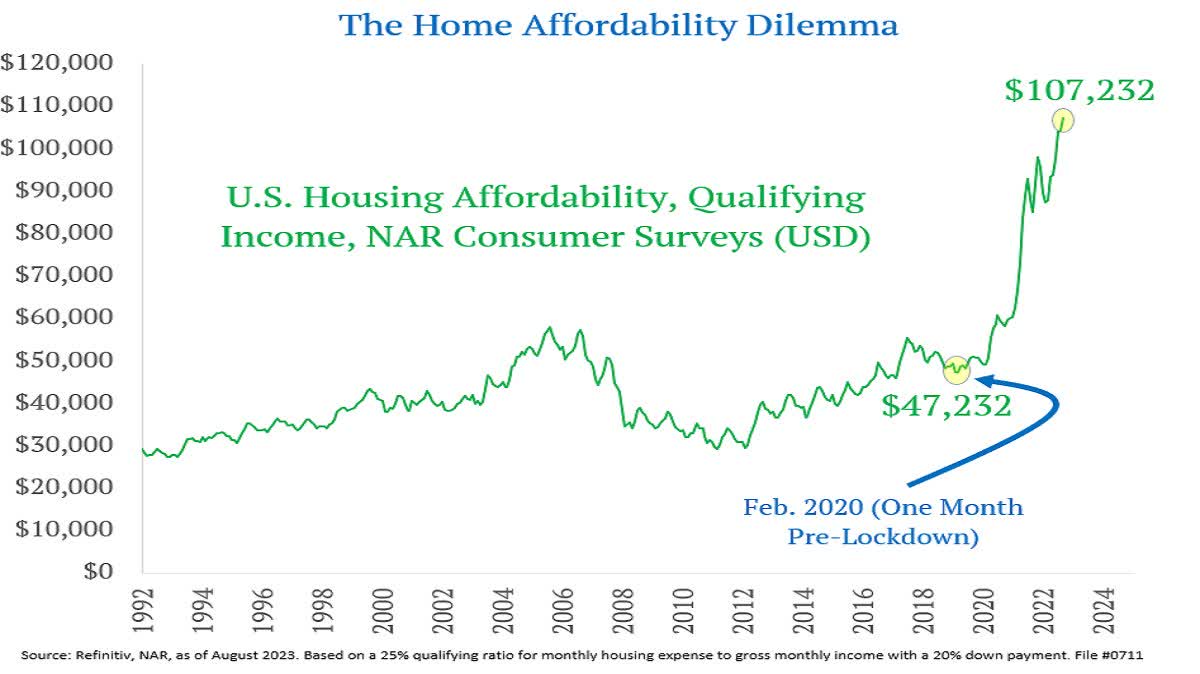

While the crowd embraced ZIRP and the deflation nonsense in 2020, it now believes in infinitely higher rates with zero consequence. From our perspective, the US market cannot function if new home sales are comatose. At current interest rates, they are not just comatose, they are half past dead.

Jeff Weniger

Our point is that the bond bear story, even if it pans out longer term, will take time to do so. There are no one-way markets and a recession likely gives the bond bear market a breather. BAC will benefit immensely as its poorly purchased held to maturity securities stop taking losses and roll-off over time. One other factor here is that BAC’s losses are almost exclusively on agency mortgage bonds. In a recession, they could benefit from a trifecta of lower rates, shallower spreads to treasuries (from stoppage quantitative tightening) and slightly higher prepayments. Overall, we like the stock here and are upgrading it to Buy with the expectation of 7%-9% annual returns over the long term. We now go over the preferred shares and tell you how you can make the low end of that range with virtually zero risk from BAC.

Bank of America Corporation 7.25% CNV PFD L (BAC.PR.L)

For investors looking just for income, BAC.PR.L is an excellent security that has stripped yield of 6.93% as we write this. Thanks to a unique setup, these preferred shares are practically non-callable. These are convertible at your option (option of the holder) into 20 shares of common stock. The number for this conversion was the $50 stock price when this was issued.

BAC also has a right to force a conversion but there is a catch for the bank. For it to force a conversion the price has to exceed $65 (130% of BAC common share price at issuance) for 20 trading days during any period of 30 consecutive trading days. Of course if that happened, you make out like a bandit as the $1,050 would convert to $1,300 and give you a big upside. So 6.92% yield plus big upside (23%) to call. Remember those two.

Bank of America Corporation 5.875% NCM PFD HH (BAC.PR.K)

To show you how ridiculously cheap BAC.PR.L is, we give you two comparisons from BAC preferred suite. BAC.PR.K currently has a stripped yield of 6.63%. So right away, you are getting a better yield with BAC.PR.L. Since BAC.PR.K trades at $22.26, upside to call is just 12.3%. So on both measures BAC.PR.K falls short. Yes, BAC.PR.K has more likely call probability in a deflationary bust versus BAC.PR.L, but the overall setup for BAC.PR.L is much better for those looking for a strong “locked-in” income source.

Bank of America Corporation 4.125% DP PFD PP (BAC.PR.P)

There are some BAC fixed rates like BAC.PR.P that are trading well below par and have huge theoretical upside to call. BAC.PR.P for example has 58% upside to par. But thanks to the extremely low coupon rate, par is an impossible dream. Even here you are getting just 6.56% stripped yield, versus 6.92% for BAC.PR.L.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Read the full article here

Leave a Reply