Background

We spend a great deal of time reviewing demutualized banks. For the patient investor, these traditionally sleepy opportunities often present unusually attractive risk-rewards, due primarily to inexpensive valuations and a multi-decade history of bank consolidation.

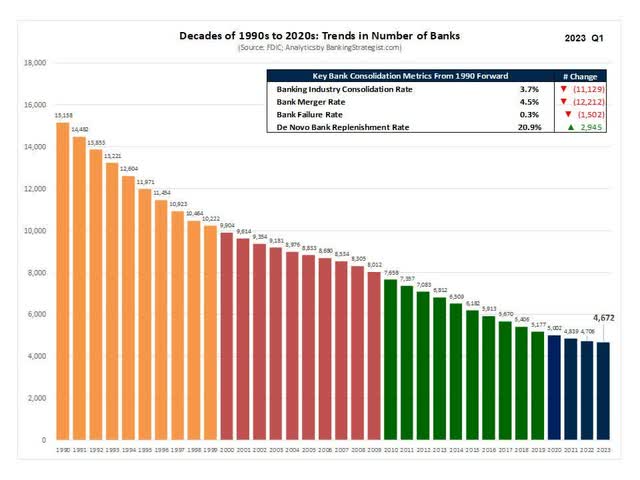

As illustrated below, mergers and acquisitions in the bank sector have resulted in a significant reduction in the number of industry participants. And this trend is expected to continue as the U.S. remains “over-banked” with nearly 4,700 players.

Banking Strategist

Our strategy is to invest in banks trading below tangible book value (TBV) with overcapitalized balance sheets, solid asset quality, and shareholder-friendly management teams.

This combination typically leads to a modest dividend, accretive share repurchases, and ultimately a sale to a larger institution.

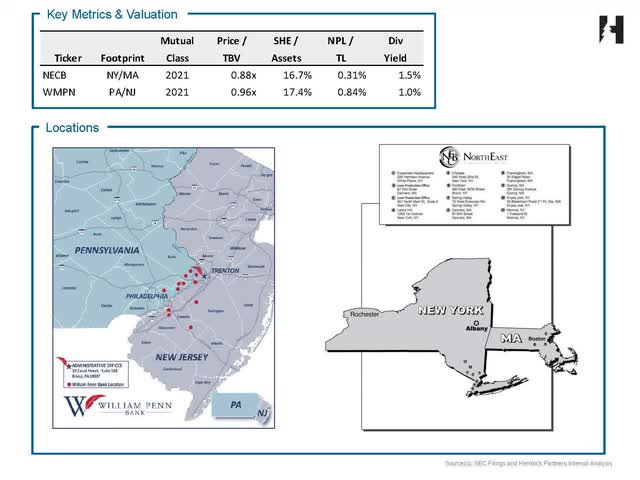

Two banks that fit this mold and are aggressively repurchasing shares under TBV are William Penn and NorthEast Community.

William Penn Bank

One of our favorite small caps is William Penn Bancorporation (NASDAQ:WMPN), the holding company for William Penn Bank, which serves the Delaware Valley via branches in Bucks County and Philadelphia, Pennsylvania, as well as Burlington and Camden Counties in New Jersey.

We have written about the firm multiple times in the past. A more detailed overview of the company and an explanation of our investment thesis can be found here.

In mid-July, WMPN reported 2Q TBV of $12.48 per share. Management is excellent at capital allocation, using its overcapitalized balance sheet to pay a small dividend and execute a robust stock repurchase program.

Since March 2022, the company has repurchased 27% of shares outstanding via five repurchase programs. Most importantly, the average purchase price per share of the five programs is $11.50, well below the 2Q reported TBV ($12.48).

And the good news keeps coming.

In late August, WMPN authorized a sixth stock repurchase program to acquire another 10% of outstanding stock.

And finally, WMPN released its 10-K (fiscal year ends June 30) on Thursday. In the document, shares outstanding, as of September 7, continued to shrink, down to 11.1 million, which means TBV is likely inching towards $13 per share.

In March 2024, WMPN will be eligible to be acquired, a fairly typical outcome for demutualized banks. For an acquirer, WMPN offers a high-quality portfolio and an attractive footprint in the surrounding markets of Philadelphia.

Historically, the average thrift is acquired at 130% of TBV. To be conservative, we typically model an exit multiple of 120%.

Using this range and the new TBV estimate of $13, we estimate an acquisition price of $15 to $17 per share or a roughly 33% return (prior to dividends) using the midpoint.

Hemlock Partners

NorthEast Community Bank

A similar set-up exists at NorthEast Community Bancorp, Inc. (NASDAQ:NECB), the parent company for NorthEast Community Bank, a New York State chartered savings bank that operates in New York and Massachusetts.

Despite trading at only 88% of TBV, NECB maintains a solid balance sheet. Asset quality is excellent, with a non-performing loan to total loan ratio of just 0.31%.

Further, with a tangible capital to asset ratio of over 16%, the bank is overcapitalized with the ability to pay a dividend and repurchase shares.

NECB completed its first stock repurchase program by acquiring 10% of shares outstanding at a cost of $22.8 million or $13.93 per share (versus TBV of $18) and is now executing a second initiative, which authorizes another 10% of outstanding common stock.

The bank becomes an acquisition target in the second half of July 2024. Using the same range as described above, we estimate an acquisition price of $21 to $23 per share or a roughly 40% return (prior to dividends) using the midpoint.

Wrap Up

Investing in banks below TBV, a proxy for liquidation value, with robust balance sheets and shareholder-friendly management teams has historically been a recipe for attractive returns.

It’s a niche worth exploring for patient small-cap investors.

Both WMPN and NECB are excellent examples of how bank leadership can drive shareholder value by distributing a dividend and aggressively repurchasing shares below TBV.

Read the full article here

Leave a Reply