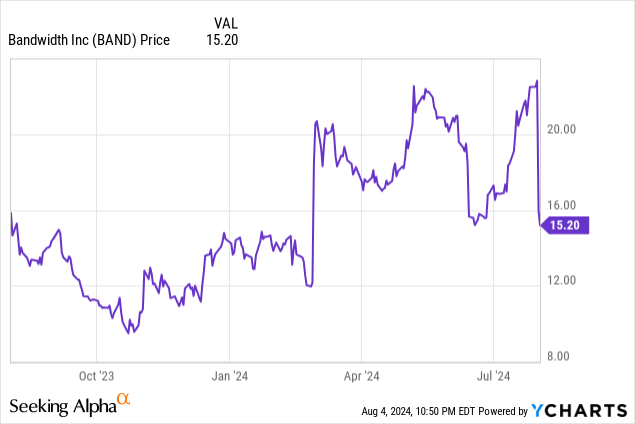

The market has been in a foul mood this earnings season, with investors selling off growth stocks on fears of ineffective rate cuts and a weaker macroeconomy. While near-term losses have been painful, it’s a great time for investors with strong stomachs and long-term oriented horizons to buy undervalued stocks at a great price.

Bandwidth (NASDAQ:BAND) is one such stock. Though the company has certainly required tremendous patience, there’s a lot of value to be tapped here for patient investors. The stock has suffered a sharp 30%+ selloff since reporting Q2 results, despite a beat and raise in the quarter plus other outstanding metrics, like a rebound in dollar-based net retention rates. Now up only single digits for the year and underperforming the broader markets, it’s a great time for investors to get into Bandwidth as a rebound play.

Focus on the long-term drivers for Bandwidth

I last wrote a bullish note on Bandwidth in May, when the stock was trading at healthier levels near $22. Now substantially lower despite a raised outlook for FY24 and improving core metrics, I’m perplexed at the disconnect with the market’s negative reaction on Bandwidth, and I remain quite bullish on this stock going forward.

In particular, the two near-term factors that I’m focused on to support a shorter-term recovery for Bandwidth are its recent paydown of debt, shoring up its balance sheet by striking a favorable repayment deal; as well as the company’s improving net retention rates and double-digit revenue growth (more on this in the following sections).

But Bandwidth’s advantages also span beyond the near term. Here’s a refresher on my long-term bull case for this company:

- Large $17 billion TAM. Bandwidth estimates its 2023 market opportunity at $17 billion (as cited in its most recent investor presentation), indicating that its ~$0.7 billion in annual revenue is only ~4% penetrated into this broad market.

- Revenue re-acceleration is encouraging. Bandwidth is confident in its ability to grow in the mid-teens through 2026, finally outpacing its larger rival Twilio (which continues to cite headwinds from the crypto industry and its Segment subsidiary).

- Land and expand with improving net retention rates. The company is achieving a net revenue retention rate that is now above 110%. In addition, average revenue per customer is growing ~10% y/y, both of which are a reflection of the company’s ability to encourage greater customer usage over time.

- Austerity measures have led to meaningful profitability gains. Though still not fully profitable from a GAAP perspective, Bandwidth’s layoffs and focus on bottom-line efficiency alongside a disciplined growth path have allowed the company to generate substantially better adjusted EBITDA.

Stay long here and use the near-term dip as an opportunity to buy.

Shoring up the balance sheet

For most small/mid-cap tech companies, the balance sheet rarely gets much attention unless a money-losing company is about to run out of resources. In Bandwidth’s case, however, we can point to a recent debt repayment deal as an upside driver for this stock.

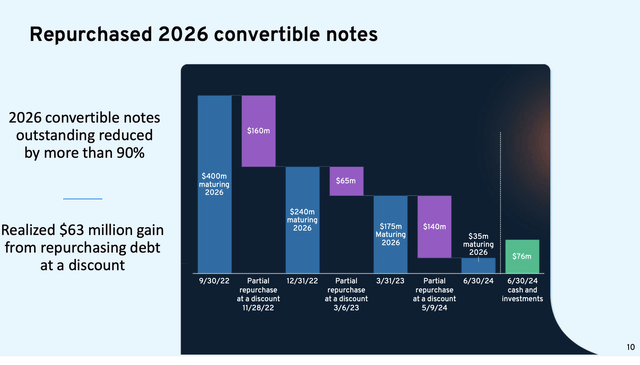

Bandwidth debt paydown (Bandwidth Q2 earnings deck)

As shown in the snapshot above, Bandwidth notes that it gained $63 million by repurchasing a large chunk of its 2026 convertible debt at a significant discount (we do note that the company’s ability to purchase back debt at a discount may signal its creditors’ jitteriness over Bandwidth’s prospects).

Bandwidth’s net debt position has long been a negative separator between this company and many of its small/mid-cap tech peers, but with this deal, Bandwidth is moving in the right direction. At the end of Q1, Bandwidth had a net debt position of $272 million; after this deal, at the end of Q2, Bandwidth had $76.4 million of cash and $320.7 million of debt remaining ($40 million drawn on the company’s revolving line of credit, and a remaining $280.7 million convertible debt balance), putting its net debt position at $244.3 million, which is a sequential improvement of nearly $30 million – not small for a company whose market value is just over half a billion dollars.

Improving top-line metrics

And despite the post-earnings selloff, Bandwidth’s core business appears to be showing signs of health. Take a look at the company’s Q2 results trended against historical quarterly results below:

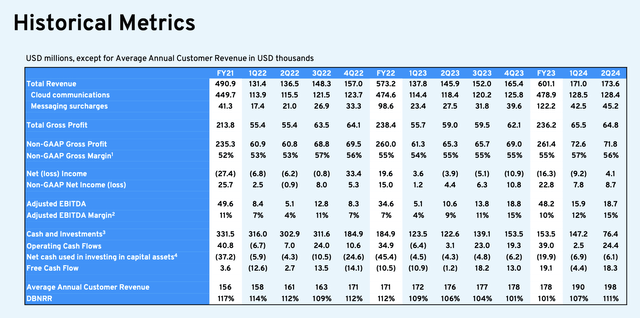

Bandwidth trended financials (Bandwidth Q2 earnings deck)

Bandwidth’s revenue grew 19% y/y to $173.6 million, slightly edging out over Wall Street’s expectations of $173.4 million. But perhaps the more meaningful result is the fact that dollar-based net retention (DBNRR) improved to 111% in the quarter, which is a four-point improvement sequentially and a five-point improvement on a y/y basis.

Recall that weakening net retention rates were the key driver that precipitated Bandwidth’s sharp fall from share prices above $150 in 2021. As a company that relies on its “land and expand” business model, sequentially improving net retention rates are a core signal that Bandwidth’s customers are committed to expanding their usage. We note as well that average annual customer revenue improved 13% y/y to $198,000.

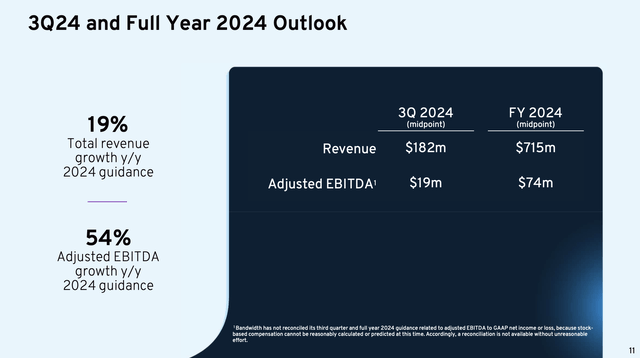

Moreover: Bandwidth’s outlook for Q3 also calls for a slight acceleration in total revenue to $182 million, or 20% y/y growth: one point better than in Q2.

Bandwidth outlook (Bandwidth Q2 earnings deck)

We expect that election-related messaging and advertising will be a key driver of Bandwidth’s growth in the second half of FY24.

Also of note: Bandwidth’s adjusted EBITDA margin climbed six points y/y to 15%, while nominal adjusted EBITDA leaped 76% y/y, driven by a combination of the company’s ongoing headcount optimization efforts coupled with strong top-line results and net retention rates. We note the fact that Bandwidth’s guidance calls for just a 10.3% adjusted EBITDA margin for FY24, essentially flat to FY23 margins, which may be quite conservative considering Q1 came in at a 12% margin (eight points of y/y improvement) and Q2 came in at 15%.

Valuation and key takeaways

At current share prices near $15, Bandwidth trades at a market cap of just $587.0 million. After we net off the aforementioned $244.3 million of net debt on the company’s ending Q2 balance sheet, its resulting enterprise value is $831.3 million.

This sits at a 1.2x EV/FY24 revenue multiple and an 11.2x EV/FY24 adjusted EBITDA multiple, which is quite modest considering the fact that the company’s outlook, particularly on adjusted EBITDA margins, looks like it has room to slide upward. Stay long here and leverage the post-earnings dip as a buying opportunity.

Read the full article here

Leave a Reply