Introduction

Banco de Sabadell (OTCPK:BNDSF) (OTCPK:BNDSY) is a relatively small Spanish bank with just under a quarter of a trillion Euro in assets and a market cap of just under 6B EUR. As a bank predominantly focusing on Spain (while it also has a 40B EUR mortgage portfolio in the UK with a low LTV ratio of 55%), it is perhaps not as attractive as a Santander or BBVA which also offer good exposure to other markets, but Sabadell could and should be seen as a call option on the health of the Spanish economy. Trading at just 5 times earnings and at a discount of almost 50% to its tangible book value, I think the stock is again getting too cheap to ignore. I’m saying ‘again’ because the share price is still more than three times higher than the 31 cents it was trading at when the previous article was published. The total return in the past three years was approximately 270%. But as I will explain in this article, that still doesn’t mean the stock is expensive.

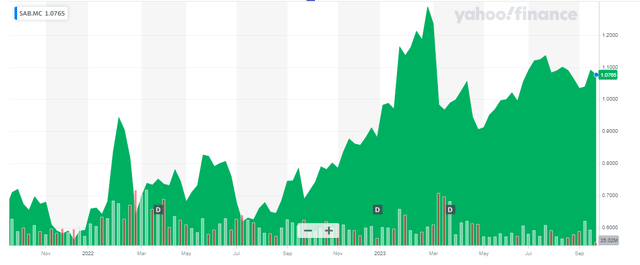

Yahoo Finance

I would recommend to only trade in Banco Sabadell through the Madrid stock exchange to take advantage of the superior liquidity. The ticker symbol in Spain is SAB, and the current share price is 1.08 EUR (as of the closing bell on Wednesday). Keep in mind there are 5.6 billion shares outstanding, resulting in a market capitalization of 5.9B EUR at this point.

Unfortunately the website mainly contains ‘download only’ links, but you can find all relevant information and documentation here.

The net interest income is expanding

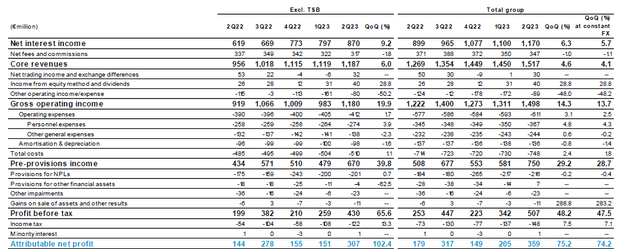

The financial performance of Banco Sabadell is mainly boosted by the net interest income. And as the image below shows, there has been a consistent increase in that net interest income. Looking at the Spanish operations (the left hand side of the table below, excluding the contribution from TSB, Sabadell’s UK operations), we see a consistent increase of the net interest income and after posting a 9.2% QoQ NII increase, the net interest income in the second quarter of 2023 was almost 60% higher than the net interest income in the second quarter of last year.

Banco Sabadell Investor Relations

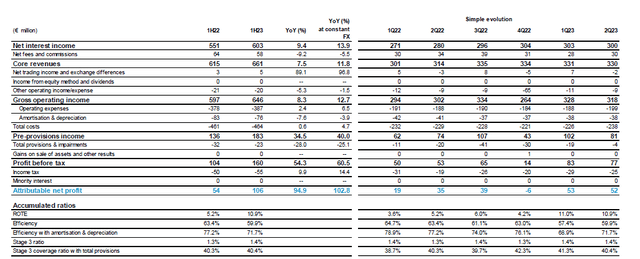

And including the UK operations, the difference is pretty good as well, but definitely less outspoken as the net interest income in the UK has been relatively flat. While there was a QoQ net interest income increase of 70M EUR, this was entirely thanks to the operations outside of the UK. As you can see below, The net interest income in the UK stagnated but the attributable net income increased thanks to lower provisions and impairment charges. This resulted in an attributable net income of 106M EUR in the first half of 2023 which is almost double the H1 2023 result. The stronger result was caused by the higher net interest income (on a YoY basis there definitely is a clear increase and it’s only stagnating somewhat in the past few quarters) and a reduction in loan loss provisions. It will be interesting to see if the low level of loan loss provisions continues as last year, we did see an acceleration in the second semester of the year.

Banco Sabadell Investor Relations

Going back to the consolidated financial results, Banco Sabadell reported a net income of 359M EUR in the second quarter of the year, and combined with the 205M EUR in the first quarter, the total net income in the first half of the year was 564M EUR. Note: the Q1 result was pretty weak due to the impact of the new bank tax in Spain. I discussed that new tax in this older article about BBVA (BBVA), and this had a profound negative impact on Banco Sabadell as the majority of its assets are in Spain (unlike a Santander or BBVA which have strong exposure to other regions and as thus less sensitive to the new Spanish bank tax). The new bank tax is not tax deductible (which is a pity), but there also was some good news as the payments into the Single Resolution Fund will likely decrease going forward as the ‘build-up phase’ has been completed now.

As there are currently 5.6B shares outstanding, the EPS was approximately 0.10 EUR per share (and adjusted for the AT 1 coupons, this was 0.11 EUR per share).

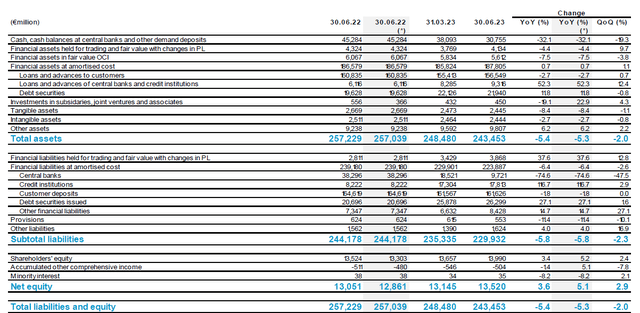

As of the end of June, the bank had about 243B EUR in assets on its balance sheet, and about 13.5B EUR was represented by equity. That’s important as the total equity ratio has increased compared to a year ago. In the past twelve months, the balance sheet shrank by 14B EUR while the total equity increased by about half a billion Euro and the equity versus total assets ratio increased from 5.07% to 5.55%.

Banco Sabadell Investor Relations

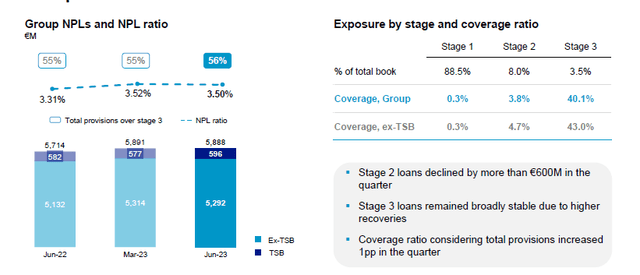

It’s always important to keep an eye on the balance sheet as well, as the total amount of non-performing loans has been increasing (which isn’t a surprise given the higher interest rates and contracting economy). The total NPL level remained stable in the second quarter while the total provisions for the Stage 3 assets increased to 56%.

Banco Sabadell Investor Relations

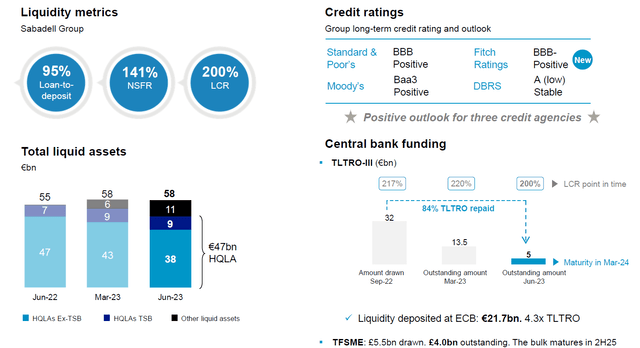

So thanks to the continuous loan loss provisions recorded every quarter, it looks like Sabadell has its non-performing loan issue under control. It is also encouraging to see the total amount of loans in Stage 2 has decreased by approximately 600M EUR. And it is also important to confirm Sabadell has excellent access to liquidity. Its loan to deposit ratio is relatively low at 95% while there are about 58B EUR in liquid assets on the balance sheet. That 58B EUR represents almost 40% of the total amount of customer deposits.

Banco Sabadell Investor Relations

I also still like the mortgage portfolio in the UK, held in the TSB subsidiary. That bank has a pretty high CET1 ratio of 17.3% on a fully-loaded basis with very low loan loss provisions. In the second quarter, the cost of risk was just 0.15%.

The explanation for the strong performance of the UK loan book is pretty straightforward. Of the 33.7B GBP in loans, in excess of 90% is related to residential real estate (excluding properties in the ‘buy to let’ category). Of that loan book, 85% of the loans have an LTV ratio of less than 75% while the average LTV ratio is just 55%. This basically means the almost 34B GBP in mortgages is backed by 61B GBP in real estate at the time of underwriting the loans. So even if the real estate prices drop by 30% in the UK, the residential loan book should still be fine. Of course, more recent loans with a higher LTV ratio will suffer more so the TSB loan book definitely isn’t a ‘zero risk’ loan book, but the low cost of risk of around 0.15% per year shows the resilience.

What about the full-year guidance?

Thanks to the pretty strong performance in the first semester, Sabadell has now been able to increase its full-year targets. Whereas the bank was expecting a net interest income increase in the ‘mid-teens’ range, it has now upgraded this to ‘in excess of 20%’. Hardly a surprise considering the NII increased by almost 30% in the first half of the year.

Meanwhile, the total cost of risk has decreased. Thanks to keeping this limited to 56bp in the first half of the year, Sabadell is now guiding for ‘less than 60bp’, coming from ‘less than 65 bp’. Meanwhile, the Return on Tangible Equity should now come in at 10.5%, which is about 150 bp higher than the initial guidance of 9%. And considering the RoTE was about 10.8% in the first semester, the new guidance actually implies a slightly weaker result in the second half of the year.

Considering the total attributable tangible equity is about 10.5B EUR, the full-year earnings will likely come in at around 1.1B EUR, which represents approximately 20 cents per share. Considering the tangible book value per share is approximately 2.07 EUR per share, there is a decent margin of safety for the shareholders. Additionally, the bank has started a 204M EUR share buyback program which could add about 4 cents per share in tangible value.

That sounds counter-intuitive as the bank can only repurchase just over 3% of its shares, but considering the stock is trading at just over 0.5 times the tangible book value, every share that is repurchased at such a discount is adding value to the remaining shares.

Also keep in mind the bank has been guiding for a further increase in the RoTE from 2024 on and if we would assume an 11% RoTE on a 2.10 EUR tangible book value per share, the EPS could come in at around 23 cents per share on an annualized basis.

Investment thesis

Banco Sabadell is a relatively small bank with ‘just’ 250B EUR in assets and with a focus on just two core markets: Spain and the UK, and this increases the risk profile somewhat. That being said, it looks like the loan book is stabilizing now and the total loan loss provisions and impairment charges will come in lower than anticipated. Applying a cost of risk of 60 bp across the portfolio shouldn’t be an issue for Sabadell as its net interest income and fee income should be more than sufficient to cover those issues.

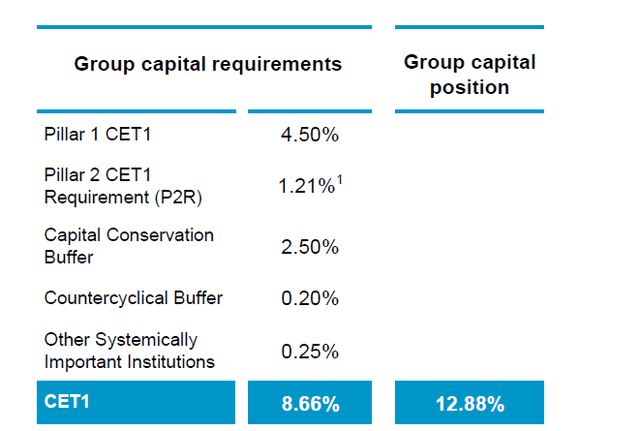

Banco Sabadell Investor Relations

Additionally, its CET1 ratio of 12.88% is 422 bp higher than the minimum requirement (as shown above) which means that based on the 78.5B EUR in Risk-Weighted Assets, there is a capital surplus of 3.3B EUR or close to 60 cents per share. This obviously does not mean Sabadell will distribute the ‘excess capital’, but the combination of an almost 50% discount to tangible book value, the P/E ratio of around 5 and the strong capital buffers make Sabadell interesting again.

The downside is of course the very close correlation of the financial results with the Spanish economy. About 42B EUR of the loan book in Spain was lent to SMEs and corporate loans, so I will keep an eye on the asset quality there.

I currently have no position in Banco Sabadell but it looks like the stock has been unfairly punished lately and could be worth a speculative long position.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply